Automotive steering system research: EPS dominates the market, SBW prepares for fully autonomous driving

After hundreds of years of development, automotive steering systems have derived HPS, EHPS, EPS, SBW and other types. At present, HPS (hydraulic power steering) and EHPS (electronic hydraulic power steering) have been widely used in commercial vehicles, while EPS (electric power steering) is mainly applied to passenger cars, and SBW (Steer-by-Wire) has the lowest penetration rate.

EPS occupies the passenger car market, while HPS and EHPS dominate the commercial vehicle market

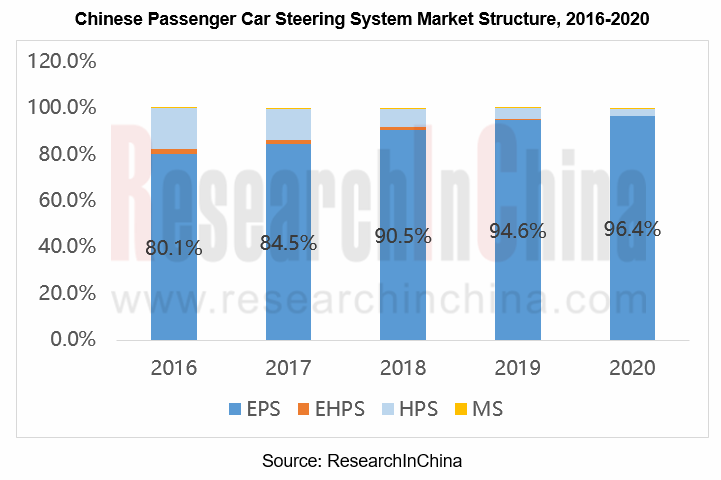

In Chinese passenger car steering system market, the share of EPS has increased from 80.1% in 2016 to 96.4% in 2020; only a small number of passenger cars adopt HPS and EHPS solutions. Relatively speaking, the higher the price of cars, the higher the proportion of EPS solutions applied.

Due to its small size, low power consumption, light weight and flexibility, EPS is the first choice for new energy vehicles. EPS accounted for 99.91% of the new energy passenger car market in 2020, and this proportion is expected to reach 100% in the future.

HPS and EHPS are usually seen in most commercial vehicles, especially heavy-duty vehicles, thanks to their high power and low prices. In 2020, China's commercial vehicle steering systems were still dominated by HPS and EHPS, of which EHPS made up for 40.1%. However, the market shares of HPS and EHPS will gradually be grabbed by EPS in the future because they not only consume lots of power, but also cause hydraulic oil leakage, which do not meet environmental protection requirements.

The EPS penetration rate of local passenger car brands is gradually increasing

In the Chinese passenger car market, the EPS penetration rate of Chinese passenger car brands is much lower than that of foreign passenger car brands. In 2020, the former was 90.7%, while the latter hit as high as 100%. However, with the gradual tightening of environmental protection, local brands will gradually abandon the polluting steering systems such as HPS and EHPS. By 2026, the EPS penetration rate of Chinese passenger car brands is expected to reach 100%.

Multinational companies dominate the market, while local companies strive to survive

At present, the global automotive steering system market is mainly occupied by vendors such as JTEKT, Bosch, ZF, ThyssenKrupp, NSK, Mando, Hitachi Astemo. These multinational companies have deployed the Chinese market through sole proprietorship or joint ventures, firmly occupied the supply channels of luxury and joint venture brand automakers, and penetrated into the supply system of local automakers.

There are more than 100 local companies in China, but most of them are small companies targeting the aftermarket with weak competitiveness. Zhejiang Shibao, CAAS, Elite, Nexteer Automotive, etc. which have relatively strong competitiveness can compete with multinational giants. For example, Nexteer Automotive and Zhejiang Shibao have entered the supply systems of American, German and Japanese automakers by virtue of their robust strength, and have taken places in the siege of multinational companies.

Major vendors and automakers have deployed SBW which will be promising in the future

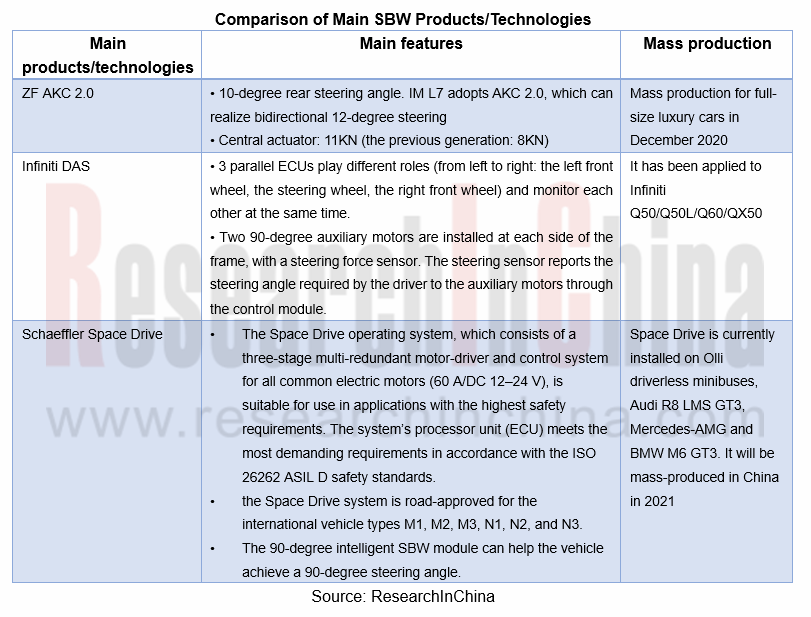

The biggest difference between SBW and EPS is that the former removes the mechanical connection between the steering wheel and the rack and uses ECU to transmit commands instead. SBW features fast response, flexible installation, lighter weight, and improved collision safety.

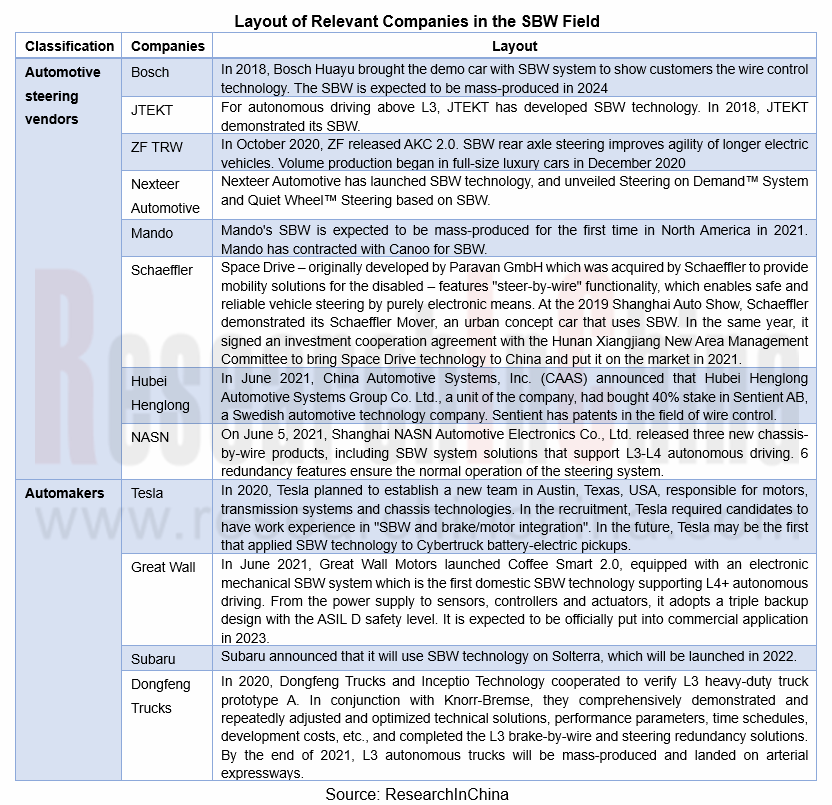

SBW technology was proposed as early as 1950. After decades of development, it has now been mass-produced on Infiniti’s several models. Although SBW still has problems such as high cost, immature technology, limited user acceptance, low penetration rate, etc., some automotive steering vendors and automakers are very optimistic about SBW technology and are making efforts herein. There will be a number of production models using SBW.

China Automotive Engineering Research Institute Co., Ltd. (CAERI) has worked with Huawei, Baidu, Schaeffler and many other companies to jointly compile SBW and Brake System Communication Protocol Requirements and Test Specifications, which is conducive to promoting the development of SBW technology and its application in intelligent vehicles.

At present, the penetration rate of SBW in China is extremely low, and was estimated at 0.1% in 2020. In the next few years, the penetration rate will jump rapidly, and it is expected to reach 15% by 2026. Meanwhile, the market scale will gradually expand to RMB12.16 billion, with lucrative development prospects.

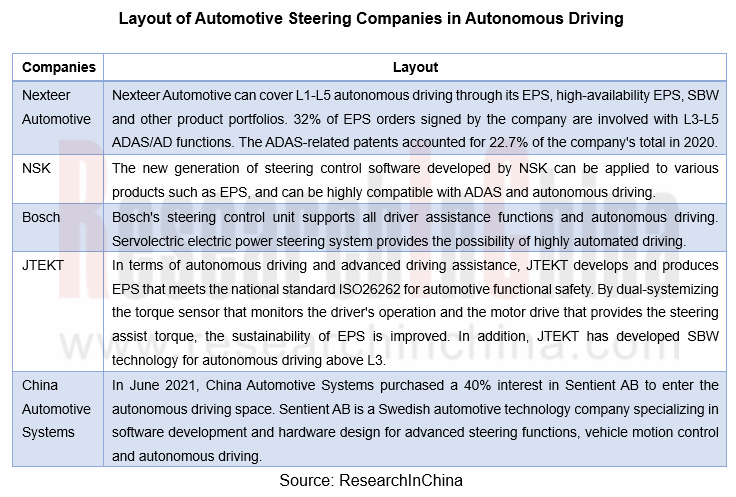

EPS is the key to ADAS functions, while SBW is one of the key technologies for fully autonomous driving

The automotive steering system is closely related to the development of autonomous driving. At present, EPS is the key to ADAS functions, serving different levels of autonomous driving with typical ADAS functions like APA, LDW&LKA and DSR. However, in essence, the steering signal of EPS still comes from the driver, while the steering signal of SBW stems from the algorithm. Therefore, SBW can be completely separated from the driver to control steering as one of the key technologies for fully automatic driving in the future.

At present, some automotive steering system companies have begun to deploy autonomous driving.

Global and China Automotive IGBT and SiC Research Report, 2022

1. In 2025, China's automotive SiC market will be valued at RMB12.99 billion, sustaining AAGRs of 97.2%.

Silicon carbide (SiC) devices that feature the resistance to high voltage and high frequency ...

Passenger Car Chassis Domain Controller Industry Report, 2022

Chassis domain controller research: full-stack independent development, or open ecosystem route?

Chassis domain consists of transmission, driving, steering and braking systems. Conventional vehicle ...

China Automotive LiDAR Industry Research Report, 2022

LiDAR research: Chinese passenger cars will carry over 80,000 LiDAR sensors in 2022

1. The mass production of LiDAR is accelerating, and the installations are expected to exceed 80,000 units in 2022

...

China Autonomous Driving Data Closed Loop Research Report, 2022

1. The development of autonomous driving is gradually driven by data rather than technology

Today, autonomous driving sensor solutions and computing platforms have become increasingly homogeneous, an...

Overseas LiDAR Industry Research Report, 2022

LiDAR Research: Perception Algorithms Become the Layout Focus of Foreign Vendors

Amid a variety of technology routes in parallel, rotating mirror and flash solutions are adopted most widely during OE...

Smart Car OTA Industry Research Report, 2022

Smart car OTA research: With the arrival of OTA3.0 era, how can OEMs explore payment modes of SAAS?

Driven by the development of smart cars, China's OTA installation rate has been growing. According ...

Chinese Joint Venture OEMs’ ADAS and Autonomous Driving Report, 2022

Joint Venture OEM's ADAS Research: Joint venture brands lead in L2/L2.5 installation rate, but have not involved L2.9 for the time being

Following "Chinese Independent OEMs’ ADAS and Autonomous Drivi...

Global and China Hybrid Electric Vehicle Research Report, 2022

Hybrid Research: China Hybrid EV penetration rate will hit 22% within five years

With the development of automobile energy-saving and new energy technologies and the promotion of low-carbon emission ...

China Smart-Road Roadside Perception Industry Report, 2022

Top 10 roadside perception suppliers: quality suppliers come to the front in each market segment.

The growing number of roadside perception players comes with active industrial investment and financ...

China Passenger Car Brake-by-Wire and AEB Market Research Report, 2022

Brake-by-wire research: with an astonishing growth in installation rate, One-Box has commanded much more of the market.

In new energy vehicles, especially intelligent vehicles, the bake-by-wire techn...

Multi-domain Computing and Zone Controller Research Report, 2022

Multi-domain computing and zone controller research: five design ideas advance side-by-side.In the trend for higher levels of autonomous driving, intelligent vehicles pose more stringent requirements ...

Overseas ADAS and Autonomous Driving Tier 1 Suppliers Report, 2022

Overseas ADAS Tier1 Suppliers Research: The gap between suppliers has widened in terms of revenue growth, and many of them plan to launch L4 products by 2025Countries allow L3/L4 vehicles on the road ...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022

ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function applicat...

China Passenger Car Electronically Controlled Suspension Industry Report, 2022

Research on electronically controlled suspension: four development trends of electronically controlled suspension and air suspension

Basic concepts of suspension and electronically controlled suspens...

China L2/L2+ Smart Car Audio Market Report, 2022

Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy...

China Commercial Vehicle T-Box Report, 2022

TOP10 commercial vehicle T-Box suppliers: using terminal data to build telematics platforms will become a megatrend.

1. From the perspective of market size, the pace of popularizing T-Box accelerates...

Electric Drive and Power Domain Industry Report, 2022

Electric drive and power domain research: efficient integration becomes a megatrend, and integration with other domains makes power domain stronger.

Electric drive systems have gone through several ...

China Autonomous Retail Vehicle Industry Report, 2022

Research on Autonomous Retail Vehicles: Lower Costs Accelerate Mass Production with Ever-spreading Retail Scenarios Autonomous retail vehicles integrate technologies such as 5G, artificial intelligenc...