Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Because of burning money and suffering a huge loss, many people thought NIO would soon go out of business. NIO however recovered from troughs again in late 2023, by virtue of its strong financing capacity, battery swap cooperation with Changan and Geely, and release of ET9 and many innovative technologies. In eight years, NIO closed more than 20 funding rounds and raised over RMB100 billion. Wherein, the biggest support came from Anhui, the hometown of NIO’s CEO Li Bin.????

Hefei, capital of Anhui, is known as "The Best Venture Capital City". In 2020, Hefei invested RMB7 billion to save NIO. In 2021, NIO and the People's Government of Hefei City signed an agreement to deepen cooperation. Both parties agreed to jointly plan and construct the Xinqiao Intelligent Electric Vehicle Industrial Park to build a world-class intelligent electric vehicle industrial cluster with a complete industry chain. At present, the park has successfully attracted hundreds of related companies.

With capital and support from all parties, NIO has left no stone unturned in investing in new technologies and R&D.

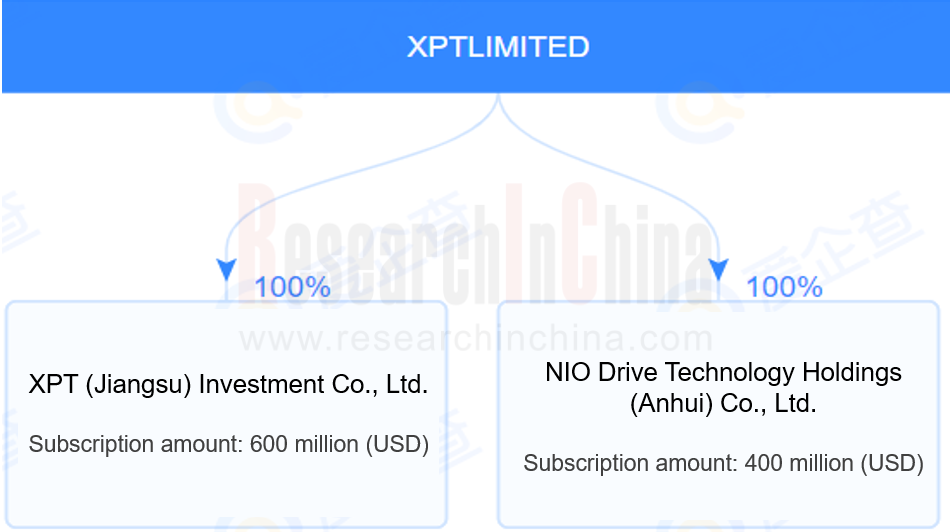

NIO has made extensive investments in intelligent electric vehicles. For example, XPT LIMITED, NIO’s company responsible for electrification, has established NIO Drive Technology Holdings (Anhui) Co., Ltd.

NIO Drive Technology Holdings (Anhui) Co., Ltd. invested and established Hefei NIO Industrial Investment Center Partnership (Limited Partnership).

Hefei NIO Industrial Investment Center Partnership (Limited Partnership) has invested in automotive electronics industry chain companies such as Hefei MONE IC, Suzhou Enkris Semiconductor, SINPRO, BeBest, and INGIN Automotive Technology.

With tens of billions of yuan invested in R&D each year, NIO has begun to produce a range of industry-leading results. This article highlights nine of them.

1. Self-develop an operating system, no longer needing AUTOSAR and QNX

According to the information provided by AI-Drive, NIO has replaced AUTOSAR with its in-house developed operating system SkyOS, and QNX with its own microkernel. SkyOS features NIO’s self-developed hypervisor, and NT3.0 platform can enable cockpit-driving integration. SkyOS encapsulates subsystems of each in-vehicle operating system such as multimedia, graphics, integrated computing and security into more than 1,000 atomic capabilities, which can combine with each other and can be flexibly utilized by various development departments at the same level within NIO.??

If all OEMs self-develop operating systems and kernels as NIO to replace AUTOSAR and QNX, AUTOSAR-based ecosystem and operating system providers will then lose value. Yet most OEMs are incapable of independently developing OS in full stack, and there is still market space for operating system and middleware providers.

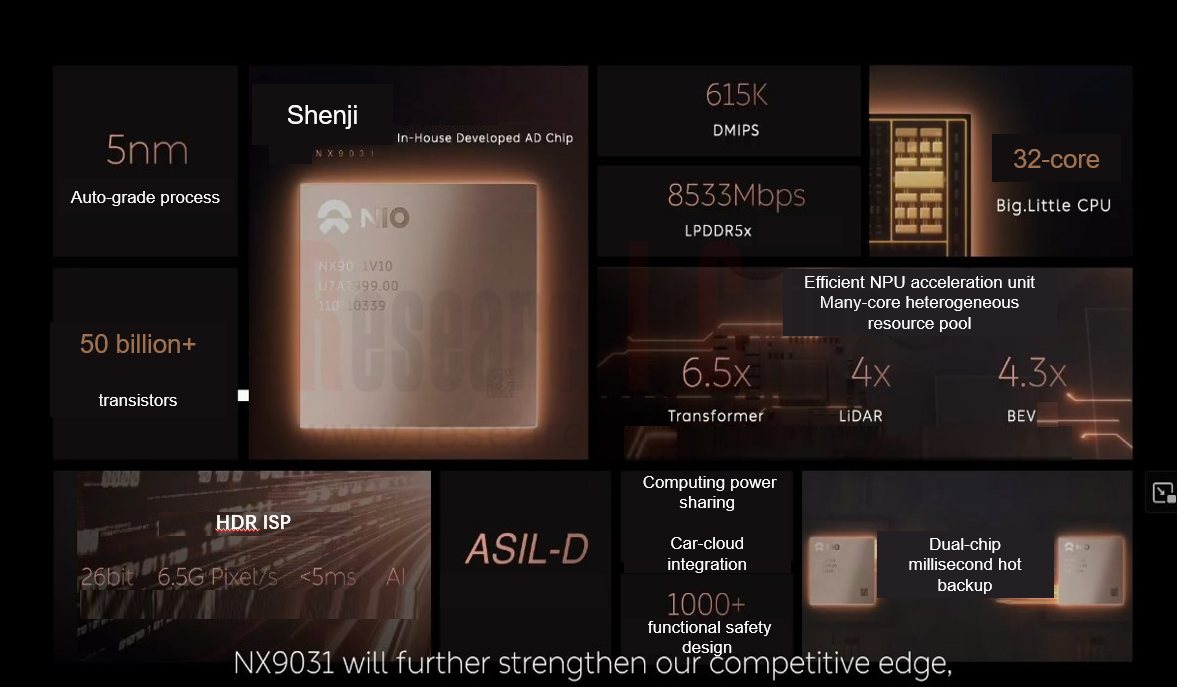

2. Self-develop intelligent driving chip Shenji NX9031

Tesla was the first one to self-develop intelligent driving chips. NIO, Xpeng and Li Auto follow suit. NIO's self-developed autonomous driving chip, called Shenji NX9031, features the following: 5nm process; over 50 billion transistors; LPDDR5X storage; 32-core CPU (large and small cores configuration); HDR ISP, with a width of 26 bits and pixel processing power of 6.5 GPixel/s; ASIL-D functional safety level.?

It is generally believed that only when the chip production reaches one million pieces will there be a cost advantage. Tesla has already achieved this, while NIO will not be able to dilute chip cost until it launches its second brand and expands sales.??

Investing in in-house development of intelligent driving or cockpit chips is not too difficult for conventional brands with large sales such as Geely, GAC, and BYD, because they have enough sales to support. As long as emerging carmakers get through independent development of intelligent driving chips and prove the value of cost reduction and efficiency improvement, conventional automakers are likely to follow suit. For example, GAC Capital has invested in autonomous driving chip company EVAS Intelligence, and may build in-depth cooperation with it in the future.

If OEMs’ sales are not high enough, it will be hard to spread the cost of chip R&D. And chip R&D requires continuous heavy investments, and the chip department will then become a huge burden. That OPPO stopped developing chips in-house is a lesson to be learned.???

3. Fully chassis-by-wire and VMC intelligent computing platform

NIO ET9's "SkyRide Intelligent Chassis System" integrates the three core hardware systems for the first time: steer-by-wire, rear-wheel steering and fully active suspension. Brake-by-wire already has many application cases, but there are very few application cases of steel-by-wire. NIO ET9 uses steel-by-wire, brake-by-wire, and active suspension simultaneously, and SkyRide integrates most hardware, which is the first in the world.??

NIO's previous generation ICC (Intelligent Chassis Controller) has also evolved to VMC intelligent computing platform. Realizing the decoupling of software and hardware and combining SkyOS, VMC supports flexible deployment of expandable new functions and new wire-controlled hardware. Moreover, it connects upward to AD intelligent driving and downward to each actuator, and integrates drive system, braking system, steering system, active suspension and other wire-controlled hardware, which makes the vehicle motion control hit a new high. Meanwhile, VMC is also data-driven, and the fully wire-controlled intelligent chassis therefore has the ability to evolve, iterate, and grow.???

4. Integrated hydraulic fully active suspension

NIO and ClearMotion jointly developed an active suspension electric drive unit. Unlike the pneumatic suspension of Mercedes-Benz or Porsche, it features higher integration and smaller size. Each damper is highly integrated with an independent electro-hydraulic pump, and the brushless DC motor make quick responses, completing information processing, calculation and response within 1 millisecond. Also the suspension supports a wide height adjustment range (travel) from +40mm (up) to -50mm (down), 1,000 torque adjustments per second, and independent control of the four wheels, meeting driving needs in multiple scenarios.??

In August 2023, ClearMotion joined hands with BWI International, and started construction of its first production plant in Changshu, Jiangsu, which is expected to start delivering products globally by the end of 2024, and may also supply other auto brands besides NIO in the future.

SkyRide integrated hydraulic fully active suspension, with each damper highly integrated with an independent electric hydraulic pump, enables body adjustment 60 times faster than an air suspension. NIO is not the only one to develop hydraulic active suspension. BYD Disus-P is also an intelligent hydraulic suspension. But NIO develops more deeply. For example, SkyRide fully active suspension has a stratospheric mode: "Stratospheric Mode" activated via one button enables 6-axis adjustment of the body like an airplane, fully suppressing the vehicle's vibration on continuously undulating roads; it can also be integrated with PanoCinema to realize the 5D dynamic cinema mode, which deeply links overall substantial movements of the body with the video plot, providing an immersive audio-visual experience.???

Intelligent suspension technology routes are relatively diverse, and it is hard to say which one is the future trend. However NIO’s development history of intelligent suspension and intelligent chassis indicates two trends:

The first is to integrate the control in three directions (transverse, longitudinal and vertical) in the chassis domain. Only one of suspension control, steering control or braking control has limited prospects;

The second is that OEMs have a fairly big say on chassis control and cross-domain scheduling. NIO has already realized data sharing and function calling across domains such as intelligent driving domain, cockpit domain and chassis domain. Tier1s can generally only work on integration within one domain, and it is difficult for them to play a role in the cross-domain aspect.

Therefore, the software R&D teams of OEMs will become ever bigger, and Tier1s or Tier2s will become increasingly dependent on OEMs.

5. The world's first 925V continuous wave winding motor with hepta safety redundancy

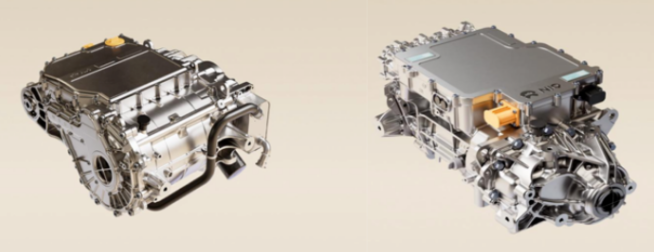

Motors of NIO ET9 released in December are SiC motors customized for 900V, with the 180kW inductive asynchronous motor in the front and the 340kW permanent magnet synchronous motor in the rear. The front 180kW inductive asynchronous motor, with its weight reduced to 69kg and power density of 2.6kW/kg, boasts the highest power density in the industry.

The rear 340kW permanent magnet motor is the world's first 925V continuous wave winding motor. This process realizes endless welding, and the slot full rate of one-piece molding as high as 86%, further improving the motor efficiency. The rear motor weighs 79kg and has power density of 4.3kW/kg.

NIO ET9 pioneers the hepta safety redundancy for passenger cars, involving drive, braking, steering, sensing, computing, communication, and power distribution. Dual-motor redundancy ensures stable driving in rainy and snowy weathers and slippery roads, greatly reducing power loss. In addition to the main braking system IPB, the braking redundancy also has a backup braking system RBU; the steering redundancy has dual 12V power supply system and double hardware for the steering motor.?

6. 46105 large cylindrical battery and 150kWh battery pack

To realize global 900V high-voltage architecture, full-stack self-development capabilities from battery cell to battery pack are needed. NIO independently developed 46105 large cylindrical battery cells and battery packs for 900V. The energy density per cell is 292Wh/kg; the capacity of the whole pack is 120kWh; the charging efficiency of the battery pack for ultra-fast charging and battery swapping is 5C. The battery parameters disclosed also include: 1.6mΩ internal resistance per cell; 5C high-voltage ultra-fast charging capability that enables a range of 255km with a 5-minute charge.???????

According to GGII data, currently the average internal resistance value that can be achieved by large cylindrical batteries using the full-tab process is 0.9-2 milliohms, while the energy density per cell of most large cylindrical batteries ranges at 270-330Wh/kg. NIO 46105 battery has not exceeded or come to the forefront in terms of internal resistance and energy density per cell.????

In December, NIO live-streamed the test of the 150kWh battery pack on ET7. The car ran 1,044 kilometers without charging or swapping batteries, making it the largest mass-produced battery pack for passenger cars in China. The battery pack uses semi-solid punch cells jointly developed by NIO and WELION New Energy. The energy density per cell is 360Wh/kg, and that of the whole pack is 260Wh/kg.?

The 150kWh battery released by NIO and WELION New Energy has an energy density 30% higher than CATL’s most advanced Qinlin Battery and 25% higher than the 4680 battery that Tesla took three years to develop. The unit cost of the 150kWh battery pack reaches RMB300,000, so it is only rented but not sold.

By industry insiders’ estimates, a battery pack similar to NIO’s 150kWh pack requires an investment of around RMB1 billion from testing to small-scale production, twice as high as mainstream power batteries.

7. NOMI capable of active prediction and association

NIO’s voice assistant NOMI has been wakened up more than 1 billion times in total. Recently, NOMI added NOMI Association, NOMI Listen, NOMI See-and-Speak, and NOMI Notes. For example, under the “NOMI association” function, NOMI can make associations according to what the user says, add words to complete the sentence, and display it in the recognition box, providing prompts when the user can't think of what to say.

The new version of NOMI automatically recognizes whether there are new people in the car, and actively greets the passengers in the rear.

Meanwhile, NIO has integrated heterogeneous computing power, that is, integrate cockpit 8155, intelligent driving Orin, NIO Phone, and NIO BOX for high-speed data transmission and exchange. For example, some complex visual algorithm modules (such as OMS) in the cockpit can be put on Orin to free up computing power for 8155 to support speech computing.

8. Self-developed NIO PHONE

NIO is China’s first OEM to launch phone products. Development of NIO PHONE is one of NIO's most disapproved innovative directions. Li Bin said that it will take three years to know strategic importance of developing mobile phones, and when mobile phone giants such as Huawei and Xiaomi sell ever more cars, everyone will know the significance of self-developing mobile phones. However the problem is that Li Bin himself does not use NIO Phone; on the other hand, in addition to mobile phones, Huawei and Xiaomi also have a huge range of smart home products and consumer electronics, which are difficult for latecomers like NIO to copy.?

9. NIO’s charging and battery swap system

NIO's charging and battery swap system is its most competitive asset.

In December 2023, NIO officially released its 4th-generation battery swap station, which is equipped with 4 NVIDIA Orin X SoCs (2 for the previous generation), and 6 ultra-wide-angle LIDARs (2 for the previous generation), with the whole station's computing power up to 1016TOPS. It is compatible with multi-specification battery packs, and supports multi-brand sharing for battery swap.?

In December 2023, NIO announced a fully liquid-cooled fast charging pile, with peak power of 640kW, maximum output current of 754A, maximum output voltage of 1000V, and 2.4kg liquid-cooled charging gun cable. It can intelligently distribute charging power in real time in the station. The fully liquid-cooled pile released by Huawei in October features maximum output power of 600kW, maximum current of 600A, and voltage of 1000V. The key parameters of NIO's fully liquid-cooled fast charging pile are slightly higher than Huawei's.??

By the end of 2023, NIO has boasted more than 2,300 battery swap stations. It plans to build another 1,000 stations in 2024.

As of December 22, 2023, NIO has built a total of 20,922 charging piles, the most among auto brands. It plans to add 20,000 charging piles in 2024, building a total of more than 41,000 charging piles.

In 2022, Wuhan NIO Energy Co., Ltd., which is responsible for charging and swapping operations, recorded about RMB1.1 billion in revenue and tens of millions of yuan in profits. In the first five months of 2023, Wuhan NIO Energy Co., Ltd. sold over RMB2 billion, becoming profitable. Moreover, starting from 2024, OEMs like Geely and Changan will connect to NIO’s battery swap stations, helping to reduce the cost per battery swap.?

In summary, most of NIO's technological innovations are at the forefront of the industry and play a forward-looking leading role. Yet a small part of its technology R&D does not have a reference value for other manufacturers. Under competitive pressure, in November 2023 NIO also started reducing staffs and costs, and postponing or cutting long-term investment projects that will not contribute to its financial results in the next three years.???