China Passenger Car HUD Industry Chain Development Research Report, 2023

Research on HUD industry chain: new technologies such as LBS and optical waveguide help AR-HUD become a “standard configuration”.

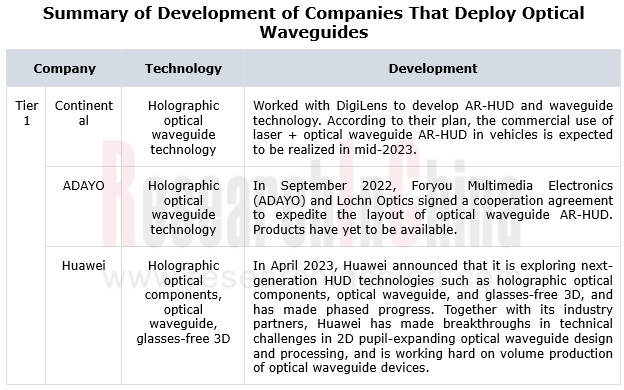

As HUD technology advances, AR-HUD, which can combine virtual information and real road scenes in the form of images, is favored by automakers. With maturing technology and declining cost, HUD has begun to penetrate into low-price vehicle models, and will become a "standard configuration" for smart cars in the future. For example, Changan Deepal S7, a model unveiled in early March 2023 with starting price of RMB169,900, cancels the dashboard and uses a 53-inch holographic AR-HUD system instead. The AR-HUD supplier is Zhejiang Crystal-Optech.

The AR-HUD industry chain covers suppliers of picture generation units (PGU), optical mirrors, glass, software and other components. Among them, the PGU plays the most crucial part at the upstream end, making up 50% of the total cost of HUD, and the optical mirror follows, taking a 20% share. The lower cost of the two major components, namely PGU and optical mirror, means a reduction in the total cost of AR-HUD, bringing an extremely fast progress in the implementation of AR-HUD. Therefore the new technologies related to the two components have developed rapidly in recent years.

Emerging projection technologies such as LCoS and LBS are capturing market shares.

PGU is used to generate pictures and control brightness. At present, the most mature PGU technology path for AR HUD is DLP, a high-cost technology monopolized by TI. Yet Chinese suppliers conduct in-depth research on emerging projection technologies like LCoS and LBS, aiming to seize the initiative and overtake on the bend.

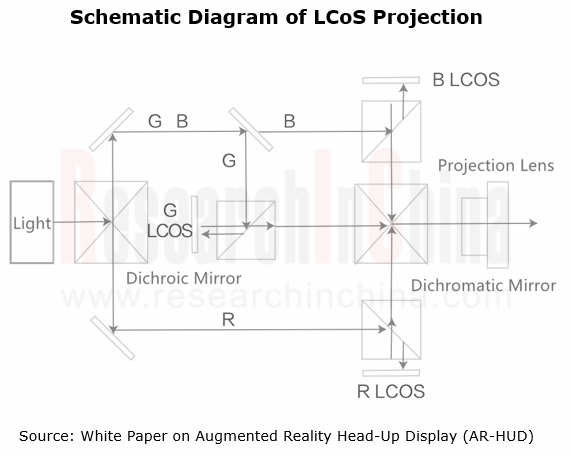

LCoS technology uses the LCoS panel to modulate the optical signal emitted by the light source and projected to the screen, but the light emitted will not penetrate the reflective LCoS panel. LCoS offers the following benefits: 1. High light use efficiency, up to 40% or higher; 2. High resolution, up to 4k or even 8k, and wide color gamut; 3. Low cost after the process matures.

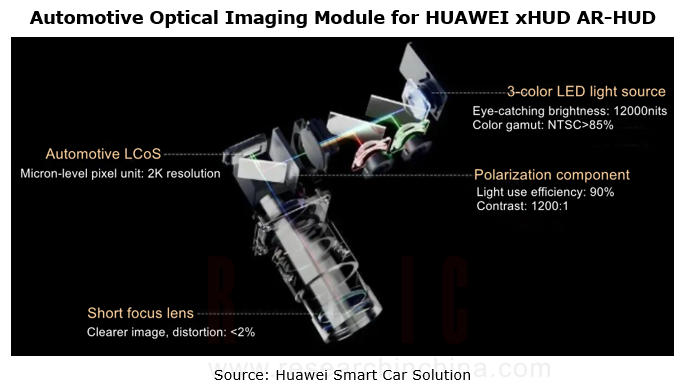

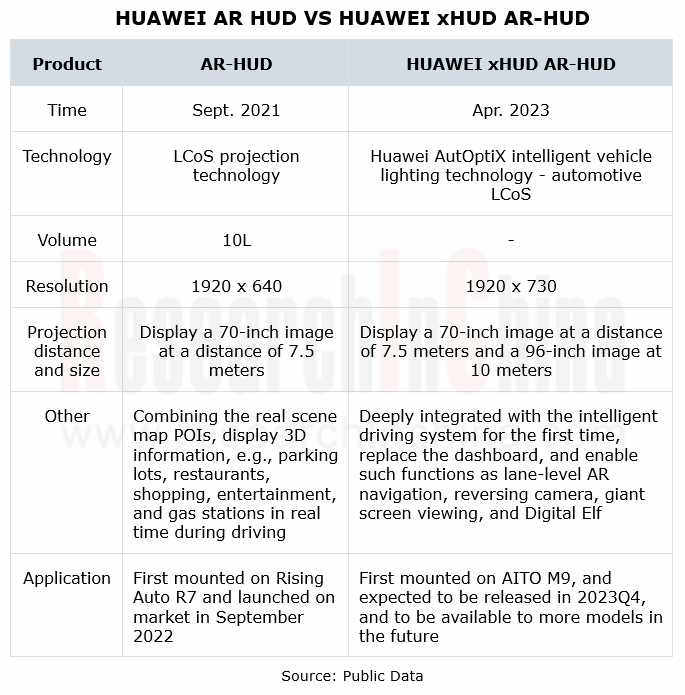

In September 2021, Huawei introduced its AR-HUD product, and in April 2023, Huawei released the xHUD AR-HUD. Both products use LCoS projection technology and feature small size and large format. HUAWEI xHUD AR-HUD can display a 70-inch image at a distance of 7.5 meters, and a 96-inch image at 10 meters. This product can support such applications as intelligent driving visualization, lane-level navigation, reversing camera, Digital Elf, and giant screen viewing.??

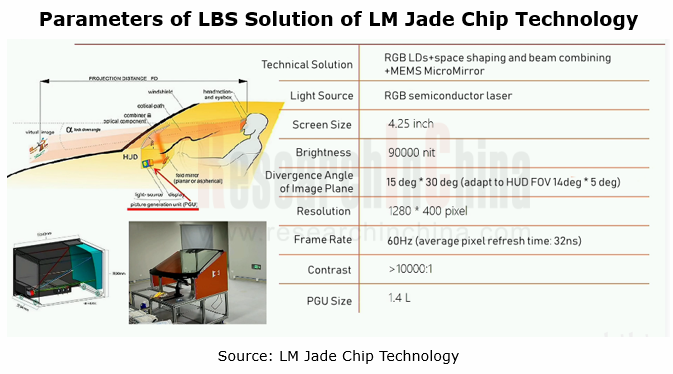

LBS, a laser scanning and projection technology, uses lasers as the light source, and realizes projection via a MEMS micro-mirror. It offers the following benefits: 1. Greatly simplified optical engine, and small size; 2. High contrast, easily up to 7000:1; 3. High brightness and wide color gamut (>150%); 4. Low power consumption (<4-6W), and low heat generation. Nevertheless, for the temperature-sensitive laser diodes fall short of the working requirements of 85°C, LBS has yet to be mature enough to be applied.???

Founded in 2021, LM Jade Chip Technology is a Chinese company engaged in development and industrial application of MEMS chips and laser scanning micro-display modules. For AR-HUD, it has developed a complete LBS-based solution LM-PGU-1000 and provided to its partners such as Sunny Optical Technology, OFILM and Aptiv. LM-PGU-1000 has the following features: 1. A solution to display speckle, speckle contrast: <4%; 2. Higher horizontal resolution and larger horizontal FOV; 3. Lower power consumption and higher brightness; 4. Higher contrast.

Waveguide technology will become the ultimate optical display solution.

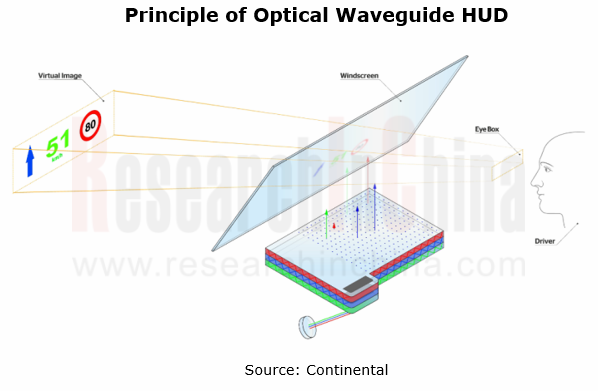

Too large installation size and fairly high cost of AR HUD are currently the sore points for the industry. The waveguide technology allows for removal of the mechanical and optical mechanisms inside conventional HUDs, which means the first two reflections are omitted so that the information from the light source is directly projected onto the windshield. AR HUD occupies space one tenth of conventional mechanical solutions. In addition, the optical waveguide solution delivers high light transmittance, large FOV, and good display effect.

Optical waveguide falls into geometric optical waveguide and diffractive optical waveguide. Wherein, the diffractive optical waveguide technology is the key development direction of AR-HUD, and is divided into surface relief grating waveguide and volume holographic grating waveguide.

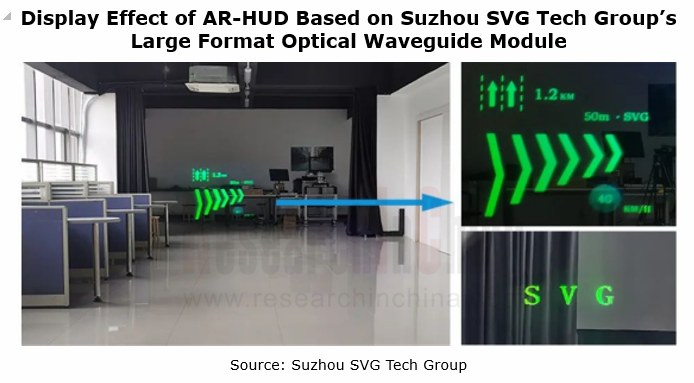

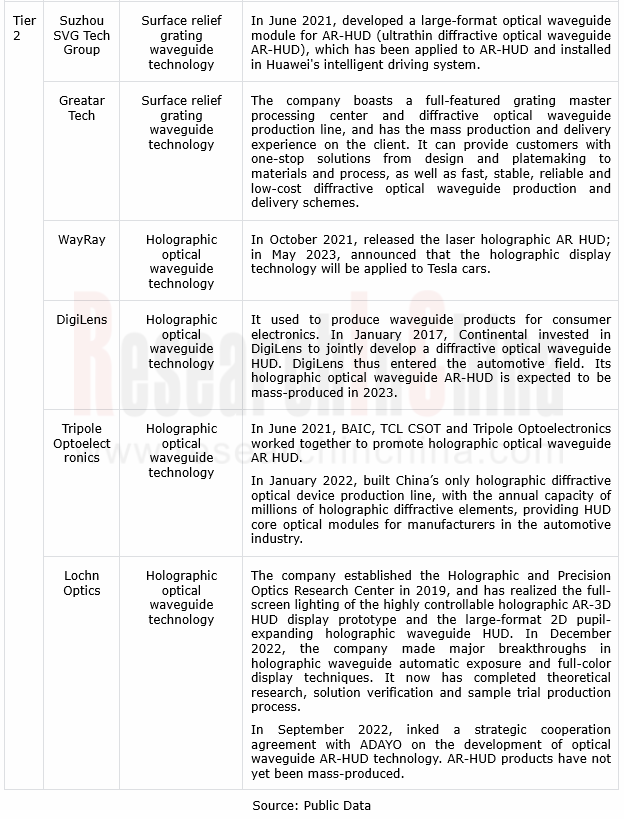

Surface relief grating waveguide, a mature technology often seen in AR near-eye display devices, provides thinness, large field of view, and large eye movement range. At present, it is a mainstream optical waveguide solution for AR-HUD, and manufacturers such as Suzhou SVG Tech Group and Greatar Tech are all making layout of it.

With independent R&D of 3D lithography equipment as the core driver, Suzhou SVG Tech Group works on research and industrialization of optoelectronic materials and devices for the fields of information photonics and new displays. In June 2021, the joint-stock private company announced a large-format optical waveguide module for AR-HUD. This module offers the display effects of ultra-thinness, large field of view, and long virtual image viewing distance. Based on the self-developed micro-nano lithography equipment and platform, this module can process about 2x1011 nanometer units on the 20cmx20cm waveguide surface, and provide a projection distance longer than 15 meters. Currently this module has been used in AR-HUD and installed in Huawei's intelligent driving system.

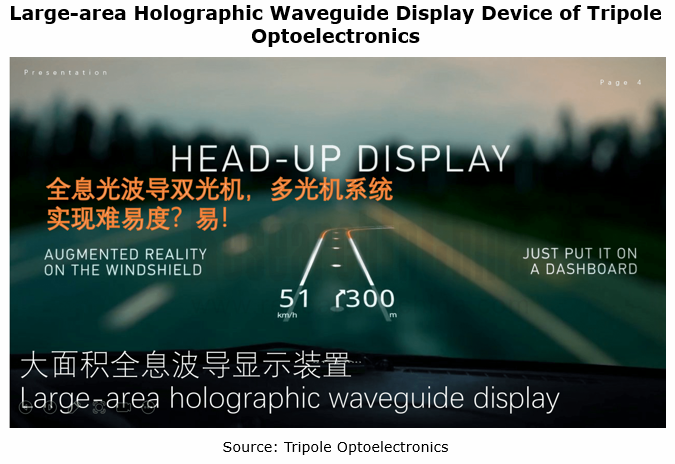

The volume holographic grating waveguide can reduce the volume of AR-HUD to one fifth to one tenth of the conventional geometric optics ones. Compared with reflector-type AR-HUD with a volume of 22L, the holographic optical waveguide enables a volume of only 2.4L; the main imaging module can also standardized and mass-produced at low cost. Such AR-HUD is promising. However the production process is complicated, and currently few manufacturers have the ability to produce in quantities. It is in 2023 that the application of corresponding AR-HUD products will start.?

Tripole Optoelectronics began to deploy volume holographic diffractive optical waveguide technology in 2019. In June 2021, Tripole Optoelectronics worked with BAIC and TCL CSOT to promote holographic optical waveguide AR-HUD. In January 2022, the company built a holographic diffractive optical device production line with the annual capacity of millions of holographic diffractive elements, providing large-area holographic optical waveguide AR-HUD products for manufacturers in automotive industry.??

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing, 2023-2024

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing: Comprehensive layout in eight major fields and upgrade of Huawei Smart Selection

The “Huawei Intelligent Driving Business...

Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Li Auto overestimates the BEV market trend and returns to intensive cultivation.

In the MPV market, Denza D9 DM-i with the highest sales (8,030 units) in January 2024 is a hybrid electric vehicle (H...

Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Because of burning money and suffering a huge loss, many people thought NIO would soon go out of business. NI...

Monthly Monitoring Report on China Automotive Sensor Technology and Data Trends (Issue 3, 2024)

Insight into intelligent driving sensors: “Chip-based” reduces costs, and the pace of installing 3-LiDAR solutions in cars quickens. LiDARs were installed in 173,000 passenger cars in China in Q1 2024...

Autonomous Driving Simulation Industry Report, 2024

Autonomous Driving Simulation Research: Three Trends of Simulation Favoring the Implementation of High-level Intelligent Driving.

On November 17, 2023, the Ministry of Industry and Information Techno...

Mobile Charging Robot Research Report, 2024

Research on mobile charging robot: more than 20 companies have come in and have implemented in three major scenarios.

Mobile Charging Robot Research Report, 2024 released by ResearchInChina highlight...

End-to-end Autonomous Driving (E2E AD) Research Report, 2024

End-to-end Autonomous Driving Research: status quo of End-to-end (E2E) autonomous driving

1. Status quo of end-to-end solutions in ChinaAn end-to-end autonomous driving system refers to direct mappi...

Monthly Monitoring Report on China Automotive Intelligent Driving Technology and Data Trends (Issue 2, 2024)

Insight into intelligent driving: ECARX self-develops intelligent driving chips, and L2.5 installation soared by 175% year on year.

Based on the 2023 version, the 2024 version of Monthly...

Monthly Monitoring Report on China Automotive Intelligent Cockpit Technology and Data Trends (Issue 2, 2024)

Insight into intelligent cockpit: the trend towards large screens is obvious, with >10" center console screens sweeping over 80%.

Based on the 2023 Edition, the 2024 Edition of Monthly Monitoring...

China Intelligent Driving Fusion Algorithm Research Report, 2024

Intelligent Driving Fusion Algorithm Research: sparse algorithms, temporal fusion and enhanced planning and control become the trend.

China Intelligent Driving Fusion Algorithm Research Report, 2024 ...

Automotive Electronics OEM/ODM/EMS Industry Report, 2024

Automotive electronics OEM/ODM/EMS research: top players’ revenue has exceeded RMB10 billion, and new entrants have been coming in.

At present, OEMs in the Chinese automotive electronics indus...

Analysis on Xpeng’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Research on Xpeng’s layout in electrification, connectivity, intelligence and sharing: in the innovation-driven rapid development, secured orders for 100 flying cars.

NIO, Xp...

Automotive Cockpit SoC Research Report, 2024

Automotive Cockpit SoC Research: Automakers quicken their pace of buying SoCs, and the penetration of domestic cockpit SoCs will soar

Mass production of local cockpit SoCs is accelerating, and the l...

Automotive Integrated Die Casting Industry Report, 2024

Integrated Die Casting Research: adopted by nearly 20 OEMs, integrated die casting gains popularity.

Automotive Integrated Die Casting Industry Report, 2024 released by ResearchInChina summari...

China Passenger Car Cockpit Multi/Dual Display Research Report, 2023-2024

In intelligent cockpit era, cockpit displays head in the direction of more screens, larger size, better looking, more convenient interaction and better experience. Simultaneously, the conventional “on...

Automotive Microcontroller Unit (MCU) Industry Report, 2024

With policy support, the localization rate of automotive MCU will surge.

Chinese electric vehicle companies are quickening their pace of purchasing domestic chips to reduce their dependence on impor...

Automotive Digital Key Industry Trends Research Report, 2024

Automotive Digital Key Industry Trends Research Report, 2024 released by ResearchInChina highlights the following: Forecast for automotive digital key market;Digital key standard specifications and co...

Automotive XR (VR/AR/MR) Industry Report, 2024

Automotive XR (Extended Reality) is an innovative technology that integrates VR (Virtual Reality), AR (Augmented Reality) and MR (Mixed Reality) technologies into vehicle systems. It can bring drivers...