Global and China GaAs Industry Report, 2019-2025

-

May 2019

- Hard Copy

- USD

$2,700

-

- Pages:105

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

ZJF141

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,900

-

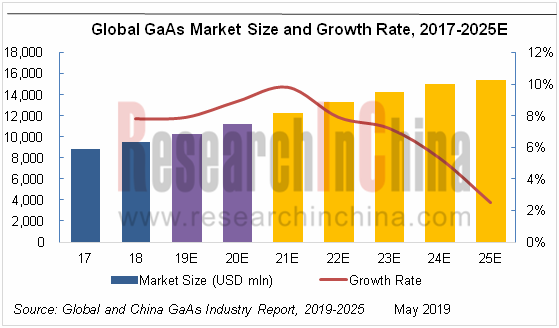

Gallium arsenide (GaAs), one of the most mature compound semiconductors, is an integral part of smartphone power amplifier (PA). In 2018, GaAs-based radio frequency (RF) seized over half of the GaAs wafer market. As smartphone market is being saturated and chips become smaller in size, GaAs-based RF grows at a slower pace in recent years. Yet in the wake of 4G-to-5G evolution of communication technology, GaAs will still play a key part in 6GHz-below frequency bands market due to its merits of high power and high linearity needed by carrier aggregation and multiple-input and multiple-output (MIMO) technologies. Beyond that, GaAs is also applicable to automotive electronics and military fields. In 2018, global GaAs components market boasted the total output value of USD9,519 million including that of integrated device manufacturers (IDM), an increase of 7.8% from a year earlier.

GaAs components find wide application in smartphones, wireless communications, automotive electronics, and military area, of which GaAs-based RF for smartphones, wireless communications led by communication base stations, automotive electronics and military purpose occupies roughly 53.4%, 27.2%, 2.2% and 5.3% of GaAs wafer market, respectively.

As for competitive pattern, Skyworks and Qorvo grab the biggest market shares, a combined over 55%. In global GaAs wafer foundry market which was worth USD789 million in 2018, WIN Semiconductors is the first-ranking vendor commanding 72.7% of the market in 2017.

Global and China GaAs Industry Report, 2019-2025 highlights the following:

GaAs (definition, application, production process, technical comparison, etc.);

GaAs (definition, application, production process, technical comparison, etc.);

Global GaAs industry (market size, supply and demand, competitive pattern, competitive products market, etc.);

Global GaAs industry (market size, supply and demand, competitive pattern, competitive products market, etc.);

GaAs downstream industries (handset, wireless communications, etc.);

GaAs downstream industries (handset, wireless communications, etc.);

RF front end market and segments (PA, antenna, filter, etc.);

RF front end market and segments (PA, antenna, filter, etc.);

19 foreign and Chinese vendors (Skyworks, Qorvo, Win Semi, etc.) (profile, operation, R&D, manufacturing base and technical characteristics, etc.).

19 foreign and Chinese vendors (Skyworks, Qorvo, Win Semi, etc.) (profile, operation, R&D, manufacturing base and technical characteristics, etc.).

1 Overview of GaAs

1.1 Introduction to GaAs

1.2 Application of GaAs

1.3 Comparison among GaAs, GaN and SiGe

1.4 Manufacturing Technique of GaAs

2 GaAs Industry

2.1 Industry Chain of GaAs

2.2 Global Capacity of GaAs

2.3 GaAs Supply and Demand

2.4 Competitive Pattern

2.5 Competitive Products Market

2.5.1 SiC

2.5.2 GaN

3 Downstream Markets of GaAs

3.1 Network Devices

3.2 Mobile Phone

3.3 Global Mobile Phone Market Size

3.4 China Mobile Phone Industry by Region

4 Wireless RF System Front-End

4.1 RF System of Latest Mobile Phones and Tablets

4.2 Mobile Phone Filter

4.3 Mobile Phone Antenna Switch

4.4 Mobile Phone PA

4.5 Supply Relationship between Mobile Phone PA and Brands

4.6 Competition among GAAS PA, RF MEMS and CMOS PA

5 GaAs Vendors

5.1 Murata

5.2 Kopin

5.3 Semiconductor Division of Sumitomo Electric

5.4 Freiberger

5.5 AXT

5.6 IQE

5.7 WIN Semiconductor

5.8 AWSC

5.9 VPEC

5.10 GCS

5.11 TriQuint

5.12 Avago

5.13 ANADIGICS

5.14 RFMD

5.15 RDA

5.16 Skyworks

5.17 SEDI

5.18 Hittite Microwave

5.19 M/A-COM Technology

Comparison of Basic Physical Properties between Semiconductor Materials

Applications of Compound Semiconductors

Processing Technology of Compound Semiconductor Devices

Supply Chain of GaAs Industry

Capacity of Major Global GaAs IDM Vendors, 2012-2018

Capacity of Major Global GaAs Foundries, 2012-2018

GaAs Wafer Foundry Market, 2016-2018

Global GaAs Demand, 2013-2025

Capacity and Market Share of Global GaAs Vendors

GaAs Downstream Markets

Competitive Pattern (Including IDMs) of Global GaAs Components Market, 2018

Competitive Pattern of GaAs Wafer Foundry Market, 2018

Ranking of Global GaAs Vendors by Revenue, 2016-2018

Dropping Unit Price of Silicon Carbide Components

Structure of GaN HEMT Component

Applied Markets of GaN

GaN Downstream Markets and Their Size, 2018&2025E

Key Suppliers of GaN Components

Shipment of Global Household Wireless Network Equipment, 2013-2018

Global Enterprise-Level Network Device Shipment, 2013-2018

Global Wi-Fi Device Shipment, 2013-2018

Proportion of 4G Mobile Phone, 2013-2018

Average PA Consumption per Mobile Phone, 2013-2018

Comparison between PA Products

PA Demand from Smartphones

Global Mobile Phone Shipment, 2013-2018

China’s Mobile Phone Shipments (100 million units), 2013-2025E

Shipment of Major Global Mobile Phone Vendors, 2017-2018

Operating System of Global Smart Phone, 2018

Shipment of Major Chinese Smart Phone Vendors, 2017-2018

China Mobile Phone Output by Region, 2018

Mobile Phone and Tablet – RF Framework

RF Front End Market Size, 2016-2022E

Market Size of Filters and Duplexers of Mobile Phone, 2013-2018

Market Share of Major BAW, SAW Vendors, 2018

Shipment of Antenna Switches of Mobile Phone by Technology, 2013-2018

Market Share of Major Mobile Phone Antenna Switches Producers, 2018

Revenue of Major Global Mobile Phone PA Producers, 2013-2018

Proportion of Major PA Suppliers of Samsung, 2016-2018

Proportion of Major PA Suppliers of Huawei, 2016-2018

Proportion of Major PA Suppliers of APPLE, 2016-2018

Sales and Operating Margin of Murata, FY2013-FY2018

Sales of Murata by Region, FY2013-FY2018

Revenue, New Orders and Backlog of Murata, FY2013-FY2018

Operating Income and Net Income of Murata, FY2013-FY2018

Orders of Murata by Product, FY2013-FY2018

Revenue Breakdown of Murata by Product, FY2013-FY2018

Revenue of Murata by Application, FY2013-FY2018

Market Share of Global GaAs Epilayer Vendors, FY2017-FY2018

Kopin Global Distribution

Revenue and Operating Margin of KOPIN, 2013-2018

Revenue of KOPIN by Business, 2016-2018

Revenue of KOPIN by Client, 2016-2018

Applications of Sumitomo Electric’s Main Products

Principal Business of AXT

Revenue and Operating Margin of AXT, 2013-2018

Revenue of AXT by Product, 2013-2018

Revenue of AXT by Region, 2013-2018

Revenue and Operating Margin of IQE, 2013-2018

Revenue of IQE by Business, 2013-2018

Revenue of IQE by Region, 2013-2018

Revenue and Operating Margin of WIN Semiconductors, 2013-2018

Gross Margin, Net Income and Operating Margin of WIN Semiconductors, 2013-2018

Gross Margin and Operating Margin of WIN Semiconductors, 2013-2018

Manufacturing Capacity of WIN Semiconductors, 2013-2018

Production Yield of WIN Semiconductors, 2013-2018

Core Competitiveness of WIN Semiconductors

Technology Distribution of WIN Semiconductors

Revenue and Gross Margin of AWSC, 2013-2018

Foundry Service of AWSC

Revenue and Operating Margin of VPEC, 2013-2018

Revenue and Gross Margin of TRIQUINT, 2013-2018

Revenue of TRIQUINT by Business, 2013-2018

Mobile Phone Revenue of TRIQUINT by System, 2013-2018

Revenue of Network Division of TRIQUINT by Product

GaAs Capacity of TRIQUINT’s Texas Plant, 2016-2018

BAW Capacity of TRIQUINT’s Texas Plant, 2016-2018

FLSAW Capacity of TRIQUINT’s Florida Plant, 2016-2018

FLIPCHIP Capacity of TRIQUINT’s Costa Rica Plant, 2016-2018

Triquint Technical Route

RF Framework Trend of Smart Phone

Revenue and Operating Margin of AVAGO, FY2013-FY2018

Revenue of AVAGO by Division, FY2013-FY2018

Revenue and Gross Margin of ANADIGICS, 2013-2018

Revenue of ANADIGICS by Client, 2013-2018

Revenue of ANADIGICS by Business, 2013-2018

Revenue of ANADIGICS by Region, 2013-2018

Revenue and Operating Margin of RFMD, FY2013-FY2018

Revenue of RFMD by Division, FY2013-FY2018

Revenue of RFMD by Region, FY2013-FY2018

Revenue and Operating Margin of RDA, 2013-2018

Baseband Product Roadmap of RDA

Major Clients of RDA

China Market Share of RDA’s Products

Product Schedule of RDA

Revenue of RDA by Product,2018

Revenue and Gross Margin of SKYWORKS, FY2013-FY2018

Expenditures of SKYWORKS, FY2013-FY2018

Revenue and Operating Margin of SKYWORKS, FY2013-FY2018

Revenue of SKYWORKS by Region, FY2013-FY2018

Revenue of SKYWORKS by Client, FY2013-FY2018

SEDI Wireless Products

Optics Fiber Products

Revenue and Operating Income of Hittite Microwave, 2013-2018

Revenue and Operating Income of M/A-COM, 2013-2018

Revenue of M/A-COM by Product, 2013-2018

Global and China CMOS Camera Module (CCM) Industry Report, 2020-2026

The global CCM market has been ballooning thanks to expeditious penetration of multi-camera phones and advances in automotive ADAS, being worth $22.723 billion with a year-on-year spike of 16.6% in 20...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2020-2025

Electronic components like MLCC enjoy a rosy prospect alongside the burgeoning electronic manufacturing, the thriving internet and the prevalence of smart hardware.

MLCC was much sought after and it...

Global and China Voice Coil Motor (VCM) Industry Report, 2019-2025

VCM (voice circle motor or voice coil actuator), a part for smartphone camera, shares around 6% of smartphone camera industry chain value.

Globally, popularity of smartphones such as those with mult...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2019-2025

Chinese aluminum electrolytic capacitor market has been expanding amid a transfer of its downstream industries to China like home appliance illumination, cellphones and computers as well as automatic ...

Global and China Flexible Printed Circuit (FPC) Industry Report, 2019-2025

Flexible printed circuit (FPC) products make their way into consumer electronics like smartphone and tablet PC, in the form of modules for display, touch control, fingerprint recognition, etc. The vol...

Global and China GaAs Industry Report, 2019-2025

Gallium arsenide (GaAs), one of the most mature compound semiconductors, is an integral part of smartphone power amplifier (PA). In 2018, GaAs-based radio frequency (RF) seized over half of the GaAs w...

Global and China Advanced Packaging Industry Report, 2019-2025

The global semiconductor packaging and testing market is enlarging with the prevalence of consumer electronics, automotive semiconductors and the Internet of Things (IoT), with its size edging up 2.5%...

Global and China MLCC Electronic Ceramics Industry Report, 2019-2025

MLCC is mainly used in audio and video equipment, mobile phones, computers and automobiles. The prospective boom of MLCC formula powder hinges on demand: 1) The accelerated renewal of consumer electro...

Global and China OLED Industry Report, 2019-2025

OLED, a new-generation display technology, features simple display structure, green consumables and flexibility and can be rolled up, which makes it easier to transport and install without considering...

Global and China Camera Module Industry Report, 2019-2025

Affected by factors like the maturity of mobile phone markets worldwide and the prolonged replacement of mobile phone by users, the mobile phone market has undergone a slowdown in growth rate. From Q4...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2018-2023

MLCC finds most application in consumer electronics, automobile and industrial fields and gets beefed up remarkably with the approaching 5G era of cellphones and tablet PCs, the advances in automotive...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2018-2023

Aluminum electrolytic capacitor, a core electronic component, is widely used in consumer electronics, computers and peripherals, industry, electric power, lighting and automobiles.

Global aluminum e...

Global and China CMOS Camera System Industry Report, 2017-2021

Global CCM (CMOS Camera Module) market was worth USD16.611 billion in 2015, a year-on-year rise of 3.8% from 2014, the slowest rate since 2010. Global market fell modestly in 2016 due to a drop in shi...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2017-2021

Global OLED market size approximated USD15.7 billion in 2016, a 20.8% rise from a year earlier. Stimulated by reports that Apple will adopt OLED screen for multiple iPhone models in 2017-2018, OLED sc...

Global and China CMOS Camera System Industry Report, 2016-2020

Global and China CMOS Camera System Industry Report, 2016-2020 covers the following:1. Analysis of CMOS Image Sensor (CIS) Industry and Market, with 7 vendors involved.2. Analysis of CMOS Camera Lens ...

Global and China Multi-layer Ceramic Capacitor (MLCC) Industry Report, 2017-2020

The rapid development of consumer electronics and industrial intelligentization has greatly promoted the booming of passive components including multi-layer ceramic capacitor (MLCC). In 2015, China’s ...

Global PCB Industry Report, 2015-2020

Global PCB Industry Report, 2015-2020 highlights the followings:1. Global PCB Market and Status Quo of the Industry2. Global Downstream Markets of PCB3. Mobile Phone PCB Trends4. Tablet PC/Laptop Comp...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2016-2020

The OLED market has been developing rapidly worldwide over the recent years, and its market size reached USD13 billion in 2015. With technology and capacity construction, OLED (from small-sized panels...