Autonomous driving domain controller research: explore computing power distribution and evolution strategies for driving-parking integrated domain controllers.

In China, at this stage the industry is concentrating efforts on mass production and application of L2++ or L2+++ autonomous driving that is infinitely close to L3. In this process, various new solutions mushroom, including new technologies (BEV perception, data closed loop, etc.), new functions (urban NOA, highway NOA, home zone parking pilot (HPP), valet parking, etc.), new architectures (domain centralized EEA, cross-domain fusion EEA, etc.), new sensors (4D imaging radar, LiDAR, etc.), new chips (high-compute chip integrated BEV framework, etc.), new communication protocols, and new development concept (SOTIF).

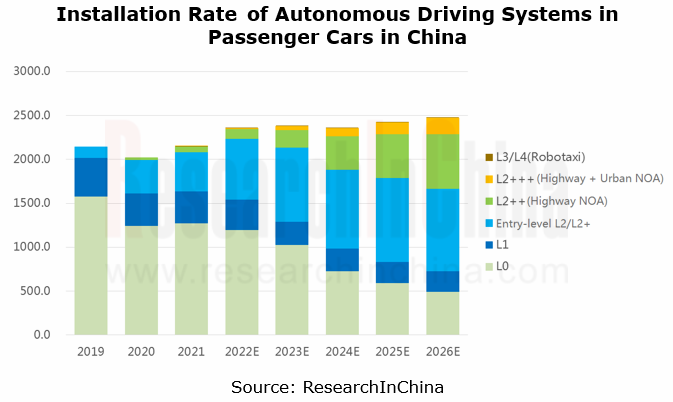

By 2026, the sales of passenger cars equipped with OEM L2++ (supporting highway NOA and driving-parking integration) are expected to reach 6.236 million units; the sales of passenger cars with OEM L2+++ (supporting urban NOA + AVP) are expected to reach 1.833 million units.

The autonomous driving development path is becoming clear, and the industry heads in the direction of “cost reduction” and “efficiency improvement”.

The development path of autonomous driving system tends to be clear, and "cost reduction" and "efficiency improvement" have been a megatrend for the industry. By Black Sesame’s estimate, the BOM cost of domain controllers can be controlled within RMB3,000 in the case of 10V (camera) NOA function, supporting 50-100T physical computing power; in addition, by 2024, the cost of a complete 100TOPS NOA solution (domain controller and chip + HD map and positioning module + system integration and development + test and verification, based on BEV algorithms and without LiDAR) is expected to drop significantly to less than RMB7,000 from the current RMB15,000.

The computing power distribution and evolution strategies for driving-parking integrated domain controllers have become clear, highlighting the following solutions:

Entry-level L2/L2+: many vehicle models have already packed L2 driving assistance functions, and most of them use intelligent front-view all-on-ones such as 1R1V/3R1V solution, with low mass production costs, and the average computing power of platforms lower than 5 TOPS; L2 often adopts chips with low-to-medium computing power, such as Horizon Robotics J2/J3, Ambarella CV Series, Mobileye EyeQ3/4 and EyeQ6L upgrade version, TI TDA4VL, and Renesas R-CAR V3H.

L2++: in 2023, lightweight driving-parking integration and highway NOA are the key functions spawned by major OEMs, most of which use 5R5V or 5R6V configuration scheme coupled with high precision positioning and HD map modules, to realize end-to-end highway NOA, HPP and other functions. Such systems mostly use 1-3 cost-effective SoCs and 5-20TOPS domain controller platforms. Moreover, to further reduce the cost, single-chip driving-parking integrated domain controllers are becoming a trend.

L2++ Pro: with lower chip costs, lightweight driving-parking integrated domain controllers tend to offer higher computing power of 30-70 TOPS, and can run 6V, 7V, 9V, 10V and 11V perception solutions to enable more powerful vision algorithms; at the chip level, the evolution route has been presented, for example, new products like TI TDA4VH, black sesameA1000, RenesasR-Car V4H, and EyeQ6H are scheduled to start volume production and be installed in vehicles during 2023-2024.

L2+++: the key functions of high performance driving-parking integration and urban NOA are infinitely close to L3. Based on BEV perception algorithms, the urban NOA allows for "getting rid of HD map", and can carry 1-3 LiDARs or 4D imaging radar and >100TOPS computing platforms. At the chip level, chip vendors design high-compute chip architectures actively compatible with BEV perception algorithms and deliver their BEV algorithm framework to customers.

L3/L4: mainly used in Robotaxies at present. It is expected that in 2023 China will release the L3 autonomous driving standards. It will still take a very long time from draft and final draft release to system R&D, and then to SOP and deployment.

Typical driving-parking integrated domain controllers that often adopt 5R5V, 5V6R and 5R11V help to enable highway NOA functions such as HWA (highway assist), TJA (traffic jam assist) and AES (automatic emergency steering), as well as parking functions like APA (automated parking assist), HPA (home-zone parking assist) and RPA (remote parking assist). With 1-3 additional LiDARs, they can realize urban NOA.

Neusoft Reach X-Box 4.0: with Horizon Robotics J5 and SemiDrive X9 high-compute chips and a 5R11V sensor solution, it supports access to 11 HD cameras, 4D radars, ultrasonic radars and 8MP cameras, and meets ISO 26262 functional safety and ISO 21434 cyber security standards, so as to enable highway NOA.

To cut down cost and improve efficiency, in addition to common solutions, other solutions such as 6V, 7V and 9V have also come out. Players reduce the use of radars, enhance vision-only algorithms and introduce BEV perception algorithm framework. Some Tier 1 suppliers even propose introduction of BEV perception algorithm framework into platforms with computing power of over a dozen TOPS, so as to further lower the threshold to enable urban NOA.

QCRAFT 6V1R Highway NOA Solution: compared with 5V5R solutions, the Horizon Robotics J5-based solution has a higher cost of domain controllers but saves the cost of 4 radars. On the whole there is not a big difference in their cost. QCRAFT's 6V1R solution highlights visual perception algorithm, and also brings the fisheye camera in the perception results during driving. Based on this hardware, the 6V1R solution allows for deployment of the BEV framework, and provides better experience and a longer service life than 5V5R solutions.

DJI Vision-only Driving-parking Integrated Solution: with computing power of 32TOPS, it is supposed to use a TI TDA4VH SoC. The perception solutions include a pair of DJI vehicle-specific front-view IMU stereo cameras, a rear-view mono camera, and four surround view fisheye cameras. Based on the powerful online real-time visual perception, decision and planning capabilities, this driving-parking integrated solution can enable all functions except urban NOA without relying on HD maps (the 7V configuration coupled with HD maps to realize urban NOA).

Emerging carmakers already stay one step ahead, and conventional OEMs are also accelerating architecture upgrade and high-level NOA implementation.

OEMs are stepping up E/E architecture evolution. Take BYD as an example:

e3.0 Architecture: launched in 2021, the architecture integrates five major functional domains: power, chassis, safety, entertainment, and body electronics. The electronic parts of each functional domain are laid out in a centralized way. The 12-in-1 body domain features four domain controllers and self-developed vehicle operating system (BYD OS) in the new E/E architecture;

Central Computing Platform + Zone Controller Architecture: in 2024, the central computing platform + zone controller architecture was introduced to create BYD OS, a vehicle operating system which consists of two parts: BI OS for the chassis control domain; BU OS for intelligent cockpit and intelligent driving assistance.

BYD's previous autonomous driving systems mostly used the front-view all-in-one solutions from Bosch, ZF and Veoneer. Although the old solutions have yet to fall into disuse in full, BYD is also building closer partnerships with chip vendors and integrators such as Nvidia, Horizon Robotics, Huawei, Baidu and Momenta on high-end models like Denza, Yangwang and Xingji.

At the end of 2021, BYD and Momenta announced the establishment of a new joint venture called “DiPi Intelligent Mobility Co.” to develop NOA, an advanced autonomous driving system to be mass-produced and deployed in 2023. This solution is expected to be equipped with dual Desay SV IPU04 ORIN autonomous driving domain controllers.

In general, in the fierce low-cost competition among automakers, autonomous driving system Tier 1 suppliers, domain controller Tier 1 suppliers and even SoC vendors are accelerating their pace of hardware and algorithm innovations in a bid to seek out most cost-effective solution combinations that provide better performance experience.

1 Summary on Autonomous Driving Domain Controllers and Solutions of OEMs

1.1 Evolution of Electrical and Electronic Architecture (EEA) of OEMs

1.1.1 Four Dimensions of Automotive EEA Upgrade: Software Architecture, Hardware Architecture, Communication Architecture, and Power Supply Architecture

1.1.2 Domain Integrated Platform and Vehicle Computing Platform in the Evolution of Automotive EEA

1.1.3 Evolution Trend of Automotive EEA in the Next Decade

1.1.4 New-generation EEA and Domain Controller Layout of OEMs (1)

1.1.5 New-generation EEA and Domain Controller Layout of OEMs (2)

1.1.6 New-generation EEA and Domain Controller Layout of OEMs (3)

1.1.7 New-generation EEA and Domain Controller Layout of OEMs (4)

1.2 Autonomous Driving Domain Controllers and System Solutions of OEMs

1.2.1 Configurations of Autonomous Driving Domain Controllers and System Solutions of OEMs (Incl. Ongoing R&D Projects) (1)

1.2.2 Configurations of Autonomous Driving Domain Controllers and System Solutions of OEMs (Incl. Ongoing R&D Projects) (2)

1.2.3 Configurations of Autonomous Driving Domain Controllers and System Solutions of OEMs (Incl. Ongoing R&D Projects) (3)

1.2.4 Configurations of Autonomous Driving Domain Controllers and System Solutions of OEMs (Incl. Ongoing R&D Projects) (4)

1.2.5 Configurations of Autonomous Driving Domain Controllers and System Solutions of OEMs (Incl. Ongoing R&D Projects) (5)

1.2.6 Configurations of Autonomous Driving Domain Controllers and System Solutions of OEMs (Incl. Ongoing R&D Projects) (6)

1.2.7 Configurations of Autonomous Driving Domain Controllers and System Solutions of OEMs (Incl. Ongoing R&D Projects) (7)

1.2.8 Configurations of Autonomous Driving Domain Controllers and System Solutions of OEMs (Incl. Ongoing R&D Projects) (8)

1.2.9 Configurations of Autonomous Driving Domain Controllers and System Solutions of OEMs (Incl. Ongoing R&D Projects) (9)

2 Summary on Autonomous Driving Domain Controllers and Solutions of Tier 1 Suppliers

2.1 Development Directions of Driving-parking Integrated Domain Controllers

2.1.1 Development Directions: Distribution and Evolution Scheme of Computing Power of Driving-parking Integrated Domain Controllers

2.1.2 Development Directions: City NOA, "More Weight on Perception, Less Weight on Maps" to Be Applied on Large Scale

2.2 Entry-level L2/L2+ Front View Integrated Solutions

2.2.1 Definition of Entry-level L2/L2+ Front View Integration: Basic Configurations - 1V / 1V1R/ 1V3R / 1V5R

2.2.2 Entry-level L2/L2+ Front View Integrated Solutions: Horizon J3

2.2.3 Entry-level L2/L2+ Front View Integrated Solutions: EyeQ6L

2.3 Lightweight Driving-parking Integrated Domain Control Solutions (L2++)

2.3.1 Definition of Lightweight Driving-parking Integrated Domain Control (L2++): Driving-parking Integration and Highway NOA

2.3.2 Lightweight Driving-parking Integrated Domain Control Solutions (L2++) (1)

2.3.3 Lightweight Driving-parking Integrated Domain Control Solutions (L2++) (2)

2.3.4 Lightweight Driving-parking Integrated Domain Control Solutions (L2++) (3)

2.3.5 Lightweight Driving-parking Integrated Domain Control Solutions (L2++) (4)

2.3.6 Lightweight Driving-parking Integrated Domain Control Solutions (L2++) (5)

2.3.7 Lightweight Driving-parking Integrated Domain Control Solutions (L2++) (6)

2.3.8 Lightweight Driving-parking Integrated Domain Control Solutions (L2++) (7)

2.3.9 Lightweight Driving-parking Integrated Domain Control Solutions (L2++) (8)

2.3.10 Lightweight Driving-parking Integrated Domain Control Solutions (L2++) (9)

2.3.11 Lightweight Driving-parking Integrated Domain Control Pro Upgrade Solutions (L2++) (1)

2.3.12 Lightweight Driving-parking Integrated Domain Control Pro Upgrade Solutions (2)

2.3.13 Lightweight Driving-parking Integrated Domain Control Pro Upgrade Solutions (3)

2.3.14 Lightweight Driving-parking Integrated Domain Control Pro Upgrade Solutions (4)

2.3.15 Typical Lightweight Driving-parking Integrated Domain Control Products (1)

2.3.16 Typical Lightweight Driving-parking Integrated Domain Control Products (2)

2.3.17 Typical Lightweight Driving-parking Integrated Domain Control Products (3)

2.3.18 Typical Lightweight Driving-parking Integrated Domain Control Products (4)

2.4 High-performance Driving-parking Integrated Domain Control Solutions (L2+++)

2.4.1 Definition of High-performance Driving-parking Integrated Domain Control (L2+++): City NOA and Highway NOA

2.4.2 High-performance Driving-parking Integrated Domain Control Solutions (L2+++) (1)

2.4.3 High-performance Driving-parking Integrated Domain Control Solutions (L2+++) (2)

2.4.4 High-performance Driving-parking Integrated Domain Control Solutions (L2+++) (3)

2.4.5 High-performance Driving-parking Integrated Domain Control Solutions (L2+++) (4)

2.4.6 High-performance Driving-parking Integrated Domain Control Solutions (L2+++) (5)

2.4.7 High-performance Driving-parking Integrated Domain Control Solutions (L2+++) (6)

2.4.8 High-performance Driving-parking Integrated Domain Control Solutions (L2+++) (7)

2.4.9 High-performance Driving-parking Integrated Domain Control Solutions (L2+++) (8)

2.4.10 High-performance Driving-parking Integrated Domain Control Solutions (L2+++) (9)

2.4.11 High-performance Driving-parking Integrated Domain Control Solutions (L2+++) (10)

2.4.12 High-performance Driving-parking Integrated Domain Control Solutions (L2+++) (11)

2.4.13 Typical High-performance Driving-parking Integrated Domain Control Products (1)

2.4.14 Typical High-performance Driving-parking Integrated Domain Control Products (2)

2.4.15 Typical High-performance Driving-parking Integrated Domain Control Products (3)

2.4.16 Typical High-performance Driving-parking Integrated Domain Control Products (4)

2.5 Cockpit-driving Integrated Domain Control Solutions

2.5.1 As EEA Evolves, Cockpit-driving Integration Is around the Corner and Vehicle Central Computing Platform Is Being Laid Out

2.5.2 Cockpit-driving Integration Is Expected to Be Available to Vehicles during 2024-2025

2.5.3 Cockpit-driving Integrated Solutions (1)

2.5.4 Cockpit-driving Integrated Solutions (2)

2.5.5 Cockpit-driving Integrated Solutions (3)

2.5.6 Cockpit-driving Integrated Solutions (4)

2.5.7 Cockpit-driving Integrated Solutions (5)

2.5.8 Cockpit-driving Integrated Solutions (6)

2.6 Summary on Autonomous Driving Domain Controllers and Solutions of Tier 1 Suppliers

2.6.1 Summary on Autonomous Driving Domain Control Product Lines of 33 Tier 1 Suppliers (1)

2.6.2 Summary on Autonomous Driving Domain Control Product Lines of 33 Tier 1 Suppliers (2)

2.6.3 Summary on Autonomous Driving Domain Control Product Lines of 33 Tier 1 Suppliers (3)

2.6.4 Summary on Autonomous Driving Domain Control Product Lines of 33 Tier 1 Suppliers (4)

2.6.5 Summary on Autonomous Driving Domain Control Product Lines of 33 Tier 1 Suppliers (5)

2.6.6 Summary on Autonomous Driving Domain Control Product Lines of 33 Tier 1 Suppliers (6)

2.6.7 Summary on Autonomous Driving Domain Control Product Lines of 33 Tier 1 Suppliers (7)

2.6.8 Summary on Autonomous Driving Domain Control Product Lines of 33 Tier 1 Suppliers (8)

2.6.9 Summary on Autonomous Driving Domain Control Product Lines of 33 Tier 1 Suppliers (9)

2.6.10 Summary on Autonomous Driving Domain Control Product Lines of 33 Tier 1 Suppliers (10)

2.6.11 Summary on Autonomous Driving Domain Control Product Lines of 33 Tier 1 Suppliers (11)

2.6.12 Summary on Autonomous Driving Domain Control Product Lines of 33 Tier 1 Suppliers (12)

2.6.13 Summary on Autonomous Driving Domain Control Product Lines of 33 Tier 1 Suppliers (13)

3 Research on Key Points of Autonomous Driving Domain Controllers

3.1 China Passenger Car Autonomous Driving Domain Controller Market

3.1.1 Forecast for Installation Rate of L1/L2/L2+/L2++/L2+++/L3-L4 (Robotaxi) Autonomous Driving Systems in Passenger Cars in China

3.1.2 Attached Datasheet: Forecast for Installation Rate of L1/L2/L2+/L2++/L2+++/L3-L4 (Robotaxi) Autonomous Driving Systems in Passenger Cars in China

3.1.3 China’s Passenger Car Autonomous Driving Domain Controller Shipments (10,000 Units), 2022-2026E

3.1.4 Estimated Supply of China’s Passenger Car Autonomous Driving Domain Controller Suppliers, 2022

3.1.5 China’s Passenger Car Autonomous Driving Domain Controller Market Size (RMB100 Million), 2022-2026E

3.1.6 Analysis of Autonomous Driving Domain Controller Cost in China: Prices and Target Markets of Products with Different Positions

3.1.7 Single-chip Driving-parking Integrated Solutions Help Automakers Further Lower Costs

3.2 Autonomous Driving Domain Control SoC Solutions

3.2.1 Faster Chip Localization

3.2.2 Cockpit-parking Integrated Processor of SemiDrive: X9U

3.2.3 Intelligent Driving Processor of SemiDrive: V9P, L2+ Single-chip Driving-parking Integration

3.2.4 SemiDrive Central Computing Architecture 2.0 (SCCA 2.0)

3.2.5 Smart BEV Technology Framework of Black Sesame (1)

3.2.6 Smart BEV Technology Framework of Black Sesame (2)

3.2.7 Black Sesame’s Wudang Series C1200 Intelligent Vehicle Cross-domain Computing Chip Platforms

3.2.8 BEV Space-time Fusion Architecture on Journey J5

3.2.9 Chinese Autonomous Driving SoCs: Horizon Robotics - Cooperation on Front View

3.2.10 Chinese Autonomous Driving SoCs: Horizon Robotics - Cooperation on Domain Controller

3.2.11 Chinese Autonomous Driving SoCs: Horizon Robotics – Application in Models

3.2.12 Chinese Autonomous Driving SoCs: Black Sesame - Cooperation on Domain Controller

3.2.13 Chinese Autonomous Driving SoCs: Black Sesame - Cooperation on Domain Controller and Surround View

3.2.14 Chinese Autonomous Driving SoCs: Black Sesame - Application in Models

3.2.15 Chinese Autonomous Driving SoCs: SemiDrive - Cooperation on Domain Controller

3.2.16 Product Selection of Chinese Autonomous Driving Domain Control SoCs (1)

3.2.17 Product Selection of Chinese Autonomous Driving Domain Control SoCs (2)

3.2.18 Product Selection of Chinese Autonomous Driving Domain Control SoCs (3)

3.2.19 Product Selection of Global Autonomous Driving Domain Control SoCs (1)

3.2.20 Product Selection of Global Autonomous Driving Domain Control SoCs (2)

3.2.21 Product Selection of Global Autonomous Driving Domain Control SoCs (3)

3.2.22 Product Selection of Global Autonomous Driving Domain Control SoCs (4)

3.2.23 Product Selection of Global Autonomous Driving Domain Control SoCs (5)

3.3 Design/Production Business Models for Domain Controllers

3.3.1 Three Development Cooperation Models for Domain Controllers: White Box, Gray Box, and Black Box

3.3.2 Five Production Business Models for Domain Controllers (1)

3.3.3 Five Production Business Models for Domain Controllers (2)

3.3.4 Five Production Business Models for Domain Controllers (3)

3.3.5 Three Profit Sharing Models for Domain Controllers

3.4 Domain Controller EMS Model

3.4.1 Domain Controller EMS Model: Origin

3.4.2 Domain Controller EMS Model: Logic of Division of Labor in Software and Hardware Separation

3.4.3 Domain Controller EMS Model: Provide Domain Controller Hardware EMS and Hardware-related Underlying System Development

3.4.4 Domain Controller EMS Model: Interest Demand of Each Core Participant

3.4.5 Domain Controller EMS Model: EMS Cost Composition

3.4.6 Domain Controller EMS Model: Typical Cooperation Cases (1)

3.4.7 Domain Controller EMS Model: Typical Cooperation Cases (2)

3.4.8 Mainstream Domain Controller EMS Providers (1)

3.4.9 Mainstream Domain Controller EMS Providers (2)

3.4.10 Mainstream Domain Controller EMS Providers (3)

3.4.11 Typical Responsibilities of Domain Controller OEMs (1)

3.4.12 Typical Responsibilities of Domain Controller OEMs (2)

3.4.13 Strategic Choices of OEMs in EMS Model (1)

3.4.14 Strategic Choices of OEMs in EMS Model (2)

3.4.15 Strategic Choices of OEMs in EMS Model (3)

3.4.16 Strategic Choices of OEMs in EMS Model (4)

3.4.17 Strategic Choices of OEMs in EMS Model (5)

4 Chinese Domain Controller Vendors

4.1 Neusoft Reach

4.1.1 Profile

4.1.2 Product Line: Key Collaborations and Designations by OEMs

4.1.3 Autonomous Driving Domain Controller: Product Matrix

4.1.4 Domain Controller Products: X-Box Series Driving-parking Integrated Domain Controllers

4.1.5 Domain Controller Products: High-performance Driving-parking Integrated Domain Controller - X-Box 4.0

4.1.6 Domain controller Products: Cost-effective Driving-parking Integrated Domain Controller - X-Box 3.0

4.1.7 Domain Controller Products: Multi-domain Fusion Controller - X-Center

4.1.8 Domain Controller Products: Central Computing Unit Products Jointly Developed with UAES

4.1.9 Software Platforms: NeuSAR Is Officially Upgraded to Version 4.0, Supporting Cross-domain Integration

4.1.10 Software Platforms: Standard SOA Middleware

4.1.11 Software Platforms: NeuSAR DS Domain Controller Software Development Platform

4.1.12 Ecosystem Construction: Build Strategic Cooperation with Multiple Parties

4.2 Desay SV

4.2.1 Operating Results, 2022

4.2.2 Autonomous Driving Domain Controller Product Line: Key Collaborations and Designations by OEMs

4.2.3 Autonomous Driving Domain Controller (IPU): Product Development Planning

4.2.4 Autonomous Driving Domain Controller (IPU): Technology Roadmap

4.2.5 Autonomous Driving Domain Controller (IPU): Product Comparison

4.2.6 Autonomous Driving Domain Controller (IPU): Ecosystem Construction

4.2.7 IPU04 Autonomous Driving Domain Controller: Hardware Architecture

4.2.8 IPU04 Autonomous Driving Domain Controller: Software Architecture

4.2.9 IPU03 Domain Controller: Build Strategic Cooperation with Xpeng and Nvidia

4.2.10 IPU02 Driving-parking Integrated Controller

4.2.11 Bought Shares of Momenta and MAXIEYE

4.3 iMotion

4.3.1 Operating Results, 2022

4.3.2 Supply Chain

4.3.3 Strategic Outlook

4.3.4 Solutions to Meet Different Market Needs

4.3.5 Autonomous Driving Domain Control Product Solutions

4.3.6 IDC Series Driving-parking Integrated Domain Controller Products Planning

4.3.7 IFC Series Front View All-in-One Products Planning

4.3.8 Driving-parking Integrated Domain Controllers: IDC HIGH

4.3.9 Driving-parking Integrated Domain Controllers: IDC MID

4.3.10 Driving-parking Integrated Solution: Hardware Configuration and Functional Highlights

4.3.11 "End-to-end" Driving-parking Integrated Solution

4.3.12 Big Data Closed-loop System

4.4 Freetech

4.4.1 Autonomous Driving Product Roadmap

4.4.2 ODIN Intelligent Driving Digital Base

4.4.3 Business Concept - "Intelligent Driving Platform as a Service"

4.4.4 High-level Autonomous Driving Roadmap

4.4.5 Autonomous Driving Domain Controllers: Product Matrix

4.4.6 Autonomous Driving Domain Controllers: Product Line

4.4.7 Autonomous Driving Domain Controllers: Product Roadmap

4.4.8 Autonomous Driving Domain Controllers: ADC20 for Cost-effective 5V5R Driving-parking Integrated Solutions

4.4.9 Autonomous Driving Domain Controllers: ADC20 for Lightweight Driving-parking Integrated Solutions

4.4.10 Autonomous Driving Domain Controllers: ADC25 for Enhanced Driving-parking Integrated Solutions

4.4.11 Autonomous Driving Domain Controllers: ADC30 for L3 High-level Autonomous Driving Solutions

4.4.12 Autonomous Driving Domain Controllers: Comparison between Product Lines

4.4.13 Software Stack: End-to-end Full-stack Solution

4.4.14 3rd-generation Front View Camera (FVC3)

4.4.15 4D Imaging Radar Product - FVR40

4.5 Hong Jing Drive

4.5.1 Profile

4.5.2 Autonomous Driving Domain Controllers: Product Line Layout

4.5.3 Autonomous Driving Domain Controllers: Product Matrix

4.5.4 Driving-parking Integrated Domain Controllers: Based on Single Journey 3

4.5.5 Single-SoC High-level Intelligent Driving Domain Controller

4.5.6 Smart Camera Module (IPM) and APA/IDDC

4.5.7 Software Algorithm Stack

4.5.8 Features of BEV Algorithm

4.5.9 New Generation Software Algorithm Architecture for Parking 2.0

4.5.10 HyperData Infra Data Closed-loop Platform

4.5.11 Clients

4.5.12 Domain Controller Capacity: Build a Smart Factory

4.6 Technomous

4.6.1 Profile

4.6.2 Autonomous Driving Domain Controllers: Product Matrix

4.6.3 Autonomous Driving Domain Controllers: Product Portfolio

4.6.4 Driving-parking Integrated Domain Controllers: iECU 3.1

4.6.5 Driving-parking Integrated Domain Controllers: iECU1.5

4.6.6 Driving-parking Integrated Domain Controllers: Technical Features of iECU1.5

4.6.7 Driving-parking Integrated Domain Controllers: Application by Typical Customers

4.6.8 Software Platform Solutions

4.6.9 Software Platform: MotionWise

4.7 Haomo.ai

4.7.1 Profile

4.7.2 Three Core Product Lines

4.7.3 "Little Magic Box" Intelligent Driving Domain Controller

4.7.4 Autonomous Driving Domain Controller: "Little Magic Box 3.0"

4.7.5 Hpilot Autonomous Driving Product Roadmap

4.8 Motovis

4.8.1 Business Overview

4.8.2 Business Strategy: Key Collaborations and Designations by OEMs

4.8.3 Autonomous Driving Domain Controllers: Product Matrix

4.8.4 Single-SoC Driving-parking Integrated Domain Controller: Magic Pilot

4.8.5 Single-SoC Driving-parking Integrated Domain Controller: Key Technical Features of Magic Pilot

4.9 Huawei

4.9.1 Computing/Communication (CC) Architecture

4.9.2 The Five Major Solutions of the Automotive BU Are Fully Upgraded

4.9.3 MDC Autonomous Driving Computing Platform: Product Portfolio

4.9.4 MDC Autonomous Driving Computing Platform: Software and Hardware Architecture

4.9.5 MDC Autonomous Driving Computing Platform: Application Fields

4.9.6 MDC Autonomous Driving Computing Platform: MDC810

4.9.7 MDC Autonomous Driving Computing Platform: Parameters of MDC 210 and MDC 610

4.9.8 MDC Autonomous Driving Computing Platform: Platform Framework

4.9.9 MDC Autonomous Driving Computing Platform: Hardware Platform

4.9.10 MDC Autonomous Driving Computing Platform: Software Architecture

4.9.11 MDC Autonomous Driving Computing Platform: Software and Tool Chain

4.9.12 MDC Autonomous Driving Computing Platform: Automotive Security Platform

4.9.13 MDC Autonomous Driving Computing Platform: Customers and Partners

4.9.14 MDC Autonomous Driving Computing Platform: Cooperative Models

4.10 HoloMatic

4.10.1 Business Overview

4.10.2 Business Strategy: Key Collaborations and Designations by OEMs

4.10.3 Autonomous Driving Domain Controllers: Product Matrix

4.10.4 HoloIFC Smart Front View Camera

4.10.5 HoloArk Driving-parking Integrated Domain Controller

4.10.6 HoloArk Domain Controller R&D

4.10.8 HoloArk 1.0 Domain Controller: System Optimization Strategy

4.10.9 HoloArk 1.0 Domain Controller: Data Closed-loop Strategy

4.10.10 HoloArk 1.0 Domain Controller: Data Closed-loop Architecture and Tool Chain 1.0

4.10.11 HoloArk 2.0 Domain Controller: Framework of Driving-parking Integrated System

4.10.12 Design Concept - CID One (Center Information Display One)

4.11 MINIEYE

4.11.1 Business Overview

4.11.2 Business Strategy: Progressive Development Route

4.11.3 Business Strategy: Key Collaborations and Designations by OEMs

4.11.4 Autonomous Driving Domain Controller: Product Matrix

4.11.5 Autonomous Driving Domain Controller Product: iPilot

4.11.6 Typical Autonomous Driving Solutions

4.12 MAXIEYE

4.12.1 MAXIPILOT Autonomous Driving Product Matrix

4.12.2 Business Strategy: Key Collaborations and Designations by OEMs

4.12.3 Autonomous Driving Domain Controller: Product Matrix

4.12.4 Autonomous Driving Solution: Three Versions of NOM Realize "Point-to-Point"

4.12.5 BEV Algorithm and Data Closed Loop

4.12.7 Develop High-level Driving-parking Integrated Solutions

4.12.8 Single-vision L2 Solution

4.12.9 Single-vision Solution to Build Data Closed-loop Capabilities

4.12.10 MAXI-NET 1.0 Deep Learning Network

4.12.11 Commercial Vehicle Autonomous Driving Platform Solution

4.13 ZongMu Technology

4.13.1 Business Strategy: Integrate the Industry Chain to Build An Intelligent Driving Ecosystem

4.13.2 Business Strategy: Key Collaborations and Designations by OEMs

4.13.3 Autonomous Driving Domain Controllers: Product Matrix

4.13.4 Amphiman Driving-parking Integrated Domain Controller: Key Technical Features

4.13.5 Parking Controllers: Drop’nGo? Lite and Drop’nGo? GenII

4.13.6 Driving-parking Integrated Domain Controllers: Amphiman Technology Roadmap

4.13.7 Driving-parking Integrated Domain Controllers: Amphiman 3000 Technology Architecture

4.13.8 Cockpit-driving Integrated Domain Controller: Trinity3000 Technology Architecture

4.14 Baidu

4.14.1 2nd Generation Vision-only Perception System Lite++: BEV Algorithm

4.14.2 2nd Generation Vision-only Perception System Lite++: Lightweight Autonomous Driving Map

4.14.3 Apollo's New "Cabin Map" Product Matrix: Intelligent Driving

4.14.4 Apollo's New "Cabin Map" Product Matrix: Intelligent Cockpit

4.14.5 Apollo's New "Cabin Map" Product Matrix: Intelligent Map

4.14.6 Apollo's New "Cabin Map": Agile and V Models

4.14.7 Apollo's New "Cabin Map": Build A New Cooperation Model

4.14.8 Apollo's New "Cabin Map": Apollo City Driving Max

4.14.9 Apollo's New "Cabin Map": Apollo City Driving Max Software and Hardware Product Solutions

4.14.10 Apollo's New "Cabin Map": Apollo Highway Driving Pro

4.14.11 Apollo's New "Cabin Map": Apollo Highway Driving Pro Software and Hardware Product Solutions

4.14.12 Apollo's New "Cabin Map": Apollo Parking

4.14.13 Apollo's New "Cabin Map": Apollo Parking Software and Hardware Product Solutions

4.14.14 Apollo's New "Cabin Map": Apollo Robo-Cabin

4.14.15 Apollo's New "Cabin Map": Apollo Robo-Cabin Software and Hardware Product Solutions

4.14.16 Autonomous Driving Domain Controllers: Product Matrix (Latest Product Map)

4.14.17 Autonomous Driving Domain Controllers: Apollo ANP2.0

4.14.18 Autonomous Driving Computing Platform ACU (Previous-generation Product)

4.14.19 Apollo Mainly Promotes the ANP+AVP All-domain Intelligent Driving System

4.15 Joynext

4.15.1 Global Business Layout of Joyson Electronic

4.15.2 Intelligent Vehicle Business Layout of Joyson Electronic

4.15.3 Joyson Electronic Autonomous Driving Domain Controllers: Development Planning

4.15.4 nDriveH

4.15.5 Functional Domain Integration: Cockpit-driving Integration

4.15.6 Functional Domain Integration: Deep Integration with Software Development

4.15.7 Human-Machine Co-Driving System: Intelligent Cockpit HMI for High-level Autonomous Driving

4.15.8 Human-Machine Co-driving System

4.15.9 Zonal-Central Architecture

4.16 NavInfo

4.16.1 Operating Results, 2022

4.16.2 "Scene Map for Intelligent Driving"

4.16.3 Autonomous Driving Domain Controllers: Product Matrix

4.17 ECARX

4.17.1 Brand Concept

4.17.2 Autonomous Driving Domain Controllers: Product Matrix

4.17.3 Cockpit-parking Integrated Solution Design Based on "Longying No.1"

4.17.4 Central Computing Platform - Super Brain

4.18 Pony.ai

4.18.1 Strategic Directions

4.18.2 "Shitu" Intelligent Driving Solution

4.18.3 "Fangzai" Automotive Domain Controller

4.18.4 "Cangqiong" Data Closed-loop Tool Chain

4.18.5 Horizon J5-based NOA Driving-parking Integrated Solution

4.18.6 L4 Autonomous Vehicle Domain Controller

4.18.7 Autonomous Driving Software and Hardware Systems of New Generation L4 Robotaxi

4.19 Z-ONE Tech

4.19.1 Intelligent Driving Domain Controller Product – ZPD

4.20 Yihang.ai

4.20.1 Autonomous Driving Domain Controllers: Product Matrix

4.20.2 Driving-parking Integrated Lite Solution: Single TI TDA4

4.20.3 NOA Driving-parking Integrated Flagship Solution

4.20.4 Mass Production Path of Autonomous Driving

4.20.5 All-scenario Full Self-driving (FSD) Solution

4.21 Jingwei Hirain

4.21.1 Operating Results, 2022

4.21.2 Operating Results of Intelligent Vehicle Business, 2022

4.21.3 Autonomous Driving Domain Controllers: Product Line Layout

4.21.4 Intelligent Driving Domain Controller Product Platform

4.21.5 Driving-parking Integrated Domain Controller Solution

4.21.6 2nd Generation Intelligent Driving Domain Controller (ADCU)

4.21.7 Intelligent Driving Domain Controller (ADCU) and Vehicle High Performance Computer (HPC)

4.21.8 ADAS Domain Controller

4.21.9 Performance Features of ADAS Domain Controller

4.22 Idriverplus

4.22.1 Development History

4.22.2 Core Business Lines

4.22.3 Product Lines: Key Collaborations and Designations by OEMs

4.22.4 Autonomous Driving Domain Controllers: Product Matrix

4.22.5 Passenger Car H-INP Highway Pilot Solution

4.22.6 Passenger Car A100/A200 Domain Controller

4.22.7 IDRIVERBRAIN

4.23 DJI Automotive

4.23.1 Profile

4.23.2 Autonomous Driving Domain Controllers: Product Line

4.23.3 New Generation Intelligent Driving Solutions

4.23.4 Intelligent Driving Solutions: D80/D80+, D130/D130+

4.23.5 Autonomous Driving Domain Controllers: Middleware

4.23.6 Autonomous Driving Domain Controllers: MCU

4.23.7 Autonomous Driving Domain Controllers: Ethernet switch

4.23.8 Lingxi Intelligent Driving System: Highlight Stereo Vision

4.23.9 All-scenario Intelligent Driving User Journey Map

4.24 EnjoyMove Technology

4.24.1 Profile and Products

4.24.2 Product Line: Key Collaborations and Designations by OEMs

4.24.3 High Performance Computing Group XCG Gen1

4.24.4 Driving-parking Integrated Domain Controller DCU 3.0: System Architecture Topology Based on Single Journey 3 (5V5R12U)

4.24.5 Driving-parking Integrated Domain Controller DCU 3.0

4.24.6 Driving-parking Integrated Domain Controller DCU 3.0: Technical Specifications

4.24.13 Driving-parking Integrated Domain Controller DCU 3.0: System Architecture Design

4.24.14 Driving-parking Integrated Domain Controller DCU 3.0: Adopt L3 Functional Safety Design

4.24.15 Driving-parking Integrated Domain Controller DCU 3.0: Architecture Topology

4.24.16 Vehicle Cross-domain TSN Protocol Stack: Used in Li Auto L9

4.24.17 Software Platform EMOS: Cross-domain SOA Middleware

4.24.18 Software Platform EMOS: TüV ASIL-D Certification

4.24.19 Software Platform EMOS 1.0

4.25 Novauto

4.25.1 Product Line Solutions

4.25.2 New NOVA-ADCU Reference Solution

4.25.3 NOVA-ADCU Ultra: High-level Driving-parking Integrated Domain Controller Reference Solution

4.25.4 NOVA-ADCU Ultra: Lightweight Driving-parking Integrated Domain Controller Reference Solution

4.25.5 NOVA-ADCU Ultra: Stereo Intelligent Driving Reference Solution

4.25.6 NOVA-ADCU Ultra: Roadside Perception Reference Solution

4.25.7 Jingzhe R1: Performance Parameters

4.25.8 Jingzhe R1: Full-process Development Tool Chain - "Luban"

4.25.9 Jingzhe R1: Hardware Design Reference Platform

4.25.10 Jingzhe R1: Based on Energy-efficient AI Processing Architecture "Pinghu"

4.25.11 Automatic Compression Tool: NOVA-Slim

4.25.12 Training and Acceleration Tool: NOVA-3D

4.25.13 NOVA-Box Intelligent Driving Computing Platform

4.25.14 NOVA-Box Computing Platform Solution

4.25.17 Partners

4.26 G-Pulse (Intron)

4.26.1 Profile

4.26.2 Cockpit-driving Integrated Controller: MADC3.5

4.26.3 High-level Driving-parking Integrated Controller MADC 2.5: Based on Dual J5 and Passing Matrix 5 Certification

4.26.4 High-level Driving-parking Integrated Controller MADC 2.5: A Domain Control Platform Hardware Board Based on Dual J5

4.26.5 Driving-parking Integrated Controller MADC 2.0: Based on 3 Journey J3 Chips

4.26.6 L3 and Above Autonomous Driving Domain Controllers: System Architecture

4.27 CICTCI

4.27.1 Product Lines

4.27.2 C-V2X & ADAS Integrated Domain Controller

4.28 ThunderX (ThunderSoft)

4.28.1 1st Generation RazorDCX Takla Intelligent Driving Domain Controller

4.28.2 2nd Generation Production-level Intelligent Driving Domain Control Solution

4.28.3 Autonomous Driving Domain Controllers: Product Matrix

4.28.4 Business Strategy: Autonomous Driving Cooperative Development Model

4.28.5 SOA Software Platform

4.28.6 Autonomous Driving Domain Control Middleware: RazorWareX1.0

Toolchain

4.29 Foryou Group

4.29.1 Autonomous Driving Domain Controllers: Product Matrix

4.29.2 ADC02 High-performance Driving-parking Integrated Solution

4.30 Lan-You Technology

4.30.1 Profile

4.30.2 Intelligent Driving Domain Controller (YDU) Product Planning

4.30.3 YDU2.0 Driving-parking Integrated Domain Controller

4.31 Nullmax

4.31.1 Profile

4.31.2 Divide Driving-parking Integration into 4 Forms

4.31.3 Driving-parking Integrated Solutions Based on Platforms with Different Computing Power

4.31.4 Ecosystem Platform Construction

4.31.5 Implementation of Driving-parking Integrated Algorithm

4.31.6 Full-stack Self-developed Autonomous Driving Brain: MAX

4.31.7 Data Closed Loop: MaxFlow Self-growth System

4.31.8 Online Trigger Strategy

4.31.9 Solutions Covering Both Cloud and Vehicle Scenarios

4.31.10 Platform-based BEV-AI Technology Architecture

4.32 Unlimited AI

4.32.1 Profile

4.32.2 Intelligent Driving Domain Controllers: Cooperation Model

4.32.3 Intelligent Driving Domain Controllers: Product Line

4.32.4 Software-defined ADAS All-in-One

4.32.5 L2.99 Multifunctional Intelligent Driving Domain Controller: "Wukong No.1"

4.32.6 L2.99 Intelligent Driving Domain Controller

4.32.7 J3+X9H-based High-performance Multi-domain Controller: "Wukong No.2"

4.32.8 Dual J3-based Intelligent Driving Domain Controller

4.32.9 Vehicle Central Computer (HPC): "Wukong No.3"

5 Foreign Domain Controller Vendors

5.1 Tesla

5.1.1 Evolution of System Parameters from FSD HW1.0 to HW4.0

5.1.2 HW4.0 Computing Platform

5.2 Bosch

5.2.1 Operating Results, 2022

5.2.2 Revenue and R&D Deployment in China

5.2.3 Business Structure: Restructuring the Mobility Solutions Division

5.2.4 Business Structure: XC Division

5.2.5 Business Structure: Structure and Distribution of XC Division in China

5.2.6 Business Architecture: Further Integrating ETAS

5.2.7 Core Business Planning and Positioning

5.2.13 Autonomous Driving Domain Controllers: Product Development Trends

5.2.14 Autonomous Driving Domain Controllers: Evolution of DASy Technology

5.2.15 Autonomous Driving Domain Controllers: L1-L4 Development Planning

5.2.16 Autonomous Driving Domain Controllers: Computing Power Development Planning

5.3 Continental

5.3.1 Development Plan for High Performance Computer (HPC)

5.3.4 SOP Timetable of High Performance Computers (HPC) in Different Domains

5.3.5 Software Platform for Next-generation Automotive Electronics Architectures: EB xelor

5.3.6 Autonomous Driving Domain Controller ADC615: Based on Horizon J5

5.3.7 8MP Front View Camera All-In-One: Based on Horizon J3

5.3.8 The 5R1V Multi-sensor Fusion System Solution Has Secured Mass Production Orders

5.3.9 6th Generation Long-Range Radar and Surround Radar to Be Produced in 2023

5.4 ZF

5.4.1 Operating Results, 2022

5.4.2 Development Outlook for 2023

5.4.3 Layout in China

5.4.4 Corporate Strategy: "See, Think, Act"

5.4.5 Autonomous Driving Domain Controllers: Product Development Trends

5.4.6 Autonomous Driving Domain Controllers: 4th Generation ProAI

5.4.7 Autonomous Driving Domain Controllers: 3rd Generation ProAI

5.4.8 Autonomous Driving Domain Controllers: Structure Design of 3rd Generation ProAI

5.4.9 coDrive L2+ Driving Assistance System

5.4.11 Domain Control Basic Software: Strategic Cooperation with Neusoft Reach

5.4.12 Domain Control Basic Software: Established a Global Software Center

5.4.13 Domain Control Basic Software: Cooperation with KPIT

5.4.14 Autonomous Driving Solutions

5.5 Aptiv

5.5.1 Possess Full-stack System Capabilities

5.5.2 Autonomous Driving Controllers: Development Progress

5.5.3 5R1V0D Intelligent Front View All-In-One

5.5.4 Lightweight Driving-parking Integrated Solutions

5.5.7 Ultra PAD Autonomous Driving Domain Controller

5.5.9 New 6th Generation ADAS Platform

5.5.11 ADAS Platform

5.5.14 ADAS Platform: Software and Hardware Composition and Technical Features

5.5.17 Smart Vehicle Architecture (SVA)

5.5.18 SVA(TM) Network Topology

5.5.19 Acquisition of Wind River Software

5.5.20 Aptiv + Wind River: End-to-End Cloud Native DevOps Platform

5.5.21 Wind River VxWorks Microkernel Architecture

5.6 Magna & Veoneer

5.6.1 Magna Acquired the Active Safety Business of Veoneer from Qualcomm

5.6.2 Operation of Veoneer’s Active Safety Business

5.6.3 Challenges Faced by Magna+Veoneer

5.6.4 Veoneer’s Autonomous Driving Product Line Layout

5.6.5 Veoneer’s Active Safety Platform Architecture

5.6.6 Veoneer’s L2+ Hands-off System

5.6.7 Veoneer’s ADAS Software Stack Roadmap

5.6.8 Mercedes-Benz L3 Autonomous Vehicles Are Equipped with Veoneer’s Solutions

5.6.9 Veoneer’s ADAS ECU Products

5.6.10 Veoneer’s ADAS/AD ECU

5.6.11 Functional Architecture of Veoneer’s ADAS/AD ECU

5.7 Visteon

5.7.1 Development Trend Planning for Cockpit Electronics and Autonomous Driving

5.7.2 Autonomous Driving Domain Controllers

Autonomous Delivery Industry Research Report, 2024

Autonomous Delivery Research: Foundation Models Promote the Normal Application of Autonomous Delivery in Multiple Scenarios

Autonomous Delivery Industry Research Report, 2024 released by ResearchInCh...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2024

Intelligent driving regulations and vehicles going overseas: research on regional markets around the world and access strategies. "Going out”: discussion about regional markets aroun...

China Passenger Car HUD Industry Report, 2024

HUD research: AR-HUD accounted for 21.1%; LBS and optical waveguide solutions are about to be mass-produced. The automotive head-up display system (HUD) uses the principle of optics to display s...

Ecological Domain and Automotive Hardware Expansion Research Report, 2024

Automotive Ecological Domain Research: How Will OEM Ecology and Peripheral Hardware Develop? Ecological Domain and Automotive Hardware Expansion Research Report, 2024 released by ResearchInChina ...

C-V2X and CVIS Industry Research Report, 2024

C-V2X and CVIS Research: In 2023, the OEM scale will exceed 270,000 units, and large-scale verification will start.The pilot application of "vehicle-road-cloud integration” commenced, and C-V2X entere...

Automotive Intelligent Cockpit Platform Configuration Strategy and Industry Research Report, 2024

According to the evolution trends and functions, the cockpit platform has gradually evolved into technical paths such as cockpit-only, cockpit integrated with other domains, cockpit-parking integratio...

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing,2023-2024

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing: Comprehensive layout in eight major fields and upgrade of Huawei Smart Selection

The “Huawei Intelligent Driving Business...

Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Li Auto overestimates the BEV market trend and returns to intensive cultivation.

In the MPV market, Denza D9 DM-i with the highest sales (8,030 units) in January 2024 is a hybrid electric vehicle (H...

Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Because of burning money and suffering a huge loss, many people thought NIO would soon go out of business. NI...

Monthly Monitoring Report on China Automotive Sensor Technology and Data Trends (Issue 3, 2024)

Insight into intelligent driving sensors: “Chip-based” reduces costs, and the pace of installing 3-LiDAR solutions in cars quickens. LiDARs were installed in 173,000 passenger cars in China in Q1 2024...

Autonomous Driving Simulation Industry Report, 2024

Autonomous Driving Simulation Research: Three Trends of Simulation Favoring the Implementation of High-level Intelligent Driving.

On November 17, 2023, the Ministry of Industry and Information Techno...

Mobile Charging Robot Research Report, 2024

Research on mobile charging robot: more than 20 companies have come in and have implemented in three major scenarios.

Mobile Charging Robot Research Report, 2024 released by ResearchInChina highlight...

End-to-end Autonomous Driving (E2E AD) Research Report, 2024

End-to-end Autonomous Driving Research: status quo of End-to-end (E2E) autonomous driving

1. Status quo of end-to-end solutions in ChinaAn end-to-end autonomous driving system refers to direct mappi...

Monthly Monitoring Report on China Automotive Intelligent Driving Technology and Data Trends (Issue 2, 2024)

Insight into intelligent driving: ECARX self-develops intelligent driving chips, and L2.5 installation soared by 175% year on year.

Based on the 2023 version, the 2024 version of Monthly...

Monthly Monitoring Report on China Automotive Intelligent Cockpit Technology and Data Trends (Issue 2, 2024)

Insight into intelligent cockpit: the trend towards large screens is obvious, with >10" center console screens sweeping over 80%.

Based on the 2023 Edition, the 2024 Edition of Monthly Monitoring...

China Intelligent Driving Fusion Algorithm Research Report, 2024

Intelligent Driving Fusion Algorithm Research: sparse algorithms, temporal fusion and enhanced planning and control become the trend.

China Intelligent Driving Fusion Algorithm Research Report, 2024 ...

Automotive Electronics OEM/ODM/EMS Industry Report, 2024

Automotive electronics OEM/ODM/EMS research: top players’ revenue has exceeded RMB10 billion, and new entrants have been coming in.

At present, OEMs in the Chinese automotive electronics indus...

Analysis on Xpeng’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Research on Xpeng’s layout in electrification, connectivity, intelligence and sharing: in the innovation-driven rapid development, secured orders for 100 flying cars.

NIO, Xp...