Automotive Ultrasonic Radar and OEMs’ Parking Route Research Report, 2024

1. Over 220 million ultrasonic radars will be installed in 2028.

In recent years, the installations of ultrasonic radars in passenger cars in China surged, up to 121.955 million units in 2023, jumping by 13.7% year on year. It is expected to be more than 140 million units in 2025 and over 220 million units in 2028.

There are two key driving factors:

First, ultrasonic radars can satisfy the requirements of autonomous driving solutions of differing levels and routes, and has a long lifecycle. In recent years, as vehicle intelligence has accelerated, parking systems have kept expanding function boundaries from semi-automated parking to APA (automated parking assist) and integrated APA, from short-range remote parking assist (RPA) to home-zone valet parking (HVP) and even long-range automated valet parking (AVP).

According to ResearchInChina, in 2023 the installation rate of integrated APA systems in passenger cars in China hit 8.2%, up 3.0 percentage points on the previous year; the installation rate of high-level parking (HVP or AVP) was 0.7%, up 0.4 percentage points. As driving-parking integration and cockpit-parking integration markets gather pace, low-speed APA (especially integrated APA), and high-level parking (especially HVP), are expected to enjoy a boom.

Second, under the domain controller architecture, driving and parking systems previously independent of each other tend to be integrated, namely, driving-parking integration with the biggest feature that driving and parking can deeply multiplex and share sensors and computing power. In 2023, driving-parking integration entered the stage of mass adoption, giving a big boost to the automated parking market and taking the core sensor, ultrasonic radar, into the "fast lane".

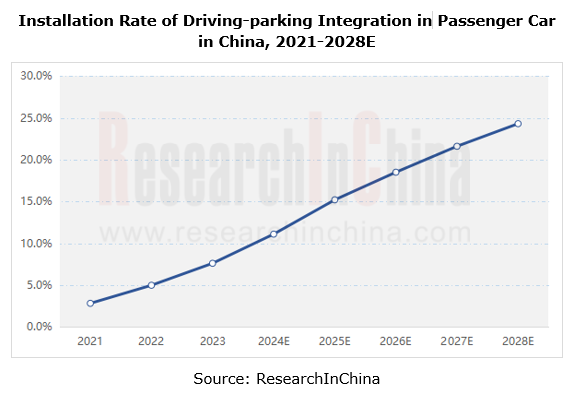

ResearchInChina’s statistics shows that in 2023, driving-parking integration was installed in 1.602 million passenger cars in China, a year-on-year spurt of 61.4%, with the installation rate reaching 7.6%, up 2.6 percentage points. It is expected that in 2025, driving-parking integration will be installed in over 3 million passenger cars, with the installation rate higher than 15%, a figured projected to hit about 25% in 2028.

2. New-generation AK2 ultrasonic radars are about to become widespread.

The optimization and upgrading of parking systems and the promotion and application of driving-parking integration require higher ultrasonic radar performance, involving longer detection range, greater anti-interference, and compliance with higher functional safety. On this basis, quite a few companies have developed the new generation of ultrasonic radar AK2 technologies and products.

Greatly differing from AK1, AK2 is codable, and improves the anti-interference capability of products by adjusting signals.

When AK1 works, all probes on the same side of the bumper send out waves in turn to avoid co-channel interference, leading to a relatively system refresh time. AK2 enables multi-sensor simultaneous transmission and reception via some special encoding modes, and some also support simultaneous transmission of different ultrasonic signals, thus greatly shortening the system refresh time.

Technological innovations give AK2 large performance superiorities, including:

Longer detection range: up to 7-8m;

Longer detection range: up to 7-8m;

Smaller blind spot: within 10cm;

Smaller blind spot: within 10cm;

Support for multi-mode switching; for example, Audiowell AK2 supports up- and down-conversion modes, while Longhorn AK2 supports three transmission modes: fixed frequency, frequency upswep and frequency downsweep;

Support for multi-mode switching; for example, Audiowell AK2 supports up- and down-conversion modes, while Longhorn AK2 supports three transmission modes: fixed frequency, frequency upswep and frequency downsweep;

Refresh time: <40ms, supporting 6 sensors to work simultaneously;

Refresh time: <40ms, supporting 6 sensors to work simultaneously;

Diagnostic function;

Diagnostic function;

DSI3 communication mode, with fast signal propagation, up to 444kbit/s;

DSI3 communication mode, with fast signal propagation, up to 444kbit/s;

ASIL B functional safety level.

ASIL B functional safety level.

Currently, more than a dozen companies like Audiowell, Baolong Automotive, ForVision and Longhorn Automotive Electronic have launched AK2 ultrasonic radar, and some of them have entered the mass production phase.

As an ultrasonic radar leader in China, with the ability to self-develop transducers and algorithms, Audiowell was the first to introduce the fourth-generation product, AK2, in 2021, and started batch delivery and sale of it in 2022. In early 2024, Audiowell AK2 has been designated by multiple automakers (including joint-venture and China’s independent ones). It is expected that the driving-parking integration solution will be mounted on over 20 new models in the year.

Baolong Automotive invested in UDAS Automotive Technology in 2022. They co-funded BaoU Technology, a company specializing in ultrasonic radar for passenger cars.

In August 2023, Baolong Automotive released AK2, a new-generation high-performance ultrasonic radar featuring a self-designed transducer with the minimum vertical FOV, and 8K FM bandwidth. It improves anti-interference performance through variable frequency transmission, allows for transmission mixed with fixed frequency and encoding modes, and can meet ASIL B functional safety level requirements.

In Q3 2023, BaoU Technology under Baolong Automotive mass-produced AK2 ultrasonic radar sensors for China’s independent automakers. In September 2023, the product was designated by another Chinese independent auto brand, and the volume production is scheduled to start in July 2024. In addition, Baolong Automotive has built a fully automated ultrasonic radar production line in Hefei Park, with AK2 capacity up to 300,000 units/month.

As a company engaged in "ADAS + autonomous driving in low-speed scenarios", ForVision received strategic investment from ThunderSoft in 2020 and launched an AK2 product in 2022, with the detection range of 8m and accuracy of 1cm. In July 2023, the product was designated by Voyah for its AK2 algorithm and hardware mass production project based on the new-generation intelligent driving platform on which Voyah builds mid-to-large-size luxury electric executive sedans and new mid-size electric SUVs, with planned lifecycle output of more than 400,000 vehicles.

To meet market demand, ForVision is building its own ultrasonic radar factory in 2024, with capacity expected to reach about 4 million units in May 2024, and annual capacity up to 10 million units. ForVision CEO Xin Yonglei said there will be nearly ten production models using ForVision's ultrasonic sensor technology in the coming year.

3. Localization of core components of AK2 speeds up.

Core components of AK2 ultrasonic radar include transducer, chip, and housing, of which transducer and chip makes up around 60% of the BOM cost.

Transducers are dominated by international Tier1s like Bosch and Valeo. China’s local companies such as Audiowell, Zongmu Technology, Baolong Automotive and Youhang Technology make continuous investment and now have self-development and production capabilities.

Wherein, Youhang Technology, positioned as a Tier2, was the first to deliver AK2 ultrasonic radar transducers on large scale in late 2022. It has three fully automated transducer production lines and plans to have capacity of 40 million transducers in 2024.

In terms of chips, in addition to Bosch, the industry mainly purchases products from Germany’s Elmos, whose chips can support highway or urban low-speed scenarios, with detection range up to 6m, and can detect obstacles, pedestrians, cyclists, or animals. In 2021, Elmos introduced E524.17, a new-generation ultrasonic radar chip which has become the preferred solution for many suppliers.

To improve chip localization, Ninestar's company, Geehy Microelectronics, has made continuous efforts on development, and mass-produced its first ultrasonic sensor chip on a large scale in 2023. The product features high integration, small size, high precision and comprehensive data collection, and can be used in automated parking assist, ultrasonic parking assist, ADAS and so on.

Moreover, Youhang Technology is also developing an ultrasonic radar chip, and plans to produce it in quantities in 2024. In October 2023, Youhang Technology raised tens of millions of yuan in its Pre-A funding round led by South China Venture Capital and co-invested by Dingjia Ventures. The raised funds are largely spent on projects including automotive-grade validation test and mass production of AK2 sensor chip, ultrasonic transducer capacity expansion, and R&D of automotive micro-crash sensor chip.

The steady development of the downstream parking market and the faster localization of upstream core components provide favorable support for mass adoption of ultrasonic radars. Yet amid fierce competition in vehicle intelligence and diverse market demands, ultrasonic radars still face many challenges.

For instance, since 2022 Tesla has eliminated 12 ultrasonic radars on Model 3/Model Y models in some regions and replaced them with Tesla Vision technology. Some OEMs or suppliers use short-range radars to replace ultrasonic radars. At CES 2024, Continental introduced Radar Vision Parking, a system based on high-resolution surround radars and surround view to replace conventional ultrasonic sensors.

Automotive Microcontroller Unit (MCU) Industry Report, 2025

Research on automotive MCUs: the independent, controllable supply chain for automotive MCUs is rapidly maturing

Mid-to-high-end MCUs for intelligent vehicle control are a key focus of domestic produc...

Automotive LiDAR Industry Report, 2024-2025

In early 2025, BYD's "Eye of God" Intelligent Driving and Changan Automobile's Tianshu Intelligent Driving sparked a wave of mass intelligent driving, making the democratization of intelligent driving...

Software-Defined Vehicles in 2025: SOA and Middleware Industry Research Report

Research on automotive SOA and middleware: Development towards global SOA, cross-domain communication middleware, AI middleware, etc.

With the implementation of centrally integrated EEAs, OEM softwar...

Global and Chinese OEMs’ Modular and Common Technology Platform Research Report, 2025

Modular platforms and common technology platforms of OEMs are at the core of current technological innovation in automotive industry, aiming to enhance R&D efficiency, reduce costs, and accelerate...

Research Report on the Application of AI in Automotive Cockpits, 2025

Cockpit AI Application Research: From "Usable" to "User-Friendly," from "Deep Interaction" to "Self-Evolution"

From the early 2000s, when voice recognition and facial monitoring functions were first ...

Analysis on Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2024-2025

Mind GPT: The "super brain" of automotive AI Li Xiang regards Mind GPT as the core of Li Auto’s AI strategy. As of January 2025, Mind GPT had undergone multip...

Automotive High-precision Positioning Research Report, 2025

High-precision positioning research: IMU develops towards "domain controller integration" and "software/hardware integrated service integration"

According to ResearchInChina, in 2024, the penetration...

China Passenger Car Digital Chassis Research Report, 2025

Digital chassis research: Local OEMs accelerate chassis digitization and AI

1. What is the “digital chassis”?

Previously, we mostly talked about concepts such as traditional chassis, ch...

Automotive Micromotor and Motion Mechanism Industry Report, 2025

Automotive Micromotor and Motion Mechanism Research: More automotive micromotors and motion mechanisms are used in a single vehicle, especially in cockpits, autonomous driving and other scenarios.

Au...

Research Report on AI Foundation Models and Their Applications in Automotive Field, 2024-2025

Research on AI foundation models and automotive applications: reasoning, cost reduction, and explainability

Reasoning capabilities drive up the performance of foundation models.

Since the second ha...

China's New Passenger Cars and Suppliers' Characteristics Research Report, 2024-2025

Trends of new cars and suppliers in 2024-2025: New in-vehicle displays are installed, promising trend of AI and cars is coming

ResearchInChina releases the China's New Passenger Cars and Suppli...

Global and China Skateboard Chassis Industry Report, 2024-2025

Skateboard chassis research: already used in 8 production models, and larger-scale production expected beyond 2025

Global and China Skateboard Chassis Industry Report, 2024-2025 released by ResearchI...

Two-wheeler Intelligence and Industry Chain Research Report, 2024-2025

Research on the two-wheeler intelligence: OEMs flock to enter the market, and the two-wheeler intelligence continues to improve

This report focuses on the upgrade of two-wheeler intelligence, analyz...

Automotive MEMS (Micro Electromechanical System) Sensor Research Report, 2025

Automotive MEMS Research: A single vehicle packs 100+ MEMS sensors, and the pace of product innovation and localization are becoming much faster.

MEMS (Micro Electromechanical System) is a micro devi...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024-2025

Cockpit-driving integration is gaining momentum, and single-chip solutions are on the horizon

The Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Repor...

Automotive TSP and Application Service Research Report, 2024-2025

TSP Research: In-vehicle connectivity services expand in the direction of cross-domain integration, all-scenario integration and cockpit-driving integration

TSP (Telematics Service Provider) is mainl...

Autonomous Driving Domain Controller and Central Control Unit (CCU) Industry Report, 2024-2025

Autonomous Driving Domain Controller Research: One Board/One Chip Solution Will Have Profound Impacts on the Automotive Supply Chain

Three development stages of autonomous driving domain controller:...

Global and China Range Extended Electric Vehicle (REEV) and Plug-in Hybrid Electric Vehicle (PHEV) Research Report, 2024-2025

Research on REEV and PHEV: Head in the direction of high thermal efficiency and large batteries, and there is huge potential for REEVs to go overseas

In 2024, hybrid vehicles grew faster than batter...