Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minicars are favored by the working class. In the fuel era, minicars mainly include Chery QQ and Benni MINI. As China vigorously develops electric vehicles, micro electric vehicles have become the focus of minicar marketing and have been recognized by more and more consumers. In recent years, the sales volume of minicars in China has grown rapidly. In 2021, the annual sales volume swelled by 198.2% year-on-year to 978,000 units. It is expected that the industry will continue to grow radically in the short to medium term. By 2027, the sales volume will hit 4.387 million units, with a compound annual growth rate of 28.4% over 2021.

Thanks to star models such as Chery QQ and Changan Benni, minicars enjoyed the market share of 6%-7% before 2008. With the introduction of the policy of popularizing cars in the countryside at the beginning of 2009, the minicar market expanded radically from 30,000 units in 2008 to 750,000 units in 2010. However, the minicar market has been sluggish since 2011 due to the termination of the aforementioned policy. In 2016, only 234,000 minicars (including 120,000 fuel minicars) were sold, accounting for 1.0%.

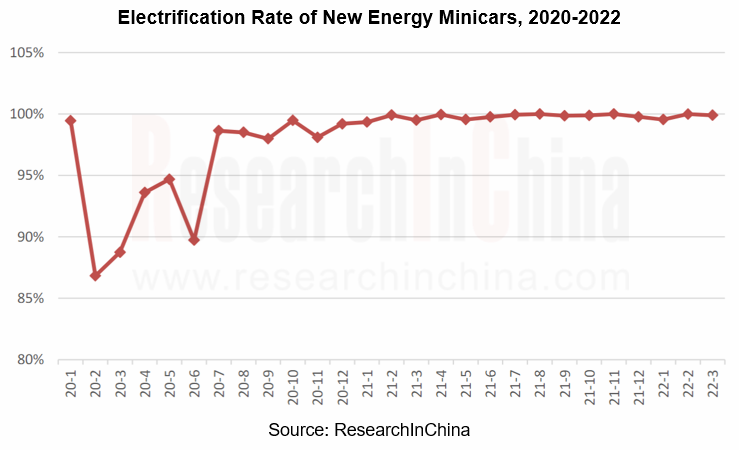

In 2016, the era of electric vehicles came. The subsidy policy sparked the emergence of electric minicars, and pushed up the sales volume of electric minicars to 420,000 units in 2018. But since the subsidy declined, the sales volume dropped to 250,000 units in 2019. In 2020, the stunning Hongguang Mini EV redefined minicars which no longer hover at the low end, so that the market boomed and the sales volume herein soared to 978,000 units in 2021. In the market, nearly 100% minicars are driven by new energy, and they are all battery-electric models. The trend of 100% electrification is expected to continue.

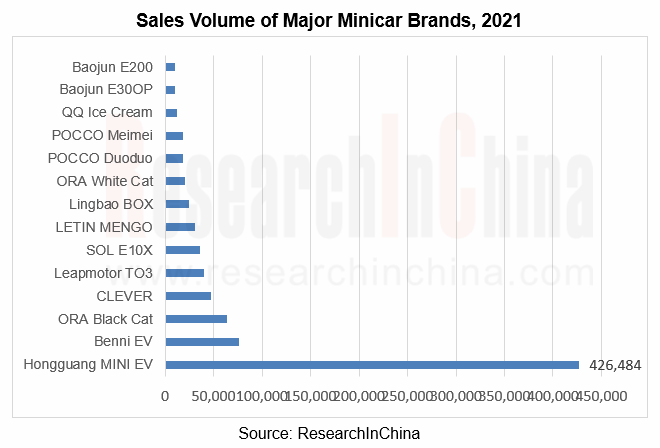

In terms of the competitive landscape, China Passenger Car Association (CPCA) revealed that there were 49 minicar models on sale in the Chinese automotive market in 2021, of which 14 models saw the sales volume of more than 10,000 units each. Among them, SAIC-GM-Wuling's Hongguang Mini EV was far ahead of its competitors with the sales volume of 426,500 units, with a market share of 43.6%. Despite chip shortage and price hikes, the sales volume was still as high as 106,700 units in the first quarter of 2022. Changan Benni EV and Great Wall ORA Black Cat secured the sales volume 76,438 units and 63,492 units respectively in 2021, occupying the second and third places, with the market share of 7.8% and 6.5% separately.

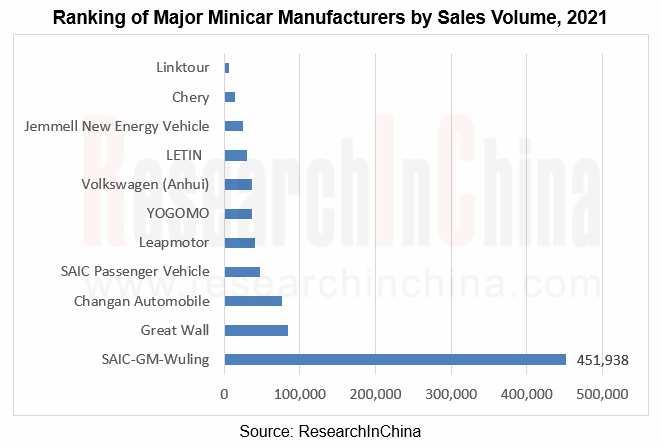

In terms of manufacturers, SAIC-GM-Wuling offered Hongguang MINI EV, Baojun E200, Baojun E300P and Baojun E100 in 2021, which gained the combined sales volume of 451,900 units, accounting for 46.2% of the minicar market. As for the second-ranked Great Wall Motor, ORA White Cat and ORA Black Cat occupied about 8.6% of the minicar market, with the total sales volume of 84,097 units. Changan Automobile only had Benni EV on sale, making up 7.8% of the minicar market as the second runner-up in the market.

Global and China Minicar Industry Report, 2022 highlights the following:

Overview of the minicar industry, including definition, classification, industry policies, etc.;

Overview of the minicar industry, including definition, classification, industry policies, etc.;

The development of Chinese minicar market, including market size, typical brands, driving factors, development trends and competitive landscape at each stage;

The development of Chinese minicar market, including market size, typical brands, driving factors, development trends and competitive landscape at each stage;

Consumption in Chinese minicar market, including customer characteristics, consumption factors and preferences;

Consumption in Chinese minicar market, including customer characteristics, consumption factors and preferences;

Profile, business, main models, and marketing of major minicar manufacturers in China.

Profile, business, main models, and marketing of major minicar manufacturers in China.

Chinese Emerging Carmakers’ Telematics System and Entertainment Ecosystem Research Report, 2022-2023

Telematics service research (III): emerging carmakers work on UI design, interaction, and entertainment ecosystem to improve user cockpit experience.

ResearchInChina released Chinese Emerging Carmake...

China Passenger Car Cockpit-Parking Industry Report, 2023

Cockpit-parking integration research: cockpit-parking vs. driving-parking, which one is the optimal solution for cockpit-driving integration?Cockpit-parking vs. driving-parking, which one is the optim...

Automotive Sensor Chip Industry Report, 2023

Sensor chip industry research: driven by the "more weight on perception" route, sensor chips are entering a new stage of rapid iterative evolution.

At the Auto Shanghai 2023, "more weight on percepti...

Automotive Electronics OEM/ODM/EMS Industry Report, 2023

Automotive electronics OEM/ODM/EMS research: amid the disruption in the division of labor mode in the supply chain, which auto parts will be covered by OEM/ODM/EMS mode? Consumer electronic manu...

China Automotive Smart Glass Research Report, 2023

Smart glass research: the automotive smart dimming canopy market valued at RMB127 million in 2022 has a promising future.Smart dimming glass is a new type of special optoelectronic glass formed by com...

Automotive Ultrasonic Radar and OEM Parking Roadmap Development Research Report, 2023

Automotive Ultrasonic Radar Research: as a single vehicle is expected to carry 7 units in 2025, ultrasonic radars will evolve to the second generation.

As a single vehicle is expec...

Autonomous Driving SoC Research Report, 2023

Research on autonomous driving SoC: driving-parking integration boosts the industry, and computing in memory (CIM) and chiplet bring technological disruption.

“Autonomous Driving SoC Research ...

China ADAS Redundant System Strategy Research Report, 2023

Redundant System Research: The Last Line of Safety for Intelligent VehiclesRedundant design refers to a technology adding more than one set of functional channels, components or parts that enable the ...

Intelligent Steering Key Components Report, 2023

Research on intelligent steering key components: four development trends of intelligent steering

The automotive chassis consists of four major systems: transmission system, steering system, driving ...

Automotive Digital Instrument Cluster Operating System Report, 2023

Digital Instrument Cluster Operating System Report: QNX commanded 71% of the Chinese intelligent vehicle cluster operating system market.

Amid the trend for the integration of digital cluster and cen...

800V High Voltage Platform Research Report, 2023

How to realize the commercialization of 800V will play a crucial part in the strategy of OEMs.

As new energy vehicles and battery technology boom, charging and battery swapping in the new energy vehi...

Automotive Intelligent Cockpit Platform Research Report, 2023

Intelligent cockpit platform research: the boundaries between vehicles and PCs are blurring, and there are several feasible paths for cockpit platforms.

Automotive Intelligent Cockpit Platform Resea...

Global and China Automotive Wireless Communication Module Industry Report,2023

Vehicle communication module research: 5G R16+C-V2X module, smart SiP module and other new products spring up.

In 2022, 4G modules swept 84.3% of the vehicle communication module market....

Intelligent Vehicle Cockpit-Driving Integration Research Report, 2023

Cockpit-Driving Integration Research: many companies are making layout and may implement it during 2024-2025.

1. What is the real cockpit-driving integration?

At present, automotive electroni...

Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosystem Research Report, 2022

Telematics System Research 2: Baidu Family Bucket, Huawei and Tencent Become the Mainstream Ecosystems

ResearchInChina released Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosyst...

China Automotive Digital Key Research Report, 2023

Automotive Digital Key Research: the pace of mobile phones replacing physical keys quickens amid the booming market

"China Automotive Digital Key Research Report, 2023" released by ResearchInChina co...

Automotive Camera Tier2 Suppliers Research Report, 2022-2023

1. The automotive camera market maintains a pattern of "one superpower and several great powers".

Automotive cameras are used to focus the light reflected from the target onto the CIS after refractio...

Emerging Carmaker Strategy Research Report, 2023 - NIO

Emerging carmaker strategy research: NIO is deploying battery swap and sub-brands for the knockout match in 2023.In 2022, the sales surged by 32.3% year on year, being concentrated in first-tier citie...