China Air Transport and Airport Industry Report, 2015-2018

-

Mar.2015

- Hard Copy

- USD

$2,400

-

- Pages:110

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

LMX062

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,600

-

Since 2014, despite negative influence from slower economic growth at home and abroad and high-speed railway on Chinese aviation market demand, China’s civil aviation passenger throughput still kept relatively rapid growth driven by tourist’s leisure demand, and cargo & mail throughput rallied slightly driven by a pickup in exports. In the first eleven months of 2014, China’s total civil aviation turnover, passenger turnover, and cargo & mail turnover reached 68.385 billion ton-kilometers, 580.181 billion passenger-kilometers, and 16.874 billion ton-kilometers, a year-on-year increase of 11.1%, 11.60%, and 8.8%, respectively.

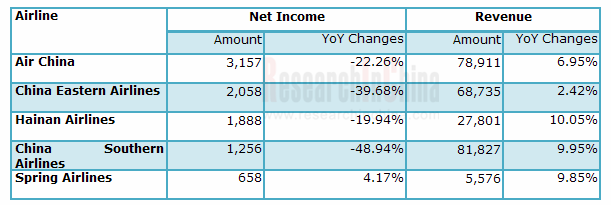

However, the airlines suffered heavy exchange losses due to yuan depreciation against dollar. In the first three quarters of 2014, four big airlines all saw sharp decline in net income, with China Eastern Airlines falling the hardest, at 48.94%. Compared with significant drop in profits of the four big airlines since 2010, Spring Airlines, a representative of budget airlines, has enjoyed continuous increase in revenue and net income ever since 2011, with the latter recording a growth of 4.17% in the first three quarters of 2014.

Revenue and Net Income of Major China Airlines in the First Three Quarters of 2014 (Unit: RMB mln)

Source: Companies Mentioned Above, ResearchInChina

To improve performance, the airlines in China have sought to make progress in two aspects since 2013: accelerate the opening up of international and regional routes; speed to expand into low-cost aviation industry.

Actively opening up new routes: In 2014, Air China added 12 routes (4 domestic ones and 8 international ones), totaling 33 international routes from 2012. In the same year, China Southern Airlines opened 9 new international routes, bringing the total newly-added international routes to 26 since 2012.

Speeding layout in low-cost aviation industry: In Mar. 2013, China West Air announced to transform into a low-cost carrier; in Jun. 2013, Hong Kong Express Airways announced its intention to transform into a low-cost carrier; on Jul. 2014, China Eastern Airlines announced its subsidiary China United Airlines to convert into a low-cost airline; on Jan. 21, 2015, Spring Airlines got its shares listed on the Shanghai Stock Exchange, becoming the first listed low-cost airline in China.

China Air Transport and Airport Industry Report, 2015-2018 focuses on the following:

Development environment for air transport industry in China, covering economic environment, policy environment, and social environment;

Development environment for air transport industry in China, covering economic environment, policy environment, and social environment;

Operation status of air transport industry and low-cost aviation market in China;

Operation status of air transport industry and low-cost aviation market in China;

Operation status of airport transportation in China, including passenger throughput, cargo & mail throughput, and airplane takeoffs and landings;

Operation status of airport transportation in China, including passenger throughput, cargo & mail throughput, and airplane takeoffs and landings;

Overall economic results of air transport industry in China, encompassing revenues and total profits of companies in the industry;

Overall economic results of air transport industry in China, encompassing revenues and total profits of companies in the industry;

16 major airlines in China, including financial situation, transport capacity, carrying capacity, load factor, development strategy, and performance forecast;

16 major airlines in China, including financial situation, transport capacity, carrying capacity, load factor, development strategy, and performance forecast;

15 major transport airports in China, including financial situation, three production index, and performance forecast;

15 major transport airports in China, including financial situation, three production index, and performance forecast;

Forecast on main data of China’s air transport industry for 2015-2018.

Forecast on main data of China’s air transport industry for 2015-2018.

Preface

1. Development Environment for China Air Transport Industry

1.1 Economic Environment

1.2 Policy Environment

1.3 Social Environment

2. Operation and Development Status of China Air Transport Industry

2.1 Operation Indicators

2.1.1 Transport Capacity

2.1.2 Traffic Turnover

2.1.3 Traffic Volume

2.1.4 Traffic Efficiency

2.2 Low-Cost Aviation Market

2.2.1 Development Process

2.2.2 Development Status

2.2.3 Future Development

3. Operation of China Airport Transportation Industry

3.1 Number of Destinations & Airports

3.2 Passenger Throughput

3.3 Cargo & Mail Throughput

3.4 Aircraft Movements

4. Economic Benefits of China Air Transport and Airport Industry

4.1 Overall

4.2 Industry Segments

5. Operation of Major Chinese Airlines

5.1 Competition Pattern

5.1.1 Performance

5.1.2 Transport Capacity

5.1.3 Traffic Volume

5.1.4 Passenger Load Factor

5.2 China Southern Airlines

5.2.1 Profile

5.2.2 Operation

5.2.3 Transport Capacity

5.2.4 Carrying Capacity

5.2.5 Load Factor

5.2.6 Strategy Transition

5.2.7 Performance Forecast

5.3 China Eastern Airlines

5.3.1 Profile

5.3.2 Operation

5.3.3 Transport Capacity

5.3.4 Carrying Capacity

5.3.5 Load Factor

5.3.6 Strategy Transition

5.3.7 Performance Forecast

5.4 Air China

5.4.1 Profile

5.4.2 Operation

5.4.3 Transport Capacity

5.4.4 Carrying Capacity

5.4.5 Load Factor

5.4.6 Development Strategy

5.4.7 Performance Forecast

5.5 Hainan Airlines

5.5.1 Profile

5.5.2 Operation

5.5.3 Transport Capacity

5.5.4 Carrying Capacity

5.5.5 Load Factor

5.5.6 Performance Forecast

5.6 Cathay Pacific Airways

5.6.1 Profile

5.6.2 Operation

5.6.3 Transport Capacity

5.6.4 Carrying Capacity

5.6.5 Load Factor

5.6.6 Performance Forecast

5.7 Shandong Airlines

5.7.1 Profile

5.7.2 Operation

5.7.3 Transport Capacity

5.7.4 Carrying Capacity

5.7.5 Load Factor

5.7.6 Performance Forecast

5.8 Spring Airlines

5.8.1 Profile

5.8.2 Operation

5.8.3 Transport Capacity

5.8.4 Carrying Capacity

5.8.5 Load Factor

5.8.6 Fund-raising Projects

5.9 Juneyao Airlines

5.9.1 Profile

5.9.2 Operation

5.9.3 Transport Capacity

5.9.4 Carrying Capacity

5.9.5 Load Factor

5.9.6 Strategy

5.10 Shenzhen Airlines

5.10.1 Profile

5.10.2 Operation

5.10.3 Transport Capacity

5.10.4 Carrying Capacity

5.10.5 Load Factor

5.11 Xiamen Airlines

5.11.1 Profile

5.11.2 Operation

5.11.3 Transport Capacity

5.11.4 Carrying Capacity

5.11.5 Load Factor

5.12 Sichuan Airlines

5.13 China Express

5.14 China United Airlines

5.15 China Postal Airlines

5.16 China Cargo Airlines

5.17 Okay Airways

6. Operation of Major Chinese Airports

6.1 Competition Pattern

6.2 Beijing Capital International Airport

6.2.1 Profile

6.2.2 Financial Position

6.2.3 Production Index

6.2.4 Performance Forecast

6.3 Shanghai Airport

6.3.1 Profile

6.3.2 Financial Position

6.3.3 Production Index

6.3.4 Performance Forecast

6.4 Baiyun Airport

6.4.1 Profile

6.4.2 Financial Position

6.4.3 Production Index

6.4.4 Performance Forecast

6.5 Shenzhen Airport

6.5.1 Profile

6.5.2 Financial Position

6.5.3 Production Index

6.5.4 Performance Forecast

6.6 Chengdu Shuangliu International Airport

6.7 Kunming Changshui International Airport

6.8 Xi’an Xianyang International Airport

6.9 Chongqing Jiangbei International Airport

6.10 Hangzhou Xiaoshan International Airport

6.11 Xiamen Gaoqi International Airport

6.12 Changsha Huanghua International Airport

6.13 Nanjing Lukou International Airport

6.14 Wuhan Tianhe International Airport

6.15 Urumqi International Airport

6.16 Qingdao International Airport

7. Summary and Forecast for China Air Transport and Airport Industry

7.1 Digital Civil Aviation 2014

7.2 Development Forecast

7.2.1 Trends

7.2.2 Data Forecast

Fluctuation of China Civil Aviation RPK around GDP Growth Rate, 1991-2014

Laws, Regulations, and Policies Concerning China Air Transport Industry, 2011-2015

Urban Household’s Per Capita Transportation Communication Expense in China, 1985-2013

High Speed Rail VS Civil Aviation

Number of China Civil Aviation Aircrafts, 2004-2013

Number of Transport Aircrafts in China Civil Aviation Industry, 2006-2013

Number of China Civil Aviation Airlines, 2004-2013

China Civil Aviation Turnover and YoY Growth, 2006-2014

China Civil Aviation Passenger Turnover and YoY Growth, 2007-2014

China Civil Aviation Cargo & Mail Turnover and YoY Growth, 2007-2014

China Civil Aviation Turnover (by Air Route), 2006-2014

China Civil Aviation Passenger Traffic Volume and YoY Growth, 2007-2014

China Civil Aviation Passenger Traffic Volume (by Air Route), 2010-2014

China Civil Aviation Cargo & Mail Traffic Volume and YoY Growth, 2006-2014

China Civil Aviation Cargo & Mail Traffic Volume (by Air Route), 2010-2014

Daily Utilization Rate of China Civil Aviation Aircrafts, 2009-2014

Passenger Load Factor and Overall Load Factor of China Civil Aviation Industry, 2010-2014

Development Course of China Low-Cost Aviation Industry, 2003-2015

Global Low-Cost Aviation Market Share, 2004-2014

Number and Market Share of Low-Cost Airlines in the World (by Region), 2014

Passenger Transport Volume of Global Low-Cost Airlines (by Region), 2014

Development Difficulties of Low-Cost Airlines in China

Introduction of Low-Cost Airlines in China

Layout of Foreign Low-Cost Airlines in China

Low-Cost Airline Share Changes in the World’s Major Markets, 2007-2014

Low-Cost Aviation VS High Speed Railway

Number of Civil Aviation Destinations and Airports in China, 2007-2013

Number of Transport Airports in China (by Region), 2013

Passenger Throughput and YoY Growth of Transport Airports in China, 2007-2014

Passenger Throughput of Transport Airports in China (by Air Route), 2010-2013

Number of Transports with Passenger Throughput Exceeding 1 Million Person-times in China, 2013

Regional Distribution of China’s Passenger Throughput, 2013

Cargo & Mail Throughput and YoY Growth of Transport Airports in China, 2007-2014

Cargo & Mail Throughput of Transport Airports in China (by Air Route), 2010-2013

Regional Distribution of China’s Cargo & Mail Throughput, 2013

Aircraft Movements and YoY Growth of Airports in China, 2007-2014

Revenue and Total Profit of Civil Aviation Enterprises in China, 2009-2014

Structure of Revenue and Total Profit of China Civil Aviation Industry, 2013

Revenue and Total Profit of Airlines in China Civil Aviation Industry, 2009-2013

Revenue and Total Profit of Airports in China Civil Aviation Industry, 2009-2013

Airlines Ranking (by Net Income) in China, Q1-Q3, 2014

Airlines Ranking (by Revenue) in China, Q1-Q3, 2014

Airlines Ranking (by Number of Aircraft Ownership) in China, H1 2014

Key Chinese Airlines’ Three Capacity Indices, 2014

Key Chinese Airlines’ Traffic Volume, 2014

Key Chinese Airlines’ Passenger Load Factors, 2014

Revenue and Net Income of China Southern Airlines, 2009-2014

Structure of Main Business Cost of China Southern Airlines, H1 2014

Number of Aircraft Ownership of China Southern Airlines, 2009-2014

Three Capacity Indices of China Southern Airlines, 2008-2014

Carrying Capacity of China Southern Airlines, 2008-2014

Structure of Passenger Traffic Volume of China Southern Airlines, 2010-2014

Overall Load Factor of China Southern Airlines, 2008-2014

Strategy Transition of China Southern Airlines

Revenue and Net Income of China Southern Airlines, 2015E-2018E

Revenue and Net Income of China Eastern Airlines, 2009-2014

Structure of Operating Cost of China Eastern Airlines, H1 2014

Number of Aircraft Ownership of China Eastern Airlines, 2009-2014

Capacity Situation of China Eastern Airlines, 2008-2014

Carrying Capacity of China Eastern Airlines, 2008-2014

Structure of Passenger Traffic Volume of China Eastern Airlines, 2010-2014

Overall Load Factor of China Eastern Airlines, 2008-2014

Revenue and Net Income of China Eastern Airlines, 2015E-2018E

Revenue and Net Income of Air China, 2009-2014

Structure of Operating Cost of Air China, H1 2014

Number of Aircraft Ownership of Air China, 2009-2014

Main Capacity Indices of Air China, 2008-2014

Carrying Capacity Indices of Air China, 2008-2014

Structure of Passenger Traffic Volume of Air China, 2009-2014

Overall Load Factor of Air China, 2008-2014

Revenue and Net Income of Air China, 2015E-2018E

Revenue and Net Income of Hainan Airlines, 2009-2014

Number of Aircraft Ownership of Hainan Airlines, 2009-2014

Capacity Indices of Hainan Airlines, 2009-2014

Capacity Indices of Hainan Airlines, 2014

Carrying Capacity Indices of Hainan Airlines, 2009-2014

Overall Load Factor of Hainan Airlines, 2008-2014

Overall Load Factor of Hainan Airlines, 2014

Revenue and Net Income of Hainan Airlines, 2015E-2018E

Flight Lines of Cathay Pacific Airways and Its Affiliated Companies

Revenue and Net Income of Cathay Pacific Airways, 2009-2014

Structure of Operating Expenses of Cathay Pacific Airways, H1 2014

Number of Aircraft Ownership of Cathay Pacific Airways, 2009-2014

Capacity Indices of Cathay Pacific Airways, 2007-2014

Carrying Capacity Indices of Cathay Pacific Airways, 2007-2014

RPK Structure of Cathay Pacific Airways (by Region), 2014

Overall Load Factor of Cathay Pacific Airways, 2007-2014

Revenue and Net Income of Cathay Pacific Airways, 2015E-2018E

Revenue and Net Income of Shandong Airlines, 2009-2014

Fleet Type of Shandong Airlines, H1 2014

Major Operating Indicators of Shandong Airlines, 2010-2014

Overall Load Factor of Shandong Airlines, 2012-2014

Revenue and Net Income of Shandong Airlines, 2015E-2018E

Introduction of Spring Airlines

Revenue and Net Income of Spring Airlines, 2011-2014

Number of Aircraft Ownership of Spring Airlines, 2011-2014

Flying Range of Spring Airlines’ Airbus A320

Capacity Indices of Spring Airlines, 2011-2015

Carrying Capacity Indices of Spring Airlines, 2011-2015

Overall Load Factor of Spring Airlines, 2011-2015E

Fund-raising Projects of Spring Airlines

Revenue and Net Income of Juneyao Airlines, 2011-2014

Revenue Structure of Juneyao Airlines (by Segment), 2011-2014

Number of Aircraft Ownership of Juneyao Airlines, 2011-2014

Aircraft Type of Juneyao Airlines, end-Jun 2014

Carrying Capacity of Juneyao Airlines, 2007-2014

Structure of Passenger Traffic Volume of Juneyao Airlines, 2011-2014

Passenger Load Factor of Juneyao Airlines, 2011-2014

Revenue and Net Income of Shenzhen Airlines, 2011-2014

Number of Aircraft Ownership of Shenzhen Airlines

Capacity Indices of Shenzhen Airlines, 2010-2014

Carrying Capacity Indices of Shenzhen Airlines, 2010-2014

Overall Load Factor of Shenzhen Airlines, 2010-2014

Total Revenue of Xiamen Airlines, 2002-2013

Total Profit of Xiamen Airlines, 2002-2013

Number of Aircraft Ownership of Xiamen Airlines, 2011-2014

Carrying Capacity Indices of Xiamen Airlines, 2009-2014

Overall Load Factor of Xiamen Airlines, 2011-2013

Main Financial Indicators of Sichuan Airlines, 2009-2013

Carrying Capacity of Sichuan Airlines, 2006-2014

Passenger Carrying Capacity of China Express, 2007-2014

Introduction of China United Airlines

Carrying Capacity of China United Airlines, 2006-2014

Carrying Capacity of China Postal Airlines, 2006-2013

Revenue and Net Income of China Cargo Airlines, 2012-2014

Carrying Capacity of China Cargo Airlines, 2006-2013

Number of Aircraft Ownership of Okay Airways, 2005-2015

Carrying Capacity of Okay Airways, 2006-2014

Three Major Indices of Main Airports in China, 2014

Revenue and Net Income of Beijing Capital International Airport, 2008-2014

Operating Expenses of Beijing Capital International Airport, H1 2014

Three Production Indicators of Beijing Capital International Airport, 2007-2014

Revenue and Net Income of Beijing Capital International Airport, 2015E-2018E

Revenue and Net Income of Shanghai Airport, 2009-2014

Structure of Operating Cost of Shanghai Airport, H1 2014

Three Production Indicators of Shanghai Pudong Airport, 2009-2014

Three Production Indicators of Shanghai Hongqiao Airport, 2009-2014

Revenue and Net Income of Shanghai Airport, 2015E-2018E

Revenue and Net Income of Baiyun Airport, 2008-2014

Three Production Indicators of Baiyun Airport, 2008-2014

Revenue and Net Income of Baiyun Airport, 2015E-2018E

Revenue and Net Income of Shenzhen Airport, 2009-2014

Three Production Indicators of Shenzhen Airport, 2007-2015

Revenue and Net Income of Shenzhen Airport, 2015E-2018E

Three Production Indicators of Chengdu Shuangliu International Airport, 2007-2014

Three Production Indicators of Kunming Changshui International Airport, 2007-2014

Three Production Indicators of Xi’an Xianyang International Airport, 2007-2014

Three Production Indicators of Chongqing Jiangbei International Airport, 2007-2014

Three Production Indicators of Hangzhou Xiaoshan International Airport, 2007-2014

Three Production Indicators of Xiamen Gaoqi International Airport, 2007-2014

Three Production Indicators of Changsha Huanghua International Airport, 2007-2014

Three Production Indicators of Nanjing Lukou International Airport, 2007-2014

Three Production Indicators of Wuhan Tianhe International Airport, 2007-2014

Three Production Indicators of Urumqi International Airport, 2007-2014

Three Production Indicators of Qingdao International Airport, 2009-2014

Main Operation Indicators in China’s Civil Aviation Transportation Industry, 2013-2014

Airports (Passenger Throughput >10 Million Person-times) in China, 2014

New International Airlines of Major Airline Companies in China, 2012-2014

Revenue and Total Profit of Civil Aviation Companies in China, 2015E-2018E

Traffic Turnover of China’s Civil Aviation, 2015E-2018E

Passenger Traffic Volume of China’s Civil Aviation, 2015E-2018E

Cargo & Mail Traffic Volume of China’s Civil Aviation, 2015E-2018E

China Cold Chain Logistics Industry Report, 2020-2026

The Chinese residents see a change in food consumption and there is a growing market demand for cold chain of food alongside the accelerating urbanization in China. Chinese governments at all levels b...

China Cold Chain Logistics Industry Report, 2019-2025

Cold chain logistics is developing apace in China as cold chain for food is increasingly needed due to the accelerating process of urbanization and the changes in residents’ diet structure, whilst loc...

China Bicycle Sharing Industry Report, 2017-2021

The sharing economy, including bicycle sharing, has flourished along with the spread of smartphone and a surge in mobile users. As an important part of urban slow/shared transport system, the bicycle ...

Global and China Third-party Logistics Industry Report, 2016-2020

Third-party logistics can not only help companies complete cargo movement but effectively reduce logistics costs and speed up cargo turnover, fully meeting their requirements on logistics quality. The...

China Cold Chain Logistics Industry Report, 2016-2020

With the growth of China’s economy over the past decade, the residents’ food consumption structure has experienced constant adjustment, a situation that led to a rising demand for food cold chain. Mor...

China Express Delivery Industry Report, 2015

In 2014, China surpassed the United States to become the world's largest express delivery country for the first time in terms of workload. Since 2015, the industry has continued to maintain a rapid gr...

China Air Transport and Airport Industry Report, 2015-2018

Since 2014, despite negative influence from slower economic growth at home and abroad and high-speed railway on Chinese aviation market demand, China’s civil aviation passenger throughput still kept r...

China Cold Chain Logistics Industry Report, 2014-2017

Since Cold Chain Logistics Development Plan of Agricultural Products was introduced in 2010, China cold chain logistics industry has entered an unprecedented rapid development stage. In October 2014, ...