China Cold Chain Logistics Industry Report, 2019-2025

-

Aug.2019

- Hard Copy

- USD

$3,400

-

- Pages:148

- Single User License

(PDF Unprintable)

- USD

$3,200

-

- Code:

ZJF145

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,800

-

- Hard Copy + Single User License

- USD

$3,600

-

Cold chain logistics is developing apace in China as cold chain for food is increasingly needed due to the accelerating process of urbanization and the changes in residents’ diet structure, whilst local Chinese governments are sparing no efforts in constructing cold chain infrastructure.

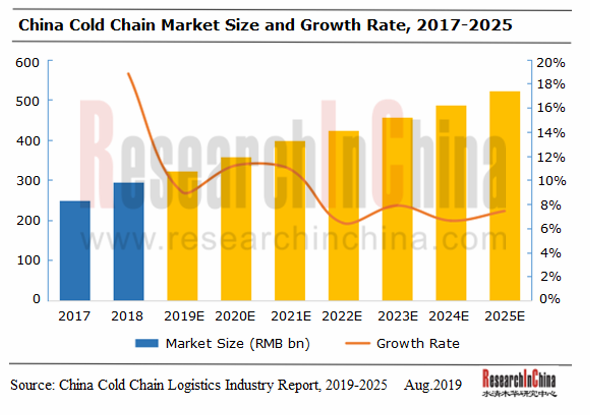

Chinese cold chain logistics market was worth RMB295.6 billion in 2018 with an upsurge of 18.8% from a year earlier, and it will keep expanding and soar to RMB522.5 billion in 2025 with an expected CAGR of 8.5% between 2018 and 2025 as the cold chain standards and policy grow clear, the fresh food e-commerce burgeons and financial innovations continue.

Robust demand for cold chain logistics comes largely from five agricultural products including meat, aquatic product, quick-frozen food, fruits & vegetables, and dairy products, among which cold chain for fruits and vegetables is the segment of the largest size; there is also a rapidly growing demand for cold chain for aquatic products. The two types of products will hold ever larger market shares with maturity of cold chain technologies. What’s more, cold chain for medicine is gathering momentum, particularly for vaccines, blood products and diagnostic reagents.

Competition in cold chain logistics:

Logistics operation: most players are engaged in both cold storage operation and cold chain transportation, like Xianyi Holding, Swire Cold Chain Logistics, and ZM Logistics. Not only have they huge cold storage capacity, but their transportation power is quite competitive.

Cold storage operation: Chinese cold storage market is scattered with a low concentration ratio and with strong regional attributes. In 2018, the top 10 cold storage operators had a total cold storage capacity of 30.89 million, commanding roughly 21.0% market shares, and the typical ones like Xianyi Supply Chain, Swire Cold Chain Logistics, and China Merchants Americold, all of which boast large cold storage network across China.

China Cold Chain Logistics Industry Report, 2019-2025 highlights the following:

Overview of cold chain logistics industry (definition, classification, composition structure, industrial chain, market features, business model, policies, etc.);

Overview of cold chain logistics industry (definition, classification, composition structure, industrial chain, market features, business model, policies, etc.);

Chinese cold chain logistics market (market size, market demand, competitive landscape, market structure, development prospects and development in key regions in the Yangtze River Delta, the Pearl River Delta and the Beijing-Tianjin-Hebei Region);

Chinese cold chain logistics market (market size, market demand, competitive landscape, market structure, development prospects and development in key regions in the Yangtze River Delta, the Pearl River Delta and the Beijing-Tianjin-Hebei Region);

Cold chain market segments including fruits & vegetables, meat, quick-frozen rice and flour products, aquatic products, dairy products, and medicine (market features, demand, etc.);

Cold chain market segments including fruits & vegetables, meat, quick-frozen rice and flour products, aquatic products, dairy products, and medicine (market features, demand, etc.);

Cold storage market (overview, overall capacity, regional analysis, competitive pattern and predictions);

Cold storage market (overview, overall capacity, regional analysis, competitive pattern and predictions);

22 Cold chain operators (profile, performance, revenue structure, cold chain business, development strategy, etc.)

22 Cold chain operators (profile, performance, revenue structure, cold chain business, development strategy, etc.)

1. Introduction to Cold Chain Logistics in China

1.1 Definition

1.2 Classification

1.2.1 Classification of Cold Storage

1.2.2 Classification of Refrigerated Trucks

1.3 Features

1.4 Development Overview

2. Major Industry Policies

2.1 Policy Environment

2.2 Relevant Standards for Cold Chain Industry

2.2.1 Basic Standards for Cold Chain Logistics

2.2.2 Standards for Cold Storage and Freezing Equipment

3. Development of Cold Chain

3.1 Current Situation

3.2 Overall Market Size

3.3 Market Prediction

3.4 Market Structure

4. Development of Cold Chain Logistics in Key Regions

4.1 Yangtze River Delta Region

4.1.1 Economic Operation

4.1.2 New Policy of the District

4.1.3 Development of and Demand for Cold Chain Logistics

4.2 Development of Cold Chain Logistics in Pearl River Delta Region

4.2.1 Economic Operation

4.2.2 Development of and Demand for Cold Chain Logistics

4.3 Development of Cold Chain Logistics in Beijing-Tianjin-Hebei Region

4.3.1 Economic Operation

4.3.2 Development of and Demand for Cold Chain Logistics

5. Cold Chain Logistics Industry Segments

5.1 Meat Products

5.1.1 Features of Meat Products Cold Chain Logistics

5.1.2 Industry Status Quo

5.1.3 Demand for Cold Chain Logistics

5.2 Aquatic Products

5.2.1 Features of Aquatic Products Cold Chain Logistics

5.2.2 Industry Status Quo

5.2.3 Demand for Cold Chain Logistics

5.3 Quick-frozen Flour Food

5.3.1 Features of Quick-frozen Flour Food Cold Chain Logistics

5.3.2 Industry Status Quo

5.3.3 Demand for Cold Chain Logistics

5.4 Fruits & Vegetables

5.4.1 Features of Fruit & Vegetable Cold Chain Logistics

5.4.2 Industry Status Quo

5.4.3 Demand for Cold Chain Logistics

5.5 Dairy Products

5.5.1 Features of Dairy Product Cold Chain Logistics

5.5.2 Industry Status Quo

5.5.3 Demand for Cold Chain Logistics

5.6 Pharmaceuticals

5.6.1 Features of Medicine Cold Chain Logistics

5.6.2 Status Quo of Medicine Cold Chain Logistics

5.6.3 Demand for Cold Chain Logistics

5.7 Demand of E-commerce for Fresh Food Cold Chain

5.7.1 Business Model

5.7.2 Market Size

6. Cold Storage Market

6.1 Overview

6.2 Capacity of Cold Storage

6.3 Analysis of Regional Markets

6.4 Competitive Landscape

6.5 Cold Storage Market Size Forecast

7. Cold Chain Operators

7.1 Xianyi Holdings

7.1.1 Profile

7.1.2 Business

7.1.3 Henan Zhongpin Food Share Co., Ltd.

7.1.4 Henan Xianyi Supply Chain Co., Ltd.

7.1.5 Alibaba and Zhongpin Corporation Signed Strategic Cooperation Agreement

7.2 ZM Logistics

7.2.1 Profile

7.2.2 Cold Chain Business

7.3 Shandong Gaishi Farming Co., Ltd.

7.3.1 Profile

7.3.2 Cold Chain Logistics Business

7.3.3 Gaishi’s “the 13th Five-Year” Plan (2016-2020)

7.4 Shenyang Nonstaple Food Group

7.4.1 Profile

7.4.2 Cold Chain Logistics Business

7.5 Zhenjiang Hengwei Supply Chain Management Co., Ltd.

7.5.1 Profile

7.5.2 Cold Chain Transportation Service

7.5.3 Cold Storage Service

7.6 Swire Cold Chain Logistics Co. Ltd.

7.6.1 Profile

7.6.2 Main Business

7.6.3 Cold Storage Business Distribution

7.6.4 Guangdong Swire Cold Chain Logistics Co. Ltd.

7.6.5 Planning for 2020

7.7 CMAC

7.7.1 Profile

7.7.2 Cold Chain Network

7.7.3 Kangxin Logistics Co., Ltd.

7.7.4 Tianjin Phase II Cold Storage Base Project Progress

7.8 Shanghai Speed Fresh Logistics Co., Ltd.

7.8.1 Profile

7.8.2 Distribution Network

7.8.3 Cold Storage Operation

7.9 CJ Rokin Logistics and Supply Chain Co., Ltd.

7.9.1 Profile

7.9.2 Main Business

7.9.3 Cold Chain Logistics Strategy

7.9.4 Ground Breaking for CJ Rokin’s Taicang-based Headquarters

7.10 Bright Real Estate Group Co., Ltd

7.10.1 Profile

7.10.2 Operation

7.10.3 Revenue Structure

7.10.4 Gross Margin

7.10.5 Cold Chain Business

7.11 Shanghai Jin Jiang International Industrial Investment Co., Ltd

7.11.1 Profile

7.11.2 Operation

7.11.3 Revenue Structure

7.11.4 Gross Margin

7.11.5 Cold Chain Logistics Development

7.11.6 Shanghai Xintiantian Dazhong Cold Logistics Co., Ltd.

7.12 Sinotrans Ltd.

7.12.1 Profile

7.12.2 Operation

7.12.3 Revenue Structure

7.12.4 Sinotrans Cold Chain Logistics

7.12.5 SinoTransPFS

7.13 Chengdu Silverplow Low-temperature Logistics

7.13.1 Profile

7.13.2 Main Business

7.13.3 Progress of Cold Chain Logistics Center

7.14 HNA Cold Chain

7.14.1 Profile

7.14.2 Operation

7.14.3 Gross Margin

7.14.4 Cold Chain Logistics Business

7.14.5 Warehousing Business

7.14.6 Main Facilities

7.15 Beijing Er Shang Group

7.15.1 Profile

7.15.2 Beijing Er-shang Group Xijiao Food Freezing Factory

7.15.3 Beijing Er Shang-Fukushima Machinery Electric

7.15.4 Beijing Sanxin Refrigeration Logistics Co., Ltd.

7.16 Hunan Hongxing Frozen Food

7.16.1 Profile

7.16.2 Cold Chain Logistics Business

7.17 Tianjin Fisheries Group

7.17.1 Profile

7.17.2 Cold Chain Logistics Business

7.18 Liaoning Dalian Ocean Fishery Group

7.18.1 Profile

7.18.2 Refrigeration Business

7.19 Hangzhou NF United Meat Co., Ltd.

7.19.1 Profile

7.19.2 Cold chain Business

7.20 Wuhan Wandun Cold Storage Logistics Co., Ltd

7.20.1 Profile

7.20.2 Business

7.21 SF Cold Chain

7.21.1 Profile

7.21.2 Cold Chain Logistics Business

7.22 JD Cold Chain

7.22.1 Profile

7.22.2 Cold Chain Logistics Business

Cold Chain Logistics

Market Size of Cold chain Logistics in China, 2010-2018

Market Size of Cold chain Logistics in China, 2016-2025

Guangdong’s GDP, 2010-2018

Output of Meat Products in China, 2010-2018

Cold Chain Logistics Process of Frozen Aquatic Products

Output of Aquatic Products in China, 2010-2018

Cold Chain Logistics Process of Quick-frozen Flour Food

China’s Output of Quick-frozen Flour Food, 2007-2018

Cold Chain Circulation Volume of Quick-frozen Flour Food in China, 2011-2022E

Cold Chain Logistics Process of Fruits and Vegetables

Output of Fruits in China, 2010-2018

Output of Vegetables in China, 2010-2018

Circulation Diagram of Dairy Products by Type

Output of Liquid Milk in China, 2010-2018

Output of Dairy Products in China, 2010-2018

Output of Frozen Drinks in China, 2010-2018

China Biopharmaceutical Market Size, 2010-2018

Chinese Biopharmaceutical Cold Chain Market Size, 2016-2025

Fresh Food Ecommerce Industry Chain in China

Fresh Food Ecommerce Industry Chain Map in China, 2018

Fresh Food E-commerce Industry Cycle in China

Total Transaction Size and YoY Growth in Fresh Food E-commerce Market in China, 2015-2025

Cold Chain Circulation Rate and Refrigerated Transport Rate of Some Commodities in China

Total Capacity of Cold Storage in China, 2010-2018 (mln cubic meters)

Capacity Structure of Cold Storage in China by Temperature, 2018

Capacity Structure of Cold Storage in China by User, 2018

Capacity Structure of Cold Storage in China by Storage Commodity, 2018

Demand for Cold Storage in China, 2010-2018

Cold Storage Capacity Distribution in Major Provinces of China, 2018

Zhongpin’s Logistics Centers in Places of Production

Zhongpin’s Logistics Centers in Places of Sales

Distribution of Zhongpin’s Major Processing and Manufacturing Bases

Business Presence of Henan Xianyi Supply Chain Co., Ltd.

Last Kilometer Cold Chain Distribution Business of ZM Logistics

Main Business of Gaishi Group

Transportation Service Network of Hengwei Supply Chain Management

Swire’s Cold Chain Value-added Service

Distribution of Swire’s Main Cold Storage Facilities by Region

Cold Chain Network of CMAC

Distribution Network of Speed Fresh Logistics

Major Partners of CJ Rokin

Revenue and Net Income of Bright Real Estate, 2009-2018

Gross Margin of Bright Real Estate, 2015-2018

Revenue and Net Income of Jinjiang International, 2009-2018

Gross Margin (%) of Jinjiang International, 2009-2018

Major Customers of Xintiantian

Revenue and Net Income of Sinotrans, 2009-2018

Distribution of SinotransPFS’ Facilities in China

SinotransPFS’ Facilities in China

Key Customers of HNA Cold Chain

Revenue and Net Income of HNA Cold Chain, 2012-2018

Gross Margin of HNA Cold Chain, 2012-2018

“Hub and Spoke” Transport Network of HNA Cold Chain

Main Warehouses of HNA Cold Chain

Main Refrigerated Trucks of HNA Cold Chain

Chilling and Freezing Showcase of Beijing Er Shang-Fukushima Machinery Electric

Main Transport Routes of Beijing Sanxin Refrigeration Logistics

Cold Storage of Hangzhou NF United Meat Cold Store

Revenue of SF Cold Chain, 2014-2018

Infrastructure of SF Cold Chain, 2018

Medicine Cold Chain Product System of SF Cold Chain

Advantages and Disadvantages of SF Cold Chain for Medicines

JD’s Solutions for Medicine Logistics

Advantages of JD Cold Chain for Medicines

Food Suitable for Cold Chain and Optimum Temperature

Classification of Cold Storage Facilities

Classification of Refrigerated Trucks Transporting Perishable Food and Biological Products by New National Standard

Comparison between Domestic and Overseas Cold Chain Logistics Development

Representative Enterprise in Cold-chain Industry Chain in China

Industrial Policies for Cold Chain Logistics Industry in China

13th Five-Year Plan for Cold Chain Development in Major Provinces and Cities of China

Basic Standards for Cold Chain Logistics

Standards for Cold Storage Facilities in China

Standard for Freezing Equipment in China

Cold Chain Circulation in China, 2011-2025

Cold Chain Circulation Market Structure in China, 2011-2025

GDP and YoY Growth of Two Provinces and One Municipality in Yangtze River Delta Region, 2010-2018

Output of Major Cold Chain Products of Two Provinces and One Municipality in Yangtze River Delta Region, 2011-2018

Cold Chain Demand from Two Provinces and One Municipality in Yangtze River Delta Region, 2011-2018

Guangdong’s Output of Agricultural and Sideline Products, 2011-2018

Guangdong’s Demand for Cold Chain, 2011-2018

GDP and YoY Growth of Beijing-Tianjin-Hebei Region, 2010-2018

Cold Chain Demand from Beijing-Tianjin-Hebei Region, 2011-2018

Overview of Cold Chain Products

Overview of Meat Products Cold Chain Logistics

Cold Chain Circulation and Transport Volume of Meat Products in China, 2011-2025

Cold Chain Circulation and Transport Volume of Aquatic Products in China, 2011-2025

Cold Chain Circulation and Transport Volume of Fruits and Vegetables in China, 2011-2025

Demand for Dairy Product Cold Chain in China, 2011-2025

Drug Classification by Temperature and Cold Chain Drug Range

Classification of Cold Chain Drugs by Temperature and Air Conditions

Polices on Pharmaceuticals Cold Chain Logistics and Their Development Courses in China

Comparison between China and Major Developed Countries in the Development of Cold Chain for Medicines

Fresh Food E-commerce Industry Supply Chain in China, 2018

Cold Storage Classification

Top 10 Cold Storage Operators in China, 2018

Cold Storage Capacity Demand in China, 2015-2025

Three Industrial Businesses of Xianyi Holdings

Cold Chain Service Projects and Scope of ZM Logistics

Distribution of Main Cold Storage Facilities of Shenyang Nonstaple

Main Cold Storage Facilities of Hengwei Supply Chain Management

Storage & Handling Business of Swire

Swire’s Main Existing and Ongoing Cold Storage Capacity and Investment Situation

Guangdong Swire Cold Chain Logistics’ Facilities

Main Cold Storage Facilities of CMAC

Operation Network of Kangxin Logistics Co., Ltd.

Main Cold Storage Facilities of Speed Fresh Logistics

Principal Business of CJ Rokin

Revenue structure of Bright Real Estate by Product, 2015-2018

Revenue structure of Bright Real Estate by Region, 2015-2018

Revenue Structure of Jinjiang International Industrial Investment by Sector, 2009-2018

Operating Revenue, Costs and Gross Margin of Low Temperature Logistics Business of Jinjiang International Industrial Investment, 2007-2018

Major Cold Chain Equipment Matching of Xintiantian

Cold Chain Logistics Routes of Xintiantian

Revenue Structure of Sinotrans by Product, 2017-2018

Revenue Structure of Sinotrans by Product, 2017-2018

Revenue structure of Sinotrans by Region, 2017-2018

Shanghai Cold Chain Logistics Center of Sinotrans

Main Cold Storage Facilities of Beijing Er-shang Group Xijiao Food Freezing Factory

Major Partners of Hunan Hongxing Frozen Food

Ships of Liaoning Dalian Ocean Fishery Group

Operating Business of Wuhan Wandun Cold Storage Logistics Co., Ltd.

China Cold Chain Logistics Industry Report, 2020-2026

The Chinese residents see a change in food consumption and there is a growing market demand for cold chain of food alongside the accelerating urbanization in China. Chinese governments at all levels b...

China Cold Chain Logistics Industry Report, 2019-2025

Cold chain logistics is developing apace in China as cold chain for food is increasingly needed due to the accelerating process of urbanization and the changes in residents’ diet structure, whilst loc...

China Bicycle Sharing Industry Report, 2017-2021

The sharing economy, including bicycle sharing, has flourished along with the spread of smartphone and a surge in mobile users. As an important part of urban slow/shared transport system, the bicycle ...

Global and China Third-party Logistics Industry Report, 2016-2020

Third-party logistics can not only help companies complete cargo movement but effectively reduce logistics costs and speed up cargo turnover, fully meeting their requirements on logistics quality. The...

China Cold Chain Logistics Industry Report, 2016-2020

With the growth of China’s economy over the past decade, the residents’ food consumption structure has experienced constant adjustment, a situation that led to a rising demand for food cold chain. Mor...

China Express Delivery Industry Report, 2015

In 2014, China surpassed the United States to become the world's largest express delivery country for the first time in terms of workload. Since 2015, the industry has continued to maintain a rapid gr...

China Air Transport and Airport Industry Report, 2015-2018

Since 2014, despite negative influence from slower economic growth at home and abroad and high-speed railway on Chinese aviation market demand, China’s civil aviation passenger throughput still kept r...

China Cold Chain Logistics Industry Report, 2014-2017

Since Cold Chain Logistics Development Plan of Agricultural Products was introduced in 2010, China cold chain logistics industry has entered an unprecedented rapid development stage. In October 2014, ...