Flying Car Research: The prospect is promising. Creator of Google self-driving cars turns to track of flying cars

ResearchInChina released Global and China Flying Car Industry Report, 2020-2026, analyzing eVTOL ((Electric Vertical Takeoff and Landing) from the perspective of status quo, trends, business models, financing, the layout of major players, and product solutions.

Compared with traditional cars and aircrafts, eVTOL has gradually materialized, featuring zero emission, low cost, point-to-point low-altitude flight (short mobility time without geographical restrictions), vertical take-off and landing, land and aerial applications. For example, EHang 216 with multi-rotor electric vertical take-off and landing is used as an ambulance in the coronavirus crisis.

Investors favor urban air mobility (UAM). The total financing of the three unicorns exceeds USD1.5 billion

By 2030, 60% of the population will migrate into cities, which may pose enormous pressure on urban ground transportation. By then, the demand for urban aerial short-distance mobility will increase significantly. Morgan Stanley predicts that the flying car market will reach USD320 billion by 2030.

Flying cars have been favored by many investors due to the broad application prospects. Larry Page, cofounder and CEO of Alphabet, Google’s parent company, was among the first to recognize their potentials, personally funding three companies, Zee Aero, Opener and Kitty Hawk. Particularly, Sebastian Thrun, Google's self-driving team founder turned CEO of flying vehicle startup Kitty Hawk. This indicates the trend of the mobility market: the future transportation may develop in the sky.

Among the three flying car unicorns, Joby Aviation is from the United States, Volocopter and Lilium are from Germany. Joby Aviation has raised the overwhelming USD820 million. Volocopter has announced the signing of their Series D funding round, and its investors include Geely, Daimler, Geely, Daimler, DB Schenker, Intel Capital, etc.

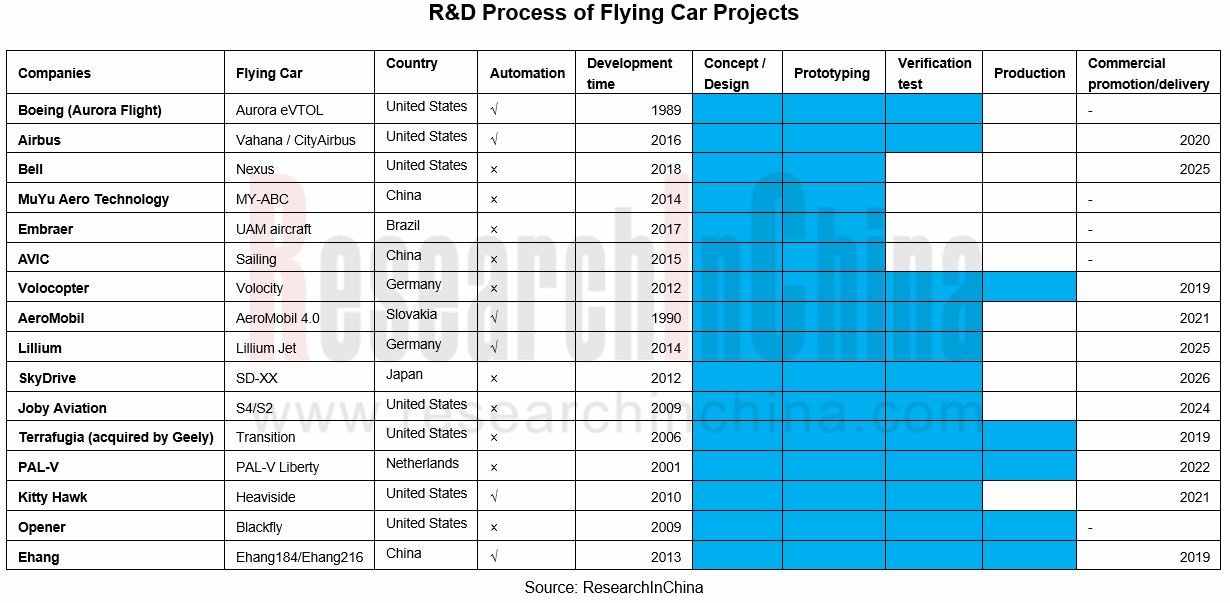

Currently, 5 flying car models have been mass-produced. Electrification and autonomous driving are the mainstream

American companies (accounting for nearly 50%) are the most enthusiastic about developing flying cars, followed by Chinese companies. Many companies aim to materialize flying cars around 2025. Five flying car projects have seen mass production, and 38% have realized automation.

Automotive technology and aviation technology are merging with each other. Benefiting from the development of automotive electrification, flying cars have a progress in endurance. For example, Airbus Vahana eVTOL has a range of up to 50 kilometers, which basically enables urban short-distance mobility.

Amid many participants, Geely, Xpeng, Hyundai and other OEMs have deployed the market

Currently, traditional airlines such as Boeing, Airbus, Bell, etc. have embarked on flying car projects. Technology companies follow suit. For example, Uber has established Uber Elevate to develop flying taxis with 9 partners including Embraer, Aurora Flight Sciences, Jaunt Air Mobility, etc.

The CEO of the OEM Xpeng recently stated that it will build flying cars in 2021. Geely completed its acquisition of the US flying-car startup Terrafugia, and invested in Volocopter, a German electric flying taxi R&D company, demonstrating its ambition to deploy UAM. Recently, Transition (TF-1), a subsidiary of Geely, obtained the world's first special airworthiness certificate from the Federal Aviation Administration (FAA), USA.

The United States, Germany, China, South Korea, Japan and many other countries have paid attention to the concept of flying cars, and many of them have formulated UAM development plans. Affected by favorable policies, insufficient urban road traffic space, autonomous driving and the development of 5G communication technology, flying cars are expected to become an important way of smart mobility in the future.

Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

In 2022Q1, the installation rate of L2 and a...

Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror mark...

Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century....

Automotive Intelligent Cockpit Platform Research Report, 2022

Research on Intelligent Cockpit Platforms: Intelligent cockpits rush into a new era of "cross-domain integration and layered software design"

Cockpit hardware platform field: Faster cross-domain inte...

Global and China Flying Car Industry Research Report, 2022

ResearchInChina has released “Global and China Flying Car Industry Research Report, 2022".

A flying car is a three-dimensional vehicle. Broadly speaking, it is a low-altitude intelligent autonomous t...

Global and China Passenger Car T-Box Market Report, 2022

Passenger car T-BOX research: T-Box OEM installation rate will reach 83.5% in China in 2025

ResearchInChina has published Global and China Passenger Car T-Box Market Report 2022 to summarize and ana...

Global and China Purpose Built Vehicle (PBV) and Robocar Report, 2022

PBV and Robocar research: new idea of building brick cars, a new car type for future mobility Building brick cars moves the cheese of traditional OEMs.

Purpose built vehicle (PBV) refers to special ...

China Automotive Voice Industry Report, 2021-2022

Automotive voice market: The boom of self-research by OEMs will promote reform in the supply mode

Before the advent of fully automated driving, the user focus on driving, and voice interaction is sti...

Global and China Automotive Emergency Call (eCall) System Market Report, 2022

Automotive eCall system: wait for the release of policies empowering intelligent connected vehicle safetyAt the Two Sessions held in March 2022, more than 10 deputies to the National People's Congress...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...