China In-Vehicle Payment Market Research Report, 2023 released by ResearchInChina analyzes and researches the status quo of China's in-vehicle payment market, components of the industry chain, layout of OEMs and payment platforms, consumer survey, and development trends.

①The market demand for in-vehicle payment is rising.

In-vehicle payment refers to the function allowing for payment through in-vehicle communication (e.g., SIM card and WiFi) and IVI system. In-vehicle payment enables car owners to pay for services such as parking, refueling, food ordering and shopping without getting off the car, bringing far more convenient and better experience to users.

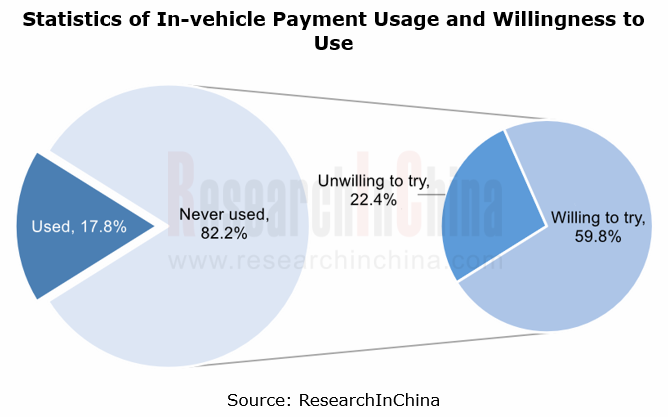

According to the survey by ResearchInChina, there are a relatively small number of people using in-car payment at this stage, making up only 17.8% of the total samples. Yet users' willingness to use this function is very high. 72.7% of the consumers who have not used in-car payment yet, or 59.8% of the total samples say they are "willing to try in-car payment".

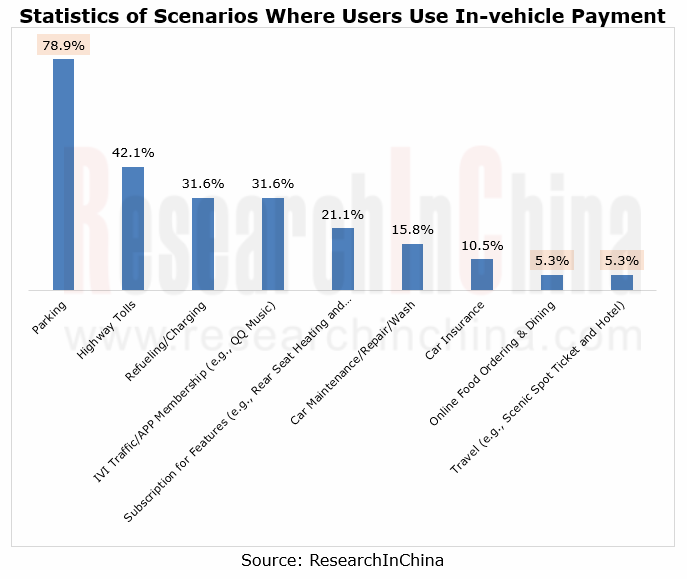

At present, users use in-car payment in such scenarios as parking, highway pass, refueling/charging, and purchasing IVI traffic and APP membership. Of the users who have used in-car payment:

- Up to 78.9% use in-car payment for parking;

- 42.1% use in-car payment for highway tolls;

- In-vehicle payment is also often used to pay for refueling/charging fees (31.6%), IVI traffic and APP membership (31.6%), feature subscription (21.1%), car maintenance/repair/wash (15.8%), and car insurance (10.5%);

- Fewer users use this function in the scenarios of online food ordering and dining (5.3%) and travel (5.3%).

②The in-vehicle payment industry chain is taking shape.

In terms of supply chain, in-vehicle payment involves two major segments: in-vehicle payment device and in-vehicle payment platform.

In-vehicle payment devices are led by communication devices (SIM card, communication module and T-Box), interaction devices (touch/voice/ face/gesture/fingerprint interaction), and authentication devices (security chip); in-vehicle payment platforms are primarily cloud platform, payment platform, IVI system, ecosystem service platform, ecosystem service provider, and OEM.

As companies in each industry chain segment worked to make layout in recent years, the in-vehicle payment market has kept growing, with the following two major features.

1. In-vehicle payment is available to more scenarios.

Foreign automakers including BMW, Mercedes-Benz, Honda and Hyundai, and Chinese automakers such as Great Wall Motor, Xpeng Motors, Geely, Chery and AITO have launched their in-car payment function. They have widely deployed this function in parking, refueling/charging and food ordering scenarios, and are also applying it on a small scale in car wash/maintenance/repair services, feature subscription, ticket booking and other scenarios.

For example, in October 2022, BMW added the BMW ConnectedDrive Store to its IVI system via OTA updates. It enables in-car payment for subscriptions, and 13 features such as front seat heating, steering wheel heating and Carplay through the IVI system.

2. Multimodal interaction is being added to in-vehicle payment.

At present, the most common in-car payment is scan to pay and password-free payment. As in-car multimodal interaction technology improves, face recognition, fingerprint recognition and voice recognition are becoming the new in-car payment interaction and authentication methods.

For example, Mercedes-Benz has added fingerprint recognition and authentication to its latest in-car payment system PAY+; Chery EXEED TX/TXL supports face verification payment, a function allowing users to pay for parking fees or shopping through face recognition. The addition of multimodal interaction makes in-vehicle payment more secure and convenient.

3. The ecosystem is a key factor affecting in-car payment.

In the mobile payment system, millions of iOS and Android developers have developed various applications and built very rich application ecosystems, meeting living, work and entertainment needs of consumers and making smartphones an indispensable terminal in users' life.

In the in-car payment system, financial institutions like China UnionPay and VISA have developed a series of in-car payment systems; Alipay, Banma Zhixing and Huawei among others have built a variety of vehicle ecosystem platforms and launched a range of in-car services covering parking, refueling, travel, shopping and other scenarios.

Compared with mobile payment, the in-vehicle payment ecosystem is still weak at this stage, only meeting the payment needs in specific scenarios. With the development of intelligent cockpit and high-level autonomous driving, drivers will be freed from driving tasks in specific scenarios and pay more attention to other in-car needs. At this time, creating an in-car living space and building a closed-loop ecosystem with payment as the entrance will become a big demand.

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2024

Intelligent driving regulations and vehicles going overseas: research on regional markets around the world and access strategies. "Going out”: discussion about regional markets aroun...

China Passenger Car HUD Industry Report, 2024

HUD research: AR-HUD accounted for 21.1%; LBS and optical waveguide solutions are about to be mass-produced. The automotive head-up display system (HUD) uses the principle of optics to display s...

Ecological Domain and Automotive Hardware Expansion Research Report, 2024

Automotive Ecological Domain Research: How Will OEM Ecology and Peripheral Hardware Develop? Ecological Domain and Automotive Hardware Expansion Research Report, 2024 released by ResearchInChina ...

C-V2X and CVIS Industry Research Report, 2024

C-V2X and CVIS Research: In 2023, the OEM scale will exceed 270,000 units, and large-scale verification will start.The pilot application of "vehicle-road-cloud integration” commenced, and C-V2X entere...

Automotive Intelligent Cockpit Platform Configuration Strategy and Industry Research Report, 2024

According to the evolution trends and functions, the cockpit platform has gradually evolved into technical paths such as cockpit-only, cockpit integrated with other domains, cockpit-parking integratio...

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing,2023-2024

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing: Comprehensive layout in eight major fields and upgrade of Huawei Smart Selection

The “Huawei Intelligent Driving Business...

Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Li Auto overestimates the BEV market trend and returns to intensive cultivation.

In the MPV market, Denza D9 DM-i with the highest sales (8,030 units) in January 2024 is a hybrid electric vehicle (H...

Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Because of burning money and suffering a huge loss, many people thought NIO would soon go out of business. NI...

Monthly Monitoring Report on China Automotive Sensor Technology and Data Trends (Issue 3, 2024)

Insight into intelligent driving sensors: “Chip-based” reduces costs, and the pace of installing 3-LiDAR solutions in cars quickens. LiDARs were installed in 173,000 passenger cars in China in Q1 2024...

Autonomous Driving Simulation Industry Report, 2024

Autonomous Driving Simulation Research: Three Trends of Simulation Favoring the Implementation of High-level Intelligent Driving.

On November 17, 2023, the Ministry of Industry and Information Techno...

Mobile Charging Robot Research Report, 2024

Research on mobile charging robot: more than 20 companies have come in and have implemented in three major scenarios.

Mobile Charging Robot Research Report, 2024 released by ResearchInChina highlight...

End-to-end Autonomous Driving (E2E AD) Research Report, 2024

End-to-end Autonomous Driving Research: status quo of End-to-end (E2E) autonomous driving

1. Status quo of end-to-end solutions in ChinaAn end-to-end autonomous driving system refers to direct mappi...

Monthly Monitoring Report on China Automotive Intelligent Driving Technology and Data Trends (Issue 2, 2024)

Insight into intelligent driving: ECARX self-develops intelligent driving chips, and L2.5 installation soared by 175% year on year.

Based on the 2023 version, the 2024 version of Monthly...

Monthly Monitoring Report on China Automotive Intelligent Cockpit Technology and Data Trends (Issue 2, 2024)

Insight into intelligent cockpit: the trend towards large screens is obvious, with >10" center console screens sweeping over 80%.

Based on the 2023 Edition, the 2024 Edition of Monthly Monitoring...

China Intelligent Driving Fusion Algorithm Research Report, 2024

Intelligent Driving Fusion Algorithm Research: sparse algorithms, temporal fusion and enhanced planning and control become the trend.

China Intelligent Driving Fusion Algorithm Research Report, 2024 ...

Automotive Electronics OEM/ODM/EMS Industry Report, 2024

Automotive electronics OEM/ODM/EMS research: top players’ revenue has exceeded RMB10 billion, and new entrants have been coming in.

At present, OEMs in the Chinese automotive electronics indus...

Analysis on Xpeng’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Research on Xpeng’s layout in electrification, connectivity, intelligence and sharing: in the innovation-driven rapid development, secured orders for 100 flying cars.

NIO, Xp...

Automotive Cockpit SoC Research Report, 2024

Automotive Cockpit SoC Research: Automakers quicken their pace of buying SoCs, and the penetration of domestic cockpit SoCs will soar

Mass production of local cockpit SoCs is accelerating, and the l...