Global and China Lithium Iron Phosphate (LiFePO4) Material and Battery Industry Report, 2015-2018

-

July 2015

- Hard Copy

- USD

$2,500

-

- Pages:103

- Single User License

(PDF Unprintable)

- USD

$2,350

-

- Code:

HK059

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,700

-

As one of the main cathode materials for lithium-ion batteries, lithium iron phosphate (molecular formula is LiFePO4, also known as LFP) features such strengths as high safety, long cycle life, and high temperature resistance. But its weakness is lower energy density. Lithium iron phosphate batteries can be used in electric vehicles, power tools, electric bicycles, energy storage devices, etc. For now, they are mainly used as power batteries for electric vehicles.

In 2014, some 12,500 tons of lithium iron phosphate were sold globally, and they were mainly sold to China, almost accounting for 75% of the total. That was mainly because Chinese electric vehicle enterprises tend to adopt lithium iron phosphate as power batteries of cathode materials. Additionally, China's great support for new energy vehicles has promoted the rapid increase of the country’s demand for lithium iron phosphate. In contrast, cathode materials for power batteries in the US, Japan, and South Korea are dominated by ternary material and lithium manganate.

Globally, the traditional lithium iron phosphate material manufacturers mainly include the U.S.-based A123 and Valence and the Canada-based Phostech, which grasp mature mass-production technology. However, the demand for lithium iron phosphate battery in the US and European countries showed an ongoing decline, a situation that plunged them into financial difficulties. For example, A123 filed a petition in bankruptcy in October 2012, and was finally acquired by China’s Wanxiang Group; Valence retreated from NASDAQ in July 2012 as it had long been in the red.

In recent years, however, lithium iron phosphate enterprises in Mainland China and Taiwan have been developing very fast, accompanied by dramatic capacity expansion and rising market position. By the end of 2014, over 80% of the world’s lithium iron phosphate originated from Mainland China and Taiwan, of which the Taiwanese lithium iron phosphate material manufacturers were mainly Formosa and Aleees, of which total capacity approximated 7,300 tons in 2014.

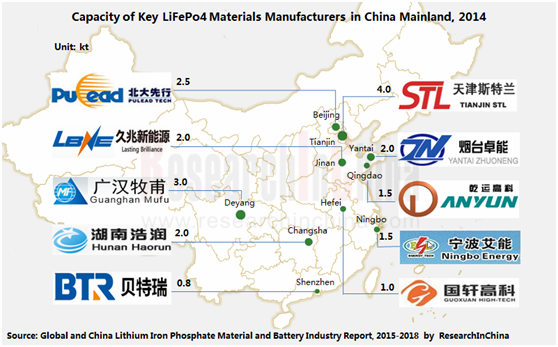

In 2014, Mainland China recorded a total capacity of about 30,000 tons of lithium iron phosphate. The major enterprises included Tianjin STL Energy Technology Co., Ltd., Guanghan Mufu Lithium Power Materials Co., Ltd., and Pulead Technology Industry Co., Ltd., etc. which contributed a combined capacity of 9,500 tons. Furthermore, there are several proposed and ongoing lithium iron phosphate projects in China. For example, Tianjin STL Energy Technology planned to expand its lithium iron phosphate capacity to 10,000 tons within three years; Pulead Technology’s Base in Qinghai is working to construct a “5,000 tons/a lithium iron phosphate and other cathode materials” project (Phase II).

In terms of EV industry, China’s mainstream cathode materials for power batteries are still lithium iron phosphate, which represents an around 40% share of power battery market, Major manufacturers consist of BYD, Guoxuan High-Tech, and Tianjin Lishen, etc. However, low energy density of lithium iron phosphate batteries restricts the EV’s driving range, a situation that makes more and more enterprises turn to ternary materials. In the future, the application percentage of lithium iron phosphate batteries in electric vehicles will fall.

However, the application of lithium iron phosphate batteries in energy storage, photovoltaic and communication batteries is on the rise, reflecting a huge space for development. In the field of electric bicycles, the batteries have obvious advantages over the traditional lead-acid batteries, hence a larger alternative space.

Global and China Lithium Iron Phosphate (LiFePO4) Material and Battery Industry Report, 2015-2018 compiled by ResearchInChina is primarily concerned with the following:

Market size, competition pattern, development prediction, etc. of the global lithium iron phosphate industry;

Market size, competition pattern, development prediction, etc. of the global lithium iron phosphate industry;

Market size, competition pattern, downstream demand, development prediction, etc. of China’s lithium iron phosphate industry;

Market size, competition pattern, downstream demand, development prediction, etc. of China’s lithium iron phosphate industry;

Operation, lithium iron phosphate business, etc. of 21 lithium iron phosphate companies at home and abroad;

Operation, lithium iron phosphate business, etc. of 21 lithium iron phosphate companies at home and abroad;

Operation, lithium iron phosphate battery business, etc. of 11 lithium iron phosphate battery companies in China.

Operation, lithium iron phosphate battery business, etc. of 11 lithium iron phosphate battery companies in China.

1. Overview of LiFePO4 Battery

1.1 Overview

1.1.1 Definition

1.1.2 Merits and Demerits

1.2 Industry Chain

2. Global LiFePO4 Market

2.1 Overview

2.2 Competition Pattern

3. Market of LiFePO4 Materials in Mainland China

3.1 Development

3.2 Supply and Demand

3.3 Competition Pattern

3.4 Patent Barriers of LiFePO4 Materials

3.4.1 Dispute on Patent

3.4.2 Latest Development

3.5 Policy Impact

4. Industry of LiFePO4 Battery in Mainland China

4.1 Supply

4.2 Demand

4.2.1 Electric Car

4.2.2 Electric Tools

4.2.3 Electric Bicycle

4.2.4 Energy Storage Equipment

4.2.5 Communication Industry

4.3 Supported LiFePO4 Battery for New Energy Vehicles in China

5. Key LiFePO4 Materials Manufacturers

5.1 A123 Systems

5.1.1 Profile

5.1.2 Operation

5.1.3 Subsidiaries in China

5.2 Valence

5.2.1 Profile

5.2.2 Operation

5.2.3 Subsidiaries in China

5.3 Phostech

5.3.1 Profile

5.3.2 LiFePO4 Business

5.4 Formosa Energy & Material Technology Co., Ltd.

5.4.1 Profile

5.4.2 LiFePO4 Business

5.5 ALeees

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 LiFePO4 Business

5.5.5 Development Dynamic

5.6 Hirose Tech

5.6.1 Profile

5.6.2 Operation

5.6.3 Competition Vantage

5.7 Tatung Fine Chemicals

5.7.1 Profile

5.7.2 Operation

5.7.3 LiFePO4 Business

5.8 Tianjin STL Energy Technology Co., Ltd.

5.8.1 Profile

5.8.2 LiFePO4 Business

5.9 Pulead Technology Industry Co., Ltd

5.9.1 Profile

5.9.2 Subsidiaries

5.9.3 LiFePO4 Business

5.10 Shenzhen BTR New Energy Material Co., Ltd

5.10.1 Profile

5.10.2 Operation

5.10.3 LiFePO4 Business

5.11 Yantai Zhuoneng Battery Material Co., Ltd.

5.11.1 Profile

5.11.2 LiFePO4 Business

5.12 Nanjing Lasting Brilliance New Energy Technology Co., Ltd.

5.12.1 Profile

5.12.2 R&D Project

5.12.3 Development History

5.13 Guanghan Mufu Lithium Power Materials Co., Ltd.

5.13.1 Profile

5.13.2 LiFePO4 Business

5.14 Hunan Shanshan Advanced Materials Co., Ltd.

5.14.1 Profile

5.14.2 Operation

5.14.3 Cathode Material Business

5.15 HeFei GuoXuan High-Tech Power Energy Co., Ltd.

5.15.1 Profile

5.15.2 Operation

5.15.3 LiFePO4 and Battery Business

5.16 ShenZhen TianJiao Technology Development LTD.

5.16.1 Profile

5.16.2 Operation

5.17 Others

5.17.1 Xinxiang Huaxin Energy Materials Co., Ltd.

5.17.2 Hunan Haorun Technology Co., Ltd.

5.17.3 NanoChem Systems (Suzhou) Co., Ltd.

5.17.4 Xinxiang Chuangjia Power Supply Material Co., Ltd.

5.17.5 QingDao Qianyun High-tech New Material Co., Ltd.

6. Key LiFePO4 Battery Manufacturers

6.1 BYD

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Goss Margin

6.1.5 LiFePO4 Battery Business

6.1.6 Forecast and Outlook

6.2 Shenzhen BAK Battery

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 R&D

6.2.5 LiFePO4 Battery Business

6.3 Tianjin Lishen Battery Joint-Stock Co., Ltd.

6.3.1 Profile

6.3.2 Operation

6.3.3 LiFePO4 Battery Business

6.4 Shenzhen Mottcell Battery Technology Co., Ltd.

6.4.1 Profile

6.4.2 LiFePO4 Battery Business

6.4.3 Applications

6.5 Wanxiang EV Co., Ltd.

6.5.1 Profile

6.5.2 LiFePO4 Battery Business

6.5.3 Application Case

6.6 CENS Energy-Tech Co., Ltd.

6.6.1 Profile

6.6.2 LiFePO4 Battery Business

6.7 Hipower New Energy Group Co., Ltd.

6.7.1 Profile

6.7.2 LiFePO4 Battery Business

6.8 Suzhou Golden Crown New Energy Co., Ltd.

6.8.1 Profile

6.8.2 LiFePO4 Battery Business

6.9 Pihsiang Energy Technology

6.9.1 Profile

6.9.2 Competitive Edge

6.9.3 Investment

6.10 Qingdao Hongnai New Energy

6.11 Huanyu Power Source Co.,Ltd.

6.11.1 Profile

6.11.2 LiFePO4 Battery Business

7. Summary and Forecast

7.1 Industry

7.2 Enterprise

Classification of Motive Power Battery

Performance of All kinds of Lithium Batteries

Industry Chain of LiFePo4 Battery

Global and Chinese Power Battery Companies and Their Main Products

Sales Volume and Growth Rate of Global Lithium Battery Cathode Materials, 2011-2015

Consumption Proportion of Cathode Material for Lithium Batteries in the World, 2014

Sales Volume of LiFePo4 and Its Proportion of Cathode Material around the World, 2010-2014

Capacity of Key LiFePo4 Materials Manufacturers in Taiwan, 2011-2015

Sales Volume of Lithium Battery Cathode Materials in China, 2011-2015

Major Varieties and Sales Volume Proportion of Lithium Battery Cathode Materials in China, 2014

Sales Volume of LiFePo4 and Its Proportion of Cathode Material in China, 2007-2014

Capacity of Key LiFePo4 Materials Manufacturers in Mainland China, 2014

Lithium Iron Phosphate Projects under Construction in China, 2015

Output of New Energy Vehicles in China, 2010-2015

Estimated Demand for Lithium Battery for New Energy Vehicles in China, 2010-2015

Quantity of Supported Power Battery of New Energy Vehicles in China by Type as of Jul. 2014

Capacity of Major Chinese Power Lithium Battery Manufacturers, 2014

Market Size Forecast of LiFePo4 Battery Used in Electric Car in China

China’s EV Output, 2011-2015

China’s Power Tool Output, 2009-2014

Electric Bicycle Output in China, 2006-2014

Installed Capacity of Wind Power and Photovoltaic, 2006-2014

Major New Energy Vehicle Models and Supported Power Battery in China

Battery Technology and Supporting Manufacturers of Power Lithium Battery Enterprises in China, 2014

History of A123 Systems

Revenue and Gross Profit of A123 Systems, FY2007- FY2012

Revenue and Net Profit of Valence, FY2008-FY2012

Operation of Valence’s Subsidiaries in China

History of Phostech

Aleees’ Revenue and Net Income, 2011-2015

Aleees’ Revenue Breakdown by Product, 2012-2014

Aleees’ Revenue Structure by Product, 2012-2014

Aleees’ Revenue Breakdown by Region, 2012-2014

Aleees’ Revenue Structure by Region, 2012-2014

Aleees’ LiFePO4 Material Capacity and Output, 2012-2014

Aleees’ LiFePO4 Material Sales Volume, 2012-2014

Hirose’s Financial Condition, 2009-2012

Revenue of Tatung Fine Chemicals Co., Ltd., 2009-2015

History of LiFePo4 R&D of Tatung Fine Chemicals Co., Ltd.

Development History of Tianjin STL Energy Technology

LiFePO4 Capacity of Tianjin STL Energy Technology, 2007-2017E

Major Production Bases of Shenzhen BTR

Revenue and Net Income of Shenzhen BeiTerui, 2012-2014

LiFePo4 Development of BTR

Revenue and LiFePO4 Capacity of Yantai ZhuoNeng Battery Material, 2011-2014

Major Customers of Yantai ZhuoNeng Battery Material

Development History of Nanjing Lasting Brilliance New Energy

Revenue and Net Income of Hunan Shanshan, 2010-2014

Cathode Material Sales Volume of Hunan Shanshan, 2009-2014

Main lithium Iron Phosphate Products of Hunan Shanshan

Revenue and Net Income of GuoXuan High-Tech, 2011-2014

Development History of Guoxuan High-Tech

Marketing of Guoxuan High-Tech Major Products

History of Tianjiao Technology

The Main Products Capacity of TianJiao Technology, 2014

Revenue and Net Income of Tiaojiao Technology, 2012-2014

Capacity of Main Products of Xinxiang Huaxin

BYD’s Revenue and Net Income, 2010-2014

BYD’s Revenue Breakdown by Product, 2012-2014

BYD’s Revenue Structure by Product, 2012-2014

BYD’s Revenue Breakdown by Region, 2012-2014

BYD’s Revenue Structure by Region, 2012-2014

Goss Margin of BYD’s Leading Products, 2012-2014

BYD’s Revenue and Net Income, 2014-2018E

Revenue and Net Income of Shenzhen BAK Battery, FY2011-FY2014

Revenue of Shenzhen BAK Battery by Product,FY2009-FY2013

Revenue of Shenzhen BAK Battery by Region,FY2009-FY2013

Revenue Structure of Shenzhen BAK Battery by Region, FY2009-FY2013

R&D Costs and % of Total Revenue of Shenzhen BAK Battery, FY2010-FY2013

Revenue of Tianjin Lishen, 2008-2014

Development History of Tianjin Lishen

Patents of Shenzhen Mottcell Battery

LiFePo4 Battery Application of CENS Energy-Tech

HiPower New Energy Group

Development History of LiFePo4 Battery Business of Pihsiang Energy Technology

Development History of Henan Huanyu Group

Chinese and Global Lithium Iron Phosphate Sales Volume and Proportion, 2011-2018E

Capacity of Lithium Iron Phosphate Material Manufacturers in China (including Taiwan), 2014/2018E

Global and China Photoresist Industry Report, 2021-2026

Since its invention in 1959, photoresist has been the most crucial process material for the semiconductor industry. Photoresist was improved as a key material used in the manufacturing process of prin...

Global and China Needle Coke Industry Report, 2021-2026

Needle coke is an important carbon material, featuring a low thermal expansion coefficient, a low electrical resistivity, and strong thermal shock resistance and oxidation resistance. It is suitable f...

Global and China 3D Glass Industry Report, 2021-2026

3D curved glass is light and thin, transparent and clean, anti-fingerprint, anti-glare, hard and scratch-resistant, and performs well in weather resistance. It is applicable to terminals such as high-...

Global and China Graphene Industry Report, 2020-2026

Graphene, a kind of 2D carbon nanomaterial, features excellent properties such as mechanical property and super electrical conductivity and thermal conductivity. Its downstream application ranges from...

Global and China 3D Glass Industry Report, 2020-2026

Global 3D glass market has been enlarging over the recent years amid demetallization of smartphone back covers and popularity of smart wearables, to approximately $2.86 billion in 2019 and to an estim...

Global and China Photoresist Industry Report, 2020-2026

In 2019, global photoresist market was valued at $8.3 billion, growing at a compound annual rate of 5.1% or so since 2010, and it will outnumber $12.7 billion in 2026 with advances in electronic techn...

Global and China Synthetic Diamond Industry Report, 2020-2026

While its mechanical property is given full play in fields like grinding and cutting, diamond with acoustic, optical, magnetic, thermal and other special properties, as superconducting material, intel...

Global and China Needle Coke Industry Report, 2020-2026

With the merits like small resistivity, excellent resistance to impact and good anti-oxidation property, needle coke has been widely used in ultra-high power graphite electrodes, nuclear reactor decel...

Global and China Optical Fiber Preform Industry Report, 2019-2025

Optical fiber preform, playing an important role in the optical fiber and cable industry chain, seizes about 70% profits of optical fiber. Global demand for optical fiber preform stood at 16.2kt in 20...

China Silicon Carbide Industry Report, 2019-2025

Silicon carbide (SiC) is the most mature and the most widely used among third-generation wide band gap semiconductor materials. Over the past two years, global SiC market capacity, however, hovered ar...

Global and China Photoresist Industry Report, 2019-2025

Photoresist, a sort of material indispensable to PCB, flat panel display, optoelectronic devices, among others, keeps expanding in market size amid the robust demand from downstream sectors. In 2018, ...

Global and China Graphene Industry Report, 2019-2025

Graphene is featured with excellent performance and enjoys a rosy prospect. The global graphene market was worth more than $100 million in 2018, with an anticipated CAGR of virtually 45% between 2019 ...

Global and China 3D Glass Industry Chain Report, 2019-2025

The evolution of AMOLED conduces to the steady development of 3D curved glass market. In 2018, the global 3D glass market expanded 37.7% on an annualized basis and reached $1.9 billion, a figure proje...

China Wood Flooring Industry Report, 2019-2025

With the better standard of living and the people’s desire for an elegant life, wood flooring sees a rising share in the flooring industry of China, up from 33.9% in 2009 to 38.9% in 2018, just behind...

Global and China Photovoltaic Glass Industry Report, 2019-2025

In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total. However, the domestic PV demand was hit by t...

Global and China ITO Targets Industry Chain Report, 2019-2025

Featured by good electrical conductivity and transparency, ITO targets are widely applied to fields of LCD, flat-panel display, plasma display, touch screen, electronic paper, OLED, solar cell, antist...

Global and China MO Source Industry Report, 2019-2025

MO source is a key raw material for metal-organic chemical vapor deposition (MOCVD) process. Global MO source output ranged at 102.6 tons in 2018, a rise of roughly 4.6% from a year earlier, a figure ...

Global and China Bi-Metal Band Saw Blade Industry Report, 2018-2023

Chinese manufacturing rebounded in the wake of a pick-up in infrastructure construction between 2016 and 2018, so did the bi-metal band saw blade as a key integral of metal processing industry. In 201...