Body (Zone) Domain Controller and Driver IC Industry Research Report,2023

Body (zone) domain controller research: evolution of body electronic and electrical architecture driven by MOSFET and HSD.

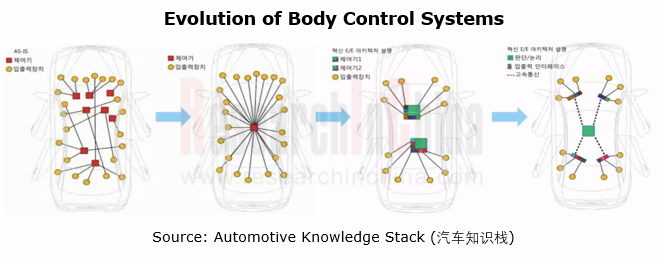

The mode of control over body electronic functions is changing with the evolution of automotive E/E architecture. The mode evolves from decentralized control over body electronics (doors, rearview mirrors, windows, lights, etc.), then to over body control modules (BCMs) and body domain controllers (BDCs), and finally to centralized control over zone control units (VIU/ZCUs).

Various integration forms of body control functions

1. Body domain controller: integrating all types of automotive electronic functions.

Body domain controllers partitioned by function generally integrate such functions as BCM, PEPS, TPMS and gateway to control all body electronic modules in a centralized way, and manage all loads, analyze and process collected information, and allocate system resources in a unified way.

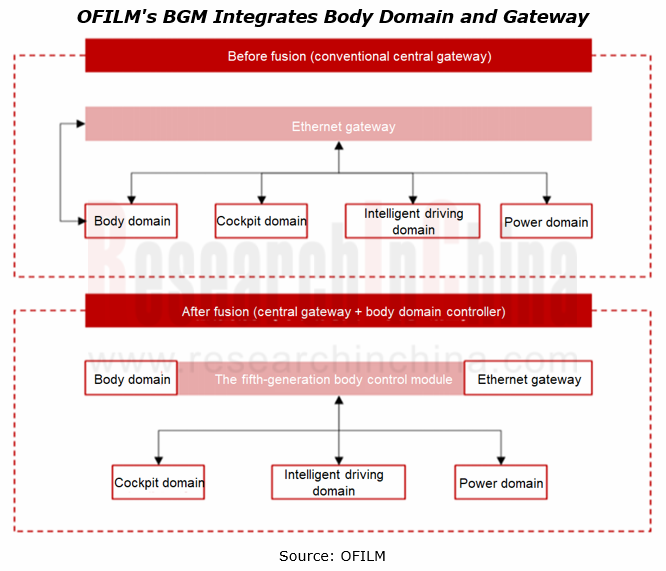

As automotive E/E architectures evolve from the domain centralized to the central computing, vertical integration (integration of multiple functional domains or other highly correlated functions) is the only way. To further centralize the computing power and improve the communication transmission rate, some companies have tried to integrate the gateway functions upward into other domains with relatively simple features. The integration of the body and the Ethernet gateway has thus become the preferred solution.

Shenzhen OFILM's fifth-generation body domain controller (BGM) integrates conventional body electronics (BCM, Ethernet gateway, air-conditioning controller, door module, power management system, etc.) for rapid information interaction via CAN, FlexRay, Ethernet and other domain controllers (e.g., entertainment domain, chassis domain and power domain). This controller is adaptable to L1 to L2+ intelligent driving platforms. The volume production of this product started in September, 2022. At present, OFILM is the exclusive supplier of body domain controllers for Geely Boyue L.

The body high performance computer (HPC) from Continental combines the previously separately implemented gateway function with the body controller function to act as a supercomputing unit. As an in-car application server (ICAS1, based on Renesas R-Car M3), this product is mass-produced for the MEB-based Volkswagen ID.3.

At the Auto Shanghai 2023, Continental exhibited its cross-domain vehicle control HPC for the first time. In addition to the original body control and gateway functions, this product also integrates chassis control applications, and cross-domain vehicle control functions such as damping control, adaptive air suspension and chassis tuning. It is expected that in 2024, Continental's HPC will be installed on more than 30 different models of quite a few automakers. In China Continental has secured two local orders. The first production model supported by this HPC is GAC Aion Hyper GT.

2. Intelligent power distribution box: integrating BCM functions.

Generally, an intelligent distribution box integrates an electric box composed of E-fuse and relay, and a body control module (BCM) in a general control unit to reduce a lot of wires between the BCM and the distribution box in conventional designs and improve the stability of the vehicle circuits. Intelligent power distribution boxes boast three core functions: power distribution, power management, and body control.

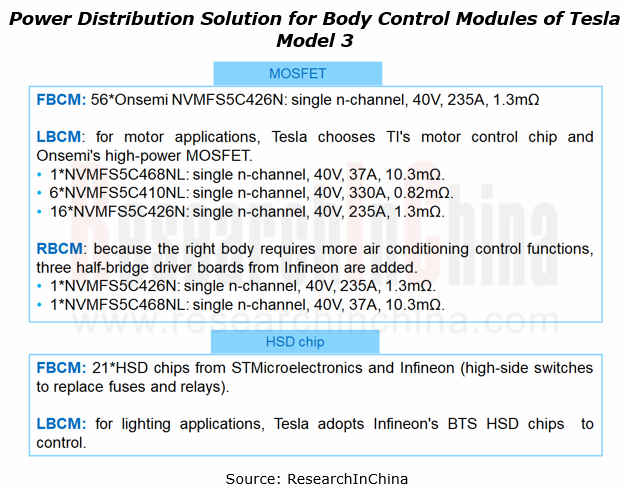

Tesla's intelligent power distribution solution completely cancels the fuse and relay combination, and switches to MOSFETs and HSD chips based on semiconductor technology instead. The power distribution box is no longer just a power distribution box. It not only enables controllable power distribution, but also acts as a controller to integrate power distribution and control functions.

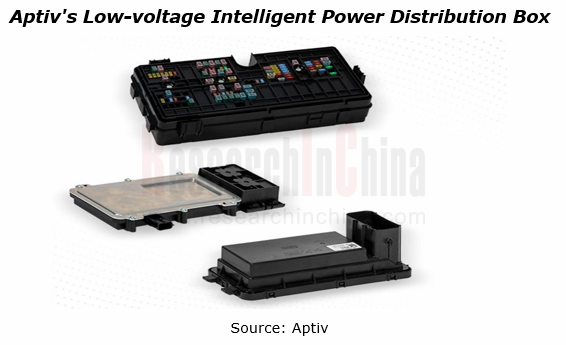

Aptiv's intelligent distribution box selectively integrates some BCM functions and low-voltage loads according to a specific E/E architecture. At present, Aptiv's mass-produced intelligent power distribution box solutions are largely deployed in the front compartment (responsible for headlights, wiper, windshield preheating, oil pump motor, etc.) and the rear compartment (responsible for rear lamps, child safety lock, etc.).

3. Zone control units (VIUs/ZCUs) for centralized architecture

Zone controllers distribute and manage devices by taking physical location as the priority, that is, they connect the nearest vehicle devices, then distribute and manage power of components in each zone, and balance different inputs and outputs.

Zone&VIU, a zone controller jointly launched by Steelmate and Xpeng, is based on the X-EEA 3.0 architecture of Xpeng. The zone controller supports left and right domains, chassis control functions and AUTOSAR, conforms to the ASIL-C functional safety standard, and enables the integration of Ethernet module and body controller. At present, it has been mass-produced for Xpeng G9.

Jingwei HiRain released a zonal control unit (ZCU) at its 2023 new product launch. This controller integrates vehicle power distribution functions (including isolating switch, primary power distribution, secondary power distribution), and zonal gateway routing functions (100M Ethernet, CAN FD, LIN, etc.), as well as body comfort domain functions, new energy power domain functions, some chassis domain functions, and I/O signal collection and control function of air-conditioning thermal management system. It is scheduled to be spawned and delivered by the end of 2023.

Body (zone) domain controllers based on semiconductor-driven control solutions

Now, the power distribution solutions for body (zone) controllers are selected according to the drive current required by loads. In general, in the “driver IC + MOSFET” discrete solution is preferred by high-current loads (in actual design, the fuse + relay solution is for >30A high current applications), while the intelligent high-side switch (HSD) solution is suitable for low-current loads.

In Tesla’s case, the body control domain of Model 3 is composed of front body control, left body control and right body control modules. Wherein, the high current load uses the “driver IC + MOSFET” solution, while the low current load adopts the intelligent HSD solution.

1. Body (zone) domain controllers (MCUs)

Body (zone) domain controllers do not require high computing power, with automotive MCU as the main control chip. In centralized architecture, the computing power will tend to be centralized. Therefore it is necessary to use an automotive MCU with more powerful performance and resources as the main control chip in a zone controller.

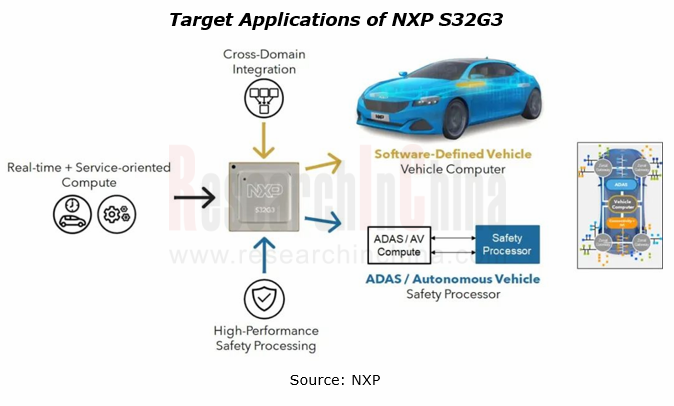

NXP's S32G3 vehicle network processors developed for domain controllers feature real-time processing, service-oriented high-performance computing, cross-domain integration and high-performance secure processing. The latest-generation S32G3 Series was officially released in late 2021 and mass-produced in February 2023. OEMs use the S32G3 processors for central computing for software-defined vehicles (SDV) to host automotive services, integrate cross-domain functions (virtual ECUs), provide secure gateway functions, and manage vehicle OTA updates.

GAC Hyper GT made a debut at the Auto Shanghai 2023. It is the first all-electric car based on the X-Soul architecture, and also the world's first model that uses the S32G3 processor as its central computing unit.

2. Application of SmartFET in zone controllers

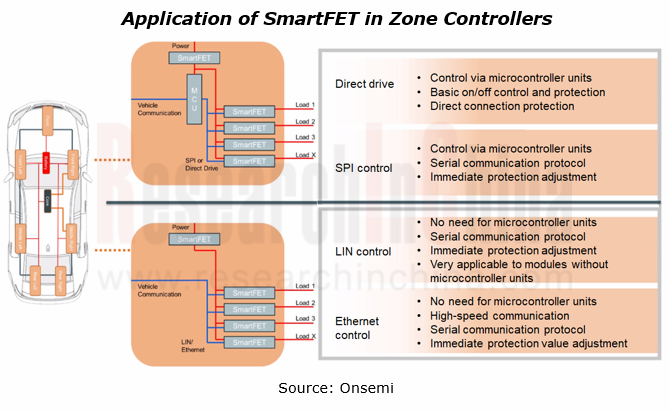

SmartFET functions as a high/low-side driver for external loads (e.g., relay in the central electrical box). In fact, the high-side SmartFET is an N-channel MOSFET where a regulated charge pump is used to pull the gate voltage high enough to drive the load. The drivers themselves need additional protection functions such as short-circuit protection, thermal shutdown (with/without automatic recovery function), overvoltage protection, logic level control (directly controlled by a microcontroller unit), and ESD protection.

Onsemi’s SmartFET used as an intelligent fuse protects the power supply in zone controllers, and provides power supply protection for all loads driven by the zone controllers. It can also drive interior and exterior lighting applications, capacitive loads, inductive loads (wipers, HVAC, doors, etc.), and resistive loads (LEDs, heating units, etc.).

3. Intelligent HSD integrated solutions

High side driver (HSD) ICs have been widely used to control vehicle low-current loads (e.g., lighting). When a short circuit occurs in a single circuit, the HSD IC provides protection much more quickly than the fuse, featuring higher safety.

VIPower? M0-7, ST's high-side driver family, meets rich system requirements of body control modules, including diagnosis, protection, high integration and dimensions optimization, and allows for compatibility design. The tiny power packages and strong driving capability of M0-7 enables uttermost PCB shrinkage. In BDUs of Xpeng P7, a large number of ST’s intelligent M0-7 HSDs from ST have been adopted.

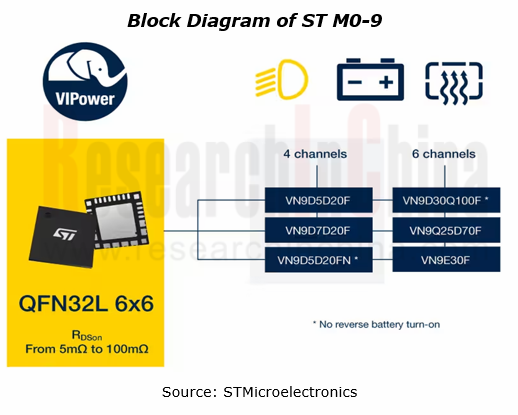

ST's VIPower? M0-9 technology introduces a new generation of automotive intelligent switches, the first in the market with digital current sensing among the fully digital on-chip diagnostic features. Designed for high-side connection in applications powered from a 12V battery, the drivers simplify the hardware and software design of electronic control units (ECUs) and enhance system reliability.

The new devices leverage ST’s latest-generation of VIPower* M0-9 technology to combine an efficient 40V trench vertical MOSFET with 3.3V digital logic, and high-precision analog circuitry in a 6 x 6 mm QFN package. Their compact dimensions and high integration save up to 40% of PCB area compared to comparable driver ICs already in the market.

In general, body domain controller and driver solutions head in the direction of intelligent HSD ICs based on single-chip solutions. As technology advances and cost reduces, their application range will gradually expand to the entire vehicle electrical system, but some extremely high current applications will still adopt “driver + MOSFET” discrete solutions. The evolution of automotive E/E architecture will accelerate between 2025 and 2030.

Monthly Monitoring Report on China Automotive Sensor Technology and Data Trends (Issue 3, 2024)

Insight into intelligent driving sensors: “Chip-based” reduces costs, and the pace of installing 3-LiDAR solutions in cars quickens. LiDARs were installed in 173,000 passenger cars in China in Q1 2024...

Autonomous Driving Simulation Industry Report, 2024

Autonomous Driving Simulation Research: Three Trends of Simulation Favoring the Implementation of High-level Intelligent Driving.

On November 17, 2023, the Ministry of Industry and Information Techno...

Mobile Charging Robot Research Report, 2024

Research on mobile charging robot: more than 20 companies have come in and have implemented in three major scenarios.

Mobile Charging Robot Research Report, 2024 released by ResearchInChina highlight...

End-to-end Autonomous Driving (E2E AD) Research Report, 2024

End-to-end Autonomous Driving Research: status quo of End-to-end (E2E) autonomous driving

1. Status quo of end-to-end solutions in ChinaAn end-to-end autonomous driving system refers to direct mappi...

Monthly Monitoring Report on China Automotive Intelligent Driving Technology and Data Trends (Issue 2, 2024)

Insight into intelligent driving: ECARX self-develops intelligent driving chips, and L2.5 installation soared by 175% year on year.

Based on the 2023 version, the 2024 version of Monthly...

Monthly Monitoring Report on China Automotive Intelligent Cockpit Technology and Data Trends (Issue 2, 2024)

Insight into intelligent cockpit: the trend towards large screens is obvious, with >10" center console screens sweeping over 80%.

Based on the 2023 Edition, the 2024 Edition of Monthly Monitoring...

China Intelligent Driving Fusion Algorithm Research Report, 2024

Intelligent Driving Fusion Algorithm Research: sparse algorithms, temporal fusion and enhanced planning and control become the trend.

China Intelligent Driving Fusion Algorithm Research Report, 2024 ...

Automotive Electronics OEM/ODM/EMS Industry Report, 2024

Automotive electronics OEM/ODM/EMS research: top players’ revenue has exceeded RMB10 billion, and new entrants have been coming in.

At present, OEMs in the Chinese automotive electronics indus...

Analysis on Xpeng’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Research on Xpeng’s layout in electrification, connectivity, intelligence and sharing: in the innovation-driven rapid development, secured orders for 100 flying cars.

NIO, Xp...

Automotive Cockpit SoC Research Report, 2024

Automotive Cockpit SoC Research: Automakers quicken their pace of buying SoCs, and the penetration of domestic cockpit SoCs will soar

Mass production of local cockpit SoCs is accelerating, and the l...

Automotive Integrated Die Casting Industry Report, 2024

Integrated Die Casting Research: adopted by nearly 20 OEMs, integrated die casting gains popularity.

Automotive Integrated Die Casting Industry Report, 2024 released by ResearchInChina summari...

China Passenger Car Cockpit Multi/Dual Display Research Report, 2023-2024

In intelligent cockpit era, cockpit displays head in the direction of more screens, larger size, better looking, more convenient interaction and better experience. Simultaneously, the conventional “on...

Automotive Microcontroller Unit (MCU) Industry Report, 2024

With policy support, the localization rate of automotive MCU will surge.

Chinese electric vehicle companies are quickening their pace of purchasing domestic chips to reduce their dependence on impor...

Automotive Digital Key Industry Trends Research Report, 2024

Automotive Digital Key Industry Trends Research Report, 2024 released by ResearchInChina highlights the following: Forecast for automotive digital key market;Digital key standard specifications and co...

Automotive XR (VR/AR/MR) Industry Report, 2024

Automotive XR (Extended Reality) is an innovative technology that integrates VR (Virtual Reality), AR (Augmented Reality) and MR (Mixed Reality) technologies into vehicle systems. It can bring drivers...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2024

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2024 released by ResearchInChina systematically analyzes the iteration process of IVI systems of mainstream automakers in Chin...

Global and China Automotive Lighting System Research Report, 2023-2024

Installations of intelligent headlights and interior lighting systems made steady growth.

From 2019 to 2023, the installations of intelligent headlights and interior lighting systems grew steadily. I...

Automotive Display, Center Console and Cluster Industry Report, 2024

Automotive display has become a hotspot major automakers compete for to create personalized and differentiated vehicle models. To improve users' driving experience and meet their needs for human-compu...