China Cold Chain Logistics Industry Report, 2014-2017

-

Jan.2015

- Hard Copy

- USD

$2,600

-

- Pages:145

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

ZJF068

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,800

-

- Hard Copy + Single User License

- USD

$2,800

-

Since Cold Chain Logistics Development Plan of Agricultural Products was introduced in 2010, China cold chain logistics industry has entered an unprecedented rapid development stage. In October 2014, the State Council issued Medium and Long-term Development Plan of Logistics Industry (2014-2020) to boost the cold chain logistics industry toward large scale, standardization and modernization.

China cold chain logistics industry is divided into two sectors: refrigeration and transportation. In the refrigeration field, Refrigerator Branch of China Warehousing Association released that China’s cold storage capacity increased by 9.68% year on year to 83.45 million cubic meters in 2013, fulfilling the goals stipulated by Cold Chain Logistics Development Plan of Agricultural Products ahead of schedule. In 2014, China’s cold storage building developed steadily with the cold storage capacity of 88.42 million cubic meters.

Source: China Cold Chain Logistics Industry Report, 2014-2017, ResearchInChina

In the competitive cold chain logistics industry, cold chain distribution and storage centers provide refrigeration services for local agricultural markets; cold chain enterprises build cold storage according to their market layout, for example, Yurun will set up 15 agricultural product cold chain parks in 2015 in accordance with its "333" plan; the professional cold storage operator Swire intends to accomplish 13 large modern cold storage facilities so as to create a nationwide cold chain network by the end of 2020.

As for cold chain transport, the issuance of "Twelfth Five-Year" Cold Chain Plan promoted the size of Chinese refrigerated truck market substantially. China’s output of refrigerated and insulated vehicles jumped 13.8% year on year to 7,063 in 2012 and soared 88.5% year on year to 13,315 in 2013. The growth was attributed to two reasons. First, the cold chain distribution scale expanded constantly, some areas even adopted compulsory cold chain distribution measures. Second, China upgraded emissions standards (from the national emissions standards Ⅲ to the national emissions standards Ⅳ) for heavy-duty trucks, so manufacturers raised the number of registered certificates for the vehicle models complying with the national emissions standards Ⅲ in advance to reduce production costs.

47 qualified companies have participated in the competition for refrigerated trucks. Among the top players including CIMC (Shandong), Zhengzhou Hongyu, Henan Bingxiong, Henan Frestec, Zhenjiang Speed Auto and KF Mobile, CIMC (Shandong) occupies the Shandong market, and seizes market share in Guangdong, Zhejiang, Hubei and other places; Henan Bingxiong performs outstandingly in Northeast China, Shanxi and Inner Mongolia; Zhenjiang Speed Auto and KF Mobile focus on East China and dominate the East refrigerated truck market. Zhengzhou Hongyu not only takes a favorable position via giants such as Shuanghui, Yurun, Topin, Sanquan and Synear in Henan, but also makes some achievements in Beijing, Hebei, Ningxia, Jiangsu and other markets.

The report mainly covers the following aspects:

Overview of China cold chain logistics industry, including definition, classification, industry chain, policies, regulations and future development trends;

Overview of China cold chain logistics industry, including definition, classification, industry chain, policies, regulations and future development trends;

Cold chain logistics modes and demand in meat, fruits & vegetables, frozen rice & flour, frozen seafood, dairy products, pharmaceuticals and other fields in China;

Cold chain logistics modes and demand in meat, fruits & vegetables, frozen rice & flour, frozen seafood, dairy products, pharmaceuticals and other fields in China;

Market size, competitive landscape and development of major market segments, such as cold storage and refrigerated trucks;

Market size, competitive landscape and development of major market segments, such as cold storage and refrigerated trucks;

Profile, financial status, output, sales volume, major customers, flagship products, R & D, distribution of production bases and technical characteristics of major cold storage builders (embracing Dalian Refrigeration and Moon Group), 10 cold storage operators (Topin, Shandong Gaishi, Wuhan Wandun, Shenyang Nonstaples, Hunan Red Star, etc.), 10 refrigerated truck manufacturers (Beiqi Foton, Henan Bingxiong, CIMC, Henan Frestec, Zhengzhou Hongyu, etc.), as well as 12 cold chain logistics operators (Shanghai Haibo, Shanghai Jin Jiang International Industrial Investment, China Railway Tielong Container Logistics, CMAC, Guangdong Swire Cold Chain Logistics, Beijing Huarifeitian, etc.).

Profile, financial status, output, sales volume, major customers, flagship products, R & D, distribution of production bases and technical characteristics of major cold storage builders (embracing Dalian Refrigeration and Moon Group), 10 cold storage operators (Topin, Shandong Gaishi, Wuhan Wandun, Shenyang Nonstaples, Hunan Red Star, etc.), 10 refrigerated truck manufacturers (Beiqi Foton, Henan Bingxiong, CIMC, Henan Frestec, Zhengzhou Hongyu, etc.), as well as 12 cold chain logistics operators (Shanghai Haibo, Shanghai Jin Jiang International Industrial Investment, China Railway Tielong Container Logistics, CMAC, Guangdong Swire Cold Chain Logistics, Beijing Huarifeitian, etc.).

1. Introduction to Cold Chain Logistics Industry in China

1.1 Definition

1.2 Features

2. Development of Cold Chain Logistics Industry in China

2.1 Policy Environment

2.2 Development Overview

2.3 Third-party Cold Chain Logistics

2.3.1 Enterprises

2.3.2 Features

2.3.3 Policy Support

3. Development of Cold Chain Logistics in China by Region

3.1 Overview of Cold Chain Logistics in Yangtze River Delta

3.1.1 Economic Performance

3.1.2 New Policy of the District

3.1.3 Status Quo and Demand of Cold Chain Logistics

3.2 Overview of Cold Chain Logistics in Pearl River Delta

3.2.1 Economic Performance

3.2.2 Status Quo and Demand of Cold Chain Logistics

3.3 Development of Cold Chain Logistics in Beijing

3.3.1 Economic Performance

3.3.2 Status Quo and Demand of Cold Chain Logistics

4. Demand for Cold Chain Logistics in China

4.1 Meat Products

4.1.1 Industry Status Quo

4.1.2 Features of Cold Chain Logistics

4.1.3 Demand for Cold Chain Logistics

4.2 Aquatic Products

4.2.1 Industry Status Quo

4.2.2 Features of Cold Chain Logistics

4.2.3 Demand for Cold Chain Logistics

4.3 Quick-frozen Flour Food

4.3.1 Industry Status Quo

4.3.2 Features of Cold Chain Logistics

4.3.3 Demand for Cold Chain Logistics

4.4 Fruits & Vegetables

4.4.1 Industry Status Quo

4.4.2 Features of Cold Chain Logistics

4.4.3 Demand for Cold Chain Logistics

4.5 Dairy Products

4.5.1 Industry Status Quo

4.5.2 Features of Cold Chain Logistics

4.5.3 Demand for Cold Chain Logistics

4.6 Pharmaceuticals

4.6.1 Features of Cold Chain Logistics

4.6.2 Status Quo for Medicine Cold Chain Logistics

4.6.3 Market Value of Medicine Cold Chain Logistics

5. Development of Cold Chain Logistics in China

5.1 Cold Storage

5.1.1 Overview

5.1.2 Operating Characteristics

5.1.3 Cold Storage Capacity of Chinese Low-Temperature Storage Industry

5.1.4 Development of Chinese Low-temperature Storage Industry in 2014

5.2 Highway Refrigerated Vehicle

5.2.1 Classification

5.2.2 Current Situation

5.2.3 Competition Pattern

5.2.4 Development Trend

5.3 Railway Refrigerator Vehicle

5.3.1 Classification

5.3.2 Current Situation

6 Cold Storage Equipment Manufacturers

6.1 Dalian Refrigeration Co., Ltd.

6.1.1 Profile

6.1.2 Business Review

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 Main Product

6.1.6 Major Customers and Suppliers

6.2 Yantai Moon Co., Ltd.

6.2.1 Profile

6.2.2 Business Review

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 Main Product

7 Cold Storage Operators

7.1 Henan Zhongpin Fresh Food Logistics Co., Ltd.

7.1.1 Profile

7.1.2 Development of Cold Chain Logistics

7.1.3 Henan Xianyi Supply Chain Co., Ltd.

7.2 Wuhan Wandun Cold Storage Logistics Co., Ltd.

7.2.1 Profile

7.2.2 Key Business

7.3 Shandong Gaishi Agricultural Trade Co., Ltd.

7.3.1 Profile

7.3.2 Cold Chain Business

7.3.3 51% Equity of Gaishi Agricultural Product Center Was Transferred

7.4 Shenyang Nonstaple Food Group

7.4.1 Profile

7.4.2 Key Business

7.4.3 Latest Development

7.5 Hunan Red Star Frozen Food Co., Ltd.

7.5.1 Profile

7.5.2 Key Business

7.6 Tianjin Fisheries Group

7.6.1 Profile

7.6.2 Key Business

7.7 Liaoning Dalian Ocean Fishery Group

7.7.1 Profile

7.7.2 Freezing and Refrigeration Business

7.7.3 Cold Transport Business

7.7.4 Strategic Goal

7.8 Hangzhou NF United Meat Co., Ltd.

7.8.1 Profile

7.8.2 Cold Storage Business

7.9 Shandong Taihua Food Co., Ltd.

7.9.1 Profile

7.9.2 Business Review

7.9.3 The Latest Progress of Cold Chain Business

8. Refrigerated Vehicle Manufacturers

8.1 BeiQi Foton Motor Co., Ltd

8.1.1 Profile

8.1.2 Business Review

8.1.3 Revenue Structure

8.1.4 Gross Margin

8.1.5 Major Customers and Suppliers

8.1.6 Refrigerated Vehicle

8.2 Zhenjiang Speed Automobile Group Co., Ltd.

8.2.1 Profile

8.2.2 Refrigerated Vehicle

8.3 Zhengzhou Hongyu Special Vehicle Co., Ltd.

8.3.1 Profile

8.3.2 Refrigerated Vehicle

8.4 China International Marine Containers (Group) Co., Ltd. (CIMC)

8.4.1 Profile

8.4.2 Business Review

8.4.3 Revenue Structure

8.4.4 Gross Margin

8.4.5 Sales Volume

8.4.6 Major Customers and Suppliers

8.4.7 CIMC Vehicles (Group) Co., Ltd.

8.4.8 Refrigerated Vehicle

8.5 Henan Bingxiong Vehicle Manufacturing Co., Ltd

8.5.1 Profile

8.5.2 Refrigerated Vehicle

8.5.3 Main Production Bases

8.6 Henan Xinfei Special Purpose Vehicle Co., Ltd.

8.6.1 Profile

8.6.2 Refrigerated Vehicle Output

8.7 Zhenjiang Kangfei Machine Building Co., Ltd.

8.7.1 Profile

8.7.2 Refrigerated Vehicle

8.8 JMC

8.8.1 Profile

8.8.2 Business Review

8.8.3 Revenue Structure

8.8.4 Gross Margin

8.8.5 Major Customers and Suppliers

8.8.6 JMC Special-purpose Vehicle Plant

8.9 Jianghuai Automobile Co., Ltd. (JAC)

8.9.1 Profile

8.9.2 Business Review

8.9.3 Revenue Structure

8.9.4 Gross Margin

8.9.5 Refrigerated Vehicle Business

8.9.6 Anhui Jianghuai Special Purpose Vehicle Co., Ltd.

8.10 Dongfeng Automobile Co., Ltd.

8.10.1 Profile

8.10.2 Business Review

8.10.3 Revenue Structure

8.10.4 Gross Margin

8.10.5 Major Customers and Suppliers

8.10.6 Refrigerated Vehicle

9. Cold Delivery Companies in China

9.1 Shanghai HaiBo Co., Ltd

9.1.1 Profile

9.1.2 Business Review

9.1.3 Revenue Structure

9.1.4 Gross Margin

9.1.5 Major Customers

9.1.6 Development of Cold Chain Logistics

9.2 Jinjiang International Industrial Investment Co., Ltd

9.2.1 Profile

9.2.2 Operation

9.2.3 Revenue Structure

9.2.4 Gross Margin

9.2.5 Development of Cold Chain Logistics

9.2.6 Shanghai Xintiantian Dazhong Cold Logistics Co., Ltd.

9.3 China Railway Tielong Container Logistics Co., Ltd

9.3.1 Profile

9.3.2 Operation

9.3.3 Revenue Structure

9.3.4 Gross Margin

9.3.5 Development of Cold Chain Logistics

9.4 Shandong Ronkin Group

9.4.1 Profile

9.4.2 Principle Business

9.4.3 Development Strategy of Cold Chain Logistics

9.4.4 Latest Development in 2013-2014

9.5 Sinotrans

9.5.1 Profile

9.5.2 Business Review

9.5.3 Revenue Structure

9.5.4 Gross Margin

9.5.5 Sinotrans Cold Chain Logistics

9.6 Chengdu Silver Plow Low-temperature Logistics Co., Ltd.

9.6.1 Profile

9.6.2 Principle Business

9.6.3 Latest Development in 2013-2014

9.7 CMAC

9.7.1 Profile

9.7.2 Cold Chain Network

9.7.3 Kangxin Logistics

9.8 Shanghai Jiaoyun Rihong International Logistics Co. Ltd.

9.8.1 Profile

9.8.2 Principle Business

9.8.3 Latest Development in 2013-2014

9.9 Guangdong Swire Cold Chain Logistics Co., Ltd

9.9.1 Profile

9.9.2 Principle Business

9.9.3 Latest Development in 2013-2014

9.10 Guangzhou Baier Cold-Chain Polyurethane Technology Co., Ltd

9.10.1 Profile

9.10.2 Principle Business

9.11 Beijing Huarifeitian

9.11.1 Profile

9.11.2 Main Facilities

9.11.3 Cold Chain Services

9.12 Beijing Er Shang Group

9.12.1 Profile

9.12.2 Cold Chain Related Business

Cold Chain Logistics

Food Suitable for Cold Chain and Optimum Temperature

Major Incentive Policies for Cold Chain Logistics Industry in China

12th Five-Year Plan for Cold Chain Development in Major Provinces and Cities of China

Comparison between Domestic and Overseas Cold Chain Logistics Development

Policies for Third-party Logistics and Third-party Cold Chain Logistics in China

Per Capita Food Expenditure of Urban Households in Yangtze River Delta, 2010-2014

Per Capita Consumption Expenditure on Some Food in Yangtze River Delta, 2013

Cold Chain Demand in Yangtze River Delta, 2011-2014

Guangdong's GDP, 2007-2014

Guangdong's Cold Chain Demand, 2011-2014

Beijing's GDP, 2007-2014

Beijing's Output of Main Agricultural Products, 2013

Beijing's Cold Chain Demand, 2011-2014

Cold Chain Categories

Output of Meat Products in China, 2007-2013

Output of Fresh & frozen meat in China (by Province), 2012-2014

Cold Chain Circulation and Transport Volume of Meat Products in China, 2011-2017E

Output of Aquatic Products in China, 2007-2014

Output of Marine Products and Freshwater Products in China, 2007-2013

Cold Chain Logistics Process of Frozen Aquatic Products

Cold Chain Circulation and Transport Volume of Aquatic Products in China, 2011-2017

China’s Output of Quick-frozen Flour Food, 2007-2014

Output of Quick-frozen Flour Food in China (by Province/Municipality), 2013-2014

Cold Chain Logistics Process of Quick-frozen Flour Food

Cold Chain Circulation Volume of Quick-frozen Flour Food in China, 2011-2017

Output of Fruit in China, 2007-2013

Output of Vegetable in China, 2007-2013

Cold Chain Logistics Process of Fruits and Vegetables

Cold Chain Transport Volume of Fruits and Vegetables in China, 2011-2017

Output of Liquid Milk in China, 2007-2013

Output of Dairy Products in China, 2007-2012

Output of Dairy Products in China (by Province/Municipality), 2013-2014

Output of Frozen Drinks in China, 2007-2014

Circulation Features of Dairy Products by Type

Cold Chain Logistics Process of Dairy Industry

Drug Classification by Temperature and Cold Chain Drug Range

Classification of Cold Chain Drugs by Temperature and Air Conditions

Key Medicine Cold Chain Features in China

Relevant Policies and Development Process of Pharmaceutical Cold Chain Logistics

China’s Biopharmaceutical Market Size, 2007-2014

China’s Biopharmaceutical Cold Chain Market Size, 2007-2014

Cold Storage Classification

Cold Chain Circulation Rate and Refrigerated Transport Rate of Some Commodities in China

Total Capacity of Cold Storage in China, 2009-2014

China's Cold Storage Capacity Structure by Temperature, 2013

China's Cold Storage Capacity Structure by User, 2013

China's Cold Storage Capacity Structure by Commodity, 2013

Main Cold Storage Investment Projects in China, 2011-2014

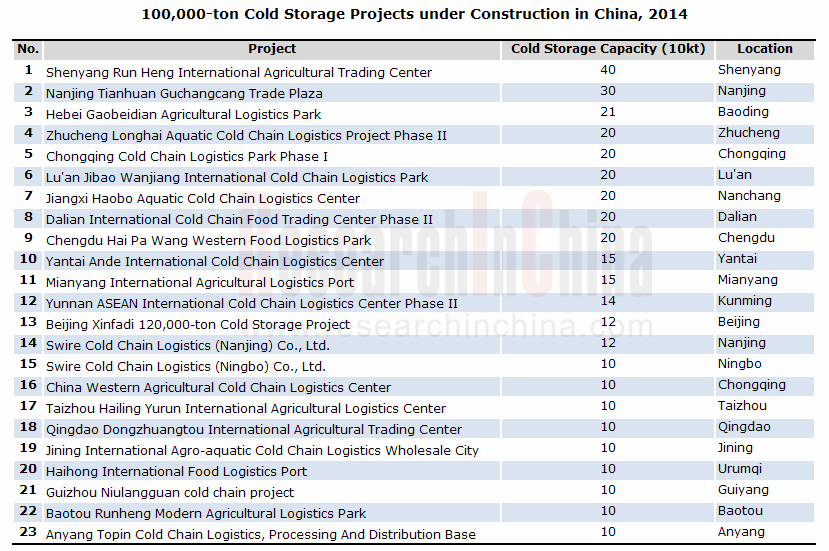

Main Cold Storage Projects under Construction, 2014

Proportion of Refrigerated Vehicles in Freight Vehicles

Output of Refrigerated and Insulated Vehicle in China, 2007-2014

Supporting of Major Refrigerated Vehicle Makers in China

Number of Railway Refrigerated Vehicles in China, 2007-2013

Revenue and Net Income of Dalian Refrigeration, 2009-2014

Revenue Structure of Dalian Refrigeration by Region, 2009-2014

Gross Profit Margin of Dalian Refrigeration, 2009-2014

Output, Sales Volume and Inventory of Dalian Refrigeration's Commercial and Industrial Refrigerators, 2012-2013

Dalian Refrigeration's Revenue from Top 5 Clients and % of Total Revenue, 2013

Dalian Refrigeration's Procurement from Top 5 Suppliers and % of Total Procurement, 2013

Revenue and Net Income of Yantai Moon, 2009-2014

Revenue Structure of Yantai Moon by Business, 2009-2014

Revenue Structure of Yantai Moon by Region, 2009-2014

Gross Profit Margin of Yantai Moon, 2009-2014

Output, Sales Volume and Inventory of Moon Group’s Commercial and Industrial Refrigerators, 2012-2013

Topin’s Logistics Centers in Production Bases

Topin’s Logistics Centers in Sales Markets

Distribution of Topin’s Main Processing and Manufacturing Bases

Main Operation Strongholds of Henan Xianyi in China

Primary Business of Wuhan Wandun

Main Business of Gaishi Group

Distribution of Main Cold Storage Bases of Shenyang Nonstaples

Main Cold Transport Vessels of Dalian Ocean Fishery Group

Revenue and Net Income of Taihua Food, 2009-2014

Revenue and Net Income of BeiQi Foton Motor, 2007-2014

Revenue Structure of Beiqi Foton by Product, 2009-2014

Revenue Structure of Beiqi Foton by Region, 2009-2014

Gross Profit Margin of Beiqi Foton, 2009-2014

Technical Indicator of Some Refrigerated Vehicles of Zhenjiang Speed Auto

Models, Configuration and Characteristics of Hongyu’s Main Insulated & Refrigerated Trucks

Revenue and Net Income of CIMC, 2009-2014

Revenue Structure of CIMC by Product, 2009-2014

Revenue Structure of CIMC by Region, 2009-2014

Gross Profit Margin of CIMC, 2009-2014

Sales Volume of CIMC’s Container and Road Transport Vehicles, 2012-2013

CIMC's Revenue from Top 5 Clients and % of Total Revenue, 2013

CIMC's Procurement from Top 5 Suppliers and % of Total Procurement, 2013

Bingxiong's Main Refrigerated and Insulated Automobile Production Bases

Revenue and Net Income of JMC, 2009-2014

Revenue Structure of JMC by Product, 2009-2014

Revenue Structure of JMC by Region, 2009-2014

Gross Profit Margin of JMC, 2009-2014

JMC's Revenue from Top 5 Clients and % of Total Revenue, 2013

JMC's Procurement from Top 5 Suppliers and % of Total Procurement, 2013

Revenue and Net Income of JAC, 2007-2012

Revenue Structure of JAC by Product, 2012

Revenue Structure of JAC by Region, 2012

Gross Profit Margin of JAC, 2009-2014

Revenue and Net Income of DFM, 2009-2014

Revenue Structure of DFM by Product, 2009-2014

Revenue Structure of DFM by Region, 2009-2014

Gross Profit Margin of DFM, 2009-2014

DFM’s Revenue from Top 5 Clients and % of Total Revenue, 2013

DFM’s Procurement from Top 5 Suppliers and % of Total Procurement, 2013

Revenue and Net Income of Shanghai HaiBo, 2009-2014

Revenue structure of Shanghai HaiBo Co., Ltd by Product, 2009-2014

Revenue structure of Shanghai HaiBo Co., Ltd by Region, 2009-2014

Gross Profit Margin of DFM, 2009-2014

Shanghai Haibo’s Revenue from Top 5 Clients and % of Total Revenue, 2013

Revenue and Net Income of Jinjiang International Industrial Investment, 2009-2014

Revenue Structure of Jinjiang International Industrial Investment by Sector, 2009-2014

Gross Profit Margin of Jinjiang International, 2009-2014

Operating Revenue and Cost of Low Temperature Logistics Business of Jinjiang International Industrial Investment, 2007-2013

Major Cold Chain Equipment Matching of Xintiantian

Revenue and Net Income of CRT, 2009-2014

Revenue Structure of CRT by Sector, 2009-2014

Gross Profit Margin of CRT, 2009-2014

Special Container Business Types of China Railway Tielong Container Logistics Co., Ltd

Long-term Partners of Ronkin Group

Principle Business of Ronkin

Revenue and Net Income of Sinotrans, 2009-2014

Revenue structure of Sinotrans by Product, 2009-2014

Revenue structure of Sinotrans by Region, 2009-2014

Gross Profit Margin of Sinotrans, 2009-2014

Cold Chain Network of CMAC

Operating Network of Kangxin Logistics

Overview of Swire's Cold Chain Cold Storage Facilities

Baier's Refrigerated Vehicle Models

Major Partners of Sinosun Logistics

Integrated Supply Chain Solutions of Sinosun

Main Professional Refrigerated Vehicles of Sinosun

"Shaft and Radial" Model Transport Network of Beijing Huarifeitian

China Cold Chain Logistics Industry Report, 2020-2026

The Chinese residents see a change in food consumption and there is a growing market demand for cold chain of food alongside the accelerating urbanization in China. Chinese governments at all levels b...

China Cold Chain Logistics Industry Report, 2019-2025

Cold chain logistics is developing apace in China as cold chain for food is increasingly needed due to the accelerating process of urbanization and the changes in residents’ diet structure, whilst loc...

China Bicycle Sharing Industry Report, 2017-2021

The sharing economy, including bicycle sharing, has flourished along with the spread of smartphone and a surge in mobile users. As an important part of urban slow/shared transport system, the bicycle ...

Global and China Third-party Logistics Industry Report, 2016-2020

Third-party logistics can not only help companies complete cargo movement but effectively reduce logistics costs and speed up cargo turnover, fully meeting their requirements on logistics quality. The...

China Express Delivery Industry Report, 2016

Thanks to the rapid growth in e-commerce industry, the online shopping habits of the Chinese consumers have been gradually developed and deepened. In 2015, the online shopping market sales reached RMB...

China Cold Chain Logistics Industry Report, 2016-2020

With the growth of China’s economy over the past decade, the residents’ food consumption structure has experienced constant adjustment, a situation that led to a rising demand for food cold chain. Mor...

China Express Delivery Industry Report, 2015

In 2014, China surpassed the United States to become the world's largest express delivery country for the first time in terms of workload. Since 2015, the industry has continued to maintain a rapid gr...

China Air Transport and Airport Industry Report, 2015-2018

Since 2014, despite negative influence from slower economic growth at home and abroad and high-speed railway on Chinese aviation market demand, China’s civil aviation passenger throughput still kept r...

China Cold Chain Logistics Industry Report, 2014-2017

Since Cold Chain Logistics Development Plan of Agricultural Products was introduced in 2010, China cold chain logistics industry has entered an unprecedented rapid development stage. In October 2014, ...

China Air Transport and Airport Industry Report, 2013-2016

In January-November 2013, China’s civil aviation industry completed total traffic turnover of 61.6 billion ton kilometers, up 10.3% YoY; passenger transport volume of 326 million people, up 11.0% YoY;...

China Express Delivery Industry Report, 2013-2016

Benefiting from the explosive growth of e-commerce, China express delivery industry has maintained rapid growth since 2013. From January to September of 2013, the express delivery enterprises with the...

China Cold Chain Logistics Industry Report, 2013

The 12th Five-Year Planning concerning cold chain logistics was issued in 2011 following the release of Farm Produce Cold Chain Logistics Development Planning by National Development and Reform Commis...

China Express Delivery Industry Report, 2012

Although the growth rate of global economy slows down in 2012, Chinese express delivery industry still maintains high-speed development. From January to October of 2012, the business revenue of expres...

China Air Transport and Airport Industry Report, 2011-2012

Impacted by the global economic slowdown, the total traffic growth of China’s civil aviation industry decelerated in 2011. The passenger traffic was 293.17 million person-times, a year-on-year increas...

China Special Freight Logistics Industry Report, 2011-2012

This report highlights the study of large goods and dangerous cargo logistics, and also analyzes the highly specialized logistics fields, such as IT logistics, pharmaceutical logistics and home applia...

China General Cargo Logistics Industry Report, 2011-2012

In China, the logistic cost is increasing these years. In 2007, the gross external logistic cost of China broke RMB4 trillion, while the figure in 2009 hit RMB6 trillion. In 2011, China’s external log...

Company Study of China Railway Tielong Container Logistics Co., Ltd, 2010-2012

China Railway Tielong Container Logistics Co., Ltd (CRT), set up in Feb.1993, has three business segments including railway freight & port approaching logistics, railway special container business, an...

China Express Delivery Industry Report, 2011

In July, 2011, in the “Twelfth Five-Year (2011-2015)” plan on the development of postal industry issued by State Post Bureau of the People’s Republic of China, the following “twelfth five-year” develo...