Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.39 million 5G base stations, established over 2,300 virtual private networks and hybrid private networks, and seen over 1,800 5G+ industrial Internet projects under construction. Viewed from 5G coverage, all prefecture-level cities, at least 97% of counties, and 40% of townships in China have already been covered by 5G, to the amount of 450 million 5G terminal users in China, taking a lion’s share above 80% of the world’s total.

The accelerated construction of 5G networks will set the stage for deeper commercialization of 5G vehicles. To date, China's Internet of Vehicles (IoV) projects based on 5G communications have spread from pilot areas to commercialized scenarios, calling for the synergy of automakers, parts suppliers and internet firms as well as 5G ecosystem partners for the sake of cross-platform interconnection and interoperability.

5G has become the sales highlight of many brand models

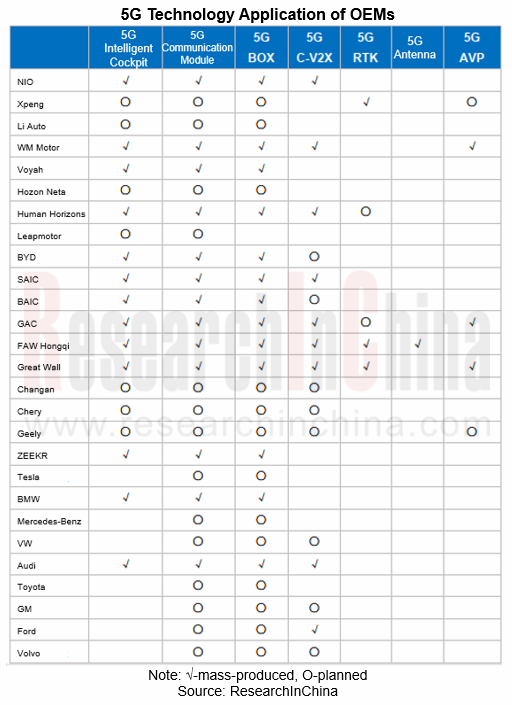

Many Chinese automakers are aggressively exploring the use of 5G technology in autonomous driving and intelligent connectivity, and they have launched 5G production models as a main selling point:

In February 2021, SAIC R officially launched MARVEL R, the world's first "5G smart electric SUV" with the SRRC certificate and being the first model that passed the automotive-grade 5G /C-V2X terminal certification;

NIO ET7, which will be mass-produced in 2022, will use the 3rd-Gen Qualcomm Snapdragon? automotive digital cockpit platform and Qualcomm Snapdragon? 5G automotive platform. It is possessed of 5G, C-V2X, Bluetooth 5.0, WiFi-6, UWB, among others;

ARCFOX α-T, the first production SUV of BAIC BJEV ARCFOX, officially called "the 5G smart electric vehicle", is equipped with the MH5000 T-BOX based on Huawei's next-generation 5G chips;

In August 2021, BYD Han unveiled a 5G version, adding a 5G optional package (including Dynaudio loudspeakers and 5G chips) to the 2021 BYD Han EV flagship version;

Great Wall Motor's 5G automotive wireless terminal has been granted the “Radio Transmission Equipment Type Approval Certificate” by the Ministry of Industry and Information Technology of the People’s Republic of China.

Among foreign OEMs, BMW, Ford, and Audi also quicken the pace of 5G vehicle production:

BMW's flagship battery-electric SUV, BMW iX, has debuted with 5G connectivity technology and Gigabit Ethernet for the first time;

The Ford C-V2X System has been officially spawned and applied since January 1, 2021. Ford has therefrom become the first automaker in China that accomplished the mass production of C-V2X technology which is now available in Wuxi, Changsha and Guangzhou. In the next step, Ford will ramp up production of models using 5G C-V2X technology;

For Audi, the upcoming Audi A7 L and A6 L made in China will be equipped with 5G communication modules that support C-V2X.

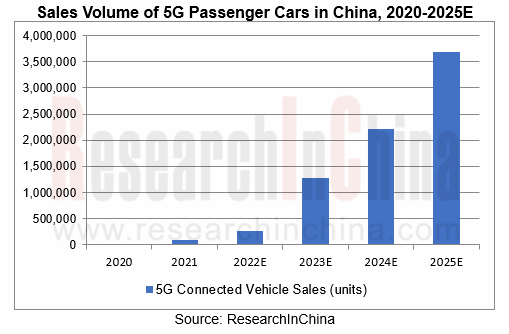

According to the production and assembly data of 5G passenger cars in China, the penetration rate of 5G vehicles constituted less than 0.4% of connected vehicles in 2021. As 5G feature gains popularity in medium and high-end passenger cars, China's 5G passenger car sales will reach 3.684 million units by 2025, with the penetration above 15% then.

Localization of 5G auto parts

While 5G vehicles are in full swing, there have emerged more than fifty 5G terminal and technical solution providers in the Chinese intelligent vehicle industry chain. Here are a few typical 5G automotive product/solution suppliers:

1. 5G Box

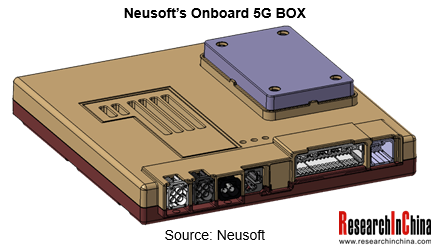

As the first enterprise certified by A-SPICE CL3 and 5G SRRC, Neusoft has cooperated with over 20 world-renowned automakers in the field of intelligent communication for 100+ models, with the annual capacity up to one million units.

By far, Neusoft has spawned 5G/V2X BOX on a large scale, which will be installed in dozens of mid-to-high-end models from well-known OEMs such as Geely and Great Wall in the near future. The Neusoft 5G BOX carried by ZEEKR 001 integrates functions such as Gigabit Ethernet, WiFi 6 and BLE 5.0 to enable precise time synchronization, high-precision satellite positioning, and multi-channel data transmission, and to offer a data access channel for intelligent driving assistance system, coupled with the high speed, high bandwidth and low latency of 5G.

2. 5G communication modules

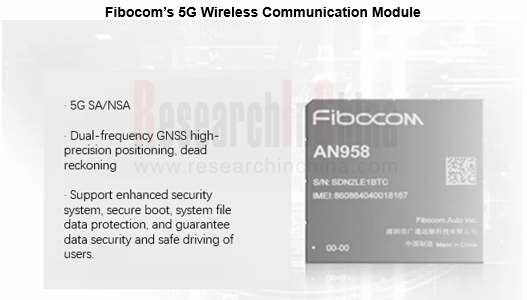

AN958-AE, the 5G automotive-grade module of Fibocom, has been certified by CCC (China Compulsory Product Certificate), SRRC (Radio Type Approval), and NAL (Network Access License for Telecom Equipment), indicating that AN958-AE meets the standard design goals in RF performance and data performance and fully suits the complex network environment of Chinese operators. It is qualified for mass production and shipment, so that Fibocom can accelerate the upgrade of automotive OEM module business from 4G to 5G.

AN958 is independently developed and designed by Fibocom Auto, Fibocom’s wholly-owned subsidiary engaged in automotive OEM module business. It is a 5G NR Sub-6 automotive communication module targeting the global market. Based on Qualcomm’s SA515M 5G automotive platform, AN958 supports 5G SA and NSA.

3. 5G antennas

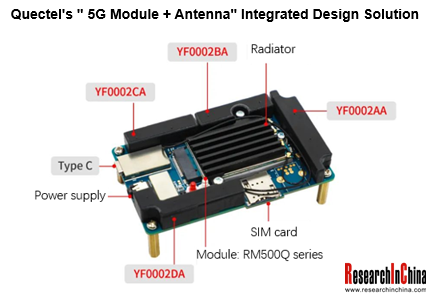

Quectel believes that the integrated design of wireless modules and antennas by a supplier that can provide application solutions at the same time will be the mainstream trend of terminal antenna design in the 5G era. Quectel's "wireless module + antenna" integrated design solution not only makes full use of its technical superiority and experience in modules, but also exerts its full-custom antenna design, integration and manufacturing capabilities.

Typical scenarios where the ‘5G + vehicle’ fusion prevails

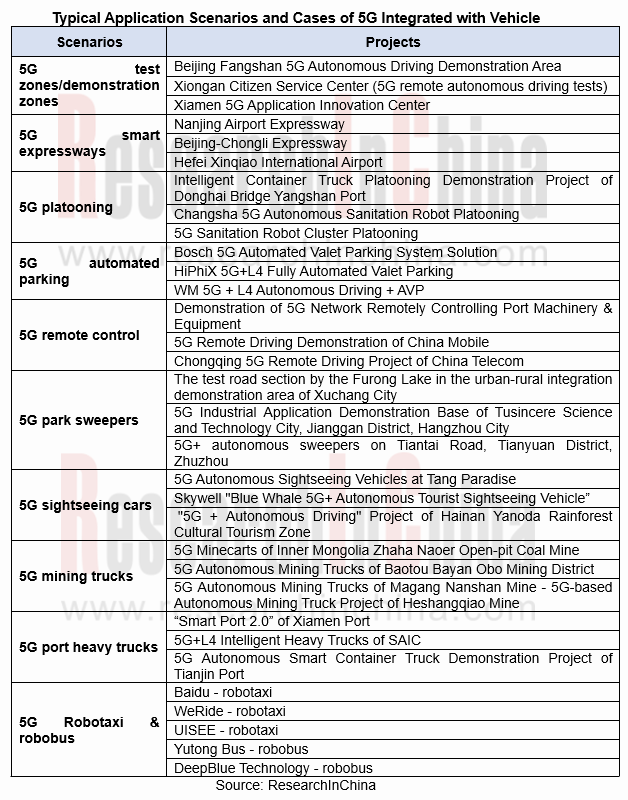

5G technology has been given full play in excess of 10 scenarios such as test areas/demonstration areas, smart expressways, platooning, automated parking, remote control and remote chauffeur, low-speed autonomous driving in parks, special self-driving, and intelligent public transportation.

Global and China Automotive Smart Antenna Research Report, 2022-2023

Smart antenna research: the integration of automotive antennas and intelligent connected terminals tends to accelerate.

The development trend of automotive antennas: tend to be intelligent, div...

Chinese Independent OEMs’ Telematics System and Entertainment Ecosystem Research Report, 2022

Vehicle telematics system research 1: the control scope is expected to expand to the entire vehicle.From January to December 2022, Chinese independent OEMs installed telematics systems in 6.42 million...

China Autonomous Shuttle Market Report, 2022-2023

Autonomous Shuttle Research: application scenarios further extend amidst policy promotion and continuous exploration

Autonomous shuttles are roughly categorized into minibuses and robobuses. Minibuse...

Intelligent Cockpit Domain Control Unit (DCU) and Head Unit Dismantling Report, 2023 (1)

Dismantling of Head Unit and Cockpit Domain Control Unit (DCU) of NIO, Toyota and Great Wall Motor The report highlights the dismantling of Toyota’s MT2712-based head unit, Fisker’s Intel A2960-based ...

Automotive Vision Algorithm Industry Research Report, 2023

Research on automotive vision algorithms: focusing on urban scenarios, BEV evolves into three technology routes.1. What is BEV?

BEV (Bird's Eye View), also known as God's Eye View, is an end-to-end t...

ADAS Domain Controller Key Component Trends Report, 2022

ResearchInChina researched and summarized China’s current mainstream high computing power ADAS domain controller products such as Huawei MDC and DJI ADAS domain controller prototype, and technical inf...

Automotive High-precision Positioning Research Report, 2023

High Precision Positioning Research: four forms of mass-produced integrated high-precision positioning products

With the continuous development of autonomous driving, the demand for high-precis...

Automotive AUTOSAR Platform Research Report, 2023

AUTOSAR research: CP + AP integration, ecosystem construction, and localization will be the key directions.

AUTOSAR standard technology keeps upgrading, and the willingness to build open cooperation ...

China Autonomous Driving Algorithm Research Report, 2023

Autonomous Driving Algorithm Research: BEV Drives Algorithm Revolution, AI Large Model Promotes Algorithm Iteration

The core of the autonomous driving algorithm technical framework is divided into th...

Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Recently, ResearchInChina selected two key components essential to current intelligent driving assistance systems - front view...

Automotive CMOS Image Sensor (CIS) Chip Industry Research Report, 2022

Automotive CIS research: three major segmentation scenarios create huge market space

It is known that the biggest application market of image sensor is smartphone field. As the smartphone market beco...

Global and China Automotive Cluster and Center Console Industry Report, 2022

Automotive Display Research: Penetration Rate of OLED, Mini LED and Other Innovative Display Technology Increased Rapidly

With the penetration of new energy and intelligent driving vehicles, the tren...

Autonomous Driving Simulation Industry Chain Report (Chinese Companies), 2022

Simulation Research (Part II): digital twin, cloud computing, and data closed-loop improve simulation test efficiency.

Simulation tests can not only be conducted in extreme working conditions and mor...

Automotive Memory Chip Industry Research Report, 2022

Automotive Memory Chip Research: Localization is imperative amid intense competition

The global smart phone storage market size hit US$46 billion in 2021 when the global automotive storage market siz...

Autonomous Driving Simulation Industry Chain Report (Foreign Companies), 2022

Simulation test research: foreign autonomous driving simulation companies forge ahead steadily with localization services.

As the functions of ADAS and autonomous driving systems are developed and th...

China Automotive Multimodal Interaction Development Research Report, 2022

Multimodal interaction research: more hardware entered the interaction, immersive cockpit experience is continuously enhanced

ResearchInChina's “China Automotive Multimodal Interaction Development Re...

Global and China Automotive Operating System (OS) Industry Report,2022

Operating system research: the automotive operating system for software and hardware cooperation enters the fast lane.

Basic operating system: foreign providers refine and burnish functions; Chinese ...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2022

Automotive radar research: installations surged by 49.5% year on year in 2021, and by 35.4% in the first nine months of 2022.

1. The installations of automotive radars sustain growth, and are expect...