Global and China IC Substrate Industry Report, 2015

-

Mar.2015

- Hard Copy

- USD

$2,350

-

- Pages:120

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

ZYW200

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,550

-

Global and China IC Substrate Industry Report, 2015 highlights the followings:

1. Status quo of semiconductor and IC packaging industry

2. Analysis on downstream market of IC substrate

3. Development trend of IC substrate

4. Analysis on IC substrate industry

5. Research on 12 IC substrate vendors

6. Research on 6 IC substrate peripheral companies

IC substrate industry may be in a predicament in 2015, rooted in two aspects: first, the maturing of FOWLP; second, the tablet sales decline and sluggish smartphone growth. In addition, the prosperity of IC substrate industry in 2013 stimulated large-scale expansion of enterprises in 2014, thus leading to an insufficient rate of capacity utilization.

For FC-CSP substrate with mobile phone and tablet PC as the core market facing strong competition from FOWLP that has overwhelming superiorities including low profile, higher speed, more I/O, higher integration, less processing step, especially needing no substrate which slashes cost as IC substrate accounts for more than half of the total cost of IC.

Although it is in its infancy without obvious cost advantage, FOWLP has been an irresistible trend, the traditional FC-CSP substrate will have to reduce the price to enter a competition, and the demand for the latter will be sharply reduced by more than 60% once FOWLP matures. So in 2015, FC-CSP substrate vendors have to substantially reduce the price to gain market advantage in advance. It is expected that in 2015 the IC substrate market will encounter a 7% scale-down to USD7.12 billion.

In the downstream market, large screen mobile phone squeezed the living space of tablet PC which declined significantly. And the single-functional tablet PC is mostly used as a toy for children with less demand for replacement. In the field of smartphone, China as the world’s largest smartphone market declined in 2014.

SiP packaging substrate will be the highlight for IC substrate market in 2015 as core components of high-end smart watches must adopt SiP packaging. Both the two core processors built in Apple Watch use SiP packaging technology. The most important SiP substrate of Apple Watch calls for the most difficult production, priced 4-5 times higher than FCCSP applied to general ARM processor. The orders are shared by Nanya, Kinsus and other Taiwanese vendors. ASE undertakes Apple Watch’s SI chip SiP packaging business.

The PC market is also likely to recover in 2015 for tablet PC slump means the recovery of laptop computer market. Laptop computer market saw the first growth in 2014 after three consecutive years of decline and is expected to continue the trend in 2015. And laptop discrete graphics card accounts for a zooming proportion, signifying GPU shipments boost.

Another excellent performer in IC substrate applications is the memory market.

1. Global Semiconductor Industry

1.1 Overview

1.2 IC Packaging

1.3 IC Packaging and Testing

2. Downstream Market of IC Substrate

2.1 Introduction to IC Substrate

2.2 Flip Chip IC Substrate

2.3 Global Mobile Phone Market

2.4 Global Smartphone Market

2.5 Chinese Mobile Phone Market

2.6 Laptop Computer Market

2.7 CPU and GPU Market

2.8 Memory Market

3. IC Substrate Market and Industry

3.1 IC Substrate Market

3.2 Wide IO/HMC Memory

3.3 Embedded Component Substrate

3.4 Embedded Trace Substrate

3.5 IC Packaging for Portable Devices

3.5.1 Status Quo

3.5.2 PoP Packaging

3.5.3 FOWLP

3.6 SIP Packaging

3.7 2.5D Packaging (SI/Glass/Organic Interposer)

3.7.1 Introduction to 2.5D Packaging

3.7.2 Application of 2.5D Packaging

3.7.3 Market Size of 2.5D Interposer

3.7.4 Suppliers of 2.5D Packaging

3.8 TSV (3D) Packaging

3.8.1 TSV Packaging Equipment

3.9 FC-PoP Packaging

3.10 IC Substrate Industry

4. IC Substrate Vendors

4.1 Unimicron

4.2 IBIDEN

4.3 Daeduck Electronics

4.4 SIMMTECH

4.5 LG INNOTEK

4.6 SEMCO

4.7 Nan Ya PCB

4.8 KINSUS

4.9 SHINKO

4.10 KYOCERA SLC

4.11 AT&S

4.12 ACCESS

4.13 EASTERN

5. IC Substrate Packaging Companies

5.1 ASE

5.2 AMKOR

5.3 SPIL

5.4 STATS ChipPAC

5.5 Mitsubishi Gas Chemical Company

5.6 AJINOMOTO

Global Semiconductor Market Size, 1994-2019E

Global Semiconductor Market Growth Rate, 2015

Downstream Application of Global Semiconductor Market, 1998-2019E

Geographical Distribution of Global Semiconductor Market, 2009-2019E

Capital of Global Semiconductor Enterprises, 2000-2019E

Geographical Distribution of Global Semiconductor Equipment Market, 2012-2016E

Wafer Process Equipment Sales by Product, 2010-2019E

Top 30 of Global Semiconductor Industry by Revenue, 2014

IC Packaging Types Used by Major Electronic Products

Global IC Packaging and Testing Market Size, 2012-2017E

Global Outsourcing IC Packaging and Testing Market Size, 2012-2017E

Global IC Packaging Market Size, 2012-2017E

Global IC Testing Market Size, 2012-2017E

Revenue of Taiwan Packaging and Testing Industry, 2009-2013

Revenue of Top 10 Global Packaging Enterprises, 2013

Global Mobile Phone Shipments, 2007-2015E

Geographical Distribution of Global 3G/4G Mobile Phone Shipments, 2011-2014

Worldwide Mobile Phone Sales to End Users by Vendor in 2013

Shipments of Top 10 Global Mobile Phone Vendors, Q3 2014

Worldwide Smartphone Sales to End Users by Vendor in 2013

Worldwide Smartphone Sales to End Users by Operating System in 2013

Shipments of Top 13 Global Smartphone Vendors, 2013-2015E

Shipments of Major Smartphone Vendors, Q3 2014

Monthly Shipments of China Mobile Phone Market, 2013-2014

Market Share of Major Vendors in China Smartphone Market, 2014

Market Share of Major Vendors in China 4G Mobile Phone Market, 2014

Global Tablet PC Shipments, 2011-2016E

Top Five Tablet Vendors, Shipments Fourth Quarter 2014

Top Five Tablet Vendors, Shipments, Market Share, and Growth, Calendar Year 2014

CPU and GPU Shipments, 2008-2015E

Laptop Computer Shipments, 2008-2015E

Shipments of Major Global Laptop ODM Vendors, 2010-2014

Memory Market Size, 2012-2016E

IC Substrate Market Size, 2009-2016E

IC Substrate Market Size by Technology, 2009-2016E

Specific Application Products of IC Substrate

Mobile DRAM Trend

Advantages of WIDE IO

SK Hynix WIDE IO2 Roadmap

HMC Architecture

HMC BENEFITS

Advantages of Embedded Passive and Active Component Motherboard

Embedded Component Substrate Process

Comparison of Embedded Active & Passive Components

Roadmap of Embedded Passive Substrate

Structure Roadmap of Embedded Active Substrate

FOWLP and PLP Process Comparison

WHY EMBEDDED TRACE?

EMBEDDED TRACE Package Features

EMBEDDED TRACE Package Sweet Spot (for Wire Bonding)

EMBEDDED TRACE Package Sweet Spot (for FLIP CHIP)

Apple iPad 4 LTE A1459 IC Package Type List

Development Trend of PoP Packaging

2.5D Interposer Manffacturing Revenue

Breakdown by Interposer Bulk Material, 2010-2017

Downstream Application of TSV

TSV Equipment Suppliers

Distribution of TSV Packaging Equipment, 2012-2017E

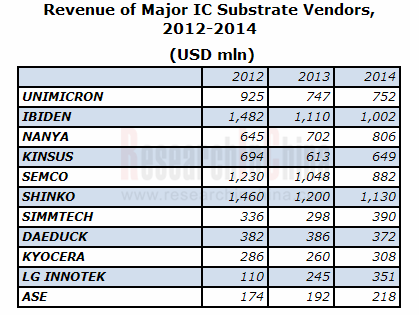

Revenue of Major IC Substrate Vendors, 2010-2014

Unimicron’s Organizational Structure

Unimicron’s Revenue and Gross Margin, 2003-2014

Unimicron’s Revenue and Operating Margin, 2009-2014

Unimicron’s Revenue and Gross Margin, Q1 2012-Q4 2014

Unimicron’s Sales Breakdown by Technology, 2010-2014

Unimicron’s Sales Breakdown by Application, 2010-2014

Unimicron’s Capacity, 2010-2014

Unimicron’s CAPEX, 2004-2013

Unimicron’s M & A

IBIDEN’s Revenue and Operating Margin, FY2006-FY2015

IBIDEN’s Revenue Breakdown by Business, FY2006-FY2015

IBIDEN’s Revenue Breakdown by Business, Q2 2012-Q2 2014

IBIDEN’s Operating Income by Business, Q2 2012-Q2 2014

Ibiden Electronics’ Revenue Breakdown by Product, FY2010-FY2015

IBIDEN’s CAPEX and Depreciation, FY2010-FY2015

Daeduck Electronics’ Revenue and Operating Margin, 2005-2014

Daeduck Electronics’ Revenue by Business, 2009-2014

Daeduck GDS’ Revenue and Operating Margin, 2005-2014

Daeduck GDS’ Revenue Breakdown by Business, 2010-2014

SIMMTECH’s Organizational Structure

SIMMTECH’s Revenue and Operating Margin, 2004-2014

SIMMTECH’s Revenue, Gross Margin and Net Profit Margin, 2009-2014

SIMMTECH’s Balance Sheet, 2009-2013

SIMMTECH’s Revenue Breakdown by Product, 2013-2015

SIMMTECH’s Gross Margin and Operating Margin, Q1 2013-Q4 2014

SIMMTECH’s Shipments, Q1 2013-Q4 2014

SIMMTECH’s Shipments, 2012-2015E

SIMMTECH’s Capacity Utilization, Q1 2013-Q4 2014

SIMMTECH’s Capacity Utilization, 2012-2015E

SIMMTECH’s Revenue by Application, 2008-2014

SIMMTECH’s Substrate Revenue by Application, 2012-2014

SIMMTECH’s Plants

LG INNOTEK’s Revenue and Operating Margin, 2006-2015E

LG INNOTEK’s Revenue and Operating Margin, Q1 2012-Q4 2014

LG INNOTEK’s Revenue Breakdown by Business, 2011-2015E

LG INNOTEK’s Operating Income by Business, 2011-2015E

SEMCO’s Revenue and Operating Margin, 2009-2014

SEMCO’s Revenue Breakdown by Department, 2010-2014

Revenue and Operating Margin of SEMCO’s ACI Segment, Q1 2013-Q4 2014

SEMCO’s HDI and PKG Revenue, Q1-Q4 2014

Nan Ya PCB’s Organizational Structure

Nan Ya PCB’s Revenue and Gross Margin, 2006-2014

Nan Ya PCB’s Revenue and Operating Margin, 2009-2015E

Nan Ya PCB’s Revenue and Growth Rate, Jan 2013-Jan 2015

Nan Ya PCB’s Capacity and Global Distribution

KINSUS’ Revenue and Gross Margin, 2004-2014

KINSUS’ Revenue and Operating Margin, 2009-2015E

KINSUS’ Revenue and Growth Rate, Jan 2013-Jan 2015

KINSUS’ Revenue Breakdown by Product, 2011-2014

KINSUS’ Revenue Breakdown by Application, 2011

KINSUS’ Revenue by Application, Q1 2014

KINSUS’ Revenue by Application, Q4 2014

Customer Distribution of KINSUS, 2013\2014

SHINKO’s Revenue and Net Income, FY2007-FY2015

SHINKO’s Revenue Breakdown by Business, FY2010-FY2015

AT&S and EBITDA Margin, FY2005-FY2015

Chongqing Substrate Plant Ramp of AT&S

AT&S’ Revenue Breakdown by Business/Region, FY2014

AT&S’ Revenue Breakdown by Business/Region, FY2015

Revenue of AT&S’ Mobile Devices & Substrates Business, Q2/13-Q4/14

Main Customers of AT&S’ Mobile Devices & Substrates Business

Revenue of AT&S’ Industrial & Automotive Business, Q2/13-Q4/14

Main Customers of AT&S’ Industrial & Automotive Business

AT&S’ Employees, 2010-2015

AT&S’ CAPEX, 2010-2015E

Financial Data of ACCESS, 2012-2013

Major Clients of ACCESS, 2011-2013

Revenue of Packaging Substrate of ACCESS, 2011-2013

Major Equipment of ACCESS

ASE’s Organizational Structure

ASE’s Revenue and Gross Margin, 2005-2015E

ASE’s Revenue and Operating Margin, 2009-2015E

ASE’s Revenue, Jan 2013-Jan 2015

ASE’s Revenue Breakdown by Business, 2010-2014

Revenue and Gross Margin of ASE’s Packaging Division, Q1 2013-Q4 2014

Revenue Breakdown of ASE’s Packaging Division by Type, Q1 2013-Q4 2014

Revenue and Gross Margin of ASE’s Materials Division, Q1 2013-Q4 2014

Revenue Breakdown of ASE’s IC Business by Application, Q1 2013-Q4 2014

ASE’s EMS Revenue and Gross Margin, Q1 2013-Q4 2014

ASE’s EMS Revenue Breakdown, Q1 2013-Q4 2014

Amkor’s Revenue, Gross Margin and Operating Margin, 2005-2014

Amkor’s Revenue Breakdown by Packaging Type, 2007-2014

Amkor’s Packaged Units, 2012-2014

Amkor’s Revenue Breakdown by Application, 2012-2014

SPIL’s Organizational Structure

SPIL’s Revenue, Gross Margin and Operating Margin, 2003-2014

SPIL’s Revenue, Jan 2013-Jan 2015

SPIL’s Revenue, Gross Margin and Operating Margin, Q4 2012-Q4 2014

SPIL’s Revenue Breakdown by Region, 2005-2014

SPIL’s Revenue Breakdown by Application, 2005-2014

SPIL’s Revenue Breakdown by Business, 2005-2014

SPIL’s Capacity, 2006-2014

STATS ChipPAC’s Revenue and Gross Margin, 2004-2014

STATS ChipPAC’s Balance Sheet, 2014

STATS ChipPAC’s Revenue Breakdown by Packaging Type, 2006-2013

STATS ChipPAC’s Revenue Breakdown by Application, 2006-2013

STATS ChipPAC’s Revenue Breakdown by Region, 2006-2013

Global Distribution of STATS ChipPAC

STATS ChipPAC’s Revenue Breakdown by Region/Business, 2014

Mitsubishi Gas Chemical’s Organization Chart

MGC’s Revenue and Operating Income, FY2009-FY2015

MGC’s Revenue by Segment, FY2009-FY2015

MGC’s Operating Income by Segment, FY2009-FY2015

CAPEX and Depreciation of MGC’s Information and Advanced Material Division, FY2009-FY2015

ABF Application

ABF Manufacturing Process

ABF Construction

Outline of Manufacturing Substrate Using ABF

Next Build-up Material in Demand

Global and China CMOS Camera Module (CCM) Industry Report, 2020-2026

The global CCM market has been ballooning thanks to expeditious penetration of multi-camera phones and advances in automotive ADAS, being worth $22.723 billion with a year-on-year spike of 16.6% in 20...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2020-2025

Electronic components like MLCC enjoy a rosy prospect alongside the burgeoning electronic manufacturing, the thriving internet and the prevalence of smart hardware.

MLCC was much sought after and it...

Global and China Voice Coil Motor (VCM) Industry Report, 2019-2025

VCM (voice circle motor or voice coil actuator), a part for smartphone camera, shares around 6% of smartphone camera industry chain value.

Globally, popularity of smartphones such as those with mult...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2019-2025

Chinese aluminum electrolytic capacitor market has been expanding amid a transfer of its downstream industries to China like home appliance illumination, cellphones and computers as well as automatic ...

Global and China Flexible Printed Circuit (FPC) Industry Report, 2019-2025

Flexible printed circuit (FPC) products make their way into consumer electronics like smartphone and tablet PC, in the form of modules for display, touch control, fingerprint recognition, etc. The vol...

Global and China GaAs Industry Report, 2019-2025

Gallium arsenide (GaAs), one of the most mature compound semiconductors, is an integral part of smartphone power amplifier (PA). In 2018, GaAs-based radio frequency (RF) seized over half of the GaAs w...

Global and China Advanced Packaging Industry Report, 2019-2025

The global semiconductor packaging and testing market is enlarging with the prevalence of consumer electronics, automotive semiconductors and the Internet of Things (IoT), with its size edging up 2.5%...

Global and China MLCC Electronic Ceramics Industry Report, 2019-2025

MLCC is mainly used in audio and video equipment, mobile phones, computers and automobiles. The prospective boom of MLCC formula powder hinges on demand: 1) The accelerated renewal of consumer electro...

Global and China OLED Industry Report, 2019-2025

OLED, a new-generation display technology, features simple display structure, green consumables and flexibility and can be rolled up, which makes it easier to transport and install without considering...

Global and China Camera Module Industry Report, 2019-2025

Affected by factors like the maturity of mobile phone markets worldwide and the prolonged replacement of mobile phone by users, the mobile phone market has undergone a slowdown in growth rate. From Q4...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2018-2023

MLCC finds most application in consumer electronics, automobile and industrial fields and gets beefed up remarkably with the approaching 5G era of cellphones and tablet PCs, the advances in automotive...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2018-2023

Aluminum electrolytic capacitor, a core electronic component, is widely used in consumer electronics, computers and peripherals, industry, electric power, lighting and automobiles.

Global aluminum e...

Global and China CMOS Camera System Industry Report, 2017-2021

Global CCM (CMOS Camera Module) market was worth USD16.611 billion in 2015, a year-on-year rise of 3.8% from 2014, the slowest rate since 2010. Global market fell modestly in 2016 due to a drop in shi...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2017-2021

Global OLED market size approximated USD15.7 billion in 2016, a 20.8% rise from a year earlier. Stimulated by reports that Apple will adopt OLED screen for multiple iPhone models in 2017-2018, OLED sc...

Global and China CMOS Camera System Industry Report, 2016-2020

Global and China CMOS Camera System Industry Report, 2016-2020 covers the following:1. Analysis of CMOS Image Sensor (CIS) Industry and Market, with 7 vendors involved.2. Analysis of CMOS Camera Lens ...

Global and China Multi-layer Ceramic Capacitor (MLCC) Industry Report, 2017-2020

The rapid development of consumer electronics and industrial intelligentization has greatly promoted the booming of passive components including multi-layer ceramic capacitor (MLCC). In 2015, China’s ...

Global PCB Industry Report, 2015-2020

Global PCB Industry Report, 2015-2020 highlights the followings:1. Global PCB Market and Status Quo of the Industry2. Global Downstream Markets of PCB3. Mobile Phone PCB Trends4. Tablet PC/Laptop Comp...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2016-2020

The OLED market has been developing rapidly worldwide over the recent years, and its market size reached USD13 billion in 2015. With technology and capacity construction, OLED (from small-sized panels...