Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022(II)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate of domain controllers surges.

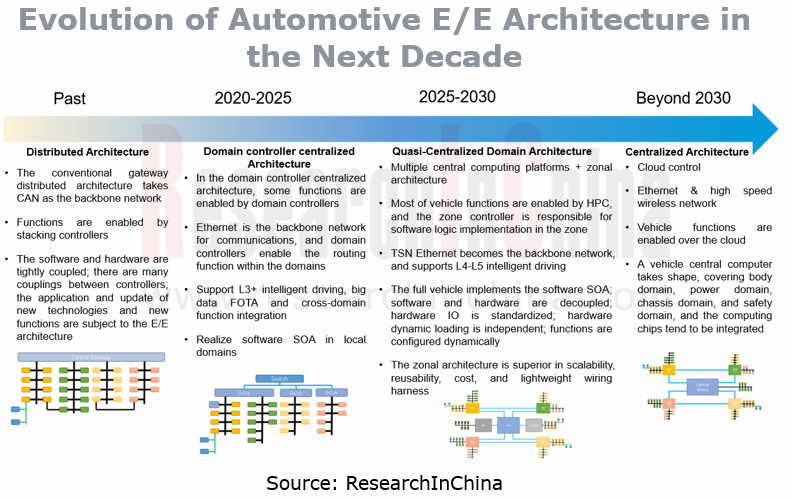

In addition to emerging carmakers that adopt new domain controller architectures from the start, conventional automakers have also stepped up the pace of using domain controllers in vehicles. Typical architectures include Geely Sustainable Experience Architecture (SEA), GAC Protoss Architecture, Great Wall E/E Platform (GEEP), BYD E3.0 Platform, and Volkswagen E3 Architecture. Through the lens of development planning, having achieved mass production of domain controller centralized architectures during 2021-2022, most OEMs will produce cross-domain fusion architectures in quantities between 2022 and 2023, and are expected to spawn centralized architectures from 2024 to 2025.

As OEMs accelerate mass production of new E/E architectures, domain controllers will be a big beneficiary. Taking autonomous driving domain controllers as an example, our statistics show that in 2021, at least 33 OEMs had over 50 production vehicle models equipped with autonomous driving domain controller products, and the number of such production models will surge in 2022.

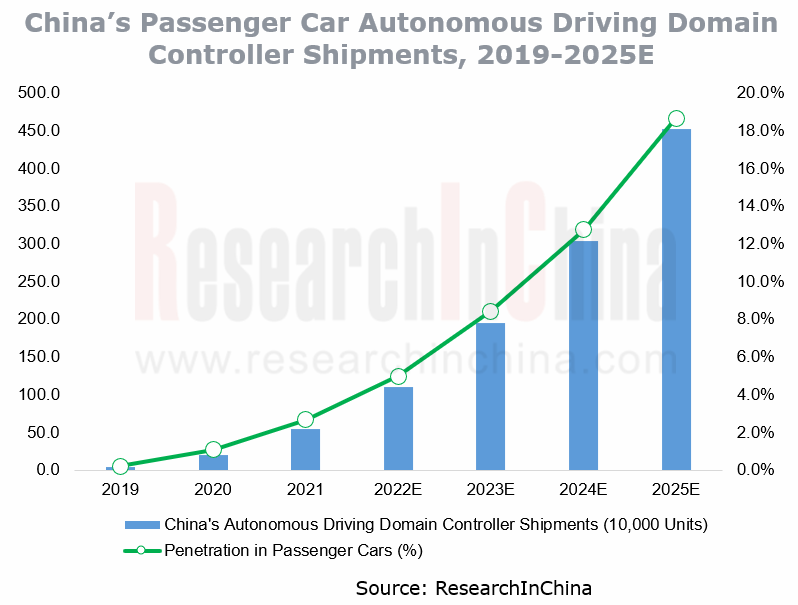

According to ResearchInChina, China shipped 539,000 autonomous driving domain controllers for passenger cars in 2021, with a penetration rate of 2.7%, a figure expected to exceed 5% in 2022. It is conceivable that in 2025, the annual shipments will reach 4.523 million sets, and the penetration rate will jumped to 18.7%; the key driver will be the soaring shipments of L2+ driving and parking integrated domain controllers.

At present, more than 18 suppliers have launched over 20 L2+ driving and parking integrated domain controllers. In 2022, NOA is to be mounted on vehicles on large scale. Also the lightweight driving and parking integrated solutions using TI TDA4 and Horizon J3 chips have lowered 30% to 50% costs compared with the NVIDIA Xavier-driven solutions, helping "NOA+ automated parking" solutions to fully cover passenger cars priced between RMB100,000 and RMB200,000. The increasing number of passenger cars will support L2+ driving assistance functions such as ramp-to-ramp highway pilot, automated parking and home-AVP.

The L3/L4 high computing power domain controllers with built-in high computing power chips, e.g., NVIDIA ORIN-X, Horizon J5, Huawei Ascend 610, EyeQ6, Qualcomm Ride (8540+9000) and Renesas V3U, support high-precision sensors like LiDAR, 4D radar and multiple 8MP cameras, enabling intelligent driving in all highway, urban and parking scenarios. Currently, they are already in the early phase of small-batch shipments, and largely mounted on over RMB300,000 high-end models.

Explore domain controller business models, Tier1, Tier0.5, Tier1.5 or ODM.

Domain controller, as a core component for intelligent connected vehicle platforms, upwardly supports development of application software, and downwardly links E/E architecture and various system components. Its importance is beyond doubt. The competition in the domain controller market tends to be white-hot as multiple business models coexist.

Automakers are of course pleased to see the current competitive landscape. Their partnerships and collaborations with multiple suppliers help them build full-stack self-development capabilities. For automakers, this is also a process of trial and error so as to create a business development model that ultimately suits them.

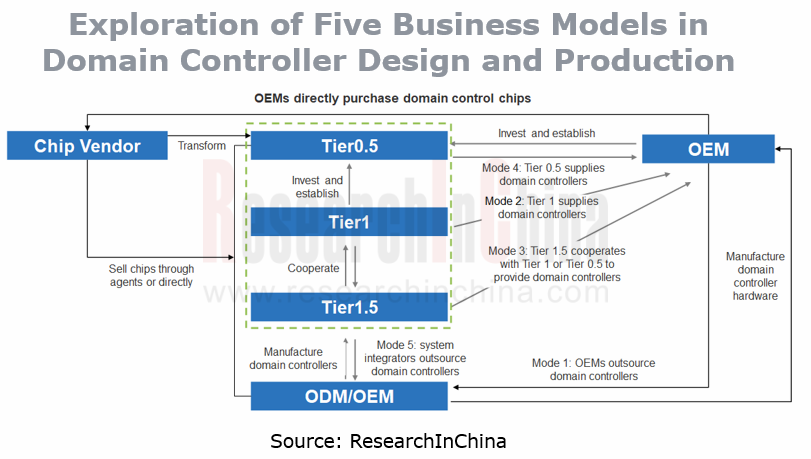

In short, there are now mainly five domain controller design and production modes:

Model 1: OEMs outsource domain controllers. This model is firstly introduced by Tesla, and then adopted by emerging carmakers like NIO and Xpeng Motors. Tesla designs domain controllers, and entrusts the production to Quanta Computer and Pegatron. NIO seeks support from Wistron and Flex. As well as the most basic hardware manufacture, ODMs/OEMs already begin to set foot in software engineering covering domain controller underlying basic software, and BSP driver.

Model 2: Tier 1 suppliers provide domain controller production for OEMs. It is the most common model of cooperation in current stage. Tier 1 suppliers adopt the white box or gray box model; OEMs have the authority to develop the application layer for autonomous driving or intelligent cockpit. Chip vendors, Tier 1 suppliers, and OEMs often form close partnerships. Chip vendors provide chips and develop software stacks and prototype design packages; Tier 1 suppliers provide domain controller hardware production, intermediate layers, and chip solution integration. Typical cooperation cases of this model include Desay SV + NVIDIA + Xpeng Motors/Li Auto/IM Motors, and ZEEKR + Mobileye + iMotion.

Model 3: Tier 1.5 suppliers born in the trend towards software and hardware separation concentrate their efforts on domain controller basic software platforms. Upwardly, they prop up OEMs to hold the independent development authority of systems, and downwardly integrate Tier 2 suppliers’ resources such as chips and sensors. As the originator of this mode, TTTech is currently valued at more than USD1 billion, and introduces key shareholders like Audi, Samsung Electronics, Infineon and Aptiv.

TTTech provides the MotionWise software platform that includes tools and middleware. Technomous co-funded by TTTech and DIAS Automotive Electronic Systems (a company under SAIC) is SAIC’s major supplier of autonomous driving domain controllers. In China, Neusoft Reach, EnjoyMove Technology, ArcherMind Technology, Megatronix Technology, ThunderSoft and the like all tend to enter the domain controller supply chain from software.

Meanwhile, Tier 1 suppliers are also playing the role of the Tier 1.5. For instance, in the field of cockpit domain controllers, Bosch which specializes in underlying cockpit software systems outsources hardware production and ecosystem construction to its partner, AutoLink. For Tier 1 suppliers, they are best able to follow the market development trend by providing a range of solutions such as software, hardware, and software and hardware integrated solutions.

Model 4: Tier 0.5 suppliers are born of OEMs’ needs for full-stack self-development capabilities. Tier 0.5 suppliers tightly bound with OEMs will partake in the whole process of OEMs from R&D, production and manufacture to even later data management and operation. There are three types of Tier 0.5 suppliers:

(1) Some OEMs spin off their parts and components division for independent operation. Examples include DIAS Automotive Electronic Systems under SAIC, Nobo Automotive Technology and Haomo AI under Great Wall Motor, and ECARX under Geely;

(2) Some OEMs seek partnerships with Tier 1 suppliers to establish joint ventures, for example, Anhui Domain Compute co-founded by Hongjing Drive and JAC, and FulScience Automotive Electronics, a joint venture of Desay SV, FAWER Automotive Parts and FAW.

(3) Chip vendors transform into Tier 0.5 suppliers. In the context of chip shortage, chip vendors have a bigger say, and even OEMs have to bypass Tier 1 suppliers to purchase directly from them. Chip vendors no longer feel fulfilled in the role as Tier 2 suppliers, and are trying to develop a strong bond with OEMs. Chip vendors participate in OEMs’ vehicle model development at the very beginning. For example, Mobileye and Geely built strategic cooperation; after acquiring Veoneer, Qualcomm will work harder to roll out autonomous driving and cockpit cross-domain fusion computing platforms; NVIDIA DRIVE Hyperion 8.1 platform is compatible with both autonomous driving and cockpit, and the chip vendor even attempts to join hands with OEMs on an autonomous driving business profit sharing model.

Model 5: system integrators outsource domain controllers to ODMs/OEMs, especially providers of autonomous driving system solutions and intelligent cockpit software platforms. For instance, Baidu’s ACU is produced by Flex, and Haomo AI also cooperates with Flex. Even many autonomous driving start-ups may adopt this model, that is, with ODMs/OEMs providing the automotive OEM hardware production capacity supplement, they supply complete "domain controller + ADAS integrated development" solutions to OEMs, aiming to be better able to compete with conventional Tier 1 suppliers.

In the age of software-defined vehicles, full-stack software system solutions will be the key to gaining competitive edges for domain controller providers.

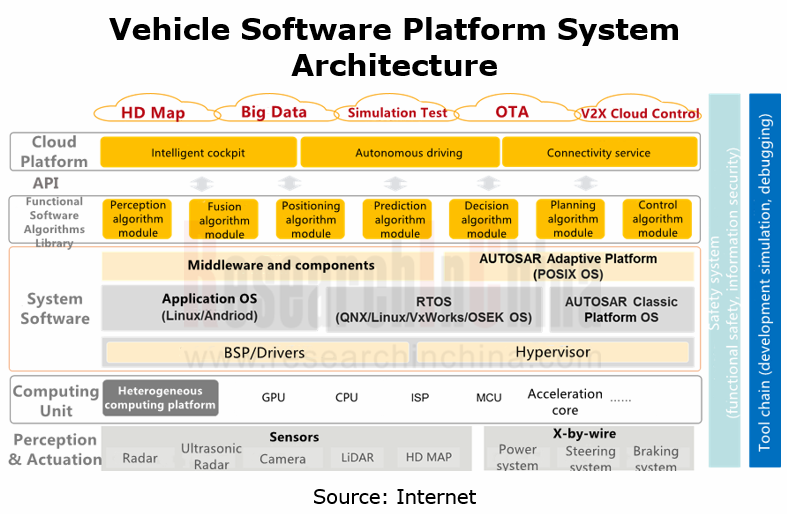

In general, we believe that against a background of software and hardware separation, the full-stack software system development capabilities will play a key part in the future contest. For domain controller providers, the key to gaining competitive edges is the continuous efforts to enrich and build underlying platforms (software-defined hardware, data services, information security, operating systems, etc.), middle-layer platforms (middleware, AutoSAR, chip adaptation, etc.), and application-layer platforms (human-machine interaction (HMI), algorithms, software stack, etc.).

In terms of intelligent cockpit, in PATEO CONNECT+’s case, the company has five core technology platforms: Operating System, Intelligent Voice, Hardware, Map, and Cloud Platform. Based on SOA and software-defined vehicles, PATEO CONNECT+ provides software application development and operation for users in intelligent cockpit, intelligent driving, and body control domain.

The in-depth cooperation with large automakers such as FAW, Dongfeng Motor, BAIC, Geely and SAIC-GM-Wuling allows PATEO to rapidly expand its intelligent cockpit division based on its telematics business. Its solutions from domain controllers and operating systems to hardware, software and cloud three-end intelligent cockpit integrated solutions help automakers create personalized driving experience for users.

At the hardware end, PATEO’s intelligent cockpit domain controller hardware platforms cover Qualcomm 8295/8155, NXP i.MX8QM, MTK8666, and homemade X9H, among others. Its products are led by:

In April 2020, PATEO's i.MX8QM-based intelligent cockpit product was first mounted on production model BEIJING X7. The use of hardware isolation technology supports operation of Linux + Android dual operating systems on the same hardware.

In April 2022, PATEO Qinggan 8155 platform fitted on Voyah Dreamer was launched on market. This platform with QNX Hypervisor technology allows operation of QNX + Android dual operating systems on the same hardware. In June, the platform became available to NETA U, NETA Auto’s new flagship model. It enables the perfect integration of dashboard and entertainment system, and thus cuts much of the hardware and software cost of intelligent cockpit domain controllers.

PATEO CONNECT+ is designing and developing the next-generation Qualcomm 8295-based intelligent cockpit platform with higher levels of domain controller integration. The 8295 chip that supports three-domain fusion will favor a sharp reduction in the cost of the cockpit. Compared with the conventional modes of multiple domain controllers and multiple wire harnesses, the three-domain hardware integration based on the 8295 automotive chip platform takes on integrated control over multiple units such as streaming rearview mirror, central display, air conditioner, and lamps. This mode will save the cost of quite a few domain controllers and intelligent component control units. With this mode, PATEO will derive diverse lower-cost solutions from Qinggan 8295-based cockpit when cooperating with different partners, assisting automakers in slashing their cost. PATEO will expand cooperation and develop solutions in such fields as vehicle intelligence, intelligent vehicle connectivity, SOA, cockpit integration, and central controller-based multi-domain fusion. This new cockpit platform is expected to be rolled out on market with related vehicle models in 2023, providing leading immersive intelligent driving experience for automotive industry.

At the software end, with long-term efforts to develop intelligent cockpit domain controllers from cloud platform to terminal platform, PATEO has built end-to-end design and development capabilities. The cloud end involves technical solution platforms such as CP access, account management, data management, and FOTA. The terminal design and development range from cockpit operating systems to HMI.

As for autonomous driving, taking Neusoft Reach as an example, it boasts the following autonomous driving domain controller products:

Neusoft Reach's new-generation central computing platform for autonomous driving based on Horizon Journey?5 chip supports the access to multi-channel LiDARs, 16-channel high-definition cameras, radars and ultrasonic radars, enabling 360° perception redundancy for the whole vehicle. The platform provides L3/L4 autonomous driving functions on the basis of open SOA, and NeuSAR, the basic software self-developed by Neusoft Reach;

Neusoft Reach’s driving and parking integrated domain controller for autonomous driving enables the access to 5-10 channels of high-definition cameras, 5-channel radars, and 12-channel ultrasonic radars, of which the cameras deliver up to 8 megapixels. The integration of parking and driving functions and sensor sharing render the enhanced perception capability for L2+ autonomous driving. Through the preset basic software and the autonomous driving-specific middleware, the SOA-based software architecture provides developers with a range of development tools;

Neusoft Reach’s X-Box3.0 domain controller enables mass production and application of L0-L3 autonomous driving for multiple scenarios, including multiple function combinations such as interior/exterior scenario, L2-L3 driving scenario, and L3+ parking scenario. This intelligent driving controller has been designated for several production models, and will be mass-produced and put on market in 2022.

In April 2022, Neusoft Reach introduced a software development platform for domain controllers - NeuSAR DS (Domain System). As a complete underlying software development platform, verification system and tool chain for domain controllers (central domain, cockpit domain and intelligent driving domain), NeuSAR DS is designed for OEMs and offers all general software functions between hardware and application layers. The platform provides a wealth of software development and debugging tools, virtualization validation systems, integrated systems, environment deployment services (e.g., IDE), commercial POSIX OS, and third-party OS integration, as well as chip BSP and secure boot solutions.

2 Evolution of Domain Controller Software and Hardware Architectures and Business Models

2.1 Domain Controller Hardware Design

2.1.1 Domain Controller Hardware Architecture

2.1.2 Hardware Architecture Upgrade: ECU Hardware Architecture Upgrade

2.1.3 Communication Architecture Upgrade: Vehicle Backbone Network Evolves to Ethernet

2.1.4 Power Architecture Upgrade: The Power Topology Is Getting More Complex

2.1.5 Challenges in Domain Controller Hardware Design: Power Integrity (PI)

2.1.6 Challenges in Domain Controller Hardware Design: Signal Integrity (SI)

2.1.7 Challenges in Domain Controller Hardware Design: EMC

2.1.8 Challenges in Domain Controller Hardware Design: Power Consumption and Heat Dissipation

2.1.9 Challenges in Domain Controller Hardware Design: Designed Service Life

2.1.10 Challenges in Domain Controller Hardware Design: Testing and Verification

2.1.11 Challenges in Domain Controller Hardware Design: Higher Requirements for Process

2.2 Domain Controller Software Design

2.2.1 Domain Controller Software Architecture

2.2.2 Domain Controller Software Architecture Upgrade: Software Architecture Is Upgraded to Adaptive AutoSAR

2.2.3 "Full-stack Self-development" System Frameworks of OEMs and Tier 1 Suppliers (1)

2.2.4 "Full-stack Self-development" System Frameworks of OEMs and Tier 1 Suppliers (2)

2.2.5 "Full-stack Self-development" Cases of OEMs and Tier 1 Suppliers (1)

2.2.6 "Full-stack Self-development" Cases of OEMs and Tier 1 Suppliers (2)

2.3 Domain Controller Design and Production Models

2.3.1 Domain Controller Design and Production: Five Procurement Models (1)

2.3.2 Domain Controller Design and Production: Five Procurement Models (2)

2.3.3 Domain Controller Design and Production: Five Procurement Models (3)

2.3.4 Domain Controller Design and Production: Three Cooperative Development Models

2.3.5 Domain Controller Design and Production: Three Profit Sharing Models

2.4 Domain Controller ODM/OEM Production Model

2.4.1 Domain Controller ODM/OEM Production Model: Mode of Cooperation

2.4.2 Domain Controller ODM/OEM Production Model: Core Players

2.4.3 Domain Controller ODM/OEM Production Model: Typical Cooperation Cases

4 Research on Intelligent Cockpit Domain Controller Technology and Market

4.1 Evolution of Intelligent Cockpit Domain

4.1.1 Development Trends of Intelligent Cockpit

4.1.2 Trend 1: Following EEA Trends, Cockpit Domain Evolves Towards Domain Fusion, Central Computing and Cloud Computing

4.1.3 Trend 2: Intelligent Cockpit Cross-Domain Fusion (1)

4.1.4 Trend 2: Intelligent Cockpit Cross-Domain Fusion (2)

4.1.5 Trend 3: in Hardware Architecture, Cockpit SoCs Evolve Towards High Computing Power, Scalability and Artificial Intelligence

4.1.6 Trend 4: in Hardware Architecture, Pluggable Hardware Interfaces Support Vehicle Head Unit Hardware System Upgrade

4.1.7 Trend 5: Software Architecture Will be SOA-based Vehicle-Cloud Integrated Platform Architecture

4.1.8 Trend 6: in Software Architecture, Cockpit Software Platforms Tend to Adopt Layered Design

4.2 Cockpit Domain Controller Software and Hardware Solutions of OEMs

4.2.1 Cockpit Domain Controller Software and Hardware Solutions of 34 OEMs (1)

4.2.2 Cockpit Domain Controller Software and Hardware Solutions of 34 OEMs (2)

4.2.3 Cockpit Domain Controller Software and Hardware Solutions of 34 OEMs (3)

4.3 Cockpit Domain Controller Solutions of Tier 1 Suppliers

4.3.1 Summary of Cockpit Domain Controller Solutions of 24 Tier 1 Suppliers (1)

4.3.2 Summary of Cockpit Domain Controller Solutions of 24 Tier 1 Suppliers (2)

4.3.3 Summary of Cockpit Domain Controller Solutions of 24 Tier 1 Suppliers (3)

4.3.4 Summary of Cockpit Domain Controller Solutions of 24 Tier 1 Suppliers (4)

4.4 Solutions of Cockpit Domain Controller Software Suppliers

4.4.1 Summary of Cockpit Domain Controller Software Solutions of 16 Suppliers (1)

4.4.2 Summary of Cockpit Domain Controller Software Solutions of 16 Suppliers (2)

4.4.3 Summary of Cockpit Domain Controller Software Solutions of 16 Suppliers (3)

4.5 Cockpit Domain Controller SoC Solutions

4.5.1 Development Trends of Intelligent Cockpit SoCs

4.5.2 Development Plans of Intelligent Cockpit SoC Vendors

4.5.3 Comparison of Performance Indicators between Intelligent Cockpit SoCs (1)

4.5.4 Comparison of Performance Indicators between Intelligent Cockpit SoCs (2)

4.5.5 Comparison of Performance Indicators between Intelligent Cockpit SoCs (3)

4.6 Cockpit Domain Controller Market Size

4.6.1 China's Intelligent Cockpit Market Size

4.6.2 China’s Intelligent Cockpit Domain Controller Shipments (10,000 Units), 2021-2025E

4.6.3 Competitive Landscape of Intelligent Cockpit Domain Controller Market (Roles Three-Party Players Pursue)

6 Chinese Domain Controller Manufacturers

6.1 Huawei

6.1.1 CC Architecture

6.1.2 Based on the CC Architecture, Launched Three Domain Controller Computing Platforms: MDC+CDC+VDC

6.1.3 CDC Intelligent Cockpit Computing Platform

6.1.4 HarmonyOS Intelligent Cockpit Platform and Pluggable Head Unit Modules

6.1.5 Kirin 990A Automotive Cockpit Chip

6.1.6 Harmony Cockpit HOS-A Software Platform (1)

6.1.7 Harmony Cockpit HOS-A Software Platform (2)

6.1.8 Intelligent Cockpit Domain Controller Platform: Some Mass Production Cases (1)

6.1.9 Intelligent Cockpit Domain Controller Platform: Some Mass Production Cases (2)

6.1.10 MDC Autonomous Driving Computing Platform: Product Portfolios

6.1.11 MDC Autonomous Driving Computing Platform: Technical Features

6.1.12 MDC Autonomous Driving Computing Platform: Software and Hardware Architecture

6.1.13 ADS Full-Stack Solution for Advanced Autonomous Driving

6.1.14 MDC Autonomous Driving Computing Platform: Technical Features

6.1.15MDC Autonomous Driving Computing Platform: Application Fields

6.1.16 MDC Autonomous Driving Computing Platform: MDC810

6.1.17 MDC Autonomous Driving Computing Platform: Parameters of MDC 210 and MDC 610

6.1.18 MDC Autonomous Driving Computing Platform: Platform Framework

6.1.19 MDC Autonomous Driving Computing Platform: Hardware Platform

6.1.20 MDC Autonomous Driving Computing Platform: Software Architecture

6.1.21 MDC Autonomous Driving Computing Platform: Software and Toolchain (1)

6.1.22 MDC Autonomous Driving Computing Platform: Software and Toolchain (2)

6.1.23 MDC Autonomous Driving Computing Platform: Software and Toolchain (3)

6.1.24 MDC Autonomous Driving Computing Platform: Software and Toolchain (4)

6.1.25 MDC Autonomous Driving Computing Platform: Automotive Security Platform

6.1.26 MDC Autonomous Driving Computing Platform: ISO26262 and ASPICE Certifications

6.1.27 MDC Computing Platform: Customers and Partners

6.1.28 MDC Computing Platform: Some Mass Production Cases

6.2 PATEO CONNECT+

6.2.1 Profile

6.2.2 Business Product Lines

6.2.3 Production and R&D Layout

6.2.4 Cockpit Products and Development History

6.2.5 Cockpit Platform Technology Evolution Direction

6.2.6 Intelligent Cockpit Domain Controllers: Product Lines

6.2.7 Intelligent Cockpit Domain Controllers: Qinggan 8155 Intelligent Cockpit Platform

6.2.8 Intelligent Cockpit Domain Controller Application Cases: Voyah FREE (1)

6.2.9 Intelligent Cockpit Domain Controller Application Cases: Voyah FREE (2)

6.2.10 Intelligent Cockpit Domain Controller Application Cases: Voyah Dreamer (1)

6.2.11 Intelligent Cockpit Domain Controller Application Cases: Voyah Dreamer (2)

6.2.12 Intelligent Cockpit Domain Controller Application Cases: NETA U Pro

6.2.13 Intelligent Cockpit Domain Controller Application Cases: BEIJING-X7

6.2.14 Intelligent Cockpit Platform: Layout of Forward-looking Technologies

6.3 Neusoft Reach

6.3.1 Autonomous Driving Domain Controllers: Product Lines (1)

6.3.2 Autonomous Driving Domain Controllers: Product Lines (2)

6.3.3 New-Generation Autonomous Driving Central Computing Platform: Equipped with Journey?5 Chip

6.3.4 Autonomous Driving Domain Controllers: X-BOX 3.0

6.3.5 Autonomous Driving Domain Controllers: Driving and Parking Integrated Domain Controller for Autonomous Driving

6.3.6 Autonomous Driving Domain Controllers: ADAS Domain Controller M-box

6.3.7 Commercial Vehicle ADAS Domain Controllers

6.3.8 General Domain Controllers: Platform Features

6.3.9 General Domain Controllers: Performance Characteristics and Application Areas

6.3.10 Domain Controller Software: Software Middleware and Ecological Software Package

6.3.11 Domain Controller Software: Adopting Open SOA

6.3.12 Domain Controller Software: NeuSAR DS Domain Controller Software Development Platform

6.3.13 Domain Controller Software: What NeuSAR DS Can Bring to OEMs?

6.3.14 Domain Controller Software: Technical Advantages of NeuSAR DS

6.3.15 NeuSAR: Next-Generation Automotive "Operating System" - NeuSAR Automotive Basic Software Platform

6.3.16 Basic Software: Software Architecture for SDV (Software Defined Vehicle)

6.3.17 Basic Software: SDV-oriented Series Solutions

6.3.18 Basic Software: NeuSAR System Architecture

6.3.19 Basic Software: NeuSAR Acquired ASIL-D Functional Safety Certificate

6.4 Desay SV

6.4.1 Latest Developments in the Three Major Businesses in 2021 (1)

6.4.2 Latest Developments in the Three Major Businesses in 2021 (2)

6.4.3 Intelligent Cockpit Domain Controllers: Product Development Planning

6.4.4 Third-Generation Intelligent Cockpit Domain Controllers

6.4.5 Third-Generation Cockpit Domain Controller Application Cases: Li ONE

6.4.6 Third-Generation Cockpit Domain Controller Application Cases: Tiggo 8 PLUS

6.4.7 Desay SV Cooperated with Huawei on HUAWEI HiCar Intelligent Connectivity Solution

6.4.8 Desay SV’s Intelligent Cockpit Domain Controller Project Passed ASPICE CL2 Evaluation

6.4.9 IPU Autonomous Driving Domain Controllers: Product Development Planning

6.4.10 IPU Autonomous Driving Domain Controllers: Revenue Expectation

6.4.11 IPU Autonomous Driving Domain Controllers: Software and Hardware Architecture and Division of Labor Logic

6.4.12 IPU Autonomous Driving Domain Controllers: Technology Roadmap

6.4.13 IPU Autonomous Driving Domain Controllers: Product Comparison (1)

6.4.14 IPU Autonomous Driving Domain Controllers: Product Comparison (2)

6.4.15 IPU Autonomous Driving Domain Controllers: Ecosystem Building

6.4.16 Cross-Domain Fusion Intelligent Computing Platform (ICP): "Aurora"

6.4.17 "Aurora" Domain Fusion Central Computing Platform: Performance Characteristics

6.4.18 "Aurora" Domain Fusion Central Computing Platform: Design Scheme (1)

6.4.19 "Aurora" Domain Fusion Central Computing Platform: Design Scheme (2)

6.4.20 IPU04 Autonomous Driving Domain Controller: Hardware Architecture

6.4.21 IPU04 Autonomous Driving Domain Controller: Software Architecture

6.4.22 IPU03 Domain Controller: Forged Strategic Partnerships with Xpeng Motors and NVIDIA

6.4.23 IPU02 Driving and Parking Integrated Controller: Using TI Jacinto 7 TDA4 SoC

6.4.24 Desay SV Bought in Momenta and MAXIEYE to Improve Its Intelligent Driving Strategy

6.5 ADAYO

6.5.1 Intelligent Cockpit Layout: Four Elements

6.5.2 Cockpit Domain Controllers: Highlights of the Fourth-Generation Products

6.5.3 Cockpit Domain Controllers: Developed Based on ADAYO AAOP 2.0

6.5.4 Cockpit Domain Controllers: Three Solutions

6.6 Haomo AI

6.6.1 Profile

6.6.2 Three Core Product Lines

6.6.3 "Little Magic Box" Intelligent Driving Domain Controller: Product Development Planning

6.6.4 Autonomous Driving Domain Controller: "Little Magic Box 3.0" (IDC 3.0)

6.6.5 Hpilot Autonomous Driving Product Roadmap

6.6.6 Hpilot Autonomous Driving Solutions: Products and Partners

6.6.7 Collecting Data via the "Little Magic Box" for Intelligent Training

6.6.8 Haomo AI Will Become One of the Largest Autonomous Driving Solution Suppliers in China

6.6.9 Data Intelligence System Product: MANA (Snow Lake)

6.6.10 "Data Intelligence System MANA" (1)

6.6.11 "Data Intelligence System MANA" (2)

6.6.12 Haomo AI Uses the Fundamental Model to Automatically Diagnose the Domain Model

6.6.13 New Technologies: Transformer-based Visual Recognition Technology

6.6.14 New Technologies: Cognitive Security Model CSS

6.6.15 Customers and Partners

6.7 Nobo Automotive Technology

6.7.1 Intelligent Cockpit Service Positioning

6.7.2 Three-Step Development Strategy

6.7.3 Business Divisions and Product Lines

6.7.4 Layout of R&D and Production Centers

6.7.5 Cockpit Domain Controllers: Product Lines (1)

6.7.6 Cockpit Domain Controllers: Product Lines (2)

6.7.7 Cockpit Domain Controllers: Product Development Roadmap (1)

6.7.8 Cockpit Domain Controllers: Product Development Roadmap (2)

6.7.9 IN9.0 Cockpit Domain Controller (Based on Qualcomm 8155)

6.7.10 IN9.0 Cockpit Domain Controller: Block Diagram

6.7.11 IN9.0 Cockpit Domain Controller: Technical Features

6.7.12 IN7.0 Cockpit Domain Controller (Based on Qualcomm 6155)

6.7.13 Cockpit Domain Controller Software Solutions

6.8 Freetech

6.8.1 Autonomous Driving Domain Controllers: Product Lines (1)

6.8.2 Autonomous Driving Domain Controllers: Product Lines (2)

6.8.3 Autonomous Driving Domain Controllers: Product Roadmap

6.8.4 Autonomous Driving Domain Controllers: ADC20 for Cost-Effective Driving and Parking Integrated Solutions (1)

6.8.5 Autonomous Driving Domain Controllers: ADC20 for Cost-Effective Driving and Parking Integrated Solutions (2)

6.8.6 Autonomous Driving Domain Controllers: ADC25 for Enhanced Parking and Parking Integrated Solutions

6.8.7 Autonomous Driving Domain Controllers: ADC30 for L3 Advanced Autonomous Driving Solutions (1)

6.8.8 Autonomous Driving Domain Controllers: ADC30 for L3 Advanced Autonomous Driving Solutions (2)

6.8.9 Autonomous Driving Domain Controllers: ADC30 for L3 Advanced Autonomous Driving Solutions (3)

6.8.10 Autonomous Driving Domain Controllers: Comparison between Product Lines

6.8.11 Autonomous Driving Product Roadmap

6.8.12 End-to-end Full-Stack Process Solutions

6.8.13 Advanced Autonomous Driving Solutions (1)

6.8.14 Advanced Autonomous Driving Solutions (2)

6.8.15 Advanced Autonomous Driving Solutions (3)

6.8.16 Advanced Autonomous Driving Solutions (4)

6.9 Technomous

6.9.1 Autonomous Driving Domain Controllers: Product Portfolios (1)

6.9.2 Autonomous Driving Domain Controllers: Product Portfolios (2)

6.9.3 Intelligent Driving Domain Controller iECU1.5: Based on TI TDA4VM SoC

6.9.4 Intelligent Driving Domain Controller iECU1.5: Technical Features

6.9.5 Autonomous Driving Domain Controllers: MotionWise Software Platform

6.9.6 Autonomous Driving Domain Controllers: Software Platform Solutions

6.9.7 Autonomous Driving Domain Controllers: Typical Customer Applications

6.10 iMotion

6.10.1 Profile

6.10.2 Autonomous Driving Domain Controllers: Customers

6.10.3 iMotion Introduced "End-To-End" Integrated Solutions and Domain Controller Products

6.10.4 Driving and Parking Integrated Domain Controllers: IDC MID and IDC HIGH

6.10.5 Driving and Parking Integrated Solutions: Hardware Configuration and Functional Highlights

6.10.6 iMotion Big Data Closed-Loop System Facilitates the Implementation of All Scenarios

6.11 Hong Jing Drive

6.11.1 Profile

6.11.2 Autonomous Driving Domain: L4-oriented, Application Dimensionality Reduced to L2, L2+ and L3 Products

6.11.3 Autonomous Driving Domain Controllers: Product Line Layout (1)

6.11.4 Autonomous Driving Domain Controllers: Product Line Layout (2)

6.11.5 Autonomous Driving Domain Controllers: Product Lines

6.11.6 Autonomous Driving Domain Controllers: IPM Smart Camera Module and APA/IDDC Domain Controller

6.11.7 Autonomous Driving Domain Controllers: High-Level Autonomous Driving Control Unit (ADCU)

6.11.8 "Gemini" Computing Platform and Autonomous Driving Full-Stack Technology Capabilities

6.11.9 Autonomous Driving System Architecture

6.11.10 The L3 Heavy Truck Jointly Developed by Hong Jing Drive and JAC Will Be Mass-Produced in H1 2022

6.11.11 Hong Jing Drive Provided Domain Controllers and Intelligent Driving Engineering Services for Li ONE

6.11.12 Domain Controller Capacity: Building A Smart Factory

6.12 Unlimited AI

6.12.1 Profile

6.12.2 Intelligent Driving Domain Controllers: Mode of Cooperation

6.12.3 Intelligent Driving Domain Controllers: Product Lines

6.12.4 Software-Defined ADAS All-in-One

6.12.5 L2.99 Multifunctional Intelligent Driving Domain Controller: "Wukong No.1"

6.12.6 L2.99 Intelligent Driving Domain Controller: Mass-Produced and Mounted on Chery Big Ant

6.12.7 L2.99 Intelligent Driving Domain Controller: Technical Advantages

6.12.8 L2.99 Intelligent Driving Domain Controller: Hardware Architecture

6.12.9 L2.99 Intelligent Driving Domain Controller: Specifications and Interface Capabilities

6.12.10 Dual J3+X9H High Performance Multi-Domain Controller

6.12.11 Dual J3 Intelligent Driving Domain Controller

6.12.12 Vehicle Central Computer (HPC)

6.13 In-Driving

6.13.1 Profile

6.13.2 Business Model and Core Businesses

6.13.3 Autonomous Driving Domain Controller Iteration and Cost Reduction Path

6.13.4 Autonomous Driving Domain Controllers: Product Line Layout (1)

6.13.5 Autonomous Driving Domain Controllers: Product Line Layout (2)

6.13.6 Fifth-Generation Domain Controller: TITAN5

6.13.7 Autonomous Driving Domain Controller: TITAN 4

6.13.8 Autonomous Driving Domain Controller: TITAN 3

6.13.9 Autonomous Driving Domain Controllers: Technical Parameters and Architecture of TITAN 3

6.13.10 Autonomous Driving Domain Controllers: System Framework of TITAN 3

6.13.11 Autonomous Driving Domain Controllers: Performance Parameters of TITAN 3

6.13.12 Autonomous Driving Software Platform: Athena

6.13.13 TITAN and PALLAS: Verified in a Real Vehicle with a Full Visual Perception Solution

6.13.14 TITAN and PALLAS: Verified in a Real Vehicle with a Full Visual Perception Solution

6.13.15 In-Driving Cooperated with Huawei: Jointly Released a Minibus Solution with Huawei MDC

6.14 Yihang.AI

6.14.1 Autonomous Driving Mass Production Path

6.14.2 NOA Driving and Parking Integrated Solution (1)

6.14.3 NOA Driving and Parking Integrated Solution (2)

6.14.4 All-Scenario Full Self-Driving (FSD) Solution

6.15 Baidu

6.15.1 Autonomous Driving Domain Controllers: Roadmap

6.15.2 Autonomous Driving Domain Controllers: Product Layout

6.15.3 Technical Features of Autonomous Driving Computing Platform 1.0 (Wuren)/2.0 (Sixi)/3.0 (Sanxian)

6.15.4 Autonomous Driving Computing Platform: Cooperated with NVIDIA on Use of DRIVE Orin Chip in “Sanxian” Domain Controller

6.15.5 Autonomous Driving Computing Platform ACU (Sixi)

6.15.6 Autonomous Driving Computing Platform ACU (Sixi) Uses TI TDA4 Processor

6.15.7 Apollo Focuses on Promoting ANP+AVP Global Intelligent Driving System

6.15.8 Apollo 6.0 Autonomous Driving Solution

6.15.9 Apollo's Fifth-Generation Robotaxi Model - Apollo Moon

6.15.10 Apollo Autonomous Driving Scenario Was Implemented

6.15.11 Intelligent Cockpit: Apollo Internet of Vehicles

6.16 Jingwei Hirain

6.16.1 Profile

6.16.2 Autonomous Driving Domain Controllers: Product Line Layout

6.16.3 Intelligent Driving Domain Controller (ADCU) and Vehicle High Performance Computing Platform (HPC)

6.16.4 ADAS Domain Controllers

6.16.5 ADAS Domain Controllers: Performance Characteristics

6.17 Joynext

6.17.1 Cockpit Domain Controllers: Business

6.17.2 Cockpit Domain Controllers: Software Architecture (1)

6.17.3 Cockpit Domain Controllers: Software Architecture (2)

6.17.4 Intelligent Cockpit Evolution Route

6.17.5 Human-Machine Copilot System: Intelligent Cockpit HMI for High-Level Autonomous Driving

6.17.6 Cockpit and Autonomous Driving Domain Controllers: Development Progress

6.18 Hangsheng Electronics

6.18.1 Product Layout

6.18.2 Intelligent Cockpit Ecosystem

6.18.3 Intelligent Cockpit Rapid Iteration Capability

6.18.4 New-Generation Cockpit Domain Controllers Based on Qualcomm 8155

6.18.5 Cockpit Domain Controllers: Product Planning

6.19 BICV

6.19.1 Profile

6.19.2 Business Layout of Parent Company BDStar Navigation

6.19.3 Intelligent Cockpit Domain Controllers

6.19.4 Visual Controller (CVBOX)

6.20 UAES

6.20.1 XE and UAES Software Platform (USP) of Cross-Domain Control Business Division

6.20.2 Vehicle Computing Platform (VCP)

6.20.3 Zone Controllers

6.20.4 Scalable Domain Controller Platform: XCU 8.0

6.20.5 AUTOSAR-based Open Software Platform

6.20.6 SOA Application under New EEA (1)

6.20.7 SOA Application under New EEA (2)

6.20.8 SOA Software and Conventional Embedded Software

6.20.9 Vehicle Computing Platform Software Architecture and USP Software Platform

6.21 Youkong Zhixing

6.21.1 Profile

6.21.2 Domain Controllers: Planned Business Directions

6.21.3 Autonomous Driving Domain Controllers: Hardware Platform (1)

6.21.4 Autonomous Driving Domain Controllers: Hardware Platform (2)

6.21.5 Autonomous Driving Domain Controllers: Software Platform Architecture

6.21.6 Autonomous Driving Domain Controllers: Implementation of Software Functions

6.21.7 Autonomous Driving Domain Controllers: Technical Highlights or Differentiation

6.21.8 Autonomous Driving Domain Controllers: Product Development Planning

6.21.9 Autonomous Driving Domain Controllers: Performance Parameters of EAXVA04 / EAXVA05

6.21.10 Autonomous Driving Domain Controllers: Performance Parameters of EAXVA03

6.21.11 Autonomous Driving Domain Controllers: Cooperative Customers

6.21.12 Autonomous Driving Domain Controller Application Cases: Meituan Autonomous Delivery Vehicle

6.21.13 Autonomous Driving Domain Controller Application Cases: Yutong L4 Autonomous Bus

6.21.14 Youkong Zhixing and Black Sesame Technologies Developed an Intelligent Driving Computing Platform

6.22 Idriverplus

6.22.1 Three Core Business Lines

6.22.2 Autonomous Driving Brains: AVDC+AVOS+BBOX (1)

6.22.3 Autonomous Driving Brains: AVDC+AVOS+BBOX (2)

6.22.4 Autonomous Driving Brains: Application Cases

6.22.5 Autonomous Driving Brains: AVOS and AVCU

6.22.6 Autonomous Driving Brains: AVOS Software System Architecture

6.23 DJI Automotive

6.23.1 Profile

6.23.2 Three Major Solutions for Intelligent Driving

6.23.3 Autonomous Driving Domain Controllers: Features

6.23.4 Autonomous Driving Domain Controllers: Middleware

6.23.5 Autonomous Driving Domain Controllers: Mass-produced and Mounted on SAIC-GM-Wuling Baojun

6.24 EnjoyMove Technology

6.24.1 Profile and Products

6.24.2 Intelligent Domain Controller: DCU3.0

6.24.3 DCU3.0: Technical Features

6.24.4 DCU3.0: System Architecture Design

6.24.5 DCU3.0: Adopting L3 Functional Safety Design

6.24.6 DCU3.0: Driving and Parking Integrated System Architecture Design

6.24.7 High Performance Computing Software Platform: EMOS1.0

6.24.8 High Performance Computing Software Platform: Technical Features of EMOS1.0

6.24.9 High Performance Computing Software Platform: Multi-Domain Fusion Software Platform

6.24.10 Multi-Domain Fusion Computing Platform

6.24.11 Business Model

6.25 Novauto

6.25.1 Profile

6.25.2 Computing Platform for High-Level Advanced Autonomous Driving: NOVA30P

6.25.3 NOVA30P: Technical Architecture and Features

6.25.4 Automatic Compression Tool: NOVA-Slim

6.25.5 Training and Acceleration Tool: NOVA-3D

6.25.6 NOVA-Box Intelligent Driving Computing Platform

6.25.7 NOVA-Box Computing Platform Solutions (1)

6.25.8 NOVA-Box Computing Platform Solutions (2)

6.25.9 NOVA-Box Computing Platform Solutions (3)

6.25.10 Partners

6.26 Intron Technology

6.26.1 Intron Technology and Horizon Robotics Jointly Developed an Autonomous Driving Domain Controller

6.26.2 L3 and above Autonomous Driving Domain Controllers: System Architecture (1)

6.26.3 L3 and above Autonomous Driving Domain Controllers: System Architecture (2)

6.26.4 CAELUS Autonomous Driving Domain Controller Solution: Based on Xilinx MPSoC

6.27 Yuanfeng Technology

6.27.1 Profile

6.27.2 Mass-Produced Qualcomm 8155-based Intelligent Cockpit Domain Controller

6.28 AutoLink

6.28.1 Profile

6.28.2 Layout of Intelligent Cockpit Domain Controller Capacity

6.28.3 AutoLink and Bosch Jointly Developed a Cockpit Domain Controller

Global and China Solid State Battery Industry Report, 2023

Solid state battery research: semi-solid state battery has come out, is all-solid state battery still far away?In recent years, the new energy vehicle market has been booming, and the penetration of n...

Global and China Passenger Car T-Box Market Report, 2023

T-Box industry research: the market will be worth RMB10 billion and the integration trend is increasingly clear.

ResearchInChina released "Global and China Passenger Car T-Box Market Report, 2023", w...

Analysis Report on Auto Shanghai 2023

Analysis on 75 Trends at Auto Shanghai 2023: Unprecedented Prosperity of Intelligent Cockpits and Intelligent Driving Ecology

After analyzing the intelligent innovation trends at the Auto Shanghai 20...

Chinese Emerging Carmakers’ Telematics System and Entertainment Ecosystem Research Report, 2022-2023

Telematics service research (III): emerging carmakers work on UI design, interaction, and entertainment ecosystem to improve user cockpit experience.

ResearchInChina released Chinese Emerging Carmake...

China Passenger Car Cockpit-Parking Industry Report, 2023

Cockpit-parking integration research: cockpit-parking vs. driving-parking, which one is the optimal solution for cockpit-driving integration?Cockpit-parking vs. driving-parking, which one is the optim...

Automotive Sensor Chip Industry Report, 2023

Sensor chip industry research: driven by the "more weight on perception" route, sensor chips are entering a new stage of rapid iterative evolution.

At the Auto Shanghai 2023, "more weight on percepti...

Automotive Electronics OEM/ODM/EMS Industry Report, 2023

Automotive electronics OEM/ODM/EMS research: amid the disruption in the division of labor mode in the supply chain, which auto parts will be covered by OEM/ODM/EMS mode? Consumer electronic manu...

China Automotive Smart Glass Research Report, 2023

Smart glass research: the automotive smart dimming canopy market valued at RMB127 million in 2022 has a promising future.Smart dimming glass is a new type of special optoelectronic glass formed by com...

Automotive Ultrasonic Radar and OEM Parking Roadmap Development Research Report, 2023

Automotive Ultrasonic Radar Research: as a single vehicle is expected to carry 7 units in 2025, ultrasonic radars will evolve to the second generation.

As a single vehicle is expec...

Autonomous Driving SoC Research Report, 2023

Research on autonomous driving SoC: driving-parking integration boosts the industry, and computing in memory (CIM) and chiplet bring technological disruption.

“Autonomous Driving SoC Research ...

China ADAS Redundant System Strategy Research Report, 2023

Redundant System Research: The Last Line of Safety for Intelligent VehiclesRedundant design refers to a technology adding more than one set of functional channels, components or parts that enable the ...

Intelligent Steering Key Components Report, 2023

Research on intelligent steering key components: four development trends of intelligent steering

The automotive chassis consists of four major systems: transmission system, steering system, driving ...

Automotive Digital Instrument Cluster Operating System Report, 2023

Digital Instrument Cluster Operating System Report: QNX commanded 71% of the Chinese intelligent vehicle cluster operating system market.

Amid the trend for the integration of digital cluster and cen...

800V High Voltage Platform Research Report, 2023

How to realize the commercialization of 800V will play a crucial part in the strategy of OEMs.

As new energy vehicles and battery technology boom, charging and battery swapping in the new energy vehi...

Automotive Intelligent Cockpit Platform Research Report, 2023

Intelligent cockpit platform research: the boundaries between vehicles and PCs are blurring, and there are several feasible paths for cockpit platforms.

Automotive Intelligent Cockpit Platform Resea...

Global and China Automotive Wireless Communication Module Industry Report,2023

Vehicle communication module research: 5G R16+C-V2X module, smart SiP module and other new products spring up.

In 2022, 4G modules swept 84.3% of the vehicle communication module market....

Intelligent Vehicle Cockpit-Driving Integration Research Report, 2023

Cockpit-Driving Integration Research: many companies are making layout and may implement it during 2024-2025.

1. What is the real cockpit-driving integration?

At present, automotive electroni...

Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosystem Research Report, 2022

Telematics System Research 2: Baidu Family Bucket, Huawei and Tencent Become the Mainstream Ecosystems

ResearchInChina released Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosyst...