Charging Infrastructure Research: Three Modes for Self-Building and Operation of OEM’s Charging Piles

Global charging pile ownership surged, while high-power fast charging network leads the growth

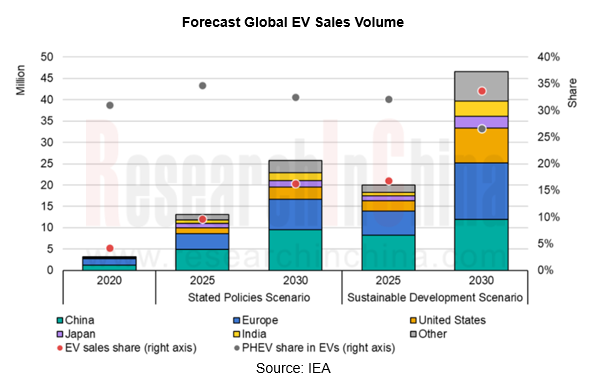

As of the end of 2020, there are over 11 million units of EVs on the road worldwide. Although global automotive industry suffered downturn under the impact of the COVID-19, global EV registration grew by 41% in 2000. According to IEA (International Energy Agency) data, global EV sales volume is expected to be 15 million units to 20 million units by 2025.

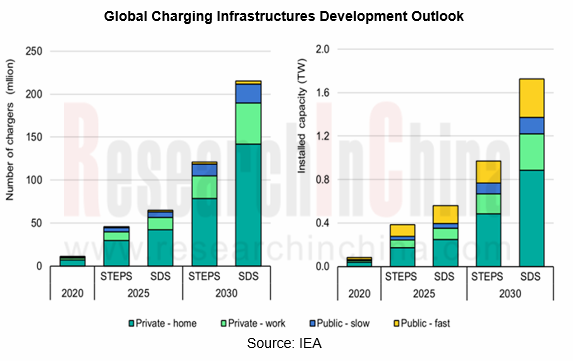

Under this background, government of each county fastens planning and construction of charging piles. Based on IEA’s statistics, number of EV charging infrastructures worldwide in 2020 amounted to 9.5 million units, including 2.5 million units public ones. Conservatively forecast, global EV charging infrastructures will increase to around 50 million units, including nearly 10 million units of public one.

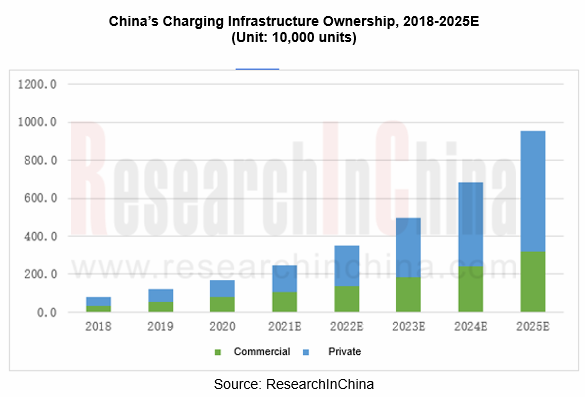

Currently, China’s charging pile ownership ranks first in the world. As of the end of 2020, China’s new energy vehicle ownership reached 4.92 million units, and number of charging piles amounted to 1.68 million units. Among them, number of private and commercial charging piles (including public and special) hit 874,700 units and 806,000 units, respectively, while car-to-pile ratio was 0.34 to 1.

It is estimated that China’s new energy vehicle ownership will amount to 17.82 million units by 2025 and number of charging piles will approximate 9.39 million units. Among them, number of private and commercial charging piles (including public and special) will hit 6.18 million units and 3.21 million units, while car-to-pile ratio will be 0.53 to 1.

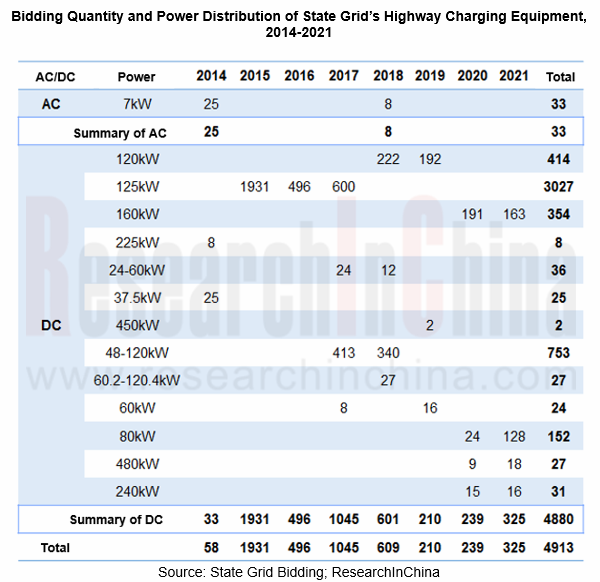

At present, China's highway fast charging network has basically taken shape, ranking first in the world. By 2020, a total of 2,251 charging stations and 9,065 charging piles have been built on 42 highways, with a service mileage of 54,000 kilometers, accounting for 35% of the total mileage of highways nationwide. According to the summary of bidding information for highway charging equipment of the State Grid over the years, highway charging piles are mainly 80 KW to 160 KW, and 240/480 KW super-power super-charging piles have been laid.

Medium and high-end intelligent EV brands vigorously layout charging network construction

Added value of intelligent EV brands has increased significantly, bringing about consumption upgrading in the automobile industry. Apart from intelligence and quality of the vehicles, charging quality improvement is also important. An article (Can the Battery Swap Mode that NIO and BAIC BJEV Both Bet on Overturn the industrial ecology?) released by ResearchInChina in August 2018 clearly pointed out that NIO builds a closed business scenario via battery swap mode to greatly enhance its brand value and service level, which is a very clever business strategy.

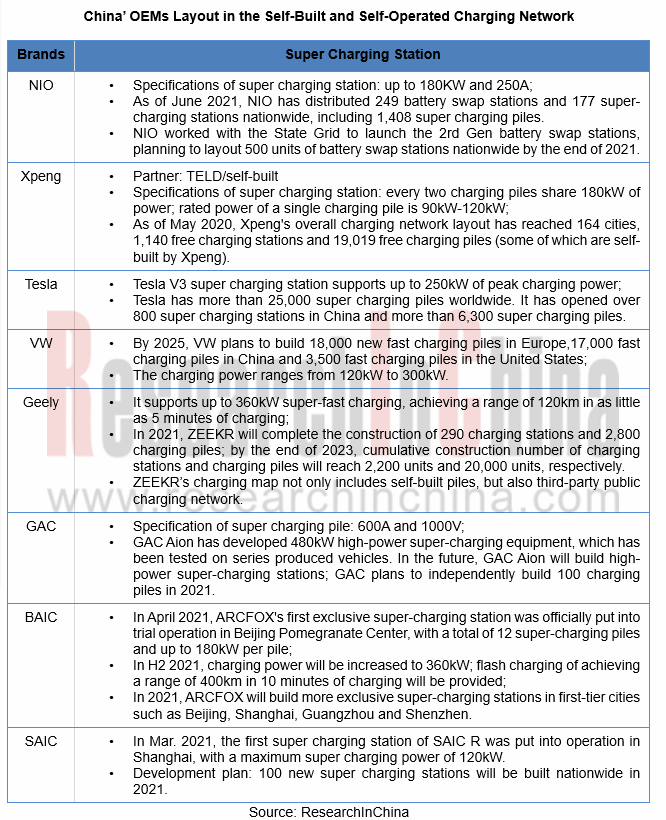

Many OEMs have also realized the importance of closed (or semi-closed) charging network. Medium and high-end start-up brands such as Tesla, NIO, Xpeng, Lixiang and other, as well as high-end EV brands of traditional OEMs, such as Geely ZEEKR, GAC Aion, BAIC ARCFOX, SAIC R, VW ID, etc., have begun or planned to layout in super charging station sector.

According to our analysis, OEMs currently mainly adopts three charging network construction and operation modes:

Mode 1: Fully self-built and self-operated "closed supercharging" system

This mode demands high costs and very high market ownership to maintain operation, represented by Tesla. In China, Tesla has laid a large number of charging piles. Although it has successively switched to the national standard interface, in fact Tesla's charging network is rarely open to the public, being a very closed charging network. Tesla has always claimed that it will allow to open super-charging piles to its peers, but we believe that the possibility of opening up in the short term is very small.

Tesla has built over 800 super charging stations and 6,300 super charging piles in China, supporting more than 710 destination charging stations, with charging network covering more than 290 cities. In 2021, its super charging pile factory in Shanghai was put into operation, with an initial planned annual production capacity of 10,000 units, mainly V3 super charging piles.

With extensive laying of Tesla's closed charging network, Tesla has actually formed a strong consumer barrier in China. Even if it faces many doubts in the short term, it will still occupy an important position in China in the long run. Its closed charging network has become one of the key factors for enterprises to achieve successful operation.

Mode 2: Fully self-built and self-operated "closed battery swap + open supercharging" system

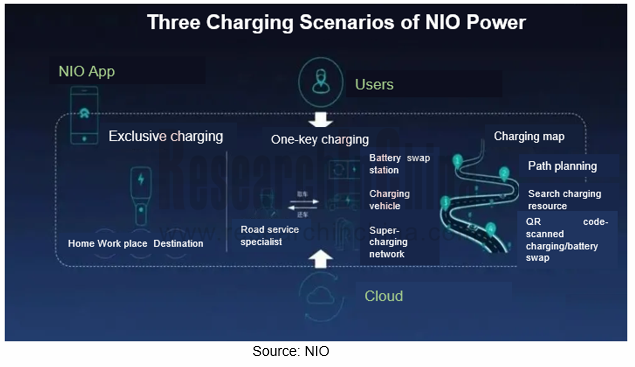

Apart from supercharging station, battery swap station is also the main way for the charging layout of OEMs. NIO regards battery swap business as one of its core business models. It introduced car-electricity separation mode and led the establishment of Wuhan Weineng Battery Asset Co., Ltd. to be responsible for the management and operation of batteries.

In April 2021, NIO worked with State Grid to deploy the 2nd Gen of battery swap stations nationwide. Its brand-new battery swap technology supports the function of in-car one-button battery swap, eliminating the need of getting off the bus. Up to 312 battery swap services are provided every day, effectively improving battery swap efficiency.

As of June 2021, NIO has laid out 249 battery swap stations and 177 super-charging stations nationwide, including 1,408 super-charging piles. NIO partnered with State Grid to release the 2nd Gen battery swap station, planning to layout 500 units of battery swap stations nationwide. With the gradual improvement of NIO's car charging and battery swap network, we predict that NIO may properly lower the brand pricing to occupy the market of RMB 250,000 to RMB 350,000 range.

Mode 3: Cooperative "Open supercharge" system + partial self-built and self-operated "closed supercharge" system

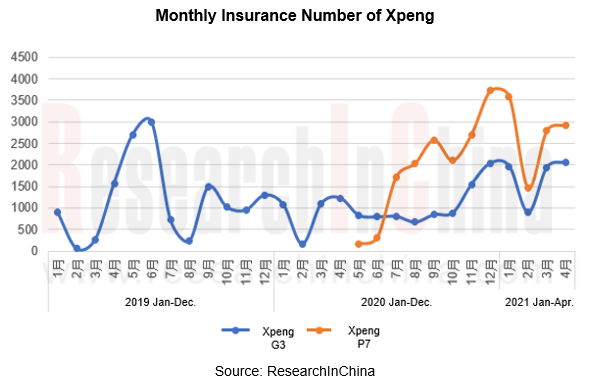

Differed from the relatively closed charging network construction and operation modes of NIO and Tesla, Xpeng mainly cooperates with third-party operators such as TELD to build free supercharging network, greatly reducing network laying and operation costs.

In addition, Xpeng has also started the construction of its own-brand exclusive charging stations similar to those of Tesla and NIO so as to further upgrade charging brand service. By the end of 2021, Xpeng will plan to build over 500 units of branded super-charging stations. We expect that Xpeng will raise the price of its pure electric SUV to be released, and the closed charging network will be the key breakthrough point for enhancing its brand value.

So far, Xpeng’s overall charging network layout has reached 164 cities, 1140 units of free charging stations and 19,019 free charging piles (some of which are self-built by Xpeng), expected to cover over 200 major cities nationwide by the end of 2021. Xpeng sales have surged since the release of its Lifetime Free Charging Plan (3,000 KWh per year) in Sept.2020.

In addition, VW (China), FAW, JAC and Wanbang New Energy jointly established CAMS Kemeth, a charging operator, which adopts an operation mode similar to that of Xpeng, namely, a combination of open + partially closed (ground lock).

For other OEMs, we think that they are more likely to adopt mode 3. But each selects varied strategies and laying ideas. For instance, the newly released Geely ZEEKR is the first 800V platform model in China, supporting rapid charging at 360kW. It can drive 120km after just 5 minutes of charging. According to the plan, ZEEKR will complete the construction of 290 charging stations and 2,800 charging piles by 2021, and build 2,200 charging stations and 20,000 charging piles by the end of 2023. So far, ZEEKR’s fast charging network has not been officially unveiled.

In the future, with the promotion of 800V high-voltage fast charging architecture technology, it is a trend for both foreign-funded enterprises and independent brands to conduct product layout in high-voltage platform, and he self-built self-operated charging network of high-end intelligent EV brands will be accelerated.

China Passenger Car Brake-by-Wire and AEB Market Research Report, 2022

Brake-by-wire research: with an astonishing growth in installation rate, One-Box has commanded much more of the market.

In new energy vehicles, especially intelligent vehicles, the bake-by-wire techn...

Multi-domain Computing and Zone Controller Research Report, 2022

Multi-domain computing and zone controller research: five design ideas advance side-by-side.In the trend for higher levels of autonomous driving, intelligent vehicles pose more stringent requirements ...

Overseas ADAS and Autonomous Driving Tier 1 Suppliers Report, 2022

Overseas ADAS Tier1 Suppliers Research: The gap between suppliers has widened in terms of revenue growth, and many of them plan to launch L4 products by 2025Countries allow L3/L4 vehicles on the road ...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022

ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function applicat...

China Passenger Car Electronically Controlled Suspension Industry Report, 2022

Research on electronically controlled suspension: four development trends of electronically controlled suspension and air suspension

Basic concepts of suspension and electronically controlled suspens...

China L2/L2+ Smart Car Audio Market Report, 2022

Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy...

China Commercial Vehicle T-Box Report, 2022

TOP10 commercial vehicle T-Box suppliers: using terminal data to build telematics platforms will become a megatrend.

1. From the perspective of market size, the pace of popularizing T-Box accelerates...

Electric Drive and Power Domain Industry Report, 2022

Electric drive and power domain research: efficient integration becomes a megatrend, and integration with other domains makes power domain stronger.

Electric drive systems have gone through several ...

China Autonomous Retail Vehicle Industry Report, 2022

Research on Autonomous Retail Vehicles: Lower Costs Accelerate Mass Production with Ever-spreading Retail Scenarios Autonomous retail vehicles integrate technologies such as 5G, artificial intelligenc...

China Passenger Car Driving and Parking Integrated Solution Industry Report, 2022

Driving and parking integrated solutions stand out in high-level intelligent driving, and the mass adoption is around the corner. According to ResearchInChina, in the first four months of 2022, China'...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022(II)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022 (I)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

China Minicar Industry Report, 2022

Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minic...

China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According...

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...

China Roadside Edge Computing Industry Report, 2022

Roadside Edge Computing Research: how edge computing enables intelligent connected vehicles?

Policies and standards for roadside edge computing are implementing one after another, favoring the boom o...

Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

In 2022Q1, the installation rate of L2 and a...

Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror mark...