Global and China Third-party Logistics Industry Report, 2016-2020

-

Feb.2017

- Hard Copy

- USD

$2,400

-

- Pages:116

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

ZHP054

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,600

-

Third-party logistics can not only help companies complete cargo movement but effectively reduce logistics costs and speed up cargo turnover, fully meeting their requirements on logistics quality. Therefore, third-party logistics develops rapidly. In 2015, global third-party logistics market size hit USD721 billion, a YoY rise of 4.5%, occupying 8.2% of the logistics market size, and increased around USD35.9 billion in 2016, up to USD756.9 billion. In the future, by virtue of high efficiency and highly standardized operation, the third-party logistics market size will grow steadily, expectedly outstripping USD900 billion in 2020, with a share of nearly 10.0% in the logistics market size.

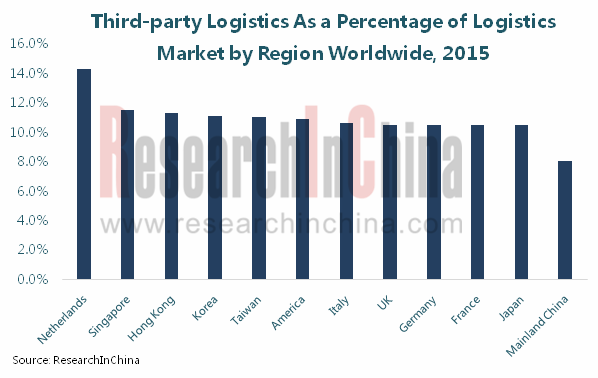

China is the world largest third-party logistics market. In 2015, its market size attained RMB1,065.2 billion or roughly USD171.8 billion (up 13.6% year on year), a 23.8% share in global market, and reached around RMB1,200 billion in 2016. Chinese (Mainland China) third-party logistics industry is still in its infancy, and lags behind the developed countries/regions by share in the whole logistic market (developed regions generally above 10.5%, Mainland China around 8.0%), leaving a large development space. Moreover, China’s regional trade imbalance also creates certain opportunities for the rapid development of third-party logistics. It is predicted that third-party logistics market size in China will see a CAGR of around 15.0% in 2016-2020.

Additionally with not a high market share, Chinese third-party logistics industry also has problems of insufficient demand and low-level demand at present, respectively due to relatively little use of third-party logistics by most traditional companies, and basic and conventional demand of companies which choose third-party logistics and their small demand for high value-added, comprehensive logistics service.

Development trend: to improve profitability and maximize operational efficiency, third-party logistics is heading towards largescale, informatization, asset-light and platform. In addition, as E-commerce in China gradually spreads to regions outside the first tier cities, third-party logistics companies make layout in the second- and third-tier cities accordingly.

Seen from competitive landscape, third-party logistics market has a low concentration rate, and the players compete fiercely. In 2015, CR10 of global third-party logistics industry was less than 20.0%, of which DHL Supply Chain & Global Forwarding with the largest market size only saw 4.1%; Sinotrans, China’s largest third-party logistics company, ranking eighth in the world, only witnessed a market share of 1.0%.

The report highlights the following:

Overview of third-party logistics, including definition, classification, industry characteristics, industry chain, etc.;

Overview of third-party logistics, including definition, classification, industry characteristics, industry chain, etc.;

Overview of global and Chinese logistics industry, including development overview, operation mode, market status, industry characteristics, development trend, etc.;

Overview of global and Chinese logistics industry, including development overview, operation mode, market status, industry characteristics, development trend, etc.;

Overview of global third-party logistics, including development situation, market size, market structure, competitive pattern, etc.;

Overview of global third-party logistics, including development situation, market size, market structure, competitive pattern, etc.;

Overview of Chinese third-party logistics, including development overview, development environment, market size, market structure, competitive pattern, problems, development trend, etc.;

Overview of Chinese third-party logistics, including development overview, development environment, market size, market structure, competitive pattern, problems, development trend, etc.;

Overview of third-party logistics market segments like automotive and pharmaceutical, including market size, status quo, etc.;

Overview of third-party logistics market segments like automotive and pharmaceutical, including market size, status quo, etc.;

Development of infrastructure (highway, railway, water carriage, aviation), transportation equipment (truck, railway wagon, etc.) and other intelligent logistics equipment;

Development of infrastructure (highway, railway, water carriage, aviation), transportation equipment (truck, railway wagon, etc.) and other intelligent logistics equipment;

Overview of 13 foreign, 9 Chinese third-party logistics companies, including operation, third-party logistics layout, etc..

Overview of 13 foreign, 9 Chinese third-party logistics companies, including operation, third-party logistics layout, etc..

1. Overview of Third-party Logistics

1.1 Definition

1.2 Classification

1.3 Industry Barriers

1.4 Industry Characteristics

1.5 Industry Chain

2. Logistics Industry

2.1 Development Overview

2.2 Operation Mode

2.3 Market Status

2.3.1 Global

2.3.2 China

2.4 Industry Characteristics

2.5 Development Trend

3. Global Third-party Logistics Industry

3.1 Development Overview

3.2 Market Size

3.3 Market Structure

3.4 Competitive Patten

4. Chinese Third-party Logistics Industry

4.1 Development Overview

4.2 Development Environment

4.2.1 Policy

4.2.2 Economy

4.3 Market Situation

4.3.1 Market Size

4.3.2 Market Structure

4.3.3 Competitive Patten

4.4 Problems

4.5 Development Trend

5. Third-party Logistics Market Segments

5.1 Automobile

5.1.1 Automotive Industry Scale

5.1.2 Status Quo of Third-party Logistics

5.2 Pharmaceutical

5.2.1 Pharmaceutical Industry Scale

5.2.2 Status Quo of Third-party Logistics

5.3 Cold-chain Third-party Logistics

6. Supporting Industries of Third-party Logistics

6.1 Infrastructure Construction

6.1.1 Highway

6.1.2 Railway

6.1.3 Water Transport

6.1.4 Aviation

6.2 Transportation Equipment Industry

6.2.1 Truck

6.2.2 Railway Wagon

6.2.3 Ship

6.2.4 Cargo Plane

6.3 Other Equipment

6.3.1 AGV

6.3.2 Automated Storage and Retrieval System (AS/RS)

7. Foreign Third-party Logistics Companies

7.1 DHL

7.1.1 Profile

7.1.2 Operation

7.1.3 Third-party Logistics Industry Layout

7.2 Kuehne + Nagel

7.2.1 Profile

7.2.2 Operation

7.2.3 Third-party Logistics Industry Layout

7.3 DB Schenker

7.3.1 Profile

7.3.2 Operation

7.3.3 Third-party Logistics Industry Layout

7.4 Nippon Express

7.4.1 Profile

7.4.2 Operation

7.4.3 Third-party Logistics Industry Layout

7.5 C.H Robinson

7.5.1 Profile

7.5.2 Operation

7.5.3 Third-party Logistics Industry Layout

7.6 UPS

7.6.1 Profile

7.6.2 Operation

7.6.3 Third-party Logistics Industry Layout

7.7 DSV

7.7.1 Profile

7.7.2 Operation

7.7.3 Third-party Logistics Industry Layout

7.8 CEVA

7.8.1 Profile

7.8.2 Operation

7.8.3 Third-party Logistics Industry Layout

7.9 Expeditors

7.9.1 Profile

7.9.2 Operation

7.9.3 Third-party Logistics Industry Layout

7.10 Others

7.10.1 Dachser

7.10.2 Panalpina

7.10.3 SNCF

7.10.4 Kintetsu

8. Chinese Third-party Logistics Companies

8.1 Sinotrans

8.1.1 Profile

8.1.2 Operation

8.1.3 Third-party Logistics Industry Layout

8.2 COSCO Shipping Logistics Co., Ltd.

8.2.1 Profile

8.2.2 Third-party Logistics Industry Layout

8.3 China Merchants Logistics Holding Co., Ltd.

8.3.1 Profile

8.3.2 Third-party Logistics Industry Layout

8.4 China National Materials Storage and Transportation Corporation

8.4.1 Profile

8.4.2 Main Subsidiary - CMST Development Co., Ltd.

8.5 Beijing Changjiu Logistics Co., Ltd.

8.5.1 Profile

8.5.2 Operation

8.5.3 Third-party Logistics Industry Layout

8.6 Others

8.6.1 China Shipping Logistics Co., Ltd.

8.6.2 Tianjin DTW Logistics Co., Ltd.

8.6.3 Qingdao Haier Logistics Co., Ltd.

8.6.4 Annto Logistics Co., Ltd.

Service Items of Third-party Logistics

Classification of Third-party Logistics Companies (by Cargo Loaded)

Classification of Third-party Logistics Companies

Difference between Third-party Logistics and Traditional Logistics

Risk Characteristics of Third-party Logistics Industry

Third-party Logistics Industry Chain

Express Delivery Mode

Warehouse Logistics Mode

Prologis Mode

Characteristics of Hardware Mode

Characteristics of E-commerce Mode

Global Logistics Market Size, 2006-2020E

Logistics Market Size as a Percentage of GDP by Region Worldwide, 2015

Logistics Cost as a Percentage of GDP by Country, 2015

Structure of Global Logistics Market Size by Region, 2015

Structure of Global Logistics Market Size by Country, 2015

Climate Index of Chinese Logistics Industry, 2011-2016

Chinese Logistics Companies by Type

Total Social Logistics in China, 2006-2020E

Total Cost of Social Logistics and YoY Growth in China, 2010-2017

Structure of Total Social Logistics in China by Product, 2010/2015

Main Information Technologies of Logistics Industry

Third-party Logistics as a Percentage of Logistics Scale Worldwide, 2010-2020E

Third-party Logistics as a Percentage of Logistics Scale by Region Worldwide, 2015

Third-party Logistics as a Percentage of Logistics Scale by Country/Region Worldwide, 2015

Risk Structure of Third-party Logistics in Asia-Pacific Region

Global Third-party Logistics Market Size, 2010-2020E

Third-party Logistics Market Size in the United States, 2010-2020E

Structure of Global Third-party Logistics Market Size by Region, 2015

Structure of Global Third-party Logistics Market Size by Country, 2015

Industry Scale of Third-party Logistics Segments in United States, 2015

Competitive Pattern of Global Third-party Logistics Market, 2015

Competitive Pattern of Third-party Logistics Market in United States, 2015

Chinese Third-party Logistics Companies by Type

Policies on Third-party Logistics Industry in China, 2015-2017

Regional Distribution of Chinese Financing Companies in Logistics Industry, 2014-2025E

Situation of Logistics Parks in Main Economic Areas in China, 2015

Third-party Logistics Revenue and YoY Growth in China, 2011-2020E

China’s Third-party Logistics Revenue as a Percentage of Global Total, 2011-2020E

Revenue Structure of Third-party Logistics in China by Region, 2015

Business Areas of Main Third-party Logistics Companies in China

Competitive Pattern of Third-party Logistics Market in China, 2015

Transport Capacity of Third-party Logistics Companies in China, 2016

Third-party Logistics as a Percentage of Logistics Market in China, 2015/2020E

Comparison among Different Types of Third-party Logistics

Global Automobile Output, 2010-2020E

Global Automobile Output Structure, 2010-2015

TOP 20 Countries by Automobile Output, 2015

Global Automobile Sales Volume, 2010-2020E

TOP 10 Countries by Automobile Sales Volume, 2010-2015

Automobile Sales Volume and YoY Growth in China, 2010-2020E

Sales Volume of Passenger Vehicles in China, 2010-2016

Sales Volume of Commercial Vehicles in China, 2010-2016

Main Automotive Logistics Businesses and Competition Situation

Development Course of Automotive Logistics in China

Classification of Automotive Logistics Companies in China

Operating Revenue of Main Automotive Logistics Companies in China, 2015

Main Automotive Third-party Logistics Companies Worldwide, 2015

Third-party Logistics Firms of Main Automakers Worldwide

Pharmaceutical Market Size in China, 2011-2020E

Growth Rate of Pharmaceutical Sales of Hospitals in China by Region, 2015

Cost Structure of Pharmaceutical Distribution in China by Channel, 2015

Main Pharmaceutical Third-party Logistics Companies Worldwide, 2015

Comparison between Chinese and Foreign Cold-chain Logistics Industry

Business Model of Cold-chain Logistics in China

Total Mileage and Density of Highways in China, 2011-2017

Structure of Total Mileage of Highways in China by Grade, 2015

Highway Freight Volume in China, 2010-2020E

Operating Mileage and Investment of Railways in China, 2011-2017

Railway Freight Volume in China, 2013-2020E

Water Transport Construction Investment in China, 2011-2016

Water Freight Volume, 2010-2020E

Navigable Length of Inland Waterways in China, 2013-2017

Structure of Navigable Length of Inland Waterways in China by Grade, 2015

Berthsof Ports in China by Tonnage, 2015

Berth (≥10kt) Structure in China, 2014-2015

Number of Civil Aviation Airports in China, 2011-2016

Air Cargo and Mail Throughput in China, 2011-2016

Air Cargo and Mail Throughput in China by Region, 2015

Air Freight Volume in China, 2010-2020E

Ownership of Trucks in China, 2010-2015

Output of Railway Wagons and YoY Growth in China, 2006-2016

Ownership of Ships for Water Transport in China, 2011-2016

Structure of Ships for Water Transport in China, 2015

Cargo Capacity of Three Major Airlines in China, 2010-2016

Transport Capacity Pricing Index of Civil Aviation Transportation in China, 2014-2016

Automated Logistics Equipment Market Size in China, 2012-2020E

Market Size Structure of Automated Logistics Equipment System in China by Equipment, 2013-2020E

New Automated Guided Vehicle (AGV) Products and YoY Growth Worldwide, 2011-2020E

Automated Guided Vehicle (AGV) Installs and YoY Growth in China, 2014-2020E

Automated Storage and Retrieval System (AS/RS) Market Size in China, 2013-2020E

Structure of Automated Storage and Retrieval System (AS/RS) Market Size in China by Sector, 2015

Branches of DHL

Operation of DHL, 2014-2016

Operation of DHL by Business, 2015-2016

Trade Structure of DHL by Region, 2015

Number of Clients of DHL in Third-party Logistics Segments, 2015

Revenue and Freight Volume of Global Forwarding Freight of DHL, 2015

Supply Chain Revenue Structure of DHL, 2015

Distribution of Employees of Kuehne + Nagel by Number, 2015-2016

Operation of Kuehne + Nagel, 2014-2016

Operation of Kuehne + Nagel by Business, 2015-2016

Revenue of Kuehne + Nagel by Region, 2014-2016

Kuehne + Nagel’s Revenue from Third-party Logistics Business, 2014-2016

Number of Clients of Kuehne + Nagel in Third-party Logistics Segments, 2015

Operation of DB Schenker, 2015

Transport Capacity of DB Schenker, 2015

Number of Clients of DB Schenker in Third-party Logistics Segments, 2015

Third-party Logistics Layout of DB Schenker in China

Global Presence of Nippon Express

Revenue and Net Income of Nippon Express, FY2010-FY2017

Development Plan of Nippon Express, FY2018

Revenue of Nippon Express by Business, FY2015-FY2016

Revenue Structure of Nippon Express by Region, FY2015-FY2016

Number of Clients of Nippon Express in Third-party Logistics Segments, 2015

Development Course of C.H. Robinson

Revenue and Net Income of C.H. Robinson, 2011-2015

Net Revenue of C.H. Robinson by Mode of Transport, 2011-2015

Total Revenue of C.H. Robinson by Region, 2013-2015

Two Information Platforms of C.H. Robinson

Major M&As of C.H. Robinson

Industry Structure of Logistics Clients of C.H. Robinson, 2015

Number of Clients of C.H. Robinson in Third-party Logistics Segments, 2015

Suppliers of C.H. Robinson by Logistics Capacity, 2015

Business Structure of UPS

Revenue and Net Income of UPS, 2013-2016

Revenue Structure of UPS by Business, 2015-2016

Revenue Structure of UPS by Region, 2015

Operation of Supply Chain & Freight Business of UPS, 2013-2015

Number of Clients of UPS in Third-party Logistics Segments, 2015

Overview of DSV

Revenue and Net Income of DSV, 2011-2016

Revenue Structure of DSV by Business, 2015-2016

Revenue Structure of DSV by Region, 2015

Global Presence of DSV and UTi

Number of Clients of UTi in Third-party Logistics Segments, 2015

Number of Clients of DSV in Third-party Logistics Segments, 2015

Distribution of CEVA’s Employees, 2015

Revenue and Net Income of CEVA, 2014-2016

Revenue Structure of CEVA by Business, 2015-2016

Revenue Structure of CEVA by Sector, 2015

Revenue Structure of CEVA by Region, 2015

CEVA’s Revenue from Third-party Logistics Business, 2014-2016

Number of Clients of CEVA in Third-party Logistics Segments, 2015

Revenue and Net Income of Expeditors, 2011-2016

Revenue Structure of Expeditors by Business, 2015-2016

Operation of Main Businesses of Expeditors, 2013-2015

Revenue Structure of Expeditors by Region, 2015

Net Revenue of Expeditors by Region, 2013-2015

Freight Volume of Expeditors, 2012-2015

Global Presence of Sinotrans

Revenue and Profits of Sinotrans, 2011-2016

Revenue Structure of Sinotrans by Business, 2014-2016

Logistics Operations of Sinotrans, 2014-2016

Global Presence of COSCO Shipping Logistics Co., Ltd.

Main Businesses of COSCO Shipping Logistics Co., Ltd.

Layout of China Merchants Logistics Holding Co., Ltd.

Fast Moving Consumer Goods (FMCG) Logistics Service Mode of China Merchants Logistics Holding Co., Ltd.

Established Transport Routes of China Merchants Logistics Holding Co., Ltd.

Intensive Management of China Merchants Logistics Holding Co., Ltd.

Visual Management of China Merchants Logistics Holding Co., Ltd.

Industrial Layout of China National Materials Storage and Transportation Corporation

China National Materials Storage and Transportation Corporation’s Revenue from Logistics Business, 2012-2016

Revenue and Net Income of CMST Development Co., Ltd., 2013-2016

Revenue Structure of CMST Development Co., Ltd. by Business, 2015-2016

Revenue and Net Income of Beijing Changjiu Logistics Co., Ltd., 2013-2016

Operating Automotive Business of Beijing Changjiu Logistics Co., Ltd., 2013-2015

Top 5 Passenger Vehicle Clients of Beijing Changjiu Logistics Co., Ltd., 2015

Business Layout of Beijing Changjiu Logistics Co., Ltd.

Business Mode of Beijing Changjiu Logistics Co., Ltd.

Revenue Structure of Beijing Changjiu Logistics Co., Ltd. by Mode of Transport, 2013-2015

Imported Complete Vehicle Transport Operation of Beijing Changjiu Logistics Co., Ltd., 2013-2015

Beijing Changjiu Logistics Co., Ltd.’s Revenue from Imported Complete Vehicle Transport Operation by Brand, 2013-2015

Shipments of Imported VW Brand Cars of Beijing Changjiu Logistics Co., Ltd., 2013-2015

Shipments of Imported Ford Brand Cars of Beijing Changjiu Logistics Co., Ltd., 2013-2015

Freight and Storage Capacity of Tianjin DTW Logistics Co., Ltd.

Freight and Distribution Capacity of Annto Logistics Co., Ltd., 2016

Presence of Self-built Distribution Center (DC) Warehouses of Annto Logistics Co., Ltd.

Presence of Distribution Centers (DC) of Annto Logistics Co., Ltd.

China Cold Chain Logistics Industry Report, 2020-2026

The Chinese residents see a change in food consumption and there is a growing market demand for cold chain of food alongside the accelerating urbanization in China. Chinese governments at all levels b...

China Cold Chain Logistics Industry Report, 2019-2025

Cold chain logistics is developing apace in China as cold chain for food is increasingly needed due to the accelerating process of urbanization and the changes in residents’ diet structure, whilst loc...

China Bicycle Sharing Industry Report, 2017-2021

The sharing economy, including bicycle sharing, has flourished along with the spread of smartphone and a surge in mobile users. As an important part of urban slow/shared transport system, the bicycle ...

Global and China Third-party Logistics Industry Report, 2016-2020

Third-party logistics can not only help companies complete cargo movement but effectively reduce logistics costs and speed up cargo turnover, fully meeting their requirements on logistics quality. The...

China Cold Chain Logistics Industry Report, 2016-2020

With the growth of China’s economy over the past decade, the residents’ food consumption structure has experienced constant adjustment, a situation that led to a rising demand for food cold chain. Mor...

China Express Delivery Industry Report, 2015

In 2014, China surpassed the United States to become the world's largest express delivery country for the first time in terms of workload. Since 2015, the industry has continued to maintain a rapid gr...

China Air Transport and Airport Industry Report, 2015-2018

Since 2014, despite negative influence from slower economic growth at home and abroad and high-speed railway on Chinese aviation market demand, China’s civil aviation passenger throughput still kept r...

China Cold Chain Logistics Industry Report, 2014-2017

Since Cold Chain Logistics Development Plan of Agricultural Products was introduced in 2010, China cold chain logistics industry has entered an unprecedented rapid development stage. In October 2014, ...