Automotive Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2024

As intelligent connected vehicles boom, the change in automotive EEA has been accelerated, and the risks caused by electronic and electrical failures have become ever higher. As a result, functional safety and SOTIF (safety of the intended functionality) have caught more attention, especially in the field of autonomous vehicles.

In 2023, standards and policies have speeded up the development of automotive functional safety and SOTIF in China. In addition to the latest functional safety standard GB_T 34590 2022 officially taking into effect on July 1, 2023, related Chinese departments also issued multiple policies concerning functional safety and SOTIF.

For example, in July 2023, the Ministry of Industry and Information Technology of China (MIIT) issued the "Guidelines for the Construction of National Internet of Vehicles Industry Standard System (Intelligent Connected Vehicles) (2023)", which clearly plans and guides the construction of standards for functional safety and SOTIF. In August 2023, the MIIT and other three departments jointly issued the Notice on the New Industry Standardization Pilot Project Implementation Plan (2023-2035), of which the Intelligent Connection Technologies in the New Energy Vehicle Industry stipulates the terms and definition of intelligent connected vehicles, functional safety and SOTIF processes, audits and evaluations, automotive cyber security, data security, software upgrades and other product and technology application standards.

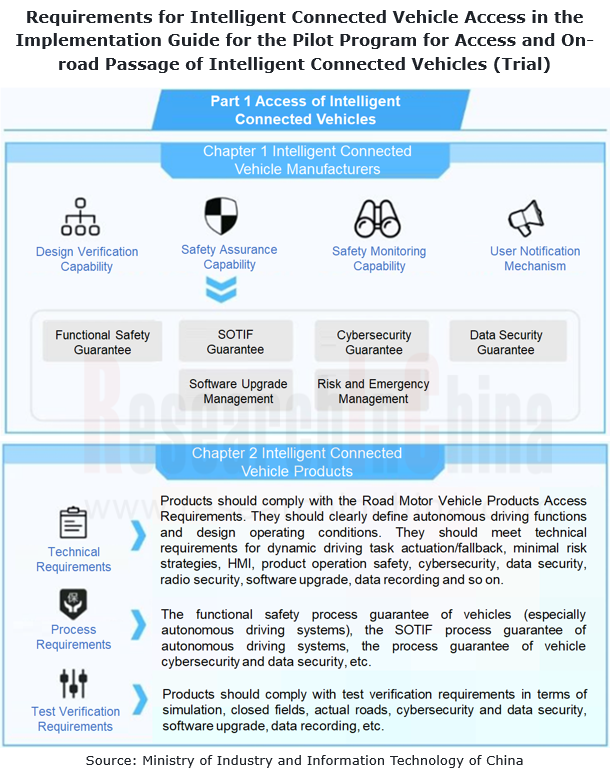

On November 17, 2023, the MIIT, the Ministry of Public Security, the Ministry of Housing and Urban-Rural Development and the Ministry of Transport jointly issued the Notice on the Pilot Program for Access and On-road Passage of Intelligent Connected Vehicles, which officially suggests access specifications for L3/L4 autonomous driving and clarifies the responsibilities in high-level intelligent driving accidents for the first time, and simultaneously started the selection of the first batch of enterprises.

The Notice specifies the requirements for the access of automotive enterprises and vehicles, especially for their safety guarantee capabilities. Enterprises are required to have the ability to guarantee functional safety, SOTIF, cybersecurity, data security, software upgrade management, and risk and emergency management.

The requirements for process guarantee of intelligent connected vehicle products include the functional safety process guarantee of vehicles (especially autonomous driving systems), the SOTIF process guarantee of autonomous driving systems, and the process guarantee of vehicle cybersecurity and data security.

Therefore functional safety and SOTIF have become the access requirements for L3 autonomous vehicles in China, and the introduction of functional safety and SOTIF standard processes into L3 and higher-level autonomous systems has become the layout focus of OEMs and suppliers.

OEMs and suppliers greatly increase automotive functional safety processes and product certifications, and embark on the layout of SOTIF process certification.

Although ISO 26262 is not a global mandatory standard, it has been widely accepted in the automotive industry and has become the threshold for automotive supply chain players. OEMs and Tier 1 suppliers will have to reject products or vendors that are not ISO 26262-certified. As intelligent vehicles develop, both autonomous driving companies and OEMs attach ever more importance to functional safety and SOTIF.

In recent years, both international mainstream OEMs and Chinese automakers have paid more attention to and invested more heavily in functional safety and SOTIF. In particular, Chinese independent automakers such as Great Wall Motor, SAIC, Geely, GAC, Changan and BYD have all raised the requirements for functional safety development of important systems. Besides setting up functional safety teams, they actively participate in functional safety training, cooperate with third-party institutions, strictly control self-developed products and vehicle functional safety products and processes, and take suppliers' functional safety development capabilities and product functional safety capabilities as the criteria to enter their supply chains.

OEMs or suppliers put ever more emphasis on functional safety certification. According to public statistics, from January to November 2023, Chinese companies passed 114 functional safety certifications, including 41 product certifications and 73 process certifications, far more than in 2022 (about 40).

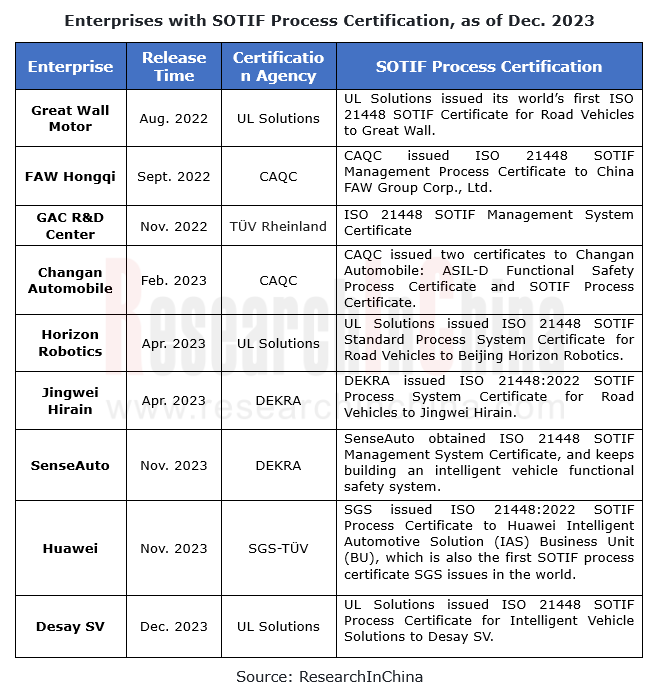

In addition to functional safety certification, the official implementation of SOTIF standards has spurred many OEMs and suppliers such as Great Wall Motor, FAW Hongqi, Changan Automobile, GAC, Horizon Robotics, Jingwei Hirain, Huawei, Desay SV and SenseAuto to deploy SOTIF processes. They have passed SOTIF process certifications in advance, laying a safety foundation for the further layout of autonomous driving systems.

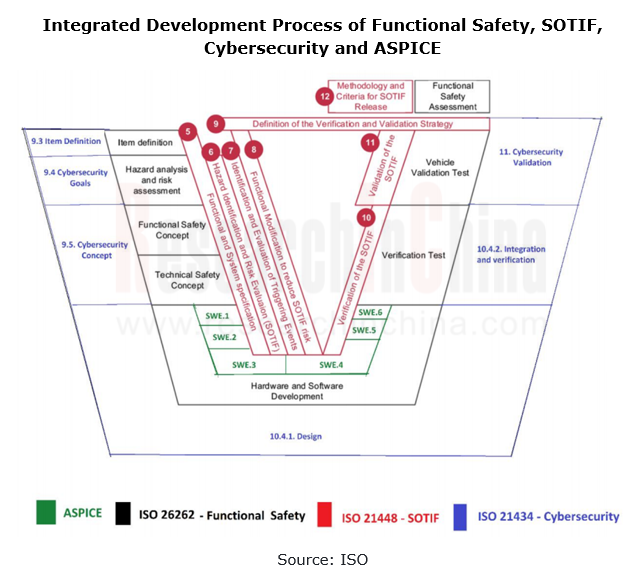

Functional safety, SOTIF, cybersecurity, etc. tends to be developed in from an independent way to an integrated way.

In addition to functional safety, the development of vehicles will have to face other safety challenges in the future, such as SOTIF and cybersecurity. Functional safety and SOTIF focus on system design and verification to ensure that the system can work safely in all situations. Cybersecurity centers on external threats and attacks. In practical application, functional safety, SOTIF and cybersecurity often cross over. In the future, intelligent connected vehicles should solve all the risks related to vehicle safety before they can be delivered in large quantities. The integrated development of the three safety systems has become a major development trend of vehicle safety in the future. Multiple companies like KOSTAL, Neta, Baolong Technology and Pan-Asia Technical Automotive Center are exploring integrated development of safety.

As vehicles carry more complex embedded electronic systems, the risks incurred by software system damage and random hardware damage are increasing. Integrating the ISO 26262 functional safety standard into the Automotive Software Process Improvement and Capability dEtermination (ASPICE) to guide automotive software development will greatly improve automotive system software development quality, development efficiency and product safety.

Automotive TSP and Application Service Research Report, 2024-2025

TSP Research: In-vehicle connectivity services expand in the direction of cross-domain integration, all-scenario integration and cockpit-driving integration

TSP (Telematics Service Provider) is mainl...

Autonomous Driving Domain Controller and Central Control Unit (CCU) Industry Report, 2024-2025

Autonomous Driving Domain Controller Research: One Board/One Chip Solution Will Have Profound Impacts on the Automotive Supply Chain

Three development stages of autonomous driving domain controller:...

Global and China Range Extended Electric Vehicle (REEV) and Plug-in Hybrid Electric Vehicle (PHEV) Research Report, 2024-2025

Research on REEV and PHEV: Head in the direction of high thermal efficiency and large batteries, and there is huge potential for REEVs to go overseas

In 2024, hybrid vehicles grew faster than batter...

Automotive AI Agent Product Development and Commercialization Research Report, 2024

Automotive AI Agent product development: How to enable “cockpit endorser” via foundation models?

According to OPEN AI’s taxonomy of AI (a total of 5 levels), AI Agent is at L3 in the AI development ...

China ADAS Redundant System Strategy Research Report, 2024

Redundant system strategy research: develop towards integrated redundant designADAS redundant system definition framework

For autonomous vehicles, safety is the primary premise. Only when ADAS is ful...

Smart Car OTA Industry Report, 2024-2025

Automotive OTA research: With the arrival of the national mandatory OTA standards, OEMs are accelerating their pace in compliance and full life cycle operations

The rising OTA installations facilitat...

End-to-end Autonomous Driving Industry Report, 2024-2025

End-to-end intelligent driving research: How Li Auto becomes a leader from an intelligent driving follower

There are two types of end-to-end autonomous driving: global (one-stage) and segmented (two-...

China Smart Door and Electric Tailgate Market Research Report, 2024

Smart door research: The market is worth nearly RMB50 billion in 2024, with diverse door opening technologies

This report analyzes and studies the installation, market size, competitive landsc...

Commercial Vehicle Intelligent Chassis Industry Report, 2024

Commercial vehicle intelligent chassis research: 20+ OEMs deploy chassis-by-wire, and electromechanical brake (EMB) policies are expected to be implemented in 2025-2026

The Commercial Vehicle Intell...

Automotive Smart Surface Industry Report, 2024

Research on automotive smart surface: "Plastic material + touch solution" has become mainstream, and sales of smart surface models soared by 105.1% year on year

In this report, smart surface refers t...

China Automotive Multimodal Interaction Development Research Report, 2024

Multimodal interaction research: AI foundation models deeply integrate into the cockpit, helping perceptual intelligence evolve into cognitive intelligence

China Automotive Multimodal Interaction Dev...

Automotive Vision Industry Report, 2024

Automotive Vision Research: 90 million cameras are installed annually, and vision-only solutions lower the threshold for intelligent driving. The cameras installed in new vehicles in China will hit 90...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2024

Radar research: the pace of mass-producing 4D imaging radars quickens, and the rise of domestic suppliers speeds up.

At present, high-level intelligent driving systems represented by urban NOA are fa...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2024

OEM ADAS research: adjust structure, integrate teams, and compete in D2D, all for a leadership in intelligent driving

In recent years, China's intelligent driving market has experienced escala...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2024

Research on overseas layout of OEMs: There are sharp differences among regions. The average unit price of exports to Europe is 3.7 times that to Southeast Asia.

The Research Report on Overseas Layou...

In-vehicle Payment and ETC Market Research Report, 2024

Research on in-vehicle payment and ETC: analysis on three major application scenarios of in-vehicle payment

In-vehicle payment refers to users selecting and purchasing goods or services in the car an...

Automotive Audio System Industry Report, 2024

Automotive audio systems in 2024: intensified stacking, and involution on number of hardware and software tuning

Sales of vehicle models equipped with more than 8 speakers have made stea...

China Passenger Car Highway & Urban NOA (Navigate on Autopilot) Research Report, 2024

NOA industry research: seven trends in the development of passenger car NOA

In recent years, the development path of autonomous driving technology has gradually become clear, and the industry is acce...