As the electric vehicle market is developing rapidly, new energy vehicle power electronics see a lucrative development opportunity

According to EV Sales, the global electric vehicle sales volume soared by 249% year-on-year to 392,000 units in April 2021. As the electric vehicle market is developing rapidly, new energy vehicle power electronics see a lucrative development opportunity. New energy vehicle power electronics generally include motor controllers (including inverters) and automotive power supplies (automotive chargers and DC/DC).

I. Motor Controller Market

1. BYD leads the highly competitive motor controller market

Benefiting from the rapid development of China's local new energy vehicle brands, Chinese local motor controller vendors led by BYD have obvious advantages in the motor controller market. In 2020, BYD still ranked first with a market share of 13.6%; among the top 10 companies, 7 are Chinese local vendors, except two foreign companies Tesla and Nidec as well as UAES, a Sino-foreign joint venture.

2. Motor controllers are developing towards integration and high voltage

Electronic control is developing towards integration, and three-in-one drive system will become the mainstream

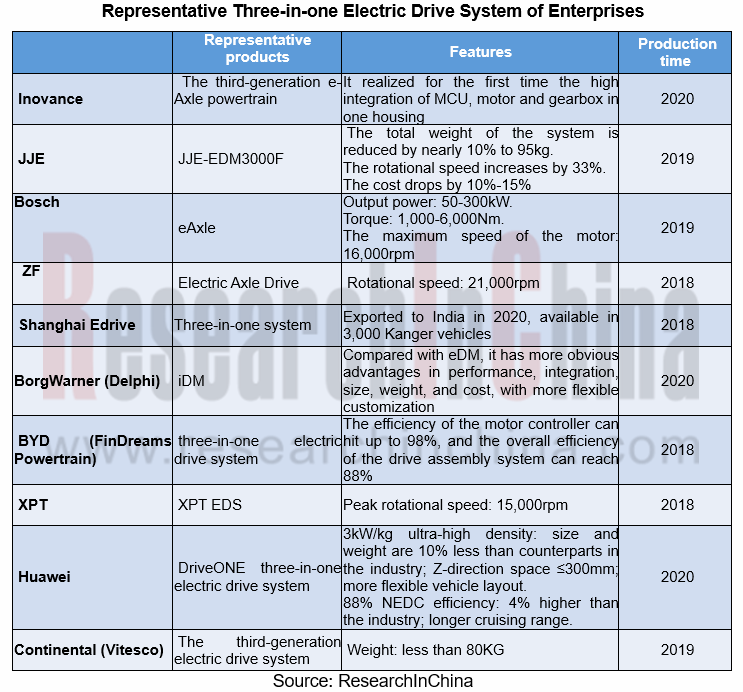

Motor controllers gradually develop from a single function to multi-functional integration, and the integration of motors and electronic control has become a major trend, among which three-in-one electric drive system will become the mainstream. In 2020, China's passenger car three-in-one electric drive system shipments exceeded 500,000 sets, accounting for about 37% of motor controller shipments.

At present, most companies still focus on two-in-one electric drive system, and companies including Bosch, BYD, Inovance, and JJE have launched three-in-one electric drive system. In 2020, Tesla, BYD, XPT and Nidec together accounted for 82.1% of the total sales volume.

The DriveONE three-in-one electric drive system launched by Huawei has the peak power density of 3kW/kg, marking the highest level in the industry, higher than Bosch eAxle which boasts 1.67 kW/kg. In the future, with the efforts of local vendors represented by Huawei and BYD, the gap between local companies and international vendors will gradually narrow.

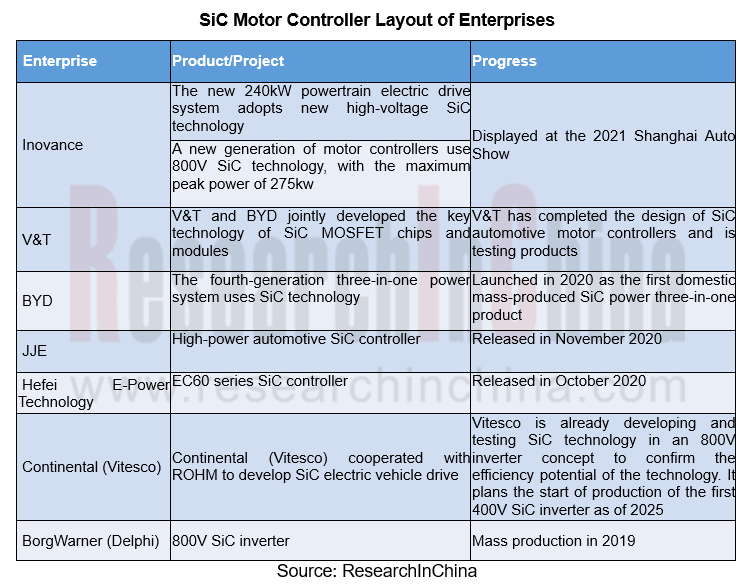

SiC motor controllers are expected to replace IGBTs

As the core components of motor controllers, IGBT modules account for about 45% of the total cost. In 2020, the global new energy vehicle IGBT module market valued approximately USD850 million. However, high-priced automotive IGBT modules have severely compressed the profit margins of electronic control companies and even automakers.

Compared with silicon-based IGBT power devices, SiC power devices feature advantages such as smaller size, lower weight, higher power density, longer cruising range, less controller loss, better thermal conductivity, and higher temperature resistance. Therefore, vendors represented by Delphi and BYD have begun to deploy SiC motor controllers which are expected to replace IGBTs in the future.

II. Automotive Power Supply Market

In Chinese new energy vehicle power supply market, there are mainly four types of players:

Foreign-funded companies mainly target joint venture automakers, while local companies support independent brands. Thanks to the relatively higher sales volume of local new energy vehicles, local companies have a certain advantage in the automotive power supply market. In 2020, there were 6 local companies among the top 10 companies in Chinese new energy vehicle charger OBC market, with the combined market share of 66%.

At present, automotive power supply products are mainly developing towards integration, high power, and bidirectional style.

(1) Integration: By integrating DC/DC, OBC, motors, electronic control devices, etc., the space occupied by the automotive power supply can be reduced, the size of the circuit board, the assembly cost as well as the BOM and PCB cost can be lowered.

(2) High-power: With longer cruising range and higher electrified capacity of electric vehicles, high power like 10kW, 20kW or more will become the mainstream, which is mainly accomplished by the three-phase AC technology. At present, BYD and Shinry have already deployed in this field.

(3) Bidirectional style: Bidirectional DC/DC features high efficiency, small size, and low cost. At the same time, it can also output battery power to the outside, effectively improving power utilization. Two-way automotive chargers can output the electric energy of the battery to realize vehicle-to-vehicle, vehicle-to-load, and vehicle-to-grid charging.

Multi-domain Computing and Zone Controller Research Report, 2022

Multi-domain computing and zone controller research: five design ideas advance side-by-side.In the trend for higher levels of autonomous driving, intelligent vehicles pose more stringent requirements ...

Overseas ADAS and Autonomous Driving Tier 1 Suppliers Report, 2022

Overseas ADAS Tier1 Suppliers Research: The gap between suppliers has widened in terms of revenue growth, and many of them plan to launch L4 products by 2025Countries allow L3/L4 vehicles on the road ...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022

ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function applicat...

China Passenger Car Electronically Controlled Suspension Industry Report, 2022

Research on electronically controlled suspension: four development trends of electronically controlled suspension and air suspension

Basic concepts of suspension and electronically controlled suspens...

China L2/L2+ Smart Car Audio Market Report, 2022

Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy...

China Commercial Vehicle T-Box Report, 2022

TOP10 commercial vehicle T-Box suppliers: using terminal data to build telematics platforms will become a megatrend.

1. From the perspective of market size, the pace of popularizing T-Box accelerates...

Electric Drive and Power Domain Industry Report, 2022

Electric drive and power domain research: efficient integration becomes a megatrend, and integration with other domains makes power domain stronger.

Electric drive systems have gone through several ...

China Autonomous Retail Vehicle Industry Report, 2022

Research on Autonomous Retail Vehicles: Lower Costs Accelerate Mass Production with Ever-spreading Retail Scenarios Autonomous retail vehicles integrate technologies such as 5G, artificial intelligenc...

China Passenger Car Driving and Parking Integrated Solution Industry Report, 2022

Driving and parking integrated solutions stand out in high-level intelligent driving, and the mass adoption is around the corner. According to ResearchInChina, in the first four months of 2022, China'...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022(II)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022 (I)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

China Minicar Industry Report, 2022

Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minic...

China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According...

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...

China Roadside Edge Computing Industry Report, 2022

Roadside Edge Computing Research: how edge computing enables intelligent connected vehicles?

Policies and standards for roadside edge computing are implementing one after another, favoring the boom o...

Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

In 2022Q1, the installation rate of L2 and a...

Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror mark...

Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century....