China Aquaculture Industry Report, 2015-2018

-

Oct.2015

- Hard Copy

- USD

$2,700

-

- Pages:140

- Single User License

(PDF Unprintable)

- USD

$2,550

-

- Code:

ZLC025

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,900

-

With the improvement of cultivation technology and the steady growth in per-capita consumption of aquatic products, both the output value of Chinese fishery industry and the output of aquatic products keep growing year after year. In 2014, the gross output value of China’s fishing industry amounted to RMB2.0859 trillion, and the added value was up to RMB971.8 billion; the national output of aquatic products totaled 64.615 million tons, a rise of 4.7% from a year earlier, of which the output of aquaculture reported 47.484 million tons, up 4.6% year on year.

Freshwater culture is the main part of aquaculture in China, with its output holding more than 60%. In 2014, the freshwater cultured output reached 29,357.6 kt, accounting for 61.8%; and mariculture output hit 18,126.5 kt, occupying 38.2%. In freshwater aquiculture, fishes are the primary varieties, making up about 88% of total output of freshwater culture; while in mariculture, the shellfishes see the highest output, an above-70% share of total output of seaculture.

The regions like Guangdong, Shandong, Fujian, Jiangsu and Hubei are the key aquaculture provinces in China, with their total output sweeping over 50% of national output. Elaborately, Guangdong is the largest province in terms of aquaculture, with equal output of freshwater culture to that of mariculture; Fujian and Shandong give priority to seaculture; while Jiangsu and Hubei are mainly involved in freshwater breeding.

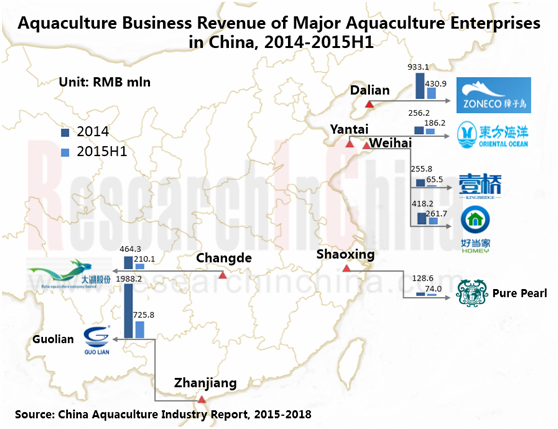

Chinese aquaculture industry is composed of individual farmers, cooperatives and enterprises, among which aquaculture enterprises are in the advantageous position in competition, but with inadequate power of exerting influence on the market. Chinese aquaculture companies consist mainly of ZONECO Group, Zhanjiang Guolian Aquatic Products Co., Ltd, Dalian Yi Qiao Sea Cucumber Co., Ltd, Shandong Oriental Ocean Sci-Tech Co., Ltd., Shandong Homey Aquatic Development Co., Ltd., Pure Pearl Group Co., Ltd and Dahu Aquaculture Company Limited. In 2014, the total aquaculture output of ZONECO Group, Zhanjiang Guolian Aquatic Products Co., Ltd and Dalian Yi Qiao Sea Cucumber Co., Ltd was merely 82.65 kt, just making up 0.174%.

Zhanjiang Guolian Aquatic Products Co., Ltd is China’s state-level penaeusvannamei genetics & breeding center, with the revenue from aquaculture business in 2014 reaching RMB1.988 billion with a share of 0.23% in Chinese aquaculture market. The company is now endeavoring to transfer to be a global aquatic marketing platform and aquatic food maker; also, it strengthens the domestic market construction and brand promotion.

ZONECO Group is primarily focused on seaculture business, boasting the largest clear seawaters in China. In 2014, the aquaculture output of the company was up to 53.43 kt, sharing 0.113% of national total output in the same period. In August 2015, the company publicized the preplan of non-public offering of shares and planned to raise RMB1.45 billion for fingerling platform construction project, O2O new business model construction project and otherwise, in a bid to accelerate its transition towards a food enterprise.

Dahu Aquaculture Company Limited is the largest freshwater fish base and in possession of about 1.8 million mu (1mu=1/15 hec.) of water area in China, making up 4.9% of the area of reservoirs and lakes with aquaculture across the country. It has been focusing on the construction of its marketing network and comprehensive industrial chain by means of acquisitions and capital increase over the recent two years.

China Aquaculture Industry Report, 2015-2018 highlights the following:

Development environment of China aquaculture industry report, involving industrial policy, residents’ consumption, the development of upstream and downstream sectors, etc.;

Development environment of China aquaculture industry report, involving industrial policy, residents’ consumption, the development of upstream and downstream sectors, etc.;

Development overview of China aquaculture industry, including status quo, mariculture, freshwater aquaculture, aquatic fingerlings, import & export, competitive landscape, prediction and outlook, etc.;

Development overview of China aquaculture industry, including status quo, mariculture, freshwater aquaculture, aquatic fingerlings, import & export, competitive landscape, prediction and outlook, etc.;

Development overview of key aquaculture regions (like Guangdong, Shandong, Fujian, Jiangsu and Hubei) in China, and the development of medium- and high-end aquatic products (such as abalone, sea cucumber, prawn, tilapia);

Development overview of key aquaculture regions (like Guangdong, Shandong, Fujian, Jiangsu and Hubei) in China, and the development of medium- and high-end aquatic products (such as abalone, sea cucumber, prawn, tilapia);

Operation, developments and so forth of 15 Chinese aquaculture companies.

Operation, developments and so forth of 15 Chinese aquaculture companies.

1. Overview of Aquaculture Industry

1.1 Basic Concepts

1.2 Product Types

1.2.1 Regular Aquatic Products

1.2.2 Famous Products

1.2.3 Superior Products for Export

2 Development Environments of China Aquaculture Industry

2.1 Policies

2.2 Consumption of Residents

2.3 Upstream and Downstream

2.3.1 Upstream

2.3.2 Downstream

3 Development of China Aquaculture Industry

3.1 Status Quo

3.2 Mariculture

3.2.1 Overview

3.2.2 Regional Structure

3.2.3 Product Structure

3.2.4 Breeding Mode

3.3 Freshwater Aquaculture

3.3.1 Overview

3.3.2 Regional Structure

3.3.3 Product Structure

3.3.4 Breeding Mode

3.4 Aquatic Fingerlings

3.5 Import and Export

3.6 Competition Pattern

3.7 Anticipation and Prospect

3.7.1 Aquaculture

3.7.2 Consumption of Aquatic Products

4 Main Aquaculture Regions in China

4.1 Fujian

4.1.1 Overview

4.1.2 Aquaculture

4.2 Jiangsu

4.2.1 Overview

4.2.2 Aquaculture

4.3 Shandong

4.3.1 Overview

4.3.2 Aquaculture

4.4 Liaoning

4.4.1 Overview

4.4.2 Aquaculture

4.5 Guangdong

4.5.1 Overview

4.5.2 Aquaculture

4.6 Zhejiang

4.6.1 Overview

4.6.2 Aquaculture

4.7 Hubei

4.7.1 Overview

4.7.2 Aquaculture

4.8 Hunan

4.8.1 Overview

4.8.2 Aquaculture

5 Development of Medium and High-end Aquatic Products In China

5.1 Abalone

5.2 Sea Cucumber

5.3 Scallop

5.4 Urchin

5.5 Conch

5.6 Penaeus Vannamei

5.7 Tilapia

5.8 Pearl

6 Key Enterprises

6.1 Dalian Yi Qiao Sea Cucumber Co., Ltd.

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 Supply and Marketing

6.1.6 R & D and Investment

6.1.7 Anticipation and Prospect

6.2 Zhanjiang Guolian Aquatic Products Co., Ltd.

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 R & D and Investment

6.2.6 Production and Marketing

6.2.7 Anticipation and Prospect

6.3 ZONECO Group

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Gross Margin

6.3.5 R & D and Investment

6.3.6 Production and Marketing

6.3.7 Anticipation and Prospect

6.4 Shandong Oriental Ocean Sci-Tech Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Gross Margin

6.4.5 R & D and Investment

6.4.6 Anticipation and Prospect

6.5 Shandong Homey Aquatic Development Co., Ltd.

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 Gross Margin

6.5.5 R & D and Investment

6.5.6 Anticipation and Prospect

6.6 Pure Pearl Group Co., Ltd.

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Gross Margin

6.6.5 Investment

6.6.6 Anticipation and Prospect

6.7 Dahu Aquaculture Company Limited

6.7.1 Profile

6.7.2 Operation

6.7.3 Revenue Structure

6.7.4 Gross Margin

6.7.5 Investment

6.7.6 Anticipation and Prospect

6.8 Hubei Wuchangyu Co., Ltd.

6.8.1 Profile

6.8.2 Operation

6.8.3 Aquaculture Business

6.9 Guangdong Haid Group Co., Ltd.

6.9.1 Profile

6.9.2 Operation

6.9.3 Revenue Structure

6.9.4 Gross Margin

6.9.5 R & D and Investment

6.9.6 Production and Marketing

6.9.7 Anticipation and Prospect

6.10 Baiyang Aquatic Group, Inc.

6.10.1 Profile

6.10.2 Operation

6.10.3 Revenue Structure

6.10.4 Investment

6.10.5 Anticipation and Development

6.11 Ningbo Tech-Bank Co., Ltd.

6.11.1 Profile

6.11.2 Operation

6.11.3 Revenue Structure

6.11.4 Aquafeed Business

6.11.5 Anticipation and Development

6.12 Tongwei Group Co., Ltd.

6.12.1 Profile

6.12.2 Operation

6.12.3 Revenue Structure

6.12.4 Aquafeed Business

6.12.5 Anticipation and Prospect

6.13 Guangzhou LUXE Seafood ENT.Ltd.

6.13.1 Profile

6.13.2 Operation

6.13.3 Development Strategy

6.14 Xunshan Group

6.14.1 Profile

6.14.2 Operation

6.14.3 Development Strategy

6.14.4 R & D

6.15 Dalian RainLion Group

6.15.1 Profile

6.15.2 Operation

6.15.3 Development Strategy

Aquaculture Industry Chain

Policies about Aquaculture Industry in China

Per-capita Ownership of Aquatic Products in China, 2006-2014

Per-capita Full-year Purchased Volume of Aquatic Products by Urban and Rural Chinese, 2006-2014

China’s Aquafeed Output, 2006-2014

Output Value and Added Value of China Aquafeed Industry, 2006-2014

Output Value and Added Value of China Fishery Drug Industry, 2006-2014

Output Value and Added Value of China Aquatic Product Circulation Industry, 2006-2014

Output Value and Added Value of China Aquatic Product Warehouse and Transportation Industry, 2006-2014

Output Value and Added Value of China Aquatic Product Processing Industry, 2006-2014

China’s Processing Quantity of Aquatic Products and Capacity Utilization, 2006-2014

China's Fishery Output Value and Added Value, 2012- 2014

China's Aquaculture Output and Breeding Area, 2012- 2014

China's Mariculture Output Value and Added Value, 2006- 2014

China's Mariculture Output and Breeding Area, 2012- 2014

China's Mariculture Output Share (by Region), 2014

China's Mariculture Output (by Product), 2007- 2014

Output Share of China's Mariculture (by Product), 2007- 2014

China's Mariculture Area (by Product), 2012- 2014

China's Mariculture Area Structure (by Product), 2012- 2014

China's Mariculture Output (by Breeding Waters), 2007- 2014

China's Mariculture Output (by Breeding Mode), 2008- 2014

China's Freshwater Aquaculture Output Value and Added Value, 2006- 2014

China's Freshwater Aquaculture Output and Breeding Area, 2012- 2014

Output Share of China's Freshwater Aquaculture (by Region), 2014

China's Freshwater Aquaculture Output (by Product), 2007- 2014

Output Share of China's Freshwater Aquaculture (by Product), 2007- 2014

China's Freshwater Breeding Area (by Breeding Waters), 2012- 2014

China's Freshwater Breeding Area Structure (by Breeding Waters), 2012- 2014

China's Freshwater Aquaculture Output (by Breeding Waters), 2007- 2014

China's Freshwater Aquaculture Output (by Breeding Mode), 2007- 2014

Output Value and Added Value of Chinese Aquatic Fingerlings, 2006- 2014

Output of Chinese Seawater Fingerlings (by Product), 2008- 2014

Output of Chinese Freshwater Fingerlings (by Product), 2008- 2014

Import and Export Volume of Aquatic Products in China, 2006- 2015

Import and Export Value of Aquatic Products in China, 2006-2015

Average Import and Export Price of Aquatic Products in China, 2006-2014

Export Volume and Value of Main Aquatic Products in China, 2014

Major Export Destinations of Main Aquatic Products in China by Export Volume and Value, 2014

Major Exporting Provinces of Main Aquatic Products in China by Export Volume and Value, 2014

Aquatic Product Output and Share of Major Aquaculture Enterprises in China, 2013- 2014

Aquaculture Revenue and Market Share of Major Aquaculture Enterprises in China, 2014

China's Mariculture Output and Breeding Area, 2012-2018E

China's Freshwater Aquaculture Output and Breeding Area, 2012-2018E

Per Capita Ownership and Consumption of Aquatic Products in China, 2014-2018E

Fujian's Aquaculture Output (by Breeding Mode), 2008- 2014

Output Share of Fujian's Mariculture (by Breeding Mode), 2014

Output Share of Fujian's Freshwater Aquaculture (by Breeding Mode), 2014

Jiangsu's Aquaculture Output (by Breeding Mode), 2008- 2014

Output Share of Jiangsu's Mariculture (by Breeding Mode), 2014

Output Share of Jiangsu's Freshwater Aquaculture (by Breeding Mode), 2014

Shandong's Aquaculture Output (by Breeding Mode), 2008- 2014

Output Share of Shandong's Mariculture (by Breeding Mode), 2014

Output Share of Shandong's Freshwater Aquaculture (by Breeding Mode), 2014

Liaoning's Aquaculture Output (by Breeding Mode), 2008- 2014

Output Share of Liaoning's Mariculture (by Breeding Mode), 2014

Output Share of Liaoning's Freshwater Aquaculture (by Breeding Mode), 2014

Guangdong's Aquaculture Output (by Breeding Mode), 2008- 2014

Output Share of Guangdong's Mariculture (by Breeding Mode), 2014

Output Share of Guangdong's Freshwater Aquaculture (by Breeding Mode), 2014

Zhejiang's Aquaculture Output (by Breeding Mode), 2008- 2014

Output Share of Zhejiang's Mariculture (by Breeding Mode), 2014

Output Share of Zhejiang's Freshwater Aquaculture (by Breeding Mode), 2014

Hubei's Aquaculture Output, 2008- 2014

Output Share of Hubei's Freshwater Aquaculture (by Breeding Mode), 2014

Hunan's Aquaculture Output, 2008- 2014

Output Share of Hunan's Freshwater Aquaculture (by Breeding Mode), 2014

China's Cultured Abalone Output, 2006-2014

Abalone Price in Weihai Aquatic Product Wholesale Market, 2014-2015

China's Cultured Sea Cucumber Output, 2006-2014

Sea Cucumber Price in Weihai Aquatic Product Wholesale Market, 2014-2015

China's Cultured Scallop Output, 2006-2014

Scallop Price in Beijing Fengtai District Xinfadi Agricultural Product Wholesale Market, 2014-2015

China's Cultured Sea Urchin Output, 2006-2014

China's Cultured Conch Output, 2006-2014

China's Cultured Penaeus Vannamei Output, 2006-2014

Output Share of China's Cultured Penaeus Vannamei (by Breeding Mode), 2006-2014

China's cultured tilapia Output, 2006-2014

Tilapia Price in Beijing Fengtai District Xinfadi Agricultural Product Wholesale Market, 2014-2015

China's Cultured Pearl Output, 2006-2014

China's Freshwater Cultured Pearl Output, 2006-2014

Revenue and Net Income of Yi Qiao Sea Cucumber, 2010-2015

Revenue of Yi Qiao Sea Cucumber (by Business), 2010-2014

Revenue Structure of Yi Qiao Sea Cucumber (by Business), 2010-2014

Revenue of Yi Qiao Sea Cucumber (by Region), 2010-2014

Revenue Structure of Yi Qiao Sea Cucumber (by Region), 2010-2014

Gross Margin of Yi Qiao Sea Cucumber, 2010-2015

Gross Margin of Yi Qiao Sea Cucumber (by Product), 2010-2015

Gross Margin of Yi Qiao Sea Cucumber (by Region), 2010-2015

Procurement from Top 5 Suppliers and% of Total Procurement of Yi Qiao Sea Cucumber, 2012-2014

Revenue from Top 5 Clients and % of Total Revenue of Yi Qiao Sea Cucumber, 2012-2014

Output, Sales Volume and Inventory of Yi Qiao Sea Cucumber, 2013-2014

R & D Costs and % of Total Revenue of Yi Qiao Sea Cucumber, 2012-2014

Revenue and Net Income of Yi Qiao Sea Cucumber, 2014-2018E

Revenue and Net Income of Guolian Aquatic Products, 2010-2015

Revenue of Guolian Aquatic Products (by Product), 2010-2015

Revenue Structure of Guolian Aquatic Products (by Product), 2010-2015

Revenue of Guolian Aquatic Products (by Region), 2010-2014

Revenue Structure of Guolian Aquatic Products (by Region), 2010-2014

Gross Margin of Guolian Aquatic Products, 2010-2015

Gross Margin of Guolian Aquatic Products (by Product), 2010-2015

Gross Margin of Guolian Aquatic Products (by Region), 2013-2014

R & D Costs and % of Total Revenue Inventory of Guolian Aquatic Products, 2012-2014

Output, Sales Volume and Inventory of Guolian Aquatic Products, 2013- 2014

Revenue and Net Income Inventory of Guolian Aquatic Products, 2014-2018E

Revenue and Net Income of ZONECO Group, 2010-2015

Revenue of ZONECO Group (by Product), 2010-2015

Revenue Structure of ZONECO Group (by Product), 2010-2015

Revenue of ZONECO Group (by Region), 2010-2015

Revenue Structure of ZONECO Group (by Region), 2010-2015

Gross Margin of ZONECO Group, 2010-2015

R & D Costs and % of Total Revenue of ZONECO Group, 2011-2014

Investment Projects Funded by Non-public Offering Plan of ZONECO Group, 2015

Output, Sales Volume and Inventory of ZONECO Group, 2013-2014

Revenue and Net Income of ZONECO Group, 2014-2018E

Revenue and Net Income of Oriental Ocean Sci-Tech, 2010-2015

Revenue of Oriental Ocean Sci-Tech (by Business), 2011-2015

Revenue Structure of Oriental Ocean Sci-Tech (by Business), 2011-2015

Revenue of Oriental Ocean Sci-Tech (by Region), 2010-2015

Revenue Structure of Oriental Ocean Sci-Tech (by Region), 2010-2015

Gross Margin of Oriental Ocean Sci-Tech, 2010-2015

Gross Margin of Oriental Ocean Sci-Tech (by Business), 2011-2015

Gross Margin of Oriental Ocean Sci-Tech (by Region), 2010-2015

Revenue and Net Income of Oriental Ocean Sci-Tech, 2014-2018E

Revenue and Net Income of Homey Aquatic Development, 2011-2015

Revenue of Homey Aquatic Development (by Business), 2012-2015

Revenue Structure of Homey Aquatic Development (by Business), 2012-2015

Revenue of Homey Aquatic Development (by Region), 2012-2015

Revenue Structure of Homey Aquatic Development (by Region), 2012- 2015

Gross Margin of Homey Aquatic Development, 2011- 2015

Gross Margin of Homey Aquatic Development (by Business), 2012-2015

R & D Costs and % of Total Revenue of Homey Aquatic Development, 2012-2014

Revenue and Net Income of Homey Aquatic Development, 2014-2018E

Revenue and Net Income of Pure Pearl, 2011- 2015

Revenue of Pure Pearl (by Product), 2011-2015

Revenue Structure of Pure Pearl (by Product), 2011-2015

Revenue of Pure Pearl (by Region), 2011-2015

Revenue Structure of Pure Pearl (by Region), 2011-2015

Gross Margin of Pure Pearl, 2011-2015

Gross Margin of Pure Pearl (by Product), 2011-2015

Gross Margin of Pure Pearl (by Region), 2012- 2015

Revenue and Net Income of Pure Pearl, 2014-2018E

Revenue and Net Income of Dahu Aquaculture, 2011-2015

Revenue of Dahu Aquaculture (by Product), 2012-2015

Revenue Structure of Dahu Aquaculture (by Product), 2012-2015

Revenue of Dahu Aquaculture (by Region), 2012- 2015

Revenue Structure of Dahu Aquaculture (by Region), 2012-2015

Gross Margin of Dahu Aquaculture, 2011- 2015

Gross Margin of Dahu Aquaculture (by Product), 2012- 2015

Revenue and Net Income of Dahu Aquaculture, 2014-2018E

Wuchangyu's Revenue and Net Income, 2011- 2015

Wuchangyu's Revenue (by Industry), 2009- 2015

Haid's Revenue and Net Income, 2009- 2015

Haid's Revenue (by Product), 2009- 2015

Haid's Revenue Structure (by Product), 2009- 2015

Haid's Revenue (by Region), 2009- 2015

Haid's Revenue Structure (by Region), 2009- 2015

Haid's Gross Margin (by Product), 2012- 2015

Haid's Gross Margin (by Region), 2012- 2015

Haid's R & D Costs and % of Total Revenue, 2012- 2014

Haid's Output, Sales Volume and Inventory, 2013- 2014

Haid's Revenue and Net Income, 2014-2018E

Baiyang's Revenue and Net Income, 2009- 2015

Baiyang's Revenue Structure (by Product), 2014

Baiyang's Revenue (by Region), 2009- 2015

Baiyang's Revenue Structure (by Region), 2009- 2015

Baiyang Revenue and Net Income, 2014-2018E

Tech-Bank's Revenue and Net Income, 2009- 2015

Tech-Bank's Revenue (by Region), 2009- 2015

Tech-Bank's Revenue Structure (by Region), 2009- 2015

Tech-Bank's Revenue (by Product), 2009- 2015

Tech-Bank's Revenue Structure (by Product), 2009- 2015

Tech-Bank's Aquaculture-related Patents

Tech-Bank's Feedstuff Sales Volume and YoY Growth Rate, 2012- 2015

Tech-Bank's Revenue and Net Income, 2014-2018E

Tongwei's Revenue and Net Income, 2009- 2015

Tongwei's Revenue (by Product), 2009- 2015

Tongwei's Revenue Structure (by Product), 2009- 2015

Tongwei's Revenue (by Region), 2009- 2015

Tongwei's Revenue Structure (by Region), 2009- 2015

Tongwei's Sales Volume of Feedstuff and Aquafeeds, 2010- 2014

Tongwei's Revenue and Net Income, 2014-2018E

Five Production Bases of Dalian RainLion

China Aquaculture Industry Report, 2015-2018

With the improvement of cultivation technology and the steady growth in per-capita consumption of aquatic products, both the output value of Chinese fishery industry and the output of aquatic products...

China Edible Vegetable Oil Industry Report, 2013-2015

In 2003-2012, China’s refined edible vegetable oil production maintained an upward trend, reaching 51.7618 million tons in 2012, an increase of 19.5% compared with 2011, 3.4 times of the output in 200...

China Tomato Product Industry Report, 2012-2015

Affected by severe drought in major tomato production regions, the global tomato output in 2012 dived to 34.721 million tons, hitting the rock bottom since 2007. The Mediterranean boasts the world’s l...

China Feedstuff Industry Report, 2012-2015

In 2011, China became the world's largest feedstuff producer with an output of 179 million tons. The feedstuff output increased by 6.4% year on year to 191 million tons in 2012, including 161.70 milli...

China Feed Additives Industry Report, 2012-2015

Feed additives as upstream products of the feed industry refer to small (trace) amounts of nutritive or non-nutritive substances or drugs added to feed for specific needs; Its main role is to increase...

China Tomato Products Industry Report, 2011-2012

Currently, there are mainly three tomato-producing clusters worldwide, i.e. U.S. California Valley, the Mediterranean Coast and China’s Xinjiang, Inner Mongolia, etc., whose tomato production altogeth...

Company Study of New Hope Liuhe Co., Ltd.,2012

Founded in 1998, New Hope Liuhe Co., Ltd went to public on Shenzhen Stock Exchange on Mar. 11, 1998. Based on farming and animal husbandry business and paying attention to steady growth, the company i...

China Aquaculture Industry Report, 2011-2012

China’s output of acquatic products in 2011 amounted to 56.1 million tons, a YoY rise of 4.4%; at the same time, the disparity between seawater and freshwater products in production ratio was narrowin...

Company Study of Zhangzidao Fishery Group, 2011

Highlighting culture and proliferation of aquatic products, Zhangzidao Fishery Group is a comprehensive sea food enterprise integrating seed breeding of choice rare sea foods, culture and proliferatio...

China Paddy and Rice Processing Industry Report, 2011-2012

The paddy and rice processing industry is an emerging industry. Rice resources can be sufficiently utilized and rice value can be raised by around 75% through deep processing. Based on different posit...

Global and China Potassium Reserves and Potash Fertilizer Industry Report, 2010-2011

Presently, the proved reserves of potassium in the world hit about 10 billion tons, but the distribution shows serious imbalance. Canada, Russia, Belarus and Brazil occupy more than 90% of the global ...

China Bio-breeding Industry Report, 2010

In 2010, sales of over 8000 seed enterprises in China reached RMB 29.8 billion, up 4.9% from a year earlier. Only about 100 biological feeding enterprises are capable of R&D independently, but the...

China Aquaculture Industry Report, 2010

Alongside with the improving living standard of people, the consumtion of high-protein aquatic products goes up year by year, and the robust demand drives the output of aquatic products to grow ever. ...

China Fertilizer and Pesticide Industry Statistics, 2009-2010

Fertilizer and pesticide are significant basic substances of agricultural production and closely related to the development of agriculture. Supported by domestic market demand and national policy, Chi...

China Tomato Products Industry Report, 2009-2010

Due to the growing price hike of tomato sauce in 2008, the tomato planting area worldwide has largely increased. In 2009, the output of tomatoes for processing in the world has increased by 15.6% year...

China Soybean and Soybean Processing Industry Report, 2009

Since mid-1990s, the demand for vegetable oil, plant and animal protein has been increasing rapidly in China, so does the demand for soybean. China now is the world's largest consumer of soybean, and ...

China Glyphosate Industry Report, 2009

Glyphosate is the pesticide with the fastest growth rate, the most yield and export volume, growing at approximately 15% annually. Now, China's current annual output of glyphosate reaches 300,000 tons...

China Fertilizer Market Report, 2008

Fertilizer, as one of the fundamental materials for the development of Chinese national economy, its output value accounts for 20% of the chemical industry. In the first half of 2008, along with the s...