China Automotive Finance Industry Report, 2022-2030

-

Mar.2022

- Hard Copy

- USD

$3,600

-

- Pages:236

- Single User License

(PDF Unprintable)

- USD

$3,400

-

- Code:

ZXF003

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,000

-

- Hard Copy + Single User License

- USD

$3,800

-

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only has the profit margin of 13% in China. Besides a strong driver for the development of automotive market, auto finance serves as a main source of profits for large automobile groups.

In a well-established automotive market, profits come mostly from the aftermarket, but China's automobile industry still pivots on the upstream of the industrial chain as concerns profitability, will avert its focus, however, from the upstream auto production and marketing to the aftermarket where diversified services will enjoy great opportunities in future.

In 2021, China produced 26.082 million and sold 26.275 million automobiles, up 3.4% and 3.8% year-on-year respectively, ending the three-year decline since 2018.

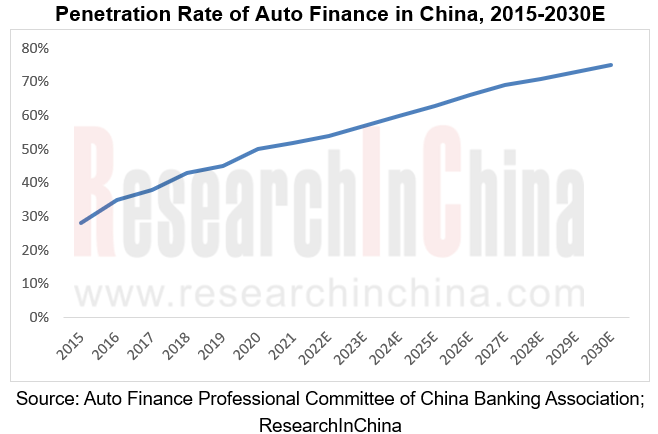

With the changes in consumer attitudes and a multitude of the emerging consumption patterns, the penetration rate of auto finance in China shows an uptrend in recent years, hitting about 52% in 2021, still far behind that of developed countries. Amid the growing mature auto finance and the improving credit system in China, there are huge potentials in auto finance industry of China, with penetration to rise considerably.

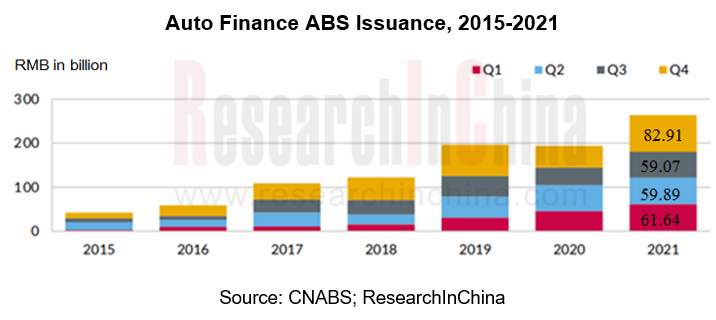

In 2021, the cumulative issuance of auto loan ABS reached RMB263.51 billion, up 35.8% over 2020.

In 2021, the cumulative issuance of auto loan ABS swelled 35.8% year on year to RMB263.51 billion, setting a new record in the interbank bond market. The issuance in the first three quarters was almost the same in scale, while it set an all-time record for a single season, namely RMB 82.9 billion, in the fourth quarter. In 2021, a total of 20 initiators participated in ABS, and they were enthusiastic enough to have more issuance, even a single initiator launched 5 ABS products. The above data shows that the auto loan ABS in the interbank bond market has fully recovered from the impact of the pandemic, and investors' acceptance of it has been further improved. In a comparatively loose financing environment, the issuance of auto loan ABS in 2022 is expected to sustain the bullish trend in 2021.

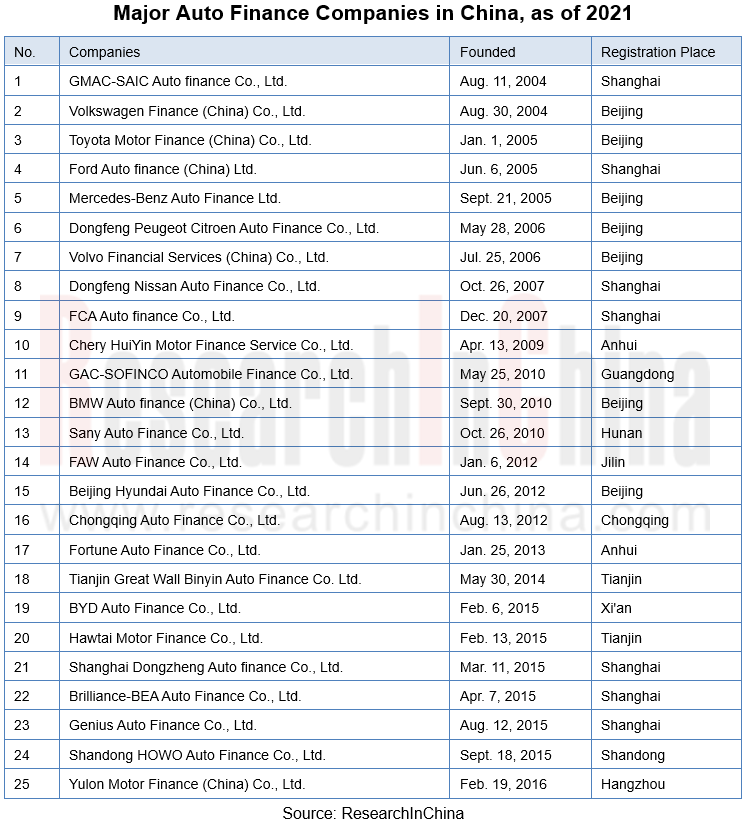

Till the end of 2021, 25 auto finance companies had been approved for establishment.

Auto finance companies have a late start in the auto finance market. In October 2003 and November 2003, the China Banking Regulatory Commission successively promulgated Administrative Measures for Auto Finance Companies and Detailed Rules for the Implementation of Administrative Measures for Auto Finance Companies, officially opening up domestic auto consumer credit and related businesses, allowing qualified Chinese and foreign institutions to establish auto finance companies in China. As of end-2021, a total of 25 auto finance companies had been approved for establishment. Backed by automakers, auto finance companies are advantageous in the auto industry chain and developing apace in recent years with rich channel resources. Based on public data, the total assets of auto finance companies nationwide are on a rapid rise over the recent years, with an average growth rate of 19.05% between 2016 and 2020, and registering RMB977.48 billion at the end of 2020.

The COVID-19 hit hard credit standing of the automotive sector, but the situation improved apparently in 2021.

Auto sales was seriously devastated at the outbreak of COVID-19 in the first quarter of 2020, and has rebounded steadily since then with China’s strong control on the pandemic.

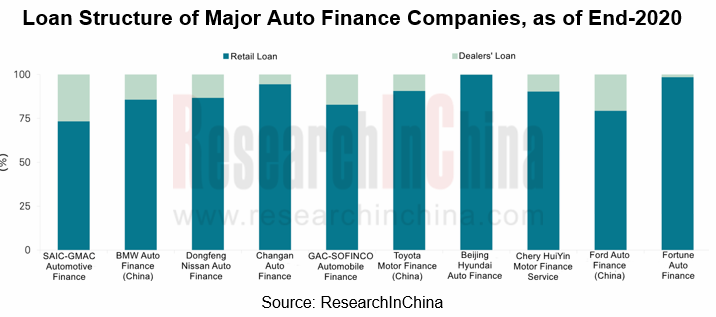

As for retailing, auto finance companies actively cooperate with OEMs to carry out promotions, and drive auto sales by enriching loan products, digitizing procedures, lowering loan thresholds, and easing the burden to car buyers. On the supply chain side, auto finance companies offer stable financial support to dealers; especially during the COVID-19 in 2020, they eased the burden on dealers by intentionally extending the repayment term and slashing loan interests and fees in response to the shortage of funds for some dealers. This move stabilizes the marketing system of OEMs. As of the end of 2020, the retail loan balance of auto finance companies in China had been RMB782.016 billion, up 8.71% year on year; the inventory wholesale loan balance had edged down 3.15% year-on-year to RMB104.652 billion.

Auto finance companies have been operating steadily on the whole, and showed professional risk control capabilities and robust business competences amid the pandemic. The regulatory indicators of auto finance companies still perform well. By the end of 2020, the auto finance industry’s average liquidity ratio had reached 214.09%, much higher than the average level of the banking industry; the auto finance industry’s capital adequacy ratio had jumped 0.79 points year on year to 21.40%; its average non-performing loan ratio had been 0.49%, and it had decreased after a surge in February and March due to the pandemic, and at the end of 2020 back to the level at the end of the previous year, and even with a slight decrease of 0.01 point.

Compared with banks and other non-bank financial institutions with more diversified operations, auto finance companies focus on auto finance with better transparency. An auto finance company's loan portfolio typically consists of two parts: retail business (loans for car buyers) and wholesale business (loans to car dealers). Also, auto finance companies can develop car rental services, which usually feature higher flexibility in product design. In practice, rental services are more concentrated in the financial leasing companies established by automakers.

China Automotive Finance Industry Report, 2022-2030 highlights the following:

Global auto finance industry (development environment, status quo, auto finance development in countries, competition, global expansion, etc.);

Global auto finance industry (development environment, status quo, auto finance development in countries, competition, global expansion, etc.);

China's auto finance industry (development environment, history, status quo, market size, competition, operation of auto finance companies, development trends, situation amid the pandemic, etc.);

China's auto finance industry (development environment, history, status quo, market size, competition, operation of auto finance companies, development trends, situation amid the pandemic, etc.);

China's auto finance market segments (auto financial leasing, used car finance and auto Internet finance);

China's auto finance market segments (auto financial leasing, used car finance and auto Internet finance);

14 OEM-related auto finance companies, 5 dealer-related auto finance companies and 11 other auto-finance-related firms.

14 OEM-related auto finance companies, 5 dealer-related auto finance companies and 11 other auto-finance-related firms.

1. Overview

1.1 Definition

1.2 Classification

1.3 Market Players

2. Global Auto finance Industry

2.1 Development Environment

2.2 Status Quo

2.3 Overview of Auto Finance in Major Countries

2.3.1 United States

2.3.2 Germany

2.3.3 Japan

2.4 Competitive Landscape

2.5 Global Expansion

3. Auto finance Industry in China

3.1 Development Environment

3.1.1 Policy

3.1.2 Economy

3.1.3 Automobile Sales

3.1.4 Car Ownership

3.2 Development Course

3.3 Status Quo

3.4 Market Size

3.5 Competitive Landscape

3.6 Operation of Auto Finance Companies

3.7 Development Trends

3.7.1 Market Share of Auto Finance Companies Grows Further

3.7.2 Used Car Financial Business Grows Rapidly

3.7.3 Cyberization of Used Car Trade

3.7.4 Auto Financial Products Becomes More Diversified

3.7.5 Improved Credit System Pushes the Development of Auto Finance Market

3.7.6 Internet Auto Finance Has Developed into a Trend

3.7.7 Consumer Structure Changes

3.7.8 Industry Reshuffle Accelerates

3.8 China's Auto Finance Industry in the Pandemic

4. Chinese Auto Finance Market Segments

4.1 Auto Financial Leasing

4.1.1 Profile

4.1.2 Development Course

4.1.3 Business Model

4.1.4 Status Quo

4.1.5 Policy Support

4.1.6 Competitive Landscape

4.1.7 Problems

4.2 Used Car Finance

4.2.1 Profile

4.2.2 Market Size

4.2.3 Price Trend

4.2.4 Market Structure

4.2.5 Huge Potential

4.2.6 Status Quo

4.2.7 Competitive Landscape

4.3 Internet Auto Finance

4.3.1 Profile

4.3.2 Policies

4.3.3 Status Quo

4.3.4 Problems

5. OEM-related Auto Finance Companies

5.1 SAIC-GMAC Automotive Finance Co., Ltd. (SAIC-GMAC)

5.1.1 Profile

5.1.2 Operation

5.1.3 New Car Finance Business

5.1.4 Used Car Finance Business

5.1.5 Developments

5.2 Volkswagen Finance (China)

5.2.1 Profile

5.2.2 Operation

5.2.3 New Car Finance Business

5.2.4 Used Car Finance Business

5.2.5 Developments

5.3 Chery Huiyin Motor Finance Service Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Auto Finance Business

5.3.5 New Car Finance Business

5.3.6 Used Car Finance Business

5.3.7 Sales Network

5.3.8 Developments

5.4 BYD Auto Finance Company Limited

5.4.1 Profile

5.4.2 Operation

5.4.3 Auto Finance Business

5.4.4 Developments

5.5 Ford Automotive Finance (China) Limited

5.5.1 Profile

5.5.2 Operation

5.5.3 Auto Finance Business

5.5.4 Sales Network

5.5.5 Developments

5.6 Dongfeng Nissan Auto Finance Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.6.3 New Car Finance Business

5.6.4 Used Car Finance Business

5.6.5 Developments

5.7 Herald International Financial Leasing

5.7.1 Profile

5.7.2 Operation

5.7.3 Auto Finance Business

5.7.4 Developments

5.8 Toyota Motor Finance (China) Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.8.3 Auto Finance Business

5.9 BMW Automotive Finance (China) Co., Ltd.

5.9.1 Profile

5.9.2 Operation

5.9.3 Auto Finance Business

5.9.4 Developments

5.10 Yulon Motor Finance (China) Co., Ltd.

5.10.1 Profile

5.10.2 Auto Finance Business

5.10.3 Developments

5.11 Changan Auto Finance Co., Ltd.

5.11.1 Profile

5.11.2 Operation

5.11.3 New Car Finance Business

5.11.4 Used Car Finance Business

5.11.5 Developments

5.12 GAC-SOFINCO Automobile Finance Co., Ltd.

5.12.1 Profile

5.12.2 Operation

5.12.3 Auto Finance Business

5.12.4 Developments

5.13 Genius Auto Finance Co., Ltd

5.13.1 Profile

5.13.2 Operation

5.13.3 New Car Finance Business

5.13.4 New Car Finance Business

5.13.5 Developments

5.14 Beijing Hyundai Auto Finance Co., Ltd.

5.14.1 Profile

5.14.2 Operation

5.14.3 New Car Finance Business

5.14.4 New Car Finance Business

5.14.5 Developments

6. Auto Finance-related Dealers

6.1 Yongda Automobiles

6.1.1 Profile

6.1.2 Operation

6.1.3 Auto Finance Business

6.1.4 Shanghai Yongda Finance Leasing Co., Ltd.

6.1.5 Yongda Financial Group Holdings Limited

6.1.6 Developments

6.2 China Grand Automotive Services Co., Ltd.

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 All Trust Leasing Co., Ltd.

6.2.6 Auto Finance Business

6.2.7 Developments

6.3 Pang Da Automobile Trade

6.3.1 Profile

6.3.2 Operation

6.3.3 Ling Tai Financial Leasing

6.3.4 Pang Da Leye Leasing Co., Ltd.

6.3.5 Developments

6.4 Anhui Yaxia Industry Co, Ltd.

6.4.1 Profile

6.4.2 Layout

6.5 Shanghai Dongzheng Automotive Finance Co., Ltd.

6.5.1 Profile

6.5.2 Operation

6.5.3 Auto Finance Business

6.5.4 Layout

7. Other Auto Finance Companies

7.1 Cango Inc.

7.1.1 Profile

7.1.2 Network

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Auto Finance Business

7.1.5 Developments

7.2 Great China Finance Leasing Co., Ltd.

7.2.1 Profile

7.2.2 Auto Finance Business

7.2.3 Developments

7.3 Zhejiang Jingu Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 Auto Finance Business

7.4 Yixin Group

7.4.1 Profile

7.4.2 Operation

7.4.3 Auto Finance Business

7.4.4 Developments

7.5 eCapital

7.5.1 Profile

7.5.2 Auto Finance Business

7.5.3 Developments

7.6 UCAR INC.

7.6.1 Profile

7.6.2 Operation

7.6.3 Auto Finance Business

7.7 Dafang Car Rental

7.7.1 Profile

7.7.2 Auto Finance Business

7.8 Jiayin Financial Leasing

7.8.1 Profile

7.8.2 Auto Finance Business

7.9 Souche

7.9.1 Profile

7.9.2 Financing

7.9.3 Auto Finance Business

7.10 Weidai Ltd.

7.10.1 Profile

7.10.2 Operation

7.10.3 Auto Finance Business

7.11 XXF

7.11.1 Profile

7.11.2 Operation

7.11.3 Auto Finance Business

Advantages and Disadvantages of Major Auto Finance Practitioners in China

Global Automobile Output, 2010-2021

Global Automobile Output by Geography, 2010-2021

Global Top 20 Countries by Automobile Output, 2019-2021

China Automobile Sales, 2019-2021

USA Automobile Sales ,2019-2021

Japan Automobile Sales, 2019-2021

India Automobile Sales, 2019-2021

S.Korea Automobile Sales, 2019-2021

Germany Automobile Sales, 2019-2021

Profit Structure of China Automobile Industry and Mature Automotive Industry Chain

Global Automobile Purchase Structure by Mode

Global Auto Finance Penetration by Country

Features of Auto Finance Service in the US

Features of Auto Finance Service in Germany

Features of Auto Finance Service in Japan

Structure of Overseas Auto Finance Market by Capital Source

Structure of China Auto Finance Market by Capital Source, 2021

Global Layout of General Motors Financial Company, Inc.

Operating Results of General Motors Financial Company, Inc.,2020-2021

Revenue from Commercial Finance Business of General Motors Financial Company, Inc. by Geography, 2020-2021

Operation of General Motors Financial Company, Inc. in China, 2020-2021

China’s Policies on Auto Finance Industry, 2004-2021

China’s GDP, 2012-2021

China’s Automobile Sales, 2010-2021

Sales Volume of Passenger Car in China, 2010-2021

Sales Volume of Commercial Vehicle in China, 2006-2021

Output and Sales Volume of NEV in China, 2011-2021

China Automobile Ownership, 2012-2021

Developmental Stages of Auto Finance in China

Retail Loan Balance of Auto Finance Companies and Number of Vehicles Purchased with Retail Loan in China, 2013-2020

Penetration of Auto Finance in China, 2015-2030E

Auto Finance ABS Issuance in China, 2015-2021

Auto Finance Market Size in China, 2015-2030E

Distribution of Loan Assets Securization Market Initiators by Type, 2021

Top 10 Issusing Agencies of Auto Loan by Issuance Scale, 2021

Auto Finance Related Enterprises Invested by BATJ

Advantages and Disadvantages of Major Auto Finance Practitioners in China

Total Assets and Market Share of Auto Finance Companies, by the end of 2020

Major Auto Finance Companies in China, as of 2021

Issuance of Financial Bonds and Asset Securitization Products of Auto Finance Companies and Financial Companies Affiliated to Automotive Groups, 2013-2021

Issuance of Personal Auto Loan ABS in the Interbank Market, 2012-2021

Issuance of Personal Auto Loan ABS in the Interbank Market by Proportion, 2015-2021

Issuance Scale of Personal Auto Loan ABS in the Interbank Market by Initiator, 2012-2021

Issued Tranches of Personal Auto Loan ABS in the Interbank Market by Initiator, 2012-2021

Interest Rate of Personal Auto Loan ABS (AAAsf-rated)

Transaction of Auto Loan ABS in the Secondary Market, 2017-2021

Market Shares of Auto Finance Companies in China, 2016-2030E

Intended Used Car Users’ Age Preferences for Vehicles

Intended Used Car Users’ Preferences for Vehicle Purchasing Channels

Cases of Chinese Internet Firms that Make Layout in Internet Auto Finance

Car Purchase Reasons of Intended Used Car Users of Different Ages

Considerations of Intended Used Car Users of Different Genders When Choosing a Car

Monthly Sales Volume of Passenger Car in China, 2019-2021

YoY Growth in Loans of Major Auto Finance Companies

Distribution of Tier-1 Capital Adequacy Ratios of Major Chinese Commercial Banks in Stress Conditions Assessed by S&P Global Ratings, As of 2020

Capital Adequacy Ratios of Major Auto Finance Companies, As of 2020

Net Interest Margins of Major Auto Finance Companies, 2020

Average Return on Total Assets of Major Auto Finance Companies, 2020

Loan Structure of Major Auto Finance Companies , As of 2020

Industrial Average Non-performing Loan Ratio and Provision Coverage of Auto Finance Companies, As of 2020

Non-performing Loan Ratio and Special Mention Loan Ratio of Major Auto Finance Companies, As of 2020

Funding Structure of Major Auto Finance Companies, As of 2020

Financial Leasing Procedures

Main Features of Auto Financial Leasing

Comparison between Financial Leasing and Financial Loans

Development Stage of Auto Financial Leasing in China

Auto Financial Leasing -- Direct Leasing Model

Auto Financial Leasing -- Sale-leaseback Model

Comparison of Business Models of Auto Financial Leasing

Penetration of Auto Financial Leasing in Major Countries

Penetration of Auto Financial Leasing in China, 2016-2030E

Policies on Auto Financial Leasing in China, 2008-2020

Major Participants in China’s Auto Financial Leasing Market

Leading Auto Financial Leasing Companies in China

Cases of Automakers in Financial Leasing

BATJ’s Deployments in Auto Financial Leasing in China

Transaction Volume of Used Cars and YoY Growth in China, 2011-2021

Monthly Transaction Volume of Used Cars in China, 2020-2021

Transaction Volume of Used Car by Region in China, Dec.2021

Cross-Region Circulation of Used Car in China, 2019-2021

Transaction Volume Structure of Used Car in China by Price Range, 2020-2021

Transaction Volume Structure of New Energy Used Car in China by Price Range, 2021

Overall Performance of Used Car in China, 2021

Trade Volume Structure of Used Cars in China by Type, 2014-2020

Trade Volume Structure of Used Cars in China by Service Life, 2010-2021

Ratio of Trade Volume of Used Cars to That of New Vehicles in Major Countries (USA, Japan, China)

Ratio of Trade Volume of Used Cars to That of New Vehicles in China, 2012-2020

Penetration of Used Car Finance in China, 2016-2030E

Cases of Major Chinese Enterprises’ Layout in Used Car Finance, 2015-2019

Advantages and Disadvantages of Used Car Finance Participants

Businesses of Major Suppliers of Used Car Financial Services

Procedures of Internet Auto Finance and Traditional Auto Mortgage Loan

Local Authorities’ Policy Support for Internet Finance

Cases of Capitals into Internet Auto Finance, 2015-2019

Development Course of Internet Auto Finance in China

Types of Players in Internet Auto Finance in China

Equity Structure of SAIC-GMAC

Net Interest Income and Net Income of SAIC-GMAC, 2013-2021

SAIC-GMAC’s Revenue by Product, 2016-2020

Loan Structure of SAIC-GMAC, 2017-2020

Wholesale Credit Business Overview of SAIC-GMAC, 2017-2020

Retail Credit Business Overview of SAIC-GMAC, 2017-2020

Main Business Types of SAIC-GMAC

Car Loan Process of SAIC-GMAC

Development History of chengxin.saic-gm.com

Used Car Loan Service Flow of SAIC-GMAC

Net Interest Income and Net Income of Volkswagen Finance (China), 2013-2018

New Retail Contracts and Penetration Rate of Volkswagen Finance (China), 2008-2020

Main Types of New Car Loans of Volkswagen Finance (China)

Composition of the Loan Product of Volkswagen Finance (China), 2010-2020

Development Course of Chery Huiyin Motor Finance Service

Revenue and Net Income of Chery Huiyin Motor Finance Service, 2014-2020

Revenue Breakdown of Chery Huiyin Motor Finance Service by Business, 2014-2020

Number and Total Amount of Retail Car Loans of Chery Huiyin Motor Finance Service, 2014-2020

Number of Retail Car Loans of Chery Huiyin Motor Finance Service by Type, 2014-2020

Amount of Retail Car Loans of Chery Huiyin Motor Finance Service by Type, 2014-2020

Main New Car Loan Products of Chery Huiyin Motor Finance Service

Cooperative Brands of Chery Huiyin Motor Finance Service

Number of Partners of Chery Huiyin Motor Finance Service at Retail Car Loan Closing by Type, 2014-2018

Equity Structure of BYD Auto Finance

Operating Results of BYD Auto Finance, 2018-2021

Main Auto Finance Products of BYD Auto Finance

Business Flow of BYD Auto Finance

Equity Structure of Ford Automotive Finance (China)

Net Interest Income and Net Income of Ford Automotive Finance (China), 2014-2020

Main Auto Finance Products of Ford Automotive Finance (China)

Loan Process of Ford Automotive Finance (China)

Number of Dealers of Ford Automotive Finance (China), 2014-2020

Number of Cities with Retail Loan Business of Ford Automotive Finance (China), 2014-2020

Loan Structure of Ford Automotive Finance (China)

Retail Loan Business Overview of Ford Automotive Finance (China), 2018-2020

Dealer Loan Business Overview of Ford Automotive Finance (China), 2018-2020

Bond Overview of Ford Automotive Finance (China)

Equity Structure of Dongfeng Nissan Auto Finance

Net Interest Income and Net Income of Dongfeng Nissan Auto Finance, 2015-2020

Retail Credit Business Overview of Dongfeng Nissan Auto Finance, 2018-2020

Dongfeng Nissan Auto Finance’s New Car Loan Products for Dongfeng Nissan Models

Dongfeng Nissan Auto Finance’s New Car Loan Products for Zhengzhou Nissan Models

Dongfeng Nissan Auto Finance’s New Car Loan Products for Venucia Models

Dongfeng Nissan Auto Finance’s New Car Loan Products for Dongfeng Infiniti Models

Car Loan Process of Dongfeng Nissan Auto Finance

Used Car Loan Products of Dongfeng Nissan Auto Finance

Bond Issuance Overview of Dongfeng Nissan Auto Finance by July 2021

Brands Supported by Herald International Financial Leasing

Equity Structure of Herald International Financial Leasing

Net Interest Income and Net Income of Herald International Financial Leasing, 2018-2021

Existing Contracts of BMW Finance, 2016-2021

Main Auto Finance Products of Herald International Financial Leasing

Net Interest Income and Net Income of Toyota Motor Finance (China), 2013-2020

Retail Business of Toyota Motor Finance (China), 2018-2020

Auto Finance Products of Toyota Motor Finance (China)

Loan Process of Toyota Motor Finance (China)

Equity Structure of BMW Automotive Finance (China)

Net Interest Income and Net Income of BMW Automotive Finance (China), 2013-2019

Existing Contracts of BMW Finance, 2016-2021

Main Car Loan Products of BMW Automotive Finance (China)

Car Loan Process of BMW Automotive Finance (China)

Equity Structure of Yulon Motor Finance (China)

Main Operations of Yulon Motor Finance (China)

Car Loan Products of Yulon Motor Finance (China)

Car Loan Process of Yulon Motor Finance (China)

Equity Structure of Changan Auto Finance

Net Interest Income and Net Income of Changan Auto Finance, 2016-2021

Auto Loan Business Structure of Changan Auto Finance, 2018-2020

Inventory Financing Business of Changan Auto Finance, 2018-2021

Consumer Credit Business of Changan Auto Finance, 2018-2021

Personal Car Consumer Loan Products of Changan Auto Finance

Loan Application Procedures of Changan Auto Finance

Used Car Loan Product of Changan Auto Finance

Used Car Business of Changan Auto Finance, 2018-2021

Equity Structure of GAC-SOFINCO Automobile Finance

Net Interest Income and Net Income of GAC-SOFINCO Automobile Finance, 2015-2020

Auto Loan Business Structure of GAC-SOFINCO Automobile Finance, 2018-2020

Retail Loan Business of GAC-SOFINCO Automobile Finance, 2018-2020

Inventory Financing Loan Business of GAC-SOFINCO Automobile Finance, 2018-2020

Auto Finance Products of GAC-SOFINCO Automobile Finance

RSA Service of GAC-SOFINCO Automobile Finance

Approval Process of GAC-SOFINCO Automobile Finance

Bonds of GAC-SOFINCO Automobile Finance

Equity Structure of Genius Auto Finance

Net Interest Income and Net Income of Genius Auto Finance, 2017-2021

Retail Auto Loans of Genius Auto Finance, 2015-2021

Loan Application Procedures of Genius Auto Finance

Equity Structure of Beijing Hyundai Auto Finance

Financing Means of Beijing Hyundai Auto Finance, 2012-2018

Net Interest Income and Net Income of Beijing Hyundai Auto Finance, 2015-2020

Loan Structure of Beijing Hyundai Auto Finance, 2018-2020

Retail Credit Business of Beijing Hyundai Auto Finance, 2018-2020

Inventory Financing Business of Beijing Hyundai Auto Finance, 2018-2020

Key Retail Finance Business of Beijing Hyundai Auto Finance

Loan Application Procedures of Beijing Hyundai Auto Finance

Loan Issuance of Beijing Hyundai Auto Finance, 2013-2021

Loan Amount of Beijing Hyundai Auto Finance, 2013-2021

Key Used Car Finance Business of Beijing Hyundai Auto Finance

Revenue and Net Income of Yongda Automobiles, 2013-2021

Financial Businesses of Yongda Automobiles

Cooperative Agencies of Yongda New Automobile Finance Division

Financial Leasing Revenue of Yongda Automobiles, 2013-2020

Six Advantages of Financial Leasing of Yongda Automobiles

Revenue and Net Income of China Grand Auto, 2014-2021

Revenue Breakdown of China Grand Auto by Business, 2015-2020

Gross Margin of China Grand Auto by Business, 2015-2020

Development Course of All Trust Leasing

Financial Data of All Trust Leasing, 2015-2020

Major Financial Leasing Schemes of All Trust Leasing

Financial Leasing Procedures of All Trust Leasing

Equity Structure of Shaanxi Changyin Consumer Finance

Planned Fundraising Projects of China Grand Auto by Non-public Offering of Share, 2016

Revenue and Net Income of Pang Da Automobile Trade, 2013-2021

Operating Leasing and Financial Leasing of Ling Tai Financial Leasing

Auto Financial Leasing Procedures of Ling Tai Financial Leasing

Financial Data of Pang Da Leye Leasing, 2014-2019

Global Layout of Anhui Yaxia Industry Co, Ltd.

Agent Brands of Anhui Yaxia Industry Co, Ltd.

Revenue of Dongzheng Auto Finance by Segment, 2015-2021

Net Interest Income of Dongzheng Auto Finance, 2016-2021

Loans Issued by Dongzheng Auto Finance (by Type), 2019-2021

Financial Products of Dongzheng Auto Finance

Loan Process of Dongzheng Auto Finance

Layout of Dongzheng Auto Finance in China

Development Course of CANGO

Dealer Network of CANGO in China

CANGO’s Customer Acquisition Network

Revenue and Net Income of CANGO, 2016-2021

Revenue of CANGO by Business, 2016-2021

Transaction Volume Metrics of CANGO

Service Range of CANGO

Service Objects and Contents of CANGO

CANGO’s End-to-end Technology-enabled Auto Platform

Application Flow of CANGO

CANGO’s Auto Financing Transactions

CANGO’s Partnerships with financial institutions

CANGO’s Strategic Synergies with NEV Partners

Presence of Great China Finance Leasing in China

Major Partners of Great China Finance Leasing

Development Course of Great China Finance Leasing

Auto Finance Solution of Great China Finance Leasing

Features of Great China Finance Leasing

Car Purchase Application Procedures of Great China Finance Leasing

Revenue and Net Income of Zhejiang Jingu, 2013-2021

Partners of Jinci Financial

Highlights of Yixin Group, as of Jun. 2021

Development Course of Yixin Group

Revenue and Net Income of Yixin Group, 2016-2021

Revenue of Yixin Group by Business, 2016-2021

Revenue of Yixin Group by Service, 2019-2021

Financed Transactions of Yixin Group, 2016-2021

Transaction Volume of Auto Finance of Yixin Group, 2020H1 & 2021H1

Revenue from Aftermarket and Its Proportion of Yixin Group, 2020H2-2021H1

Major Capital Source and Cost Change Trend of Yixin Group,2020H2-2021H1

Strategy and Business Planning of Yixin Group

Major Partners of eCapital

Development Course of eCapital

Financial Products of eCapital

Tesla-dedicated Financial Leasing Products of eCapital

Revenue and Net Income of Ucar Inc., 2015-2019

Partners of Ucar's Carbank.cn

Dafang Car Rental’s Platform (usedcar.dafang24.com) -- Six Advantages

Dafang Car Rental’s Platform (usedcar.dafang24.com) -- Procedures

Equity Structure of Jiayin Financial Leasing

New Car Financing Schemes of Jiayin Financial Leasing

Used Car Financing Schemes of Jiayin Financial Leasing

Major Cooperative Brands of Souche

Financing of Souche

Cooperative Auto Brands of Tangeche

Development Course of Weidai

Revenue and Net Income of Weidai, 2017-2019

Major Auto Finance Products of Weidai

Revenue and Net Income of XXF, 2017-2021

Revenue from Auto Retail and Financial Leasing Business of XXF, 2017-2021

Revenue from Auto Retail and Financial Leasing Business of XXF by Region, 2017-2021

Revenue from Auto Retail and Financial Leasing Business of XXF by City Level, 2018-2021

Typical Arrangement between Auto Suppliers, Customer and XXF Group

Revenue from Vehicle sold by Financial Leasing of XXF by Brand, 2018-2021

Chinese Independent OEMs’ Telematics System and Entertainment Ecosystem Research Report, 2022

Vehicle telematics system research 1: the control scope is expected to expand to the entire vehicle.From January to December 2022, Chinese independent OEMs installed telematics systems in 6.42 million...

China Autonomous Shuttle Market Report, 2022-2023

Autonomous Shuttle Research: application scenarios further extend amidst policy promotion and continuous exploration

Autonomous shuttles are roughly categorized into minibuses and robobuses. Minibuse...

Intelligent Cockpit Domain Control Unit (DCU) and Head Unit Dismantling Report, 2023 (1)

Dismantling of Head Unit and Cockpit Domain Control Unit (DCU) of NIO, Toyota and Great Wall Motor The report highlights the dismantling of Toyota’s MT2712-based head unit, Fisker’s Intel A2960-based ...

Automotive Vision Algorithm Industry Research Report, 2023

Research on automotive vision algorithms: focusing on urban scenarios, BEV evolves into three technology routes.1. What is BEV?

BEV (Bird's Eye View), also known as God's Eye View, is an end-to-end t...

ADAS Domain Controller Key Component Trends Report, 2022

ResearchInChina researched and summarized China’s current mainstream high computing power ADAS domain controller products such as Huawei MDC and DJI ADAS domain controller prototype, and technical inf...

Automotive High-precision Positioning Research Report, 2023

High Precision Positioning Research: four forms of mass-produced integrated high-precision positioning products

With the continuous development of autonomous driving, the demand for high-precis...

Automotive AUTOSAR Platform Research Report, 2023

AUTOSAR research: CP + AP integration, ecosystem construction, and localization will be the key directions.

AUTOSAR standard technology keeps upgrading, and the willingness to build open cooperation ...

China Autonomous Driving Algorithm Research Report, 2023

Autonomous Driving Algorithm Research: BEV Drives Algorithm Revolution, AI Large Model Promotes Algorithm Iteration

The core of the autonomous driving algorithm technical framework is divided into th...

Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Recently, ResearchInChina selected two key components essential to current intelligent driving assistance systems - front view...

Automotive CMOS Image Sensor (CIS) Chip Industry Research Report, 2022

Automotive CIS research: three major segmentation scenarios create huge market space

It is known that the biggest application market of image sensor is smartphone field. As the smartphone market beco...

Global and China Automotive Cluster and Center Console Industry Report, 2022

Automotive Display Research: Penetration Rate of OLED, Mini LED and Other Innovative Display Technology Increased Rapidly

With the penetration of new energy and intelligent driving vehicles, the tren...

Autonomous Driving Simulation Industry Chain Report (Chinese Companies), 2022

Simulation Research (Part II): digital twin, cloud computing, and data closed-loop improve simulation test efficiency.

Simulation tests can not only be conducted in extreme working conditions and mor...

Automotive Memory Chip Industry Research Report, 2022

Automotive Memory Chip Research: Localization is imperative amid intense competition

The global smart phone storage market size hit US$46 billion in 2021 when the global automotive storage market siz...

Autonomous Driving Simulation Industry Chain Report (Foreign Companies), 2022

Simulation test research: foreign autonomous driving simulation companies forge ahead steadily with localization services.

As the functions of ADAS and autonomous driving systems are developed and th...

China Automotive Multimodal Interaction Development Research Report, 2022

Multimodal interaction research: more hardware entered the interaction, immersive cockpit experience is continuously enhanced

ResearchInChina's “China Automotive Multimodal Interaction Development Re...

Global and China Automotive Operating System (OS) Industry Report,2022

Operating system research: the automotive operating system for software and hardware cooperation enters the fast lane.

Basic operating system: foreign providers refine and burnish functions; Chinese ...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2022

Automotive radar research: installations surged by 49.5% year on year in 2021, and by 35.4% in the first nine months of 2022.

1. The installations of automotive radars sustain growth, and are expect...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2022

In-cabin Monitoring Research: In the first nine months of 2022, the installations of DMS+OMS swelled by 130% yr-on-yr with visual DMS/OMS as the mainstream solution

Local manufacturers are keen to de...