Monthly Monitoring Report on China Automotive Intelligent Driving Technology and Data Trends (Issue 2, 2024)

Insight into intelligent driving: ECARX self-develops intelligent driving chips, and L2.5 installation soared by 175% year on year.??

Based on the 2023 version, the 2024 version of Monthly Monitoring Report on China Automotive Intelligent Driving Technology and Data Trends adds trend forecast, new vehicle research, OTA tracking and other contents, and further details the data indicators.

In the advanced intelligent driving market, the installations of L2.5 ADAS functions grew fastest.

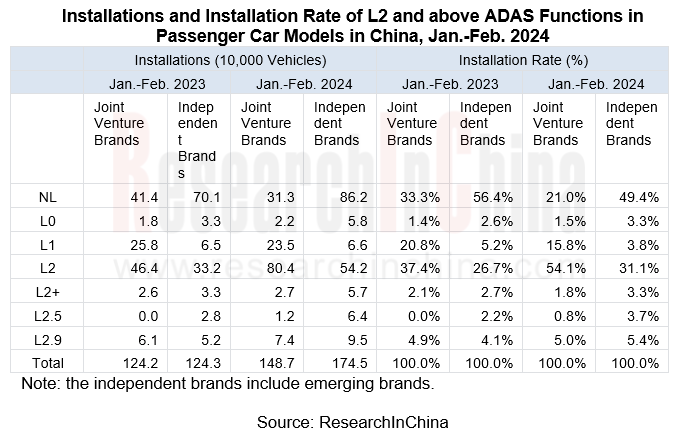

According to statistics from ResearchInChina, from January to February 2024, ADAS functions (L1-L2.9) were installed in a total of 1.977 million passenger cars in China, a like-on-like upsurge of 49.9%, with an installation rate of 61.2%, 8.1 percentage points higher than the same period last year. Wherein, L2 ADAS functions were installed in the largest number of passenger cars, up to 1.347 million units, jumping by 69.2% on an annualize basis, with an installation rate of 41.7%, up 9.6 percentage points. As seen from the growth in installations, vehicles equipped with L2.5 ADAS functions enjoyed the fastest growth, soaring by 174.9% to 76,000 units from 28,000 units in the prior-year period.??

In terms of OEM types, joint venture brands boasted installations and installation rate of L2 ADAS functions higher than Chinese independent brands. The installations reached 804,000 vehicles, up 73.2% compared with the same period of the previous year, and the installation rate was 54.1%, up 16.7 percentage points, which were mainly driven by the vehicle sales of Volkswagen, Toyota and Honda, each selling up to more than 100,000 units. In addition, joint venture brands also took a certain share in the L2.5 and L2.9 ADAS markets, mainly boosted by the sales of Mercedes-Benz and Tesla, respectively.?

Chinese independent brands had installations and installation rate of L2+ and above ADAS functions higher than joint venture brands. Wherein, L2.9 ADAS functions were installed in the largest number of passenger cars, up to 95,000 units, 84.2% more than in the same period of the previous year, with an installation rate of 5.4%, up 1.3 percentage points, which were mainly driven by the sales of brands such as AITO, Li Auto and ZEEKR, each selling more than 10,000 units.??

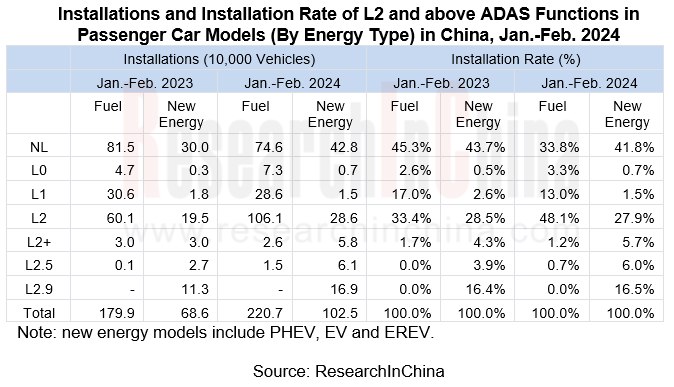

As for energy type, most fuel-powered models were installed with L2 functions, with an installation rate of 48.1%, of which the installation rates of L2+ and above functions fell off a cliff and were all lower than 2% and L2.9 functions had yet to be available. The installation rates of L2.9 and above functions in new energy models were all higher than 5%, and showed an upward trend, of which L2.9 functions boasted the highest installation rate, up to 16.5%, and were mainly installed in Model Y, AITO M7 and Model 3.???

From the perspective of the growth in installation rate, the installation rate of L2 ADAS functions in fuel-powered models grew fastest, up to 48.1% compared with 33.4% in the same period last year, which was primarily driven by the sales of models like Sagitar, Lavida and Mercedes-Benz C-Class. New energy models saw the fastest-growing installation rate of L2.5 ADAS functions, up to 6.0% compared with 3.9% in the prior-year period, which was mainly pushed up by the sales of Li Auto’s models, ZEEKR 007 and Blue Mountain DHT-PHEV.

Independent development of intelligent driving chips: ECARX joined the self-development camp, focusing on developing NPU.??

ECARX positions itself as an "incremental parts supplier" serving global automakers, and comprehensively deploy incremental parts for intelligent vehicles, such as chips, LiDAR, and computing platforms, for example:

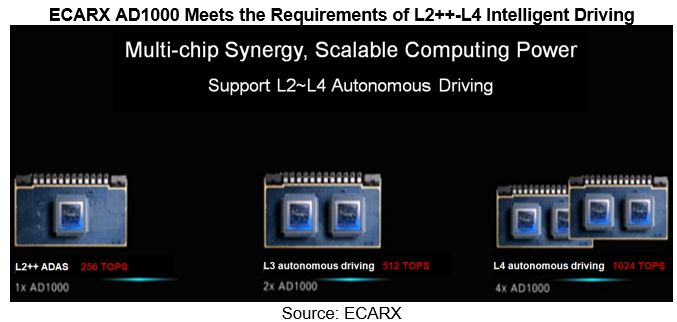

In March 2024, ECARX and SiEngine announced AD1000, a self-developed advanced intelligent driving chip in Longying Series. It adopts a 7nm process and is manufactured by TSMC. With CPU compute of 250 KDMIPS and NPU compute of 256 TOPS, and through multi-chip synergy, it enables computing power of up to 1024 TOPS, meeting the requirements of L2++-L4 intelligent driving. It is expected to come into mass production in October 2024.?

Momenta, a Tier 1 supplier of intelligent driving software, also makes layout. In July 2023, several former key staffs of OPPO ZEKU joined Momenta to develop autonomous driving chips. In January 2024, Momenta entered the IP phase in development of autonomous driving chips. In December 2023, Xinxin Hangtu (Suzhou) Technology Co., Ltd. was established as the chip project company of Momenta. The new company raised funds independently and closed the angel funding round. Currently, Momenta’s chip team has nearly 100 people.??

In addition, emerging carmakers NIO, Xpeng and Li Auto, and conventional OEM BYD are also representatives in independent development of intelligent driving chips. For example, in December 2023 NIO unveiled Shenji NX9031, a chip with CPU compute of 615K DMIPS, enabling microsecond-level dynamic wake-up of various subsystems, and having been installed on NIO ET9. Xpeng’s intelligent driving chip was brought up in late 2023 and is scheduled to be mounted on cars in 2025. BYD planned to develop dedicated intelligent driving chips in house from 2022. This project is led by BYD's semiconductor team. Currently, BYD has carried out the self-development projects of intelligent driving sensors, chips and domain controllers.??

Whether it is ECARX or OEMs, they put their focus on NPU (Neural Processing Unit) in self-developing intelligent driving chips. Their self-developed NPUs can better adapt to their intelligent driving algorithms and enable higher peak performance, energy efficiency and area efficiency, achieving the aim of quickly processing AI inference tasks. For example, according to ECARX, compared with NVIDIA Orin X, its Longying intelligent driving chip AD1000 has 100% higher NPU capabilities and 185% more local storage space in NPU. Li Auto began to work hard to self-develop intelligent driving chips in November 2023, concentrating on developing NPU modules.?????

Leveraging the 18C rules of the Hong Kong Exchanges and Clearing Limited (HKEX), China’s local intelligent driving chip vendors are concentrating their efforts on going public.

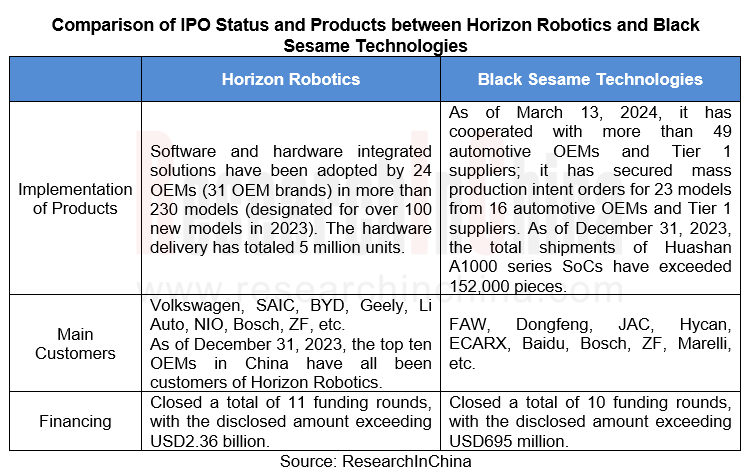

In addition to independent development, China’s local intelligent driving chip vendors are doing their utmost to be listed on HKEX. In March 2024, Horizon Robotics submitted a prospectus to the stock exchange. At the same time, Black Sesame Technologies also submitted its application for listing on the main board to HKEX again.?

On March 31, 2023, the Chapter 18C of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited officially came into effect. Chapter 18C is a new listing regime for specialist technology companies, involving listing applications from companies operating in one of five Specialist Technology Industries: (i) next-generation information technology; (ii) advanced hardware and software; (iii) advanced materials; (iv) new energy and environmental protection; and (v) new food and agriculture technologies. The 18C rules help some technology start-ups which are not profitable to quickly gain support from the capital market for listing, lowering the listing threshold requirements for commercialized and uncommercialized specialist technology companies.???

Monthly Monitoring Report on China's Automotive Intelligent Driving Technology and Data Trends has 12 issues a year, and costs US$2,000 per issue, each with different topics.??

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...

Automotive Intelligent Cockpit SoC Research Report, 2025

Cockpit SoC research: The localization rate exceeds 10%, and AI-oriented cockpit SoC will become the mainstream in the next 2-3 years

In the Chinese automotive intelligent cockpit SoC market, althoug...

Auto Shanghai 2025 Summary Report

The post-show summary report of 2025 Shanghai Auto Show, which mainly includes three parts: the exhibition introduction, OEM, and suppliers. Among them, OEM includes the introduction of models a...

Automotive Operating System and AIOS Integration Research Report, 2025

Research on automotive AI operating system (AIOS): from AI application and AI-driven to AI-native

Automotive Operating System and AIOS Integration Research Report, 2025, released by ResearchInChina, ...

Software-Defined Vehicles in 2025: OEM Software Development and Supply Chain Deployment Strategy Research Report

SDV Research: OEM software development and supply chain deployment strategies from 48 dimensions

The overall framework of software-defined vehicles: (1) Application software layer: cockpit software, ...

Research Report on Automotive Memory Chip Industry and Its Impact on Foundation Models, 2025

Research on automotive memory chips: driven by foundation models, performance requirements and costs of automotive memory chips are greatly improved.

From 2D+CNN small models to BEV+Transformer found...

48V Low-voltage Power Distribution Network (PDN) Architecture and Supply Chain Panorama Research Report, 2025

For a long time, the 48V low-voltage PDN architecture has been dominated by 48V mild hybrids. The electrical topology of 48V mild hybrids is relatively outdated, and Chinese OEMs have not given it suf...

Research Report on Overseas Cockpit Configuration and Supply Chain of Key Models, 2025

Overseas Cockpit Research: Tariffs stir up the global automotive market, and intelligent cockpits promote automobile exports

ResearchInChina has released the Research Report on Overseas Cockpit Co...

Automotive Display, Center Console and Cluster Industry Report, 2025

In addition to cockpit interaction, automotive display is another important carrier of the intelligent cockpit. In recent years, the intelligence level of cockpits has continued to improve, and automo...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2025

Functional safety research: under the "equal rights for intelligent driving", safety of the intended functionality (SOTIF) design is crucial

As Chinese new energy vehicle manufacturers propose "Equal...

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025

AI-Defined Vehicle Report: How AI Reshapes Vehicle Intelligence?

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025, released by ResearchInChina, studies, analyzes, and summarizes the c...

Automotive Digital Key (UWB, NearLink, and BLE 6.0) Industry Trend Report, 2025

Digital key research: which will dominate digital keys, growing UWB, emerging NearLink or promising Bluetooth 6.0?ResearchInChina has analyzed and predicted the digital key market, communication techn...

Integrated Battery (CTP, CTB, CTC, and CTV) and Battery Innovation Technology Report, 2025

Power battery research: 17 vehicle models use integrated batteries, and 34 battery innovation technologies are released

ResearchInChina released Integrated Battery (CTP, CTB, CTC, and CTV)and Battery...

AI/AR Glasses Industry Research Report, 2025

ResearchInChina released the " AI/AR Glasses Industry Research Report, 2025", which deeply explores the field of AI smart glasses, sorts out product R&D and ecological layout of leading domestic a...

Global and China Passenger Car T-Box Market Report 2025

T-Box Research: T-Box will achieve functional upgrades given the demand from CVIS and end-to-end autonomous driving

ResearchInChina released the "Global and China Passenger Car T-Box Market Report 20...

Automotive Microcontroller Unit (MCU) Industry Report, 2025

Research on automotive MCUs: the independent, controllable supply chain for automotive MCUs is rapidly maturing

Mid-to-high-end MCUs for intelligent vehicle control are a key focus of domestic produc...