Global and China Advanced Rigid PCB Industry Report, 2014-2015

-

July 2014

- Hard Copy

- USD

$2,800

-

- Pages:175

- Single User License

(PDF Unprintable)

- USD

$2,600

-

- Code:

ZYW178

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,100

-

- Hard Copy + Single User License

- USD

$3,000

-

Global and China Rigid PCB Industry Report, 2014-2015 is primarily concerned about the followings:

1. Overview of global rigid PCB industry

2. Analysis of PCB downstream market

3. PCB development trend

4. Analysis of photoelectricity, laptop computer, auto and memory PCB industry

5. Ranking of PCB industry

6. 33 PCB Companies

PCB industry can be divided into three categories: rigid PCB, FPCB and substrate. And FPCB and substrate are the emerging industries, for there was only rigid PCB in the early stage. Despite the rapid growth in FPCB and substrate in recent years, rigid PCB has still occupied over 50% of the total industry. And quite a few rigid PCB vendors have gained profits that are not less than that of FPCB and substrate.

PCB industry is fairly mature, with the growth rate generally not more than 6%. And the output value of rigid PCB vendors has long been declining. The year 2012 witnessed a hard time of rigid PCB vendors at a time when smartphone and tablet PC market showed an unexpectedly rapid growth, which sent rigid PCB vendors into fierce price war, thus leading to a drop in profit and revenue. Meanwhile, large PCB companies believed that the traditional rigid PCB had not enough growth potential so that they were beginning to shift their focus to FPCB and substrate. In 2013, almost all the rigid PCB vendors outside mainland China turned around, and even better in 2014 with a higher profit.

In the future, large PCB vendors will concentrate on FPCB and substrate while maintain the status quo for rigid PCB. The major vendors to expand substrate include Unimicron, SEMCO, LG INNOTEK, AT&S, DAEDUCK, Shennan Circuit, SIMMTECH, and the companies, such as Zhen Ding Technology, Young Pong and DAEDUCK GDS will go to the field of FPCB. However, only Ibiden will be committed to development of rigid PCB. In addition, some large vendors go directly into EMS field, such as Tripod Technology and Hannstar Board, the largest laptop PCB giant. This would make the future demand and supply of traditional rigid PCB more balanced, but the high-end Any layer and HDI will be obviously in short supply.

In 2014, the accelerated recovery of rigid PCB industry arises out of another reason—the retreat of Japanese PCB companies.

In November 2013, Japan's Panasonic announced its decision to sharply reduce its PCB capacity globally, with 90% of its global capacity closed down by Q1 2015. In 2013, Panasonic’s revenue from PCB business, mainly involved the R&D of ALIVH (Any Layer Interstitial Via Hole) applied in smartphones, was approximately USD310 million. In March 2013, Panasonic was reported to cut down its PCB capacity in Taiwan and Vietnam. In mid-March 2012, the company established a factory in Dayuan Township of Taoyuan County, a move that was designed to compete for HTC orders. In 2013, however, the shipments of HTC presented a sharp decline, thus resulting in fairly low capacity utilization, hence the determination to withdraw the market.

Still, the Japanese automobile PCB vendor CMK also followed suit and announced in January 2014 that it would shut down its PCB factory YAMANASHI SANKO on April 30, 2014. Meanwhile, it would suspend the production of mobile phone multilayer PCB ALIVH products. Currently, it is Austria’s AT&S alone that uses ALIVH technology.

Japanese PCB also showed the tendency of mergers and acquisitions, with NEC-TOPPAN acquired by Kyocera in August 2013. In future, Fujitsu will also be very likely to sell its PCB business. And Daisho Denshi may merge with PCB business of Hitachi Chemical.

1. Overview of PCB Industry

1.1 Output Value of Global PCB Industry

1.2 Recent Developments and Future Trends of PCB Industry

1.3 Taiwan PCB Industry

1.4 Chinese Mainland PCB Industry

1.4.1 Industrial Scale

1.4.2 Policy on PCB

1.5 Ranking of Chinese Mainland PCB Vendors

1.6 European PCB Industry

1.7 North American PCB Industry

2. PCB Downstream Market

2.1 Mobile Phone

2.1.1 Global Mobile Phone Market Size

2.1.2 Market Share of Mobile Phone by Brand

2.1.3 Smartphone Market and Industry

2.1.4 China Mobile Phone Market

2.1.5 China Mobile Phone Industry

2.2 PC Market

2.2.1 Notebook Computer Industry

2.2.2 Notebook Computer Foundry

2.2.3 Tablet PC Industry

2.2.4 China Mobile PC Industry

3. Analysis of PCB Industry

3.1 PCB Technology Trend

3.1.1 Ranking of PCB Companies for Mobile Phone

3.1.2 Supporting Relationship of Mobile Phone PCB

3.2 Memory Module PCB

3.3 Photonics PCB

3.4 PCB for Automotive Electronics

3.5 PCB for Notebook Computer

3.6 Ranking of Global PCB Companies

4. Major PCB Companies

4.1 Unimicron

4.2 Compeq

4.3 Hannstar Board PCB

4.4 Gold Circuit Electronics

4.5 Tripod Technology

4.6 Meiko

4.7 CMK

4.7.1 WUXI CMK

4.7.2 CMK GBM

4.7.3 CMKC DONGGUAN

4.8 IBIDEN

4.9 Daeduck Electronics

4.10 TTM

4.11 Unitech PCB

4.12 AT&S

4.13 Kingboard

4.13.1 Elec&Eltek

4.13.2 Tech-Wise Circuit

4.13.3 Express Electronics

4.14 SIMMTECH

4.15 T.P.T

4.16 Ellington Electronics

4.17 Chinpoon Industrial

4.18 LG INNOTEK

4.19 SEMCO

4.20 Founder PCB

4.21 Gul Technologies

4.22 Dynamic PCB

4.23 Viasystems

4.24 Nanya PCB

4.25 Shennan Circuit

4.26 WUS Electronics

4.27 Guangdong Goworld

4.28 ZDT

4.29 Multek

4.30 Kinsus

4.31 Shinko

4.32 ISU PETASYS

4.33 KYOCERA Circuit Solutions

Output Value of PCB Industry, 2001-2015

Global PCB Output Value, 1980-2001

PCB Industry Chain

Revenue of PCB Industry by Technology, 2009-2015E

Global PCB Output Value by Layer, 2013

Revenue of Global PCB Industry by Region, 2013 & 2017E

Revenue of Global PCB Industry by Region, 2012-2014

Revenue of PCB Industry in Taiwan by Product, 2010-2013

Revenue of PCB Industry in Taiwan, Jan.2001-Apr.2014

Investment Structure of PCB Companies in Mainland China, 2010-2011

Output Value of PCB Industry in Mainland China by Technology, 2011-2013

Ranking of Chinese Mainland PCB Vendors by Revenue, 2013

European PCB Production by End Market, 2013

Revenue of European PCB Vendors by Country, 2013

Revenue of European PCB Vendors by Country, 2000-2013

Quarterly Revenue of Major European PCB Vendors, 2009-2013

Output Value Growth of European PCB Vendors, 2005-2017E

TOP 50 PCB Vendors in Europe, 2013

Quarterly Revenue of Major North American PCB Vendors, Q1 2008-Q12014

Output Value Growth of North American PCB Vendors, 2005-2017E

Worldwide Mobile Phone Sales to End Users by Vendor in 2013

Smartphone Shipment of Major Chinese Mobile Phone Vendors, 2011-2013

Worldwide Smartphone Sales to End Users by Vendor, 2013

Worldwide Smartphone Sales to End Users by Operating System, 2013

Monthly Shipment of Mobile Phone in China, Jan.2013-May 2014

Market Share of Major Chinese Mobile Phone Vendors, 2014Q1

China's Monthly Mobile Phone Output, Feb-Dec 2013

China's Monthly Mobile Phone Export Value, 2013

Monthly Revenue and Profit of China Communication Terminal Equipment Manufacturing Industry, Feb-Dec 2013

Monthly Investment of China Communication Terminal Equipment Manufacturing Industry, Feb-Dec 2013

Global PC Shipment, 2008-2015

Global PC Shipment, 1999-2013

Global PC Shipment by Region, 2014 Q1

Global PC Shipment by Brand, 2014 Q1

Notebook Computer Shipment, 2008-2015E

Shipment of Major Notebook Computer ODM Vendors, 2010-2013

Market Share of Major Notebook Computer Foundries, 2006 vs.2008

Supporting Relationship and Shipment Ratio between Notebook Computer Brands and OEMs, 2010

Supporting Relationship and Shipment Ratio between Notebook Computer Brands and OEMs, 2011

Supporting Relationship and Shipment Ratio between Notebook Computer Brands and OEMs, 2012-2013

Global Tablet PC Shipment, 2011-2016E

Market Share of Major Tablet PC Brands, 2013

Shipment of Major Tablet PC Vendors, 2012-2013

Output of Notebook Computer (including Tablet PC) in China, 2004-2012

Output of Notebook Computer (including Tablet PC) in China by Region, 2010-2012

Ranking of HDI Vendors by Revenue, 2012-2013

Supply Structure of PCB for NOKIA Mobile Phone, 2010-2013

Supply Structure of PCB for SAMSUNG Mobile Phone, 2010-2013

Supply Structure of PCB for LG Mobile Phone, 2012

Supply Structure of PCB for ZTE Mobile Phone, 2010-2013

Supply Structure of PCB for RIM Mobile Phone, 2010-2011

Supply Structure of PCB for APPLE, 2010-2013

Ranking of DRAM Vendors by Revenue, 2014Q1

Market Share of DRAM Vendors Worldwide, 2014Q1

Market Share of NAND Vendors Worldwide, 2014Q1

Market Share of Memory Module PCB Vendors Worldwide, 2007-2013

Market Share of Major PV Panel Businesses in China, 2006/2010/2011/2012

Market Share of Automotive Electronic PCB Businesses, 2010-2013

Market Share of Major Notebook PCB Vendors by Shipment, 2011-2012

Top 20 PCB Vendors Worldwide by Revenue, 2012-2013

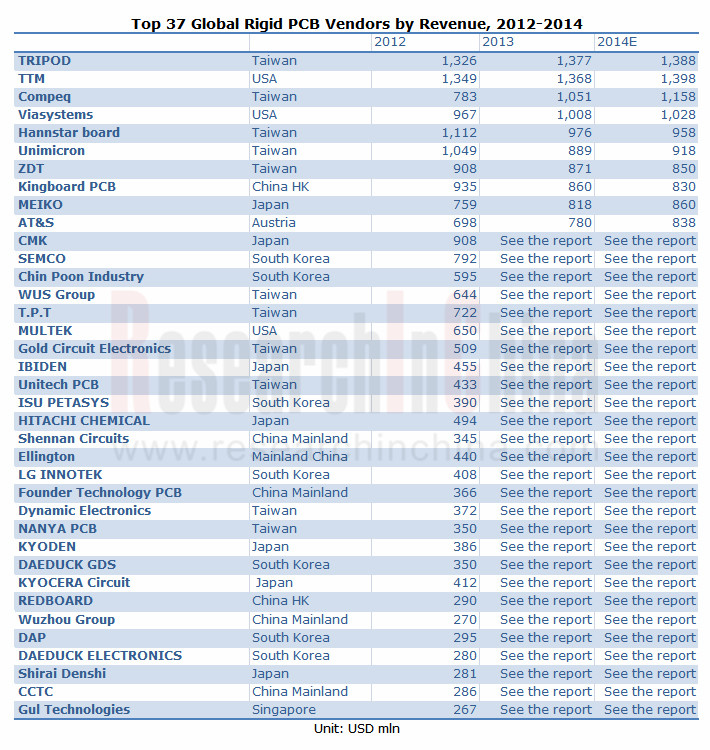

Top 37 Rigid PCB Vendors Worldwide by Revenue, 2012-2014

Gross Margin of Major PCB Vendors, 2012-2014

Gross Margin of Top 25 PCB Vendors, 2012-2014

Unimicron's M & A

Financial Data of Unimicron’s Subsidiariea in Mainland China, 2013

Revenue and Gross Margin of Compeq, 2006-2014

Revenue and Operating Margin of Compeq, 2009-2014

Monthly Revenue and Growth Rate of Compeq, May 2012-May 2014

Financial Data of Major Subsidiaries under Compeq, 2009-2013

Revenue and Gross Margin of Hannstar Board PCB, 2006-2014

Revenue and Operating Margin of Hannstar Board PCB, 2009-2014

Monthly Revenue and Growth Rate of Hannstar Board PCB, May 2012-May 2014

Revenue of Hannstar Board PCB by Application, 2009-2012

Revenue of Hannstar Board PCB by Layer, 2009-2012

Financial Data of Major Subsidiaries under Hannstar Board PCB, 20112

Financial Data of Major Subsidiaries under Hannstar Board PCB, 2013

Revenue and Gross Margin of Gold Circuit Electronics, 2005-2014

Revenue and Operating Margin of Gold Circuit Electronics, 2009-2014

Monthly Revenue and Growth Rate of Gold Circuit Electronics, May 2012-May 2014

Revenue of Gold Circuit Electronics by Product, 2010-2012

Revenue and Gross Margin of Tripod Technology, 2006-2014

Revenue and Operating Margin of Tripod Technology, 2012-2014

Revenue of Tripod Technology by Application, 2013

Revenue of Tripod Technology by Layer, 2013

Monthly Revenue and Growth Rate of Tripod Technology, May 2012-May 2014

Capacity of Tripod Technology, 2006-2011 (Unit: 1,000 m2)

Financial Data of Major Subsidiaries under Tripod Technology in Mainland China, 2013

Revenue and Operating Margin of Meiko, FY2006-FY2015

Operating Income Analysis of Meiko, FY2014

Revenue and Operating Margin of Chinese Mainland Subsidiaries under Meiko, FY2009-FY2014

Revenue of Meiko by Application, FY2013-FY2015

Revenue of Meiko by Layer, FY2013-FY2015

Revenue and Operating Margin of CMK, FY2005-FY2015

Revenue of CMK by Application, FY2007-FY2014

Revenue of CMK by Layer, FY2007-FY2014

Revenue of CMK by Region, FY2007-FY2014

Revenue and Output of WUXI CMK, 2003-2010

Revenue and Operating Margin of TTM, 2005-2014

Revenue of TTM by Region, 2011-2013

Revenue of TTM by Technology, 2013

Revenue of TTM by Application, 2008-2013

Global Presence of TTM Plants

Revenue and Gross Margin of Unitech PCB, 2006-2014

Revenue and Operating Margin of Unitech PCB, 2009-2014

Monthly Revenue and Growth Rate of Unitech PCB, May 2012-May 2014

Technology Roadmap of Rigid PCB

Technology Roadmap of Rigid-Flex PCB

Financial Data of Shanghai Unitech Electronics Co., Ltd, 2012-2013

Revenue and Profit before Taxation Margin of Kingboard, 2009-2013

Balance Sheet of Kingboard, 2009-2013

Revenue of Kingboard by Business, 2008-2013

Revenue and Operating Margin of Elec & Eltek, 2005-2013

Balance Sheet of Elec & Eltek, 2009-2013

Revenue of Elec & Eltek by Region, 2006-2013

Revenue of Elec & Eltek by Layer, 2006-2013

Capacity of Plants under Elec & Eltek

Technology Capability of Elec & Eltek

Revenue from Dongguan Plant of Express Electronics, 2009-2013

Capacity of Dongguan Plant of Express Electronics

Revenue from Suzhou Plant of Express Electronics, 2008-2013

Capacity of Suzhou Plant of Express Electronics

Capacity of Qingyuan Plant of Express Electronics

SIMMTECH’s Balance Sheet, 2009-2013

Revenue and Gross Margin of T.P.T, 2005-2014

Revenue and Operating Margin of T.P.T, 2009-2014

Monthly Revenue and Growth Rate of T.P.T, May 2012-May 2014

Client Structure of T.P.T, 2012

Revenue of T.P.T by Application, 2012

Financial Data of Major Subsidiaries under T.P.T in Mainland China

Revenue and Gross Margin of Ellington Electronics, 2009-2014

Revenue of Ellington Electronics by Layer, 2009-2013

Revenue of Ellington Electronics by Application, 2009-2012H1

Revenue of Ellington Electronics by Region, 2009-2012H1 141

Revenue Structure by Client of Ellington Electronics, 2007-2012

Revenue and Gross Margin of ChinPoon Industrial, 2005-2014

Revenue and Operating Margin of ChinPoon Industrial, 2009-2014

Monthly Revenue and Growth Rate of Chin-Poon Industrial, May 2012-May 2014

Revenue and Operating Margin of Founder PCB, 2007-2013

Financial Data of Founder PCB’s Subsidiaries, 2013

Downstream Application of Founder PCB, 2010-2012

HDI Technology Capability of Founder PCB

Revenue and Operating Income of Gul Technologies, 2005-2013

Revenue and Gross Margin of Dynamic PCB, 2006-2014

Revenue and Operating Margin of Dynamic PCB, 2009-2014

Monthly Revenue and Growth Rate of Dynamic PCB, May 2012-May 2014

Capacity of Dynamic PCB, 2009-2012

Revenue and Operating Margin of Viasystems, 2006-2014

Revenue of Viasystems by Business, 2008-2013

Global Distribution of Viasystems

Revenue of Viasystems by Application, 2008-2013

Revenue of Viasystems, 2010-2012

Revenue of DDI by End Market and Region

Major Clients of DDI

Technology Capabilities of Shennan Circuit

Revenue and Operating Income of WUS Electronics, 2007-2014

Revenue of WUS Electronics by Layer, 2010-2013

Revenue of Wus Electronics by Application, 2007-2013

Gross Margin of Wus Electronics by Application, 2012-2013

Major Clients of WUS Electronics, 2010/2011/2013

Revenue and Operating Margin of Guangdong Goworld, 2005-2014

Revenue of Guangdong Goworld by Business, 2007-2013

Revenue and Operating Margin of ZDT, 2008-2014

Revenue and Gross Margin of ZDT, 2009-2014

Monthly Revenue and Growth Rate of ZDT, May 2012-May 2014

Financial Data of Major Subsidiaries under ZDT in Mainland China, 2012

Financial Data of Major Subsidiaries under ZDT in Mainland China, 2013

Technology Roadmap of Multek ELIC, 2011-2013

Technology Roadmap of Rigid-Flex PCB of Multek, 2011-2013

Technology Roadmap of Multek Microvias, 2011-2013

Revenue and Operating Margin of ISU PETASYS, 2008-2014

Revenue of ISU PETASYS by Technology, 2012-2014

Global and China CMOS Camera Module (CCM) Industry Report, 2020-2026

The global CCM market has been ballooning thanks to expeditious penetration of multi-camera phones and advances in automotive ADAS, being worth $22.723 billion with a year-on-year spike of 16.6% in 20...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2020-2025

Electronic components like MLCC enjoy a rosy prospect alongside the burgeoning electronic manufacturing, the thriving internet and the prevalence of smart hardware.

MLCC was much sought after and it...

Global and China Voice Coil Motor (VCM) Industry Report, 2019-2025

VCM (voice circle motor or voice coil actuator), a part for smartphone camera, shares around 6% of smartphone camera industry chain value.

Globally, popularity of smartphones such as those with mult...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2019-2025

Chinese aluminum electrolytic capacitor market has been expanding amid a transfer of its downstream industries to China like home appliance illumination, cellphones and computers as well as automatic ...

Global and China Flexible Printed Circuit (FPC) Industry Report, 2019-2025

Flexible printed circuit (FPC) products make their way into consumer electronics like smartphone and tablet PC, in the form of modules for display, touch control, fingerprint recognition, etc. The vol...

Global and China GaAs Industry Report, 2019-2025

Gallium arsenide (GaAs), one of the most mature compound semiconductors, is an integral part of smartphone power amplifier (PA). In 2018, GaAs-based radio frequency (RF) seized over half of the GaAs w...

Global and China Advanced Packaging Industry Report, 2019-2025

The global semiconductor packaging and testing market is enlarging with the prevalence of consumer electronics, automotive semiconductors and the Internet of Things (IoT), with its size edging up 2.5%...

Global and China MLCC Electronic Ceramics Industry Report, 2019-2025

MLCC is mainly used in audio and video equipment, mobile phones, computers and automobiles. The prospective boom of MLCC formula powder hinges on demand: 1) The accelerated renewal of consumer electro...

Global and China OLED Industry Report, 2019-2025

OLED, a new-generation display technology, features simple display structure, green consumables and flexibility and can be rolled up, which makes it easier to transport and install without considering...

Global and China Camera Module Industry Report, 2019-2025

Affected by factors like the maturity of mobile phone markets worldwide and the prolonged replacement of mobile phone by users, the mobile phone market has undergone a slowdown in growth rate. From Q4...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2018-2023

MLCC finds most application in consumer electronics, automobile and industrial fields and gets beefed up remarkably with the approaching 5G era of cellphones and tablet PCs, the advances in automotive...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2018-2023

Aluminum electrolytic capacitor, a core electronic component, is widely used in consumer electronics, computers and peripherals, industry, electric power, lighting and automobiles.

Global aluminum e...

Global and China CMOS Camera System Industry Report, 2017-2021

Global CCM (CMOS Camera Module) market was worth USD16.611 billion in 2015, a year-on-year rise of 3.8% from 2014, the slowest rate since 2010. Global market fell modestly in 2016 due to a drop in shi...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2017-2021

Global OLED market size approximated USD15.7 billion in 2016, a 20.8% rise from a year earlier. Stimulated by reports that Apple will adopt OLED screen for multiple iPhone models in 2017-2018, OLED sc...

Global and China CMOS Camera System Industry Report, 2016-2020

Global and China CMOS Camera System Industry Report, 2016-2020 covers the following:1. Analysis of CMOS Image Sensor (CIS) Industry and Market, with 7 vendors involved.2. Analysis of CMOS Camera Lens ...

Global and China Multi-layer Ceramic Capacitor (MLCC) Industry Report, 2017-2020

The rapid development of consumer electronics and industrial intelligentization has greatly promoted the booming of passive components including multi-layer ceramic capacitor (MLCC). In 2015, China’s ...

Global PCB Industry Report, 2015-2020

Global PCB Industry Report, 2015-2020 highlights the followings:1. Global PCB Market and Status Quo of the Industry2. Global Downstream Markets of PCB3. Mobile Phone PCB Trends4. Tablet PC/Laptop Comp...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2016-2020

The OLED market has been developing rapidly worldwide over the recent years, and its market size reached USD13 billion in 2015. With technology and capacity construction, OLED (from small-sized panels...