Global and China Photovoltaic Inverter Industry Report, 2016-2020

-

July 2016

- Hard Copy

- USD

$2,350

-

- Pages:96

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

ZHP042

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,400

-

- Hard Copy + Single User License

- USD

$2,550

-

As the core device of PV system, PV inverter can convert DC to AC. PV inverters are divided into on-grid inverters and off-grid inverters.

In 2015, the global PV inverter shipment hit 56.0GW, a year-on-year surge of 44.7%, mainly thanks to rapidlygrowing demand in the United States and China. The global PV inverter shipment is expected to be 66.0GW in 2016 and over 90GW in 2020.

China is a major PV inverter market in the world. In 2015, its PV inverter shipment reached 26.5GW, accounting for 47.3% globally and soaring by 99.2% over the previous year. In 2016-2020, China's PV inverter shipment is expected to show a CAGR of about 13.0%.

In recent years, PV inverter prices have shown a ceaselessdownward trend in the wake of the decline in PV power generation prices. In 2015, the average price of centralized inverter in China fell to 0.2 Yuan/W, and the string inverter price 0.5 Yuan/W or so. In the short term, the prices will keep dropping.

The development of PV inverters mainly relies on the construction of PV power plants. In 2015, Chinese PV power plants added 15.16 million kilowatts of installed capacity, of which ground PV power plants accounted for 90.6% and distributed PV power plants 9.4%. Distributed power plants can not only take advantage of the surface of buildings, but also act as effective interfaces between smart grid and micro grid, so they are encouraged by national policies; in 2020, the installed capacity will reach 70GW.

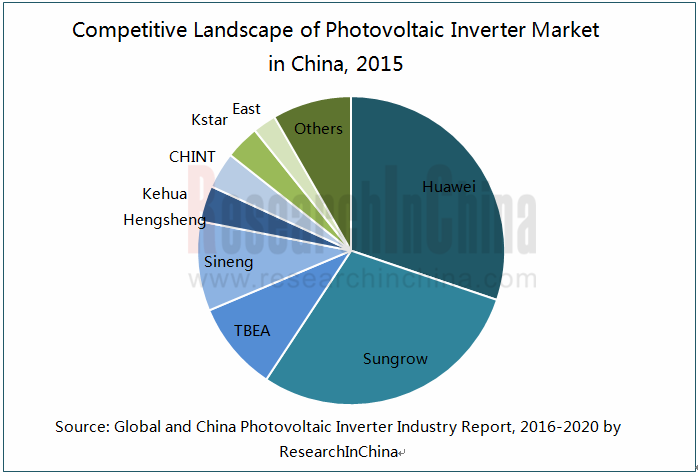

World renownedPV inverter manufacturers include Germany-based SMA, Switzerland-based ABB, Israel-based SolarEage, Japan-based TMEIC, China-based Huawei, Sungrow Power Supply, TBEA, etc. In 2015, Huawei ranked first by PV inverter shipment, while SMA was the champion by sales.

CR5 of the highly concentrated Chinese PV inverter market was up to 81.9% in 2015. Wherein, Huawei ranked first in China with 30.2% market share.

SMA’s PV inverters have a wide power range from 700W to 1,120MW. In 2015, its PV inverter shipment amounted to 7.3GW, representing a 43.7% increase over the same period of last year.

Huawei entered the PV field in 2012 and became the largest PV inverter manufacturer by shipment in China and the world in 2015. In January 2016, the company decided to cooperate with Sino-American Silicon Products Inc. in the field of solar PV inverters.

Sungrow Power Supply Co., Ltd. shipped 8.9GW of PV inverters in 2015, including 7.73GW in China. In May 2016, it launched China's first integrated medium-voltage system -- 3MW SG3000HV-MV box-type medium-voltage inverter in Shanghai.

Shenzhen KSTAR Science and Technology Co., Ltd. decided to set up Anhui Kstar Science and Technology Co., Ltd. in June 2016, and planned to build at least 300MW PV inverter and electric vehicle charging facilities as well.

Global and China Photovoltaic Inverter Industry Report, 2016-2020 by ResearchInChina mainly cover the followings:

Market size, market structure, supply and demand, market prices and competitive landscape of the global PV inverter industry;

Market size, market structure, supply and demand, market prices and competitive landscape of the global PV inverter industry;

Market environments, market size, supply and demand, market structure, market prices, competitive landscape and development factors of China PV inverter industry;

Market environments, market size, supply and demand, market structure, market prices, competitive landscape and development factors of China PV inverter industry;

Market overview, market size and market structure of main PV inverter upstream industries (IGBT, transformer, integrated circuit, resistor, capacitor, etc.) and downstream applications (PV power plants, etc.);

Market overview, market size and market structure of main PV inverter upstream industries (IGBT, transformer, integrated circuit, resistor, capacitor, etc.) and downstream applications (PV power plants, etc.);

Operation, layout in China, revenue structure and PV inverter business of 12 foreign and 17 Chinese PV inverter companies.

Operation, layout in China, revenue structure and PV inverter business of 12 foreign and 17 Chinese PV inverter companies.

1. Overview of Photovoltaic Inverter

1.1 Introduction

1.2 Classification

1.3 Technological Development

1.3.1 Evolution

1.3.2 Technique Features

1.3.3 Development Trend

1.4 Industry Chain

1.5 Cost Structure

1.6 Business Model

1.7 Industry Barrier

2. Global Photovoltaic Inverter Market

2.1 Status Quo

2.1.1 Market Size

2.1.2 Market Structure

2.1.3 Price

2.2 Supply & Demand

2.2.1 Supply

2.2.2 Demand

2.3 Market Pattern

2.3.1 Manufacturer Pattern

2.3.2 Regional Distribution

2.3.3 Development Characteristics

3. Chinese Photovoltaic Inverter Market

3.1 Marketing Environment

3.1.1 International Environment

3.1.2 Domestic Environment

3.2 Market Status

3.2.1 Market Size

3.2.2 Supply and Demand

3.2.3 Market Price

3.2.4 Market Structure

3.3 Competition Pattern

3.3.1 Local Chinese Enterprises

3.3.2 Foreign Companies

3.4 Influencing Factors

3.4.1 Favorable Factors

3.4.2 Negative Factors

4 Main Upstream Industries

4.1 IGBT

4.1.1 Application in PV Inverter

4.1.2 Market Size

4.1.3 Competition Pattern

4.2 Others

4.2.1 Integrated Circuit

4.2.2 Transformer

4.2.3 Resistor

4.2.4 Capacitor

5 Downstream Industries

5.1 PV

5.1.1 Global

5.1.2 China

5.2 PV Power Plant

5.2.1 Classification

5.2.2 Construction Costs

5.2.3 Industry Planning

5.2.4 Main Enterprises

6. Key Foreign Companies

6.1 SMA

6.1.1 Profile

6.1.2 Operation

6.1.3 PV Inverter Business

6.1.4 Business in China

6.2 ABB

6.2.1 Profile

6.2.2 Operation

6.2.3 PV Inverter Business

6.2.4 Business in China

6.3 SolarEage

6.3.1 Profile

6.3.2 Operation

6.3.3 PV Inverter Business

6.4 TMEIC

6.4.1 Profile

6.4.2 PV Inverter Business

6.4.3 Business in China

6.5 Enphase

6.5.1 Profile

6.5.2 Operation

6.5.3 PV Inverter Business

6.6 AE

6.6.1 Profile

6.6.2 Operation

6.6.3 Business in China

6.7 Danfoss

6.7.1 Profile

6.7.2 Operation

6.8 Omron

6.8.1 Profile

6.8.2 Operation

6.8.2 Business in China

6.9 Others

6.9.1 Schneider

6.9.2 Fronius

6.9.3SolarMax

6.9.4 KACO

7 Key Chinese Enterprises

7.1 Sungrow Power Supply Co., Ltd.

7.1.1 Profile

7.1.2 Operation

7.1.3 PV Inverter Business

7.2 Huawei

7.2.1 Profile

7.2.2 Operation

7.2.3 PV Inverter Business

7.3 Tebian Electric Apparatus Stock Co., Ltd. (TBEA)

7.3.1 Profile

7.3.2 Operation

7.3.3 PV Inverter Business

7.4 Shenzhen KSTAR Science and Technology Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.4.3 PV Inverter Business

7.5 Xiamen KehuaHengsheng Co., Ltd.

7.5.1 Profile

7.5.2 Operation

7.5.3 PV Inverter Business

7.6 Guangdong East Power Co., Ltd.

7.6.1 Profile

7.6.2 Operation

7.6.3 PV Inverter Business

7.7 Ningbo Ginlong Technologies Co., Ltd.

7.7.1 Profile

7.7.2 Operation

7.7.3 PV Inverter Business

7.8 GoodWe (Jiangsu) Power Supply Technology Co., Ltd.

7.8.1 Profile

7.8.2 Operation

7.8.3 PV Inverter Business

7.9 Shenzhen Clou Electronics Co., Ltd.

7.9.1 Profile

7.9.2 Operation

7.9.3 PV Inverter Business

7.10 Rongxin Power Electronic Co., Ltd.

7.10.1 Profile

7.10.2 Operation

7.10.3 PV Inverter Business

7.11 Others

7.11.1 Sineng Power Co., Ltd.

7.11.2 Shanghai Chint Power Systems

7.11.3 Growatt New Energy Technology Co., Ltd

7.11.4 Samil Power Co., Ltd.

7.11.5 Guanya Power Equipment Co., Ltd

7.11.6 Anhui EHE New Energy Tech. Co., Ltd

7.11.7 Beijing Corona Science & Technology Co., Ltd.

8 Summary and Forecast

8.1 Market

8.2 Enterprises

Functions of Inverter

Principle of PV Off-grid System

Principle of PV Grid-connected System

Evolution of Inverter Technologies

Development Trend of PV Inverter Technologies

Impact of Shield on Generating Electricity

PV Inverter Industry Chain

Main Applications of PV Inverter in China

Cost Structure of String Inverter

Global PV Inverter Sales, 2008-2020E

Global PV Inverter Revenue Structure (by Power), 2012-2018 E

Average Price of PV Inverters Worldwide, 2013-2020E

Global PV Inverter Shipment, 2013-2020E

Global Major PV Inverter Manufacturers

Global PV Inverter Demand, 2013-2020E

Classification of Global PV Inverter Manufacturers

Ranking of Global Top 10 Inverter Enterprises by Shipment and Revenue, 2015

Distribution of Major Global PV Inverter Consumer Countries, 2015

Top 10 Solar Inverter Companies in the United States, 2014

Final Results of USA's Anti-dumping and Countervailing Measures against Chinese Crystalline Silicon Solar Cells

Timetable of EU's Anti-dumping and Countervailing Measures against Chinese PV Products

China’s Major PV Industrial Policies, 2015-2016

China’s PV Inverter Market Size, 2010-2020E

China’s PV Inverter Shipment, 2013-2020E

Classification of Chinese PV Inverter Manufacturers

Average Price of PV Inverters in China, 2012-2020E

China’s PV Inverter Sales Structure (by Product), 2014-2020E

Market Share of PV Inverter Enterprises in China (by Shipment), 2015

Development of Major Global Inverter Enterprises in China

PV Inverter IGBT Brands

IGBT Supporting of PV Inverter Manufacturers

IGBT Applications

Global IGBT Market Size, 2010-2020E

Global IGBT Application Structure, 2011-2018E

Applications of Various Power Components

Major IGBT Manufacturers in China

Global PCB Output Value and Growth Rate, 2011-2020E

PCB Output Value and Growth Rate in Mainland China, 2010-2020E

Distribution of China PCB Industry

Global PCB Market Competition Pattern, 2014

Revenue of China Transformer Industry, 2010-2020E

Global PV Installed Capacity, 2005-2020E

Global New PV Installed Capacity (by Region), 2000-2015

Global Cumulative PV Installed Capacity (by Country), 2010-2015

Proportion of PV System Generating Capacity in Total Electricity Consumption in Major Countries Worldwide, 2015

New PV On-grid Capacity of Major European Countries, 2000-2015

China’s PV Installed Capacity, 2006-2020E

Operating Modes of PV Power Plants

Advantages and Disadvantages of Centralized and Distributed Power Plants

Construction Cost Structure of PV Power Plant

Investment Budget of 1MW Distributed Architecture PV

China’s Solar PV Demand, 2015/2020E

China’s Solar PV Scale Layout (by Region), 2020E

Top 20 PV Power Plant Enterprises in China (Miscellaneous), 2016

Top 20 PV Power Plant Investment Enterprises in China, 2016

Business Structure of SMA

SMA’s Global Layout

SMA’s Revenue and Net Income, 2009-2015

SMA's Revenue Structure (by Business), 2015

SMA's Revenue Structure (by Region), 2015

SMA's PV Inverter Shipment, 2009-2015

ABB's Operation, 2013-2015

ABB's Revenue (by Business), 2013-2015

ABB's Revenue (by Region), 2013-2015

ABB’s Business in China, by 2015

SolarEdge’s Main Economic Indicators, FY2014- FY2016

SolarEdge’s PV Inverters

TMEIC’s Global Footprint

TMEIC’s PV Inverter Shipment, FY2009- FY2015

Enphase’s Revenue and Net Income, 2012-2015

Enphase’s Micro Inverter Shipment, 2013-2015

AE’s Operation, 2013-2015

AE’s Revenue (by Region), 2013-2015

AE’s Sales in China, 2008-2015

Revenue of Danfoss, 2010-2015

Revenue Structure of Danfoss (by Region), 2015

Omron’s Global Business Layout

Omron’s Sales and Net Income, FY2008- FY2015

Omron’s Sales (by Business), FY2014- FY2015

Distribution of Enterprises Invested by Omron in China

PV Inverter Series of Fronius

Sungrow’s Revenue and Net Income, 2010-2016

Sungrow’s Revenue and Gross Margin (by Product), 2014-2015

Sungrow’s PV Inverter Product Categories

Sungrow’s Shipment, 2011-2015

Huawei’s Revenue and Net Income, 2011-2015

Huawei’s Revenue Structure (by Business), 2015

Huawei’s Revenue Structure (by Region), 2015

Huawei’s PV Inverter Business Development Process, 2012-2016

TBEA’s Revenue and Net Income, 2009-2016

TBEA’s Operating Revenue and Gross Margin (by Business), 2015

TBEA’s PV Product Production and Capacity under Construction, 2015

Shenzhen Kstar’s Revenue and Net Income, 2008-2015

Shenzhen Kstar’s Revenue Structure (by Business), 2014-2015

Power, Working Methods and Applications of Shenzhen Kstar’s Main PV Inverter Products

Revenue and Net Income of Shenzhen Kstar’s PV Inverter Subsidiaries, 2015

Shenzhen Kstar’s PV Inverter Output and Sales Volume, 2011-2015

Shenzhen Kstar’s PV Inverter Revenue and Gross Margin, 2011-2015

Revenue and Net Income of Xiamen KehuaHengsheng, 2010-2016

Revenue of Xiamen KehuaHengsheng (by Product), 2014-2015

Revenue and Net Income of Guangdong East Power, 2013-2015

Revenue and Gross Margin of Guangdong East Power (by Product), 2014-2015

PV Inverter Shipment of Guangdong East Power, 2012-2015

Revenue and Net Income of Ginlong Technologies, 2013-2015

Revenue Breakdown and Percentage of Ginlong Technologies (by Product), 2014-2015

Products and Applications of Ginlong Technologies

GoodWe’s Revenue and Net Income, 2013-2015

GoodWe’s Operating Revenue (by Product), 2014-2015

Revenue and Net Income of Shenzhen Clou Electronics, 2008-2015

Revenue of Main Products of Shenzhen Clou Electronics, 2014-2015

Revenue and Net Income of Rongxin Power Electronic, 2008-2015

Revenue of Main Products of Rongxin Power Electronic, 2014-2015

Sineng Power’s Distributed Inverters

Revenue and Net Income of Shanghai Chint Power Systems, 2013-2015

Main PV Inverter Equipment of Shanghai Chint Power Systems

Main PV Inverter Products of Growatt New Energy Technology

Main PV Inverter Products of Samil Power

Main PV Inverter Products of Guanya Power Equipment

Main PV Inverter Products of Anhui EHE New Energy Tech

Main PV Inverter Products of Beijing Corona Science & Technology

Growth Rate of Global and Chinese PV Inverter Markets, 2010-2020E

Prices of Global and Chinese PV Inverter Markets, 2013-2020E

Revenue Growth Rate of Major Global PV Inverter Manufacturers, 2010-2015

Competition Pattern of Chinese PV Inverter Market, 2015

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...