Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Li Auto overestimates the BEV market trend and returns to intensive cultivation.

In the MPV market, Denza D9 DM-i with the highest sales (8,030 units) in January 2024 is a hybrid electric vehicle (HEV) model. Among the top ten new energy models, Trumpchi E8 PHEV (3,470 units) and Voyah Dreamer PHEV (3,208 units) are also HEV models.???

In 2023, the sales of battery electric vehicle (BEV) models in Chinese market jumped by 24.6% year on year, plug-in hybrid electric vehicle (PHEV) models by 84.7%, and extended-range electric vehicle (EREV) models by 181%. It is absolutely clear which technology route is more accepted by current users. It stands to reason that Li Auto, which is best at EREVs, should launch all-electric and extended-range editions of MEGA simultaneously.???????

Why no extended-range edition?

Li Auto's official answer is: “only built on advanced BEV architecture can we get the optimal MPV space solution we think. The space potential of MPVs has already been exploited under existing fuel-powered vehicle architectures. Assuming Li MEGA is an extended-range MPV, the space for components like range extender and fuel tank must be reserved, so there is no way to fully release the space and the styling will not be perfect either. To produce a qualitative change in interior space, the only path is all-electric.”?????

“Li MEGA is based on Li Auto’s high-voltage BEV platform and packs Li Auto-CATL Qilin 5C battery, with a CLTC range of 710km and a cruising range of 500km in the fastest 12-minute charge. We are accelerating the construction of the 5C supercharging network, turning supercharging stations into an important configuration of all-electric products including Li MEGA and a range extender for BEV models.”

This explanation is slightly far-fetched. It can be said that Li MEGA is an idealistic product that is far from the actual needs of the public, leading to lower-than-expected MEGA sales.??

Facing the setback, Li Xiang introspected. He emphasized that Li MEGA is in the stage of 0 to 1 (commercial verification period) rather than 1 to 10 (boom period),so he lowered the sales expectation of the whole company which then began to enter the stage of proceeding steadily and step by step and making solid progress.??

In 2024, Li Auto starts large-scale deployment of super-fast charging stations, building more than 2,000 in cities in 2024 and 3,000 in 2025. It will also build 700 supercharging stations on highways in 2024.

In contrast, NIO, an OEM with the most charging stations, has already built 3,740 charging stations and 2,375 battery swap stations nationwide as of March 2024. NIO plans to build 1,000 new battery swap stations (equivalent to Li Auto's supercharging stations) in 2024. It is clear that well-funded Li Auto is more aggressive.??

Frequently push OTA updates and return to intensive cultivation?

Li Auto pushes OTA updates frequently, with a major upgrade to version 5.0 in late 2023, making owners feel as if they’ve gotten a new car.

On March 27, 2024, Li Auto announced that L Series and Li MEGA will start OTA 5.1 push, adding 41 new highlights such as:

?Add IVI hotspot and wireless screen projection

?Add HUD digital rearview mirror image

?Further enhance AEB recognition capabilities and usable scenarios

?Recognize obstacles, e.g., water-filled barriers and construction signs

?Support braking at a maximum speed of 90km/h.

?Freely select intelligent parking from left, center or right?

?Add a full-view driving recorder: five-way viewing angle, 24-hour simultaneous recording

?Enhance truck avoidance function of highway NOA

?Enhance roundabout function of urban NOA

?Add Tuning Master and Task Master Square

?Add second-row sitting position memory

Continuously optimize the management system to maintain team combat effectiveness

In the first few years of start-up, Li Auto was not the most advanced in technology. However, relying on strong product definition capabilities and organizational management capabilities, Li Auto’s team has boasted combat effectiveness stronger than other emerging automakers (except Huawei AITO), and the car sales of a single store is often more than twice that of other emerging automakers.?

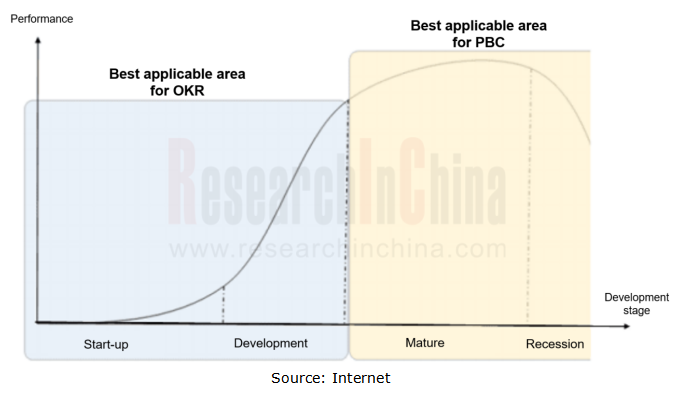

For example, to cope with the long-cycle characteristics of the automotive industry, Li Auto upgraded its employee assessment content from OKR to PBC after sales increased. Original performance assessment ratio and assessment cycle were changed accordingly, with the assessment ratio changed from “262” to “271”.???

“271” reduces the proportion of unqualified employees in performance assessment, which is theoretically friendlier than the previous appraisal system. However, under the new system, the performance assessment cycle has been adjusted to half a year. If both assessment cycles are rated "I/F", it will mean that the employee is more likely to be laid off. Li Auto said that the purpose of lengthening the assessment cycle is to match the automotive industry that has performance output characteristics of long term and complex business, and make employees focus on long-term contributions, while appropriately reducing management costs and lowering the ratio of last places.??

?

To have the ability to develop multiple models simultaneously, Li Auto introduced the IPD (Integrated Product Development) process from Huawei. Its core is PDT (Product Develop Team), which is responsible for the commercial success and the entire process of a car from definition to sales. The benefit offered by the IPD process is that the company has highly unified ideas in the processes of product definition, design, development and marketing. Li Auto started piloting the matrix management mode from IPD in 2021 and established the first horizontally organized product department.????

Li Auto transformed from a “vertical functional organization” to a “matrix organization” in December 2022, shifting from concentrating all efforts in one place to synchronously coordinating efforts at multiple points. Li Auto will fully start a matrix organization from 2023 to 2025. Based on two horizontal entity departments of strategy and product, five new departments including business, supply, process, organization, and finance will be added to ensure the quality of full-process management. In April 2023, Li Auto added another two departments: one is "CFO Office", where CFO Li Tie is responsible for process, organizational, and financial changes; the other is "Sales and Service Group", headed by former Huawei executive Zou Liangjun which mainly manages sales, delivery, after-sales and charging networks, and reports to Li Xiang.

In September 2023, Li Auto established a capacity delivery team for each manufacturing plant (including Changzhou, Beijing, and range extender plants), which runs through R&D, manufacturing, supply, procurement, and delivery links.?

Precisely because of excellent internal management and external supply chain management, Li Auto does not have big problems with production capacity expansion, ensuring the delivery surged from 132,000 cars in 2022 to 376,000 units in 2023.?

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...

Automotive Intelligent Cockpit SoC Research Report, 2025

Cockpit SoC research: The localization rate exceeds 10%, and AI-oriented cockpit SoC will become the mainstream in the next 2-3 years

In the Chinese automotive intelligent cockpit SoC market, althoug...

Auto Shanghai 2025 Summary Report

The post-show summary report of 2025 Shanghai Auto Show, which mainly includes three parts: the exhibition introduction, OEM, and suppliers. Among them, OEM includes the introduction of models a...

Automotive Operating System and AIOS Integration Research Report, 2025

Research on automotive AI operating system (AIOS): from AI application and AI-driven to AI-native

Automotive Operating System and AIOS Integration Research Report, 2025, released by ResearchInChina, ...

Software-Defined Vehicles in 2025: OEM Software Development and Supply Chain Deployment Strategy Research Report

SDV Research: OEM software development and supply chain deployment strategies from 48 dimensions

The overall framework of software-defined vehicles: (1) Application software layer: cockpit software, ...

Research Report on Automotive Memory Chip Industry and Its Impact on Foundation Models, 2025

Research on automotive memory chips: driven by foundation models, performance requirements and costs of automotive memory chips are greatly improved.

From 2D+CNN small models to BEV+Transformer found...

48V Low-voltage Power Distribution Network (PDN) Architecture and Supply Chain Panorama Research Report, 2025

For a long time, the 48V low-voltage PDN architecture has been dominated by 48V mild hybrids. The electrical topology of 48V mild hybrids is relatively outdated, and Chinese OEMs have not given it suf...

Research Report on Overseas Cockpit Configuration and Supply Chain of Key Models, 2025

Overseas Cockpit Research: Tariffs stir up the global automotive market, and intelligent cockpits promote automobile exports

ResearchInChina has released the Research Report on Overseas Cockpit Co...

Automotive Display, Center Console and Cluster Industry Report, 2025

In addition to cockpit interaction, automotive display is another important carrier of the intelligent cockpit. In recent years, the intelligence level of cockpits has continued to improve, and automo...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2025

Functional safety research: under the "equal rights for intelligent driving", safety of the intended functionality (SOTIF) design is crucial

As Chinese new energy vehicle manufacturers propose "Equal...