Chassis domain controller research: full-stack independent development, or open ecosystem route?

Chassis domain consists of transmission, driving, steering and braking systems. Conventional vehicle chassis fail to fit in with the development of vehicle intelligence and autonomous driving, and need chassis-by-wire transformation. Vehicle chassis tend to be electronic, modular and intelligent. Mechanical decoupling is a prerequisite for chassis technology upgrade. Yet in conventional chassis, braking and steering are mechanically coupled, that is, their power source is the mechanical force from drivers who control terminals with the force amplified by hydraulic pressure. In the process of intelligent evolution, the key to chassis electronics however is to enable the decoupling of the mechanical force and replace it with motor drive, so as to improve the control accuracy and also realize better combination of human and systems.

In addition to mechanical decoupling, chassis also need software and hardware decoupling. Conventional electronic chassis systems are divided by components such as electronic stability control system (ESC), electric power steering system (EPS) and electronically controlled suspension system. Each subsystem is from different suppliers or different development departments of OEMs, and has an independent vehicle power control system and vehicle dynamic control model. In the development of chassis controllers, all of which triggers such problems as strong coupling relationship between software and hardware, repeated research and development and high development cost, and countervailing negative effect between subsystems, making optimal vehicle control unreachable.

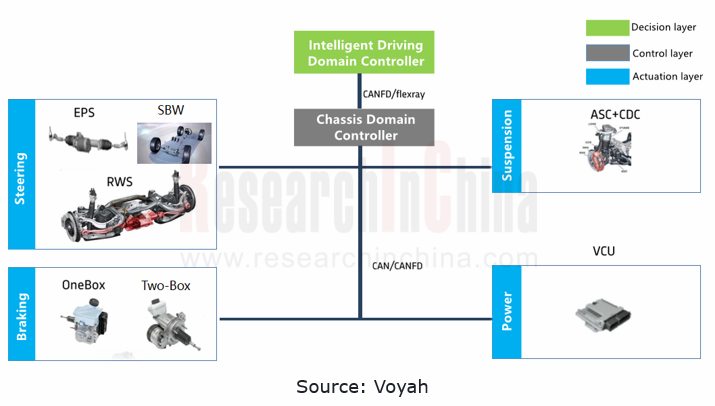

To answer the current needs for new vehicle technologies and new functions, intelligent chassis domain controllers come into being. In the field of highly automated driving, chassis domain controller products are more needed to enable the centralized control of steering, braking, suspension and even power systems, and separation of software and hardware, as well as the transverse, longitudinal and vertical coordinated control of vehicles, better serving intelligent driving.

There are two chassis domain controller technology development routes: the full-stack self-development route of some OEMs, and open ecosystem route of represented by Tier 1 suppliers.

Volkswagen MEB platform uses three controllers to control the whole vehicle and enable functions. The ICAS1 vehicle control domain controller combines many functions including body control management, drive system management, driving system management, power system management, and comfort system management, and integrates body, power and chassis domains into one domain controller.

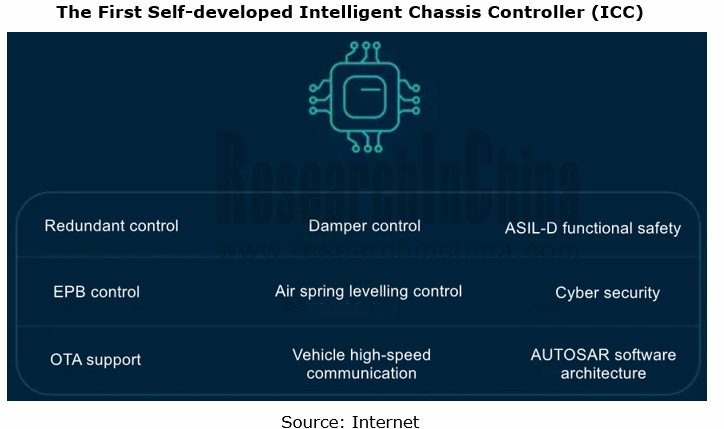

In 2022, NIO introduced its Intelligent Chassis Controller (ICC) when launching ET7. The ICC enables design and adjustment of chassis in all aspects of comfort, maneuverability and drivability and integrates control functions such as "redundant parking, air suspension and shock absorber". This controller also supports cross-domain integrated high-level automated driving scenarios. FOTA updates allow its flexible, quick iterations. The controller of NIO can uniformly adjust and control air spring leveling, shock absorber damping, electronic parking brake and other capabilities.

As concerns the open ecosystem route, chassis domain controllers pose high technical barriers, and there are few mass-produced solutions. At present, Tier 1 suppliers work on single/multi-subsystem development (domain) controllers for chassis subsystems. For example, Keboda Technology has shipped in batches its DCC (dynamic chassis control) that supports Xpeng Motors. This controller is designed to enable the dynamic control of suspensions. The two mainstream products of Suzhou Gates Electronics, i.e., continuous damping dynamic suspension electrically controlled system and air suspension electrically controlled system, are also used for suspension control.

In terms of integrated control of chassis systems, Chinese suppliers still need to learn from world-renowned Tier 1 suppliers.

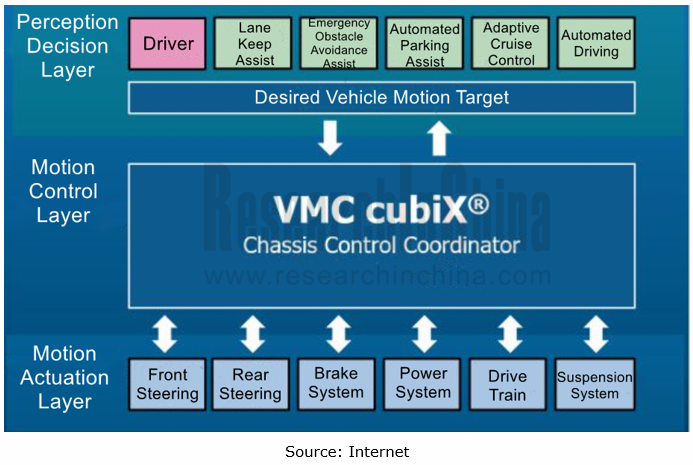

ZF's Integrated Brake Control (IBC), a brake-by-wire system, combines the brake-by-wire active rear axle steering Active Kinematics Control (AKC) and the active damping system (sMotion), bringing longitudinal, transverse and vertical safety and comfort experience. Recently, ZF’s front-axle steering, the most important component for vehicle steering systems, has also enabled drive-by-wire decoupling of software and hardware. All actuation systems are uniformly controlled by cubiX platform. cubiX is an integrated software suite for vehicle motion control, coordinating all the aforementioned actuators and sensors related to vehicle motion.

ZF's VMC cubiX gathers sensor information from the entire vehicle and environment, and prepares it for an optimized control of active systems in the chassis, steering, brakes and propulsion. Meanwhile, following a vendor-agnostic approach, cubiX can support both ZF and third-party components.

In the disruption of intelligent vehicle industry, the only constant is change. Either full-stack independent development or open ecosystem route has its own market space. There is still a wide gap between Chinese chassis (domain controller) Tier 1 suppliers and their foreign counterparts. Fortunately, chassis intelligence is bound up with vehicle electrification. Chinese OEMs have a leading edge in electrification, providing a golden opportunity for these Chinese players and drawing talents who serve Tier 1 suppliers at abroad back into domestic companies.

Automotive Cockpit Domain Controller Research Report, 2023

Research on cockpit domain controllers: various forms of products are mass-produced and mounted on vehicles, and product iteration speeds up.

Both quality and quantity have been improved, and the it...

Chinese Passenger Car OEMs’ Overseas Layout Research Report, 2023

OEMs’ overseas layout research: automobile exports are expected to hit 7.18 million units in 2025.

1. China’s automobile export market bucked the trend.

During 2021-2022, the global economy ...

Global and Chinese Automakers’ Modular Platform and Technology Planning Research Report, 2023

Research on modular platforms: explore intelligent evolution strategy of automakers after modular platforms become widespread.

By analyzing the planning of international automakers, Chinese conventi...

China Passenger Car Mobile Phone Wireless Charging Research Report, 2023

Automotive Wireless Charging Research: high-power charging solutions will lead the trend, with the installations to hit more than 10 million units in 2026.

Technology Trend: Qi2 Standard

The automo...

NXP’s Intelligence Business Analysis Report, 2022-2023

In 2015, NXP acquired Freescale for USD11.8 billion, hereby becoming the largest automotive semiconductor vendor. Yet NXP's development progress has not always gone smoothly. In 2021, Infineon replace...

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Despite the chip shortage and the sluggish economy, Bosch’s sales from all business divisions bucked the trend in 2022. Wherein, the Mobility Solutions, still the company’s biggest division, sold EUR5...

Analysis on Baidu’s Intelligent Driving Business, 2022-2023

Baidu works on three autonomous driving development routes: Apollo Platform, Apollo Go (autonomous driving mobility service platform) and intelligent driving solutions. &n...

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

Ambarella was founded in 2004 and is headquartered in California, the US. Before 2014, Ambarella was the exclusive chip supplier of GoPro. Ambarella was listed on NASDAQ in 2012. When the sports camer...

Global and China Electronic Rearview Mirror Industry Report, 2023

Electronic rearview mirror research: 2023 will be the first year of mass production as the policy takes effect

Global and China Electronic Rearview Mirror Industry Report, 2023 released by ResearchIn...

China Autonomous Driving Domain Controller Research Report, 2023

Autonomous driving domain controller research: explore computing power distribution and evolution strategies for driving-parking integrated domain controllers.

In China, at this stage the industry i...

China In-Vehicle Payment Market Research Report, 2023

China In-Vehicle Payment Market Research Report, 2023 released by ResearchInChina analyzes and researches the status quo of China's in-vehicle payment market, components of the industry chain, layout ...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2023 – Chinese Companies

Research on China’s local Tier 1 suppliers: build up software and hardware strength, and “besiege” driving-parking integration by three routes. 01 Build up their own software and hardware capabilities...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2023 (Foreign Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report,2023 (Chinese Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Company Analysis: Jingwei Hirain’s Automotive and Intelligent Driving Business, 2022-2023

Founded in 2003, Jingwei Hirain Technologies is headquartered in Beijing, with modern production facilities in Tianjin and Nantong. In 2022, Jingwei Hirain Technologies recorded revenue of RMB4,021 mi...

China Passenger Car HUD Industry Chain Development Research Report, 2023

Research on HUD industry chain: new technologies such as LBS and optical waveguide help AR-HUD become a “standard configuration”.

As HUD technology advances, AR-HUD, which can combine virtual informa...

Body (Zone) Domain Controller and Driver IC Industry Research Report,2023

Body (zone) domain controller research: evolution of body electronic and electrical architecture driven by MOSFET and HSD.

The mode of control over body electronic functions is changing with the evol...

China Automotive Fragrance and Air Purification Systems Research Report, 2023

Automotive fragrance and air purification systems: together to create a comfortable and healthy cockpitTechnology trend: intelligence of fragrance system and integration of air purification system

In...