Global and China Low and Medium-voltage Inverter Industry Report, 2013-2016

-

June 2014

- Hard Copy

- USD

$2,400

-

- Pages:99

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

LT018

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,400

-

- Hard Copy + Single User License

- USD

$2,600

-

In 2013, the rising demand from China's industrial control industry helped drive the recovery of low and medium-voltage inverter market, with the market size of low and medium-voltage inverters in China for the year hitting about RMB22.57 billion, up 5.2% from a year earlier.

In terms of market structure, the market was dominated by low-voltage inverters, while medium-voltage inverters, due to limited application, occupied a far smaller market share than low-voltage inverters. However, China witnessed a rise in the proportion of medium-voltage inverters in the low and medium-voltage inverter market, from 8.7% in 2006 to roughly 15.8% in 2013, hence with broad development prospects.

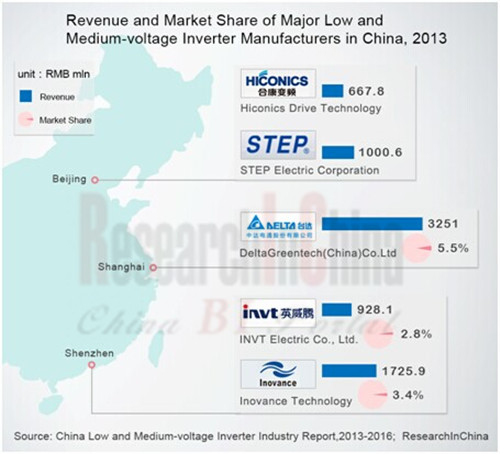

In the field of low and medium-voltage products, the Chinese enterprises mainly produce V/F control products. As for the products such as vector inverter with superior performance and high technical content, the overwhelming majority of Chinese enterprises still not have developed mature products. Currently, the major local players in Chinese low and medium-voltage inverter market are comprised of INVT, Inovance Technology, STEP Electric, Hiconics Drive Technology and EURA DRIVES, etc. In 2013, Inovance Technology occupied a 3.4% market share, making it the manufacturer with the biggest market share in China.

At present, the market share of foreign manufacturers in the Chinese low and medium-voltage inverter market exceeds 70%. In 2013, the top 5 low and medium-voltage inverter manufacturers by market share were all foreign companies, namely ABB, Siemens, Yaskawa, Delta Electronics and Schneider Electric, of which the market share of ABB and Siemens were 16.6% and 15.4%, respectively.

Hoisting machinery and elevators are the major two industries in which the Chinese low and medium-voltage inverters are widely used. And in 2013, the market size of the low and medium-voltage inverters for hoisting machinery and elevators in China reached approximately RMB3.24 billion and RMB2.12 billion, respectively. Market concentration rate of low and medium-voltage inverters for elevators was relatively higher in China, and the top 3 suppliers in terms of market share in 2013 were Inovance Technology, Emerson and Yaskawa. In addition, Fuji Electric and Schneider Electric also held a certain market share.

?

Energy conservation and environmental protection are the driving force to promote the development of China's low and medium-voltage inverter industry. Frequency conversion technology is in the process of transforming from speed governing to energy conservation. In future, most low and medium-voltage inverters will be replaced by those that have conducted automated transformation or the imported ones, and Chinese enterprises will focus on the development of control and drive technologies. It is predicted that during 2014-2016 the Chinese low and medium-voltage inverter market will keep an AAGR of around 9%, and the market size is expected to reach approximately RMB30 billion by 2016.

China Low and Medium-voltage Inverter Industry Report, 2013-2016, released by ResearchInChina, mainly focuses on the followings:

Development environment of low and medium-voltage inverters in China (including industry, policy and technology environment), etc.;

Development environment of low and medium-voltage inverters in China (including industry, policy and technology environment), etc.;

The market size of low and medium-voltage inverters in China as well as prediction, competition pattern and supply and demand analysis in the coming 3 years;

The market size of low and medium-voltage inverters in China as well as prediction, competition pattern and supply and demand analysis in the coming 3 years;

The application and market analysis of China’s low and medium-voltage inverters in the downstream sectors, including hoisting machinery, elevator, machine tool industries;

The application and market analysis of China’s low and medium-voltage inverters in the downstream sectors, including hoisting machinery, elevator, machine tool industries;

Operation of 16 key low and medium-voltage inverter manufacturers in China (including ABB, Siemens, Schneider Electric, INVT as well as Inovance Technology) and analysis on their low and medium-voltage inverter business.

Operation of 16 key low and medium-voltage inverter manufacturers in China (including ABB, Siemens, Schneider Electric, INVT as well as Inovance Technology) and analysis on their low and medium-voltage inverter business.

1. Profile of Low and Medium-voltage Inverters

1.1 Definition & Classification

1.2 Product Features

1.3 Upstream and Downstream Industry Chain

2. Development Environment of Low and Medium-voltage Inverters in China

2.1 Industry Environment

2.2 Policy Environment

2.3 Technological Environment

3. Low and Medium-voltage Inverter Market in China

3.1 Market Size

3.2 Market Supply

3.2.1 Supply of Raw Materials

3.2.2 Supply by Enterprise

3.2 Market Demand

4. Competition Pattern of Low and Medium-voltage Inverters in China

4.1 Brand Competition

4.2 Channel Competition

5. Application of Low and Medium-voltage Inverters in China

5.1 Overview of Application Industry

5.2 Inverters for Hoisting Machinery

5.3 Inverters for Elevators

5.4 Inverters for Machine Tools

5.5 Inverters for Rail Transit

5.6 Inverters for Household Appliances

5.6.1 Inverter Air Conditioners

5.6.2 Inverter Washing Machines

5.6.3 Inverter Refrigerators

6. Key Manufacturers of Low and Medium-voltage Inverter in China

6.1 INVT

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 Customers and Suppliers

6.1.6 R&D and Investment

6.1.7 Low and Medium-voltage Inverter Business

6.1.8 Development Prospects

6.2 Inovance Technology

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 Customers and Suppliers

6.2.6 R&D

6.2.7 Low-voltage Inverter Business

6.2.8 Development Prospects

6.3 STEP Electric Corporation

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Gross Margin

6.3.5 Customers and Suppliers

6.3.6 Investment

6.3.7 Elevator Inverter Business

6.3.8 Development Prospects

6.4 Hiconics Drive Technology

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Gross Margin

6.4.5 Customers and Suppliers

6.4.6 R&D and Investment

6.4.7 Low and Medium-voltage Inverter Business

6.4.8 Development Prospects

6.5 EURA DRIVES

6.5.1 Profile

6.5.2 Operation

6.6 Slanvert

6.6.1 Profile

6.6.2 Operation

6.7 Siemens China

6.7.1 Profile

6.7.2 Inverter Business

6.7.3 Siemens Electrical Drives Ltd. (SEDL)

6.7.4 Siemens Electrical Drives (Shanghai) Ltd. (SEDS)

6.7.5 Development Prospects

6.8 ABB China Ltd.

6.8.1 Profile

6.8.2 Inverter Business

6.8.3 ABB Beijing Drive Systems Co, Ltd.

6.9 Yaskawa Electric (China) Co., Ltd.

6.9.1 Profile

6.9.2 Low and Medium-voltage Inverter Business

6.9.3 Development Prospects

6.10 Fuji Electric (China) Co., Ltd.

6.10.1 Profile

6.10.2 Inverter Business

6.10.3 Investment

6.11 Schneider Electric (China) Co., Ltd.

6.11.1 Profile

6.11.2 Inverter Business

6.11.3 Schneider (Suzhou) Drives. Co., Ltd.

6.12 Delta Electronics

6.12.1 Profile

6.12.2 Inverter Business

6.12.3 Delta Greentech (China) Co., Ltd.

6.13 Mitsubishi Electric (China) Co., Ltd.

6.13.1 Profile

6.13.2 Inverter Business

6.13.3 Mitsubishi Electric Dalian Industrial Products Co., Ltd.

6.14 Emerson in China

6.14.1 Profile

6.14.2 Emerson Network Power China

6.15 Danfoss China

6.15.1 Profile

6.15.2 Zhejiang Holip Electronic Technology Co., Ltd.

6.16 Rockwell Automation (China)

6.16.1 Profile

6.16.2 Inverter Business

7. Summary and Forecast

7.1 Summary

7.2 Forecast

Comparison: Three Ways of Energy Conservation for Electric Motors

Electric Power Installed Capacity and Newly Added Installed Capacity in China, 2005-2013

Inverter Rate of Newly Added Electric Motors in China, 2006-2012

Policies on Inverters in China, 2004-2013

Comparison: Features for the Three Control Modes of Inverters

Market Size of Low and Medium-voltage Inverters in China, 2006-2013

Cost Structure of Low and Medium-voltage Inverters in China, 2013

Market Size of IGBT for Low and Medium-voltage Inverters in China, 2006-2013

Comparison: Strengths of Manufacturers of Low and Medium-voltage Inverters in China

Regional Distribution of Low and Medium-voltage Inverters in China, 2013

Proportion of Demand for Low and Medium-voltage Inverters by Load in China, 2012

Market Share of Major Manufacturers of Low and Medium-voltage Inverters in China, 2013

Classification of Domestic Manufacturers of Low and Medium-voltage Inverters in China

Revenue of Major Chinese Enterprises from Low and Medium-voltage Inverters, 2010-2012

Distribution Channels and Proportions of Low and Medium-voltage Inverters in China, 2009-2013

Product Channel Distribution of Low and Medium-voltage Inverters in China by Power Band, 2013

Market Share of Low and Medium-voltage Inverters in China by Sector, 2013

Market Size of Inverters for Hoisting Machinery in China, 2009-2016E

Demand and Market Size of Inverters for Elevators in China, 2006-2015E

Market Share of Inverters for Elevators in China by Power Band, 2013

Major Manufacturers of Inverters for Elevators in China

Market Share of Major Manufacturers of Inverters for Elevators in China, 2013

Market Size of Inverters for Machine Tools in China, 2009-2015E

Market Share of Inverters for Machine Tools in China by Power Band, 2013

Market Share of Major Manufacturers of Inverters for Machine Tools in China, 2013

Market Demand and Size of Inverters for Rail Transit in China, 2009-2015E

Market Share of Inverters for Rail Transit in China by Enterprise, 2011

Market Share of Inverter Air Conditioners in Chinese Retail Market by Retail Sales, 2008-2012

Shipment of Inverter Air Conditioners in China, 2008-2015E

Shipment of Inverters for Air Conditioners in China, 2009-2015E

Proportion of Major Inverter Air Conditioners Manufacturers in China by Sales Volume, 2013

Three Channels for Supplying Inverters for Air Conditioners and the Representative Enterprises

Market Share of Retailed Inverter Washing Machines in China by Retail Sales 2007-2012

Market Share of Inverter Refrigerators Sold in the Chinese Cities, 2011-2012

Revenue and Net Income of INVT, 2006-2014

Revenue Structure of INVT by Product, 2006-2013

Revenue Structure of INVT by Region, 2007-2012

Gross Margin of INVT by Product, 2006-2012

INVT’s Total Procurement from Top 5 Suppliers and Shares and Its Procurement from the Ranking No.1 Supplier and Shares, 2011-2013

R&D Costs and % in Revenue of INVT, 2008-2012

Investment Projects of INVT by the End of 2013

Revenue and Net Income of INVT’s Subsidiaries Producing Inverters, 2013

Capacity of Inverters of INVT by Product, 2006-2012

Revenue of INVT from Inverters and Servo Products, 2013-2016E

Revenue and Net Income of Inovance Technology, 2007-2014

Revenue of Inovance Technology by Product, 2007-2013

Revenue Structure of Inovance Technology by Region, 2007-2013

Gross Margin of Inovance Technology by Product, 2007-2013

Inovance Technology’s Total Procurement from Top 5 Suppliers and Shares and Its Procurement from the Ranking No.1 Supplier and Shares, 2011-2013

Inovance Technology’s Total Revenue from Top 5 Customers and Shares and Its Revenue from the Ranking No.1 Customer and Shares, 2011-2013

R&D Costs and % in Total Revenue of Inovance Technology, 2008-2013

Revenue and YoY Growth of Inovance Technology from Low-voltage Inverters, 2007-2015E

Gross Margin of Inovance Technology from Low-voltage Inverters, 2007-2015E

Revenue, Net Income and YoY Growth Rates of Inovance Technology, 2010-2016E

Revenue and Net Income of STEP Electric, 2007-2014

Revenue of STEP Electric by Product, 2007-2012

Revenue Structure of STEP Electric by Product, 2013

Revenue of STEP Electric by Region, 2007-2013

Gross Margin of STEP Electric by Product, 2007-2013

STEP Electric’s Total Procurement from Top 5 Suppliers and Shares and Its Procurment from the Ranking No.1 Supplier and Shares, 2010-2011

STEP Electric’s Total Revenue from Top 5 Customers and Shares and Its Revenue from the Ranking No.1 Customer and Shares, 2011-2012

Investment Construction Projects of STEP Electric, by Dec 2013

Revenue and Gross Margin of STEP Electric’s Elevator Inverter Series, 2009-2013

Revenue, Net Income and YoY Growth Rates of STEP Electric, 2011-2016E

Revenue and Net Income of Hiconics Drive Technology, 2006-2014

Revenue Structure of Hiconics Drive Technology by Product, 2006-2013

Revenue Structue of Hiconics Drive Technology by Region, 2006-2013

Gross Margin of Hiconics Drive Technology by Product, 2009-2013

Hiconics Drive Technology’s Total Procurement from Top 5 Suppliers and Shares, 2011-2012

Hiconics Drive Technology’s Total Revenue from Top 5 Customers and Shares and Its Revenue from the Ranking No.1 Customer and Shares, 2011-2012

R&D Costs and % in Revenue of Hiconics Drive Technology, 2008-2013

Investment Construction Projects of Hiconics Drive Technology, by the End of 2013

Key Types and Characteristics of Low and Medium-voltage Inverters of Hiconics Drive Technology, 2013

Revenue, Net Income and YoY Growth Rates, 2010-2016E

Revenue and Growth Rate of EURA DRIVES, 2004-2012

Operating Income and Growth Rate of EURA DRIVES, 2004-2010

Low and Medium-voltage Inverters and Application Scope of Slanvert, 2013

Revenue and Total Profit of Slanvert, 2004-2009

Low and Medium-voltage Inverter Product Series of Siemens, 2013

Key Economic Indicators of SEDL, 2004-2008

Key Economic Indicators of SEDS, 2004-2009

Types and Features of Low and Medium-voltage Inverter Products of ABB

Revenue and Total Profit of ABB Beijing Drive Systems Co., 2004-2009

Low and Medium-voltage Inverter Products of Yaskawa Electric

Inverters Producing and Selling Enterprises of Fuji Electric in China, 2013

Low and Medium-voltage Inverter Products of Fuji Electric (China)

Inverter Products of Schneider Electric and Their Application Fields

Revenue and Total Profit of Schneider (Suzhou) Drives Co., Ltd., 2004-2009

Inverter Products of Delta Electronics and Their Application Fields

Revenue of Delta Greentech (China), 2004-2013

Total Profit of Delta Greentech (China), 2004-2009

Product Category and Power Range of Low and Medium-voltage Inverters of Mitsubishi Electric

Inverter Manufacturers of Mitsubishi Electric in China

Revenue of Mitsubishi Electric Dalian Industrial Products Co., Ltd., 2004-2010

Low and Medium-voltage Inverter Product Series of Emerson

Revenue and YoY Growth of Emerson Network Power China, FY 2007-2012

Low and Medium-voltage Inverter Product Series of Holip Electronic

Low and Medium-voltage Inverter Product Series of Rockwell Automation

Gross Margin of Major Chinese Low and Medium-voltage Inverter Manufacturers, 2009-2013

Market Size of Low and Medium-voltage Inverters in China, 2006-2016E

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...