In April 2021, Waymo’s CEO and CFO left the company. In addition, the Chief Safety Officer, head of manufacturing and global supply and general manager of Laser Bear LiDAR business, head of Automotive Partnerships and Corporate Development have also resigned since late 2020.

Waymo’s L4 development model has been set back. Its efforts to develop L4 with the model of “refitted vehicles—road test data collection—trial operation” hit a bottleneck, while companies like Tesla, Mobileye and Momenta adopt the widely-accepted “shadow model” where the data collected by L2 mass-produced vehicles are used to train a L4 algorithm model.

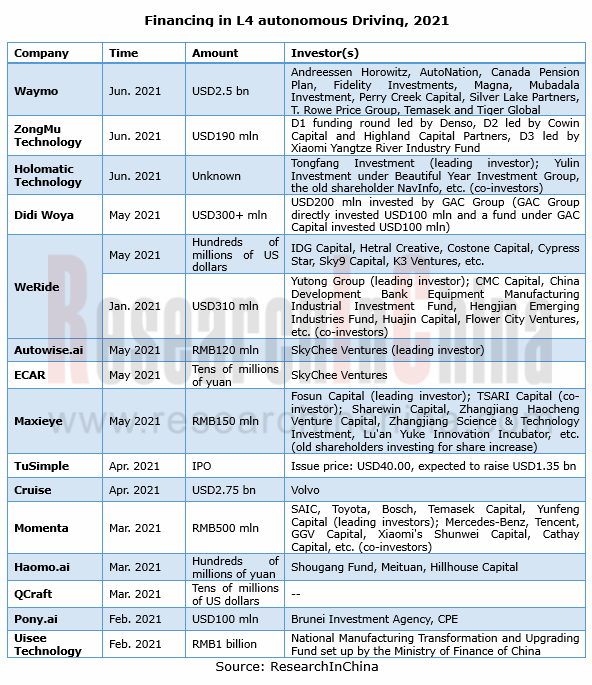

Except for few companies like Waymo and Uber which perform worse than expected, L4 autonomous driving firms in other fields gain momentum. Favored by capital in 2021, they make big strikes in technology and cost reduction, making a thriving market. As the saying goes, a thousand sails pass by the wrecked ship, and ten thousand saplings shoot up beyond the withered tree.

L4 autonomous driving firms are in capital’s good graces.

During 2020-2021, the global L4 autonomous driving industry has seen a turning point: bellwethers such as Waymo and Cruise vie for more competitive edges in Robotaxi; Uber sold its autonomous driving business to Aurora and invested USD400 million in it; technology giants like Huawei and Baidu deploy dimension reduction application of L4 autonomous driving for commercialization; WeRide and Didi Woya each have raised hundreds of millions of US dollars in 2021.

Although several of its executives have left since 2021, Waymo still raised USD2.5 billion in a new round funding in June 2021. Moreover, GM Cruise has also raised USD2.75 billion in 2021. After bouncing several times, Origin, GM Cruise’s first autonomous robotaxi design, is projected to enter volume production in early 2023.

In 2021, L4 start-ups usher in a funding boom. TuSimple, a Chinese autonomous truck manufacturer listed its shares in the US, which took its market capitalization to more than USD10 billion. The sought-after company announced to secure orders for 6,500 units of its autonomous trucks. Its domestic peer PlusAI was listed on the New York Stock Exchange by way of special purpose acquisition company (SPAC). This signals L4 autonomous driving companies have been in the new phase of rapid development. There will be more L4 autonomous driving companies going public.

Cost reduction” and “dimension reduction application” bring development opportunities to L4 autonomous driving companies.

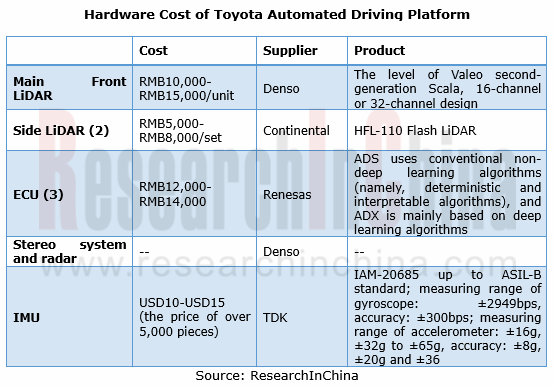

Too high cost has been an inevitable practical challenge in commercialization of L4 autonomous driving. The hardware devices for a L4 autonomous vehicle generally include: 6-12 cameras, 3-12 radars, 1-3 LiDARs, 2 GNSSs/IMUs and 2 computing platforms (including the redundant one). As the technology advances, the cost of hardware is on the decline.

On one estimate, the cost of hardware for a set of L4 autonomous driving system of Toyota is RMB40,000 or so. Wherein, the main front LiDAR costs the most, roughly RMB10,000 to RMB15,000; the combined cost of the two side LiDARs stands at RMB5,000 to RMB8,000; that of the 3 ECUs is RMB12,000 to RMB14,000. The dilution of software cost is accompanied by the rising sales.

In China, Baidu introduced Apollo Moon, its new-generation mass-produced Robotaxi in June 2021, with cost expected to be slashed to RMB480,000, a third of that of current L4 mass-produced autonomous models. The ARCFOX αT-refitted vehicle adopts the ANP-Robotaxi architecture, and packs 13 cameras, 1 LiDAR, 5 radars and Baidu's self-developed central computing platform with computing force up to 800TOPS.

In July 2021, GAC AION and Huawei launched the cooperative project AH8 model, their first co-developed large-sized intelligent full-electric SUV based on GAC GEP3.0 Chassis Platform and Huawei Computing and Communication Architecture (CCA). The L4 autonomous car is projected to be spawned in late 2023.

As costs go down, we predict RMB300,000 autonomous vehicles with L4 autonomy will come out in the next 2 or 3 years.

At present, L4 autonomous driving technology has yet to mature. Multiple automakers and technology providers have started dimension reduction application. AVP tends to be a key L4 autonomous driving technology deployed on mass-produced vehicles. For example, starting from AVP, Baidu will progressively achieve driving automation of passenger cars in all scenarios.

In January 2021, Weltmeister W6, a Baidu AVP-enabled mass-produced L4 model, rolled off the assembly line. As the world’s first model of such kind, the car carries 5 cameras, 12 ultrasonic radars and Baidu's autonomous driving computing platform ACU. The AVP solution consists of just cameras and ultrasonic radars, making its cost available.

In July 2021, Baidu and Great Wall Motor built in-depth cooperation on AVP. They plan to equip WEY Mocha with Baidu AVP that is based on Apollo software algorithms and up to ASIL-B functional safety standard, enabling L4 autonomous parking within visual range. It is predicted that the new model is about to be launched on market in the second half of 2021.

In addition, the auto parts giant ZF also tries hard to deploy AVP, in hope of developing future-oriented autonomous driving technologies with AVP as a starting point. In April 2021, ZF first released its AVP technology which enables automated parking via CalmCar 360° surround view perception and ultrasonic radars; in June, ZF led a USD150 million C round financing for CalmCar. They have forged a strategic partnership to develop a cost-effective AVP system, and plan to use it in mass-produced models of OEMs in China in 2022.

L4 autonomous driving for commercial vehicles enters the phase of cross-scenario mass production and application.

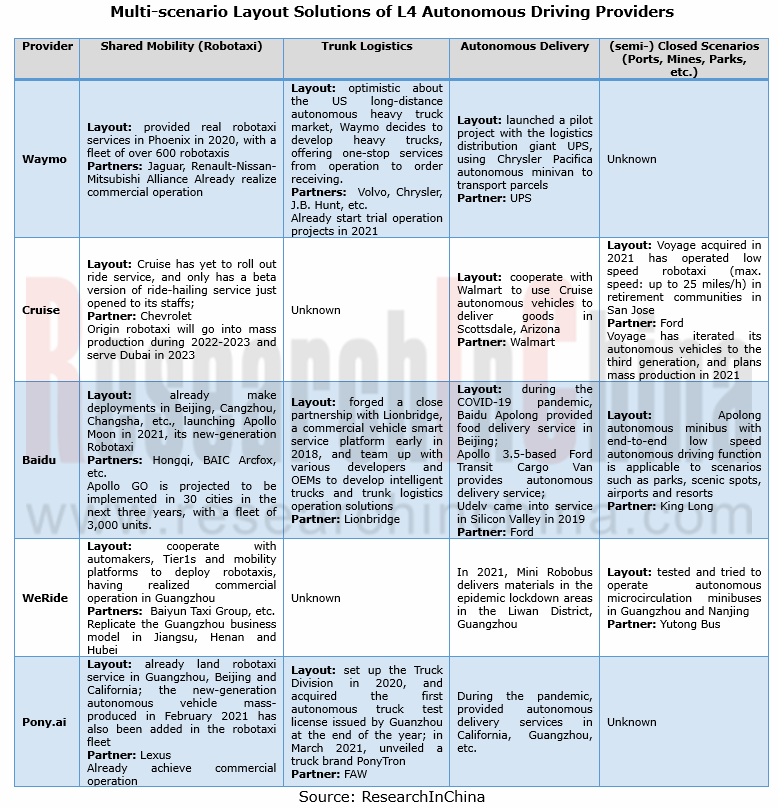

The demission of John Krafcik, Google Waymo’s CEO, becomes a watershed in the industry. It indicates that it is hard to achieve commercial operation of L4 autonomous driving in real terms by depending on tests and verifications in ideal conditions. Given this, large companies have started developing multi-scenario application solutions to amass data and iterate algorithms in actual operating scenarios.

In the near future, L4 autonomous driving layout will target designated scenarios, especially shared mobility, trunk logistics, autonomous delivery, and (semi-) closed scenarios.

L4 autonomous driving providers are working hard on application of the technology in different scenarios. Examples include Baidu Apollo with technical expertise in Robotaxi, autonomous minibus and autonomous parking, and providers like Waymo and Pony.ai which turn to autonomous logistics and delivery from Robotaxi.

Waymo: by the end of 2020, Waymo has boasted a fleet of more than 600 Robotaxi. In 2021, Waymo plans to introduce a fleet of 100 Jaguar I-PACE autonomous vehicles equipped with the latest fifth-generation software and hardware.

In terms of autonomous commercial vehicles, following its in-depth cooperation with Volvo in 2020, Waymo partnered closely with Fiat Chrysler Automobiles (FCA) to manufacture autonomous commercial trucks, and introduced Waymo Via trucking service tested on roads in two states of the US.

Motional: in March 2020, Hyundai and Aptiv set up a joint venture, a L4/L5 autonomous vehicle developer that integrated the resources of NuTonomy. The founding of this joint venture noticeably quickened their pace of deploying autonomous driving.

In October 2020, Motional and Lyft announced the resumption of their self-driving mobility service in Las Vegas; in March 2021, Motional indicated it will select Ambarella CVflow? SoC family for its autonomous vehicles; in June 2021, Motional said it will launch nuPlan, an extended public dataset.

Pony.ai: in February 2021, Pony.ai’s first Robotaxis with the latest system rolled off its standard production line; in April 2021, Pony.ai upgraded PonyPliot+ Robotaxi service in all aspects; in May 2021, the Robotaxi service was landed in Yizhuang, Beijing.

As for autonomous commercial vehicles, Pony.ai set up its Truck Division in 2020 and acquired its first autonomous truck test license issued by Guangzhou at the end of the year; in March 2021, it introduced its truck brand—PonyTron.

Although the whole highly automated driving industry still faces a range of challenges such immature supply chain, very high cost, not enough safety, and unsound laws and regulations, and needs some time for commercial application in all scenarios, L4 autonomous driving technology is getting rapid upgrade and the overall cost is dropping, which makes the commercial use in designated scenarios an expectation.

Our Global and China L4 Autonomous Driving and Start-ups Report, 2021 highlights the following:

Autonomous driving industry (main technologies, status quo of autonomous driving test, investment and financing, policies, standards, etc.);

Autonomous driving industry (main technologies, status quo of autonomous driving test, investment and financing, policies, standards, etc.);

L4 autonomous driving market (size, competitive pattern, technology trends, etc.);

L4 autonomous driving market (size, competitive pattern, technology trends, etc.);

Development of L4 autonomous driving technologies (computing platform, high-precision positioning, etc.) in China (technical solutions of providers, mass production plans of OEMs, etc.);

Development of L4 autonomous driving technologies (computing platform, high-precision positioning, etc.) in China (technical solutions of providers, mass production plans of OEMs, etc.);

Implementation of L4 autonomous driving (business models, main application scenarios (Robotaxi, autonomous delivery, etc.), etc.);

Implementation of L4 autonomous driving (business models, main application scenarios (Robotaxi, autonomous delivery, etc.), etc.);

Main Chinese and foreign L4 autonomous driving technology providers (layout, application, etc.).

Main Chinese and foreign L4 autonomous driving technology providers (layout, application, etc.).

Passenger Car Chassis Domain Controller Industry Report, 2022

Chassis domain controller research: full-stack independent development, or open ecosystem route?

Chassis domain consists of transmission, driving, steering and braking systems. Conventional vehicle ...

China Automotive LiDAR Industry Research Report, 2022

LiDAR research: Chinese passenger cars will carry over 80,000 LiDAR sensors in 2022

1. The mass production of LiDAR is accelerating, and the installations are expected to exceed 80,000 units in 2022

...

China Autonomous Driving Data Closed Loop Research Report, 2022

1. The development of autonomous driving is gradually driven by data rather than technology

Today, autonomous driving sensor solutions and computing platforms have become increasingly homogeneous, an...

Overseas LiDAR Industry Research Report, 2022

LiDAR Research: Perception Algorithms Become the Layout Focus of Foreign Vendors

Amid a variety of technology routes in parallel, rotating mirror and flash solutions are adopted most widely during OE...

Smart Car OTA Industry Research Report, 2022

Smart car OTA research: With the arrival of OTA3.0 era, how can OEMs explore payment modes of SAAS?

Driven by the development of smart cars, China's OTA installation rate has been growing. According ...

Chinese Joint Venture OEMs’ ADAS and Autonomous Driving Report, 2022

Joint Venture OEM's ADAS Research: Joint venture brands lead in L2/L2.5 installation rate, but have not involved L2.9 for the time being

Following "Chinese Independent OEMs’ ADAS and Autonomous Drivi...

Global and China Hybrid Electric Vehicle Research Report, 2022

Hybrid Research: China Hybrid EV penetration rate will hit 22% within five years

With the development of automobile energy-saving and new energy technologies and the promotion of low-carbon emission ...

China Smart-Road Roadside Perception Industry Report, 2022

Top 10 roadside perception suppliers: quality suppliers come to the front in each market segment.

The growing number of roadside perception players comes with active industrial investment and financ...

China Passenger Car Brake-by-Wire and AEB Market Research Report, 2022

Brake-by-wire research: with an astonishing growth in installation rate, One-Box has commanded much more of the market.

In new energy vehicles, especially intelligent vehicles, the bake-by-wire techn...

Multi-domain Computing and Zone Controller Research Report, 2022

Multi-domain computing and zone controller research: five design ideas advance side-by-side.In the trend for higher levels of autonomous driving, intelligent vehicles pose more stringent requirements ...

Overseas ADAS and Autonomous Driving Tier 1 Suppliers Report, 2022

Overseas ADAS Tier1 Suppliers Research: The gap between suppliers has widened in terms of revenue growth, and many of them plan to launch L4 products by 2025Countries allow L3/L4 vehicles on the road ...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022

ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function applicat...

China Passenger Car Electronically Controlled Suspension Industry Report, 2022

Research on electronically controlled suspension: four development trends of electronically controlled suspension and air suspension

Basic concepts of suspension and electronically controlled suspens...

China L2/L2+ Smart Car Audio Market Report, 2022

Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy...

China Commercial Vehicle T-Box Report, 2022

TOP10 commercial vehicle T-Box suppliers: using terminal data to build telematics platforms will become a megatrend.

1. From the perspective of market size, the pace of popularizing T-Box accelerates...

Electric Drive and Power Domain Industry Report, 2022

Electric drive and power domain research: efficient integration becomes a megatrend, and integration with other domains makes power domain stronger.

Electric drive systems have gone through several ...

China Autonomous Retail Vehicle Industry Report, 2022

Research on Autonomous Retail Vehicles: Lower Costs Accelerate Mass Production with Ever-spreading Retail Scenarios Autonomous retail vehicles integrate technologies such as 5G, artificial intelligenc...

China Passenger Car Driving and Parking Integrated Solution Industry Report, 2022

Driving and parking integrated solutions stand out in high-level intelligent driving, and the mass adoption is around the corner. According to ResearchInChina, in the first four months of 2022, China'...