Hybrid Research: China Hybrid EV penetration rate will hit 22% within five years

With the development of automobile energy-saving and new energy technologies and the promotion of low-carbon emission reduction policies worldwide, fuel economy and low-carbon emissions have been in the spotlight of automobile development, and hybrid electric vehicles have become R&D focus of current automobile industry.

The commercialization of hybrid vehicles has been developing for more than 20 years, with four major markets in the world: Europe, the United States, Japan, and China, which differ in technology, strategy and marketplace. Different automakers are also diversifying their hybrid system architectures. At present, hybrid technologies vary with technology platforms.

Hybrid vehicles are accelerating the pace of replacing fuel vehicles in China

According to statistics, 6.495 million new energy passenger cars (EVs+PHEVs) were sold globally in 2021, up 107.9% year-on-year with the market share hitting a record as high as 9%; wherein, the sales volume of battery-electric passenger cars (EVs) swelled by 110% year-on-year to 4.6 million units, and the sales volume of plug-in hybrid electric passenger cars (PHEVs) increased by 103% year-on-year to approximately 1.9 million units. In 2021, the global sales volume of energy-efficient HEVs jumped by more than 20% year-on-year to approximately 3.5 million units.

Catalyzed by a series of policies such as emission regulations, Measures for the Parallel Management of Corporate Average Fuel Consumption (CAFC) and New Energy Vehicle (NEV) Credits of Passenger Car Companies, Energy-saving and New Energy Vehicle Technology Roadmap 2.0, energy-saving and new energy vehicles are burgeoning. Low fuel consumption and Measures for the Parallel Management of Corporate Average Fuel Consumption (CAFC) and New Energy Vehicle (NEV) Credits of Passenger Car Companies have prompted automakers to accelerate the transformation toward electrification and speed up the deployment of 48V, HEV, REEV, PHEV and other hybrid roadmaps.

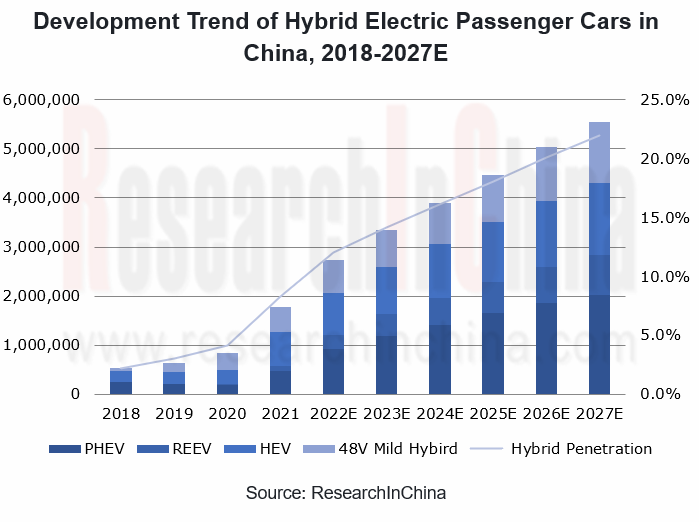

In 2021, the sales volume of hybrid passenger cars in China reached 1.778 million units, including 470,000 PHEVs, 105,000 REEVs, 689,000 HEVs, and 513,000 48V mild hybrids. With the development of hybrid systems of Chinese independent brands, PHEVs will outsell HEVs and 48V mild hybrids by 2022. REEVs have performed well since the launch, and will still grow at a relatively high growth rate from 2022 to 2027.

The penetration rate of hybrid electric passenger cars in China will fetched 8.3% in 2021, and it is expected to hit 22% by 2027 with sales over 5.5 million units.

After several years of development, Chinese independent brand automakers have made significant progress in hybrid vehicle technology, even surpassed Japanese companies such as Toyota and Honda in some aspects of performance. Their models cover weak hybrids, mild hybrids/medium hybrids, strong hybrids and so on:

Micro Hybrid - Start / Stop (12V): The currently available start / stop 12V passenger car models mainly come from European and American brands, while Chinese independent brands account for 19% of the total models;

Mild/Medium Hybrid (48V): Although Chinese independent brand automakers have deployed 48V mild hybrid system technology, they offer few models, and almost only FAW-Hongqi, Geely and Great Wall have sold cars equipped with the technology.

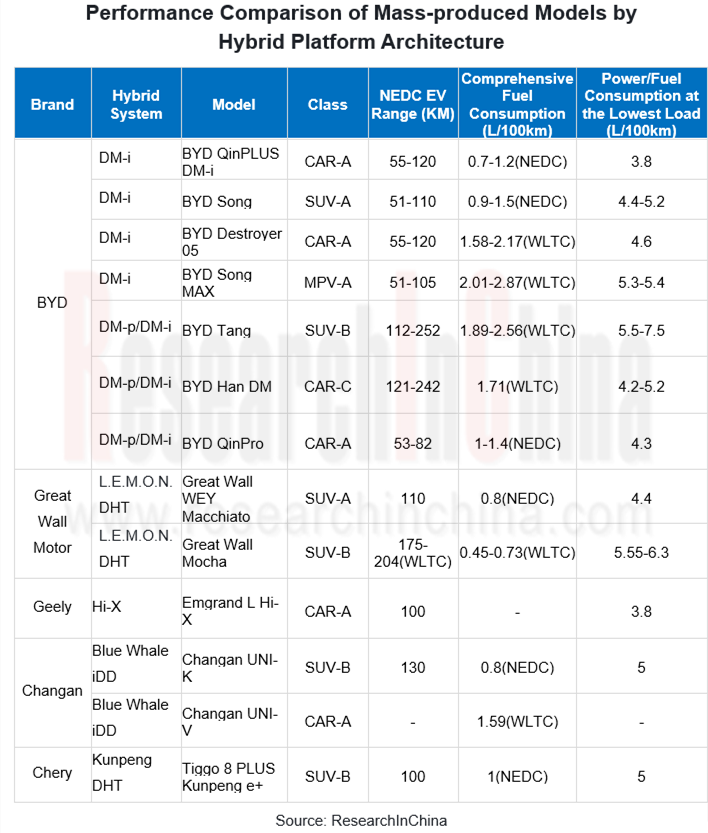

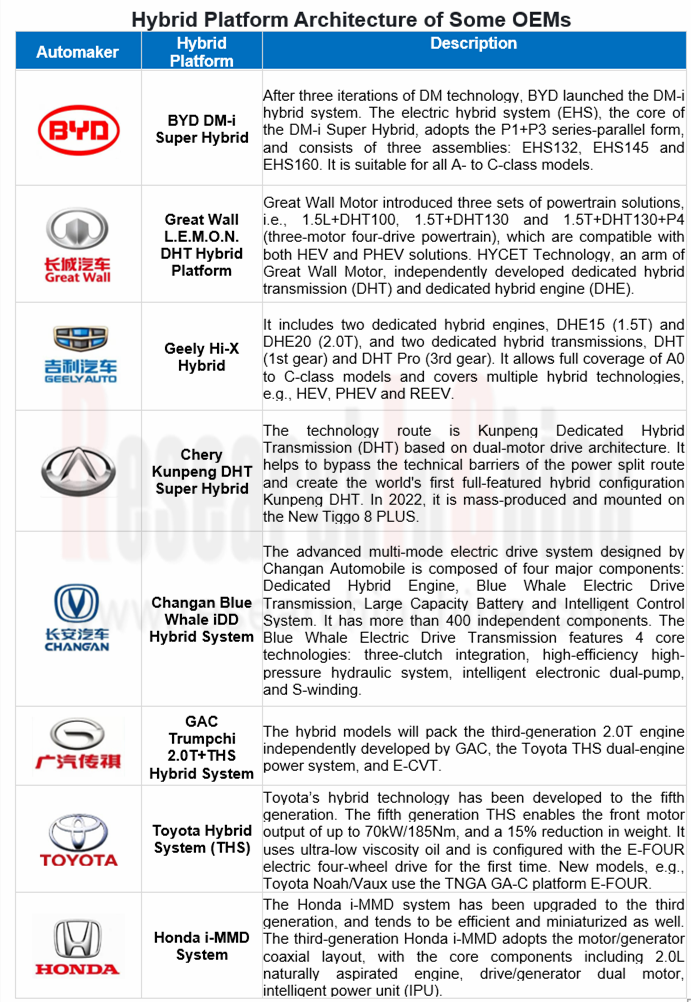

PHEV: BYD DM, DM-i, Great Wall L.E.M.O.N DHT, Geely Thor Hybrid Hi·X, Changan Blue Whale iDD and other hybrid systems have been mass-produced. BYD DM and DM-i have been installed on many of its models; DHT, has been applied to Mocha, Latte, Macchiato and other models of Great Wall; Changan Blue Whale iDD has been applied to UNI-K, UNI-V models;

REEV: The REEVs currently for sale mainly include Seres SF5, AITO M5, Li ONE and Voyah FREE. In June 2022, Li Auto released a full-size SUV - Li L9, and AITO unveiled a medium and large range-extended SUV - AITO M7. Both were so appealing that they received over 20,000 orders upon launch.

OEMs have mass-produced a new generation of DHE + DHT + integrated electric drive hybrid architecture

From the perspective of technical route selection:

48V hybrid technology maintains steady growth by continuously improving motor efficiency and electrification level. At this stage, it is mainly driven by foreign OEMs;

48V hybrid technology maintains steady growth by continuously improving motor efficiency and electrification level. At this stage, it is mainly driven by foreign OEMs;

HEV technology-based models pay more attention to development of energy saving, cost reduction, system simplification, etc.;

HEV technology-based models pay more attention to development of energy saving, cost reduction, system simplification, etc.;

PHEV technology is developing towards low energy consumption and high cost performance, and China has explored an independent development of PHEV technology path;

PHEV technology is developing towards low energy consumption and high cost performance, and China has explored an independent development of PHEV technology path;

REEV technology is complementary to other hybrid technologies due to its simple structure. High battery life and driving experience are welcomed by consumers. Driven by star models such as Li, AITO, and Voyah, it will grow rapidly in the next few years.

REEV technology is complementary to other hybrid technologies due to its simple structure. High battery life and driving experience are welcomed by consumers. Driven by star models such as Li, AITO, and Voyah, it will grow rapidly in the next few years.

From the perspective of hybrid technology platform layout of OEMs, domestic OEMs have independently developed DHE (hybrid special engine) + DHT (hybrid special transmission assembly), and the platform supports multiple hybrid architectures such as HEV, PHEV, and REEV at the same time:

Analysis on Baidu’s Intelligent Driving Business, 2022-2023

Baidu works on three autonomous driving development routes: Apollo Platform, Apollo Go (autonomous driving mobility service platform) and intelligent driving solutions. &n...

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

Ambarella was founded in 2004 and is headquartered in California, the US. Before 2014, Ambarella was the exclusive chip supplier of GoPro. Ambarella was listed on NASDAQ in 2012. When the sports camer...

Global and China Electronic Rearview Mirror Industry Report, 2023

Electronic rearview mirror research: 2023 will be the first year of mass production as the policy takes effect

Global and China Electronic Rearview Mirror Industry Report, 2023 released by ResearchIn...

China Autonomous Driving Domain Controller Research Report, 2023

Autonomous driving domain controller research: explore computing power distribution and evolution strategies for driving-parking integrated domain controllers.

In China, at this stage the industry i...

China In-Vehicle Payment Market Research Report, 2023

China In-Vehicle Payment Market Research Report, 2023 released by ResearchInChina analyzes and researches the status quo of China's in-vehicle payment market, components of the industry chain, layout ...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2023 – Chinese Companies

Research on China’s local Tier 1 suppliers: build up software and hardware strength, and “besiege” driving-parking integration by three routes. 01 Build up their own software and hardware capabilities...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2023 (Foreign Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report,2023 (Chinese Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Company Analysis: Jingwei Hirain’s Automotive and Intelligent Driving Business, 2022-2023

Founded in 2003, Jingwei Hirain Technologies is headquartered in Beijing, with modern production facilities in Tianjin and Nantong. In 2022, Jingwei Hirain Technologies recorded revenue of RMB4,021 mi...

China Passenger Car HUD Industry Chain Development Research Report, 2023

Research on HUD industry chain: new technologies such as LBS and optical waveguide help AR-HUD become a “standard configuration”.

As HUD technology advances, AR-HUD, which can combine virtual informa...

Body (Zone) Domain Controller and Driver IC Industry Research Report,2023

Body (zone) domain controller research: evolution of body electronic and electrical architecture driven by MOSFET and HSD.

The mode of control over body electronic functions is changing with the evol...

China Automotive Fragrance and Air Purification Systems Research Report, 2023

Automotive fragrance and air purification systems: together to create a comfortable and healthy cockpitTechnology trend: intelligence of fragrance system and integration of air purification system

In...

Global and China Solid State Battery Industry Report, 2023

Solid state battery research: semi-solid state battery has come out, is all-solid state battery still far away?In recent years, the new energy vehicle market has been booming, and the penetration of n...

Global and China Passenger Car T-Box Market Report, 2023

T-Box industry research: the market will be worth RMB10 billion and the integration trend is increasingly clear.

ResearchInChina released "Global and China Passenger Car T-Box Market Report, 2023", w...

Analysis Report on Auto Shanghai 2023

Analysis on 75 Trends at Auto Shanghai 2023: Unprecedented Prosperity of Intelligent Cockpits and Intelligent Driving Ecology

After analyzing the intelligent innovation trends at the Auto Shanghai 20...

Chinese Emerging Carmakers’ Telematics System and Entertainment Ecosystem Research Report, 2022-2023

Telematics service research (III): emerging carmakers work on UI design, interaction, and entertainment ecosystem to improve user cockpit experience.

ResearchInChina released Chinese Emerging Carmake...

China Passenger Car Cockpit-Parking Industry Report, 2023

Cockpit-parking integration research: cockpit-parking vs. driving-parking, which one is the optimal solution for cockpit-driving integration?Cockpit-parking vs. driving-parking, which one is the optim...

Automotive Sensor Chip Industry Report, 2023

Sensor chip industry research: driven by the "more weight on perception" route, sensor chips are entering a new stage of rapid iterative evolution.

At the Auto Shanghai 2023, "more weight on percepti...