LiDAR Research: Perception Algorithms Become the Layout Focus of Foreign Vendors

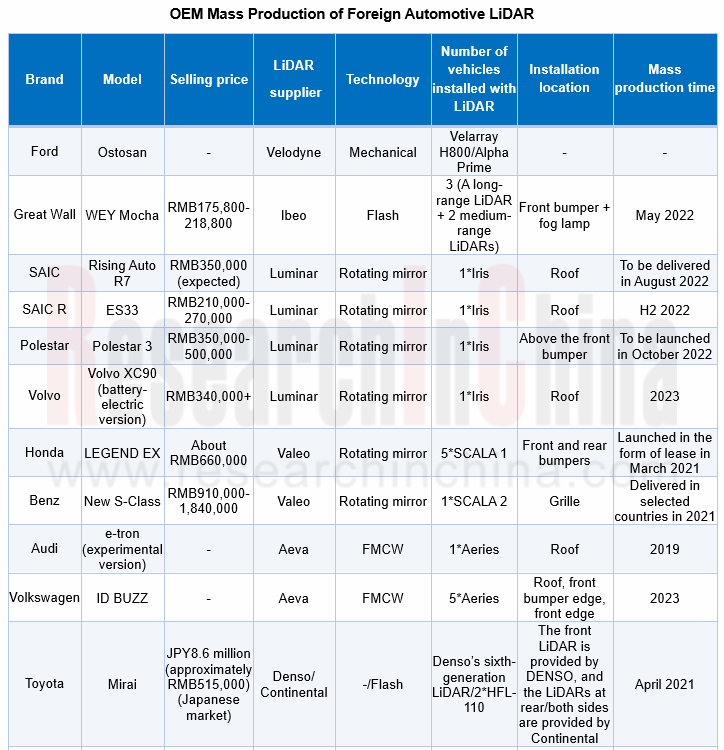

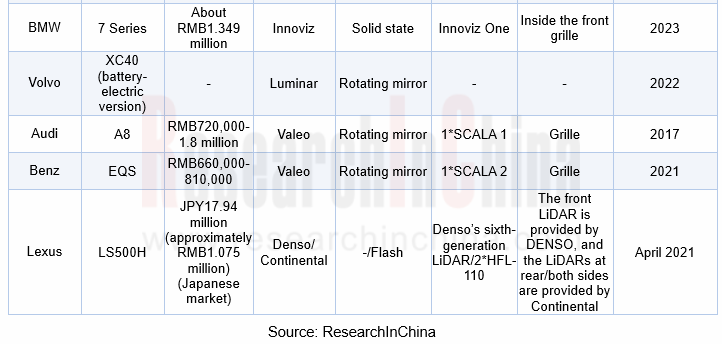

Amid a variety of technology routes in parallel, rotating mirror and flash solutions are adopted most widely during OEM mass production.

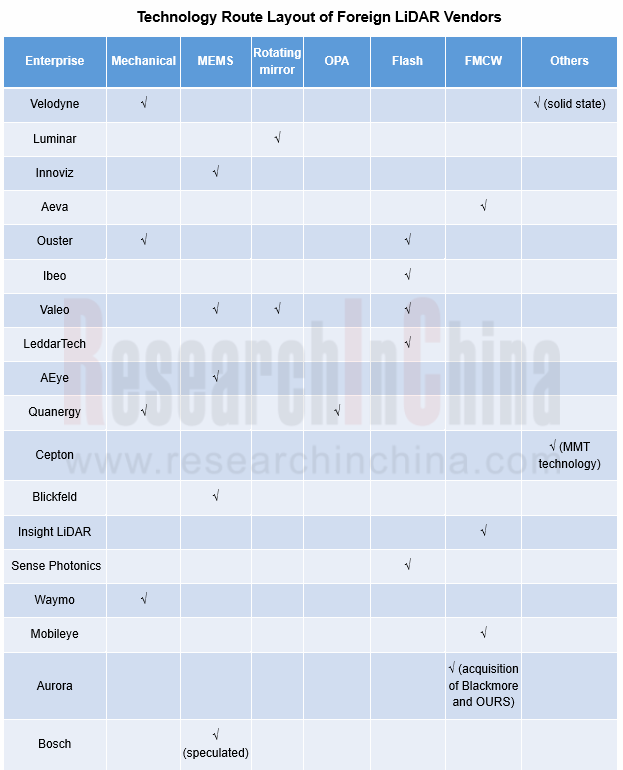

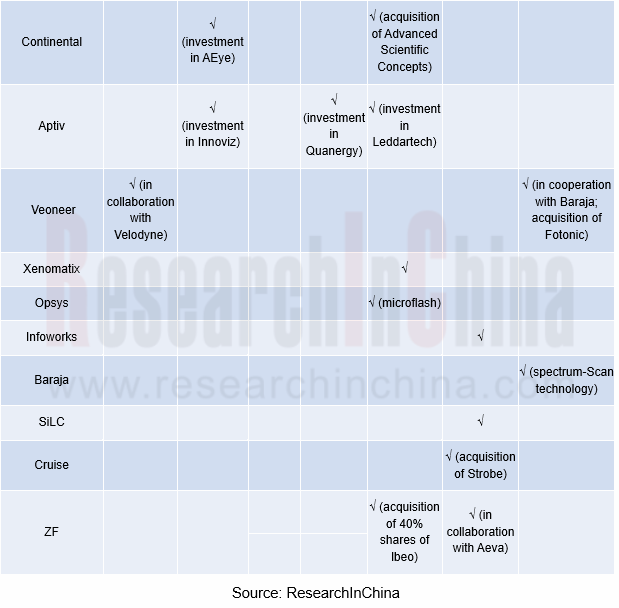

LiDAR technology routes include mechanical, MEMS, rotating mirror/prism, OPA, flash, etc. On the whole, LiDAR evolves from mechanical type to solid-state type, with multiple technology routes existing in parallel (for example, Velodyne has developed mechanical and solid-state solutions simultaneously since Velarray debuted at the 2017 Frankfurt Auto Show). Flash is the most popular solution in the layout of foreign vendors, followed by FMCW and MEMS.

As per OEM mass production, rotating mirror and flash solutions are adopted most widely. Valeo is a typical vendor leveraging the rotating mirror solution, and it produces LiDAR at the Wemding factory in Bavaria, Germany. As of 2021, its Scala LiDAR shipments had exceeded 160,000 units, with a single unit costing less than $1,000. Ibeo is known for its flash LiDAR. The ibeoNEXT LiDAR system produced by ZF features the detection range of more than 250 meters, the horizontal angular resolution of 0.04°, and the vertical angular resolution of 0.07°. It can recognize guardrails, road signs, cars, bicycles and pedestrians, along with their respective positions and movement directions. It has been installed on Great Wall WEY Mocha.

Perception algorithms become the layout focus of foreign vendors

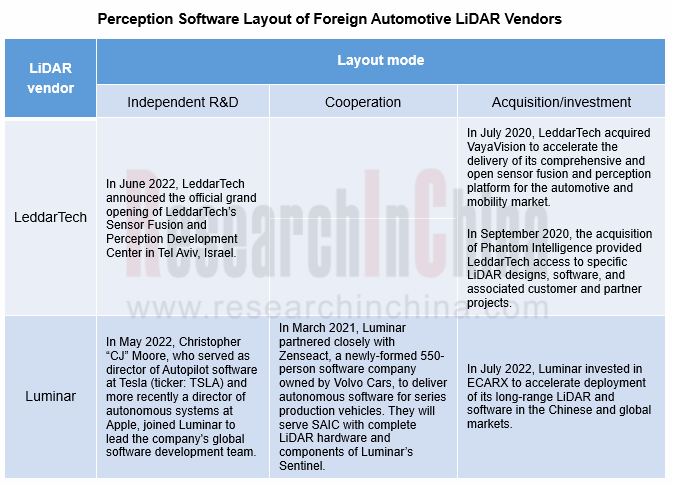

The quality of perception algorithm determines perception accuracy and distance. Therefore, LiDAR vendors not only upgrade their own hardware, but also develop perception software, so as to form the closed loop of perception fusion and system-level supply. Foreign LiDAR vendors mainly leverage self-research, acquisition and cooperation with software companies to deploy perception algorithms.

LeddarTech mainly makes its layout through acquisitions. LeddarTech acquired sensor fusion and perception software companies VayaVision and Phantom Intelligence in 2020. LeddarTech’s open platform based on its full-waveform digital signal processing technology combined with VayaVision’s raw data sensor fusion and perception software stack will deliver the most accurate environmental model, enabling the volume deployment of ADAS and AD applications. In September 2020, the acquisition of Phantom Intelligence provided LeddarTech access to specific LiDAR designs, software, and associated customer and partner projects.

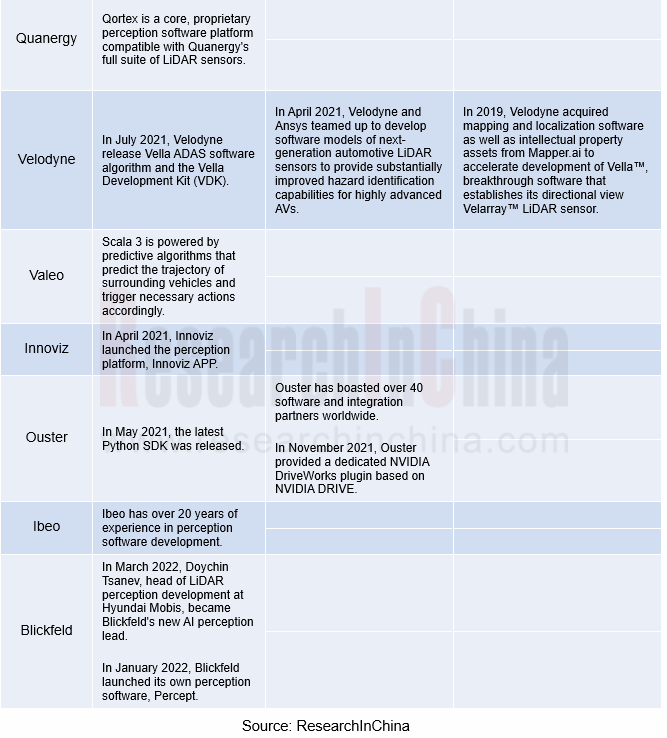

Innoviz mainly develops its own perception algorithm. In April 2021, Innoviz launched embedded automotive perception platform "Innoviz APP". Innoviz APP can accurately detect and classify objects in any 3D driving scenario up to 250 meters away, including cars, trucks, motorcycles, pedestrians, and more. It also executes perception algorithms in real time, detecting and classifying pixels as collision relevant or non-collision relevant. At the same time, it can also be integrated on chips as an embedded software IP. Innoviz's software leverages the massive data from LiDAR and proprietary AI algorithms to provide excellent scenario awareness as well as an automatically upgradable ASIL B(D) solution.

Luminar makes its layout through cooperation, investment and independent R&D. In March 2021, Luminar cooperated with Volvo’s self-driving software subsidiary Zenseact to create a “holistic autonomous vehicle stack” made for production vehicles. The stack is called Sentinel, which will integrate Zenseact’s OnePilot autonomous driving software solution alongside Luminar’s Iris LiDAR, perception software, and other components as a foundation. The system is designed to handle highway autonomy and a number of safety measures to proactively avoid collisions with evasive maneuvers, reducing accident rates by up to seven times. Luminar completed development of the alpha version of Sentinel in 2021 and plans to accomplish the beta version in 2022. In addition, Luminar will serve SAIC’s production vehicles with complete LiDAR hardware and components of Luminar’s Sentinel.

Chip-based LiDAR development is vital for mass production and cost reduction

Inside LiDAR, there are hundreds of discrete devices with high costs in materials and optical assembly, which pose a major obstacle to mass production. Chip-based LiDAR can integrate hundreds of discrete devices into one chip, effectively reducing the product size and costs while facilitating mass production.

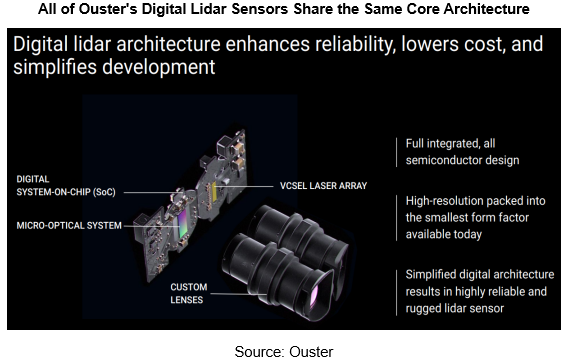

For example, all of Ouster's digital LiDAR sensors share the same core architecture. The architecture consists of two chips and a patented micro-optical system, replacing hundreds of discrete components inside traditional analog LiDAR, improving reliability and reducing price (the ES2 debuts with an expected price of $600 for series production -- and Ouster’s digital LiDAR technology provides a clear roadmap that will allow future models to break the $100 price barrier).

As shown above, in Ouster's LiDAR core architecture, a vertical cavity surface emitting laser (“VCSEL”) array integrates all lasers on a single chip. The custom SoC integrates single photon avalanche diode (“SPAD”) detectors and a proprietary digital signal processing system to handle all commands and control logic of LiDAR. The patented micro-optical system guides light through LiDAR to improve the detector efficiency exponentially.

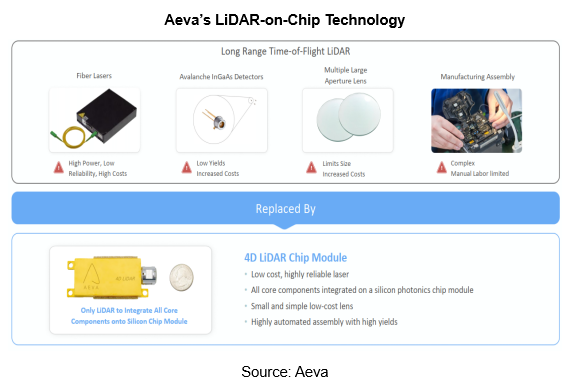

Aeva is also working on a chip-based layout. In February 2022, Aeva unveiled Aeries? II, a 4D LiDAR? sensor leveraging Aeva’s unique Frequency Modulated Continuous Wave (FMCW) technology and the world’s first LiDAR-on-chip module design which places all key components including transmitters, receivers and optics onto a silicon photonics chip in a compact module. The compact design is 75% smaller than the previous generation. Mass production is expected in 2023.

NXP’s Intelligence Business Analysis Report, 2022-2023

In 2015, NXP acquired Freescale for USD11.8 billion, hereby becoming the largest automotive semiconductor vendor. Yet NXP's development progress has not always gone smoothly. In 2021, Infineon replace...

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Despite the chip shortage and the sluggish economy, Bosch’s sales from all business divisions bucked the trend in 2022. Wherein, the Mobility Solutions, still the company’s biggest division, sold EUR5...

Analysis on Baidu’s Intelligent Driving Business, 2022-2023

Baidu works on three autonomous driving development routes: Apollo Platform, Apollo Go (autonomous driving mobility service platform) and intelligent driving solutions. &n...

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

Ambarella was founded in 2004 and is headquartered in California, the US. Before 2014, Ambarella was the exclusive chip supplier of GoPro. Ambarella was listed on NASDAQ in 2012. When the sports camer...

Global and China Electronic Rearview Mirror Industry Report, 2023

Electronic rearview mirror research: 2023 will be the first year of mass production as the policy takes effect

Global and China Electronic Rearview Mirror Industry Report, 2023 released by ResearchIn...

China Autonomous Driving Domain Controller Research Report, 2023

Autonomous driving domain controller research: explore computing power distribution and evolution strategies for driving-parking integrated domain controllers.

In China, at this stage the industry i...

China In-Vehicle Payment Market Research Report, 2023

China In-Vehicle Payment Market Research Report, 2023 released by ResearchInChina analyzes and researches the status quo of China's in-vehicle payment market, components of the industry chain, layout ...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2023 – Chinese Companies

Research on China’s local Tier 1 suppliers: build up software and hardware strength, and “besiege” driving-parking integration by three routes. 01 Build up their own software and hardware capabilities...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2023 (Foreign Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report,2023 (Chinese Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Company Analysis: Jingwei Hirain’s Automotive and Intelligent Driving Business, 2022-2023

Founded in 2003, Jingwei Hirain Technologies is headquartered in Beijing, with modern production facilities in Tianjin and Nantong. In 2022, Jingwei Hirain Technologies recorded revenue of RMB4,021 mi...

China Passenger Car HUD Industry Chain Development Research Report, 2023

Research on HUD industry chain: new technologies such as LBS and optical waveguide help AR-HUD become a “standard configuration”.

As HUD technology advances, AR-HUD, which can combine virtual informa...

Body (Zone) Domain Controller and Driver IC Industry Research Report,2023

Body (zone) domain controller research: evolution of body electronic and electrical architecture driven by MOSFET and HSD.

The mode of control over body electronic functions is changing with the evol...

China Automotive Fragrance and Air Purification Systems Research Report, 2023

Automotive fragrance and air purification systems: together to create a comfortable and healthy cockpitTechnology trend: intelligence of fragrance system and integration of air purification system

In...

Global and China Solid State Battery Industry Report, 2023

Solid state battery research: semi-solid state battery has come out, is all-solid state battery still far away?In recent years, the new energy vehicle market has been booming, and the penetration of n...

Global and China Passenger Car T-Box Market Report, 2023

T-Box industry research: the market will be worth RMB10 billion and the integration trend is increasingly clear.

ResearchInChina released "Global and China Passenger Car T-Box Market Report, 2023", w...

Analysis Report on Auto Shanghai 2023

Analysis on 75 Trends at Auto Shanghai 2023: Unprecedented Prosperity of Intelligent Cockpits and Intelligent Driving Ecology

After analyzing the intelligent innovation trends at the Auto Shanghai 20...

Chinese Emerging Carmakers’ Telematics System and Entertainment Ecosystem Research Report, 2022-2023

Telematics service research (III): emerging carmakers work on UI design, interaction, and entertainment ecosystem to improve user cockpit experience.

ResearchInChina released Chinese Emerging Carmake...