Monthly Monitoring Report on China Automotive Sensor Technology and Data Trends (Issue 3, 2024)

Insight into intelligent driving sensors: “Chip-based” reduces costs, and the pace of installing 3-LiDAR solutions in cars quickens.

LiDARs were installed in 173,000 passenger cars in China in Q1 2024, an annualized upsurge of 144.2%.

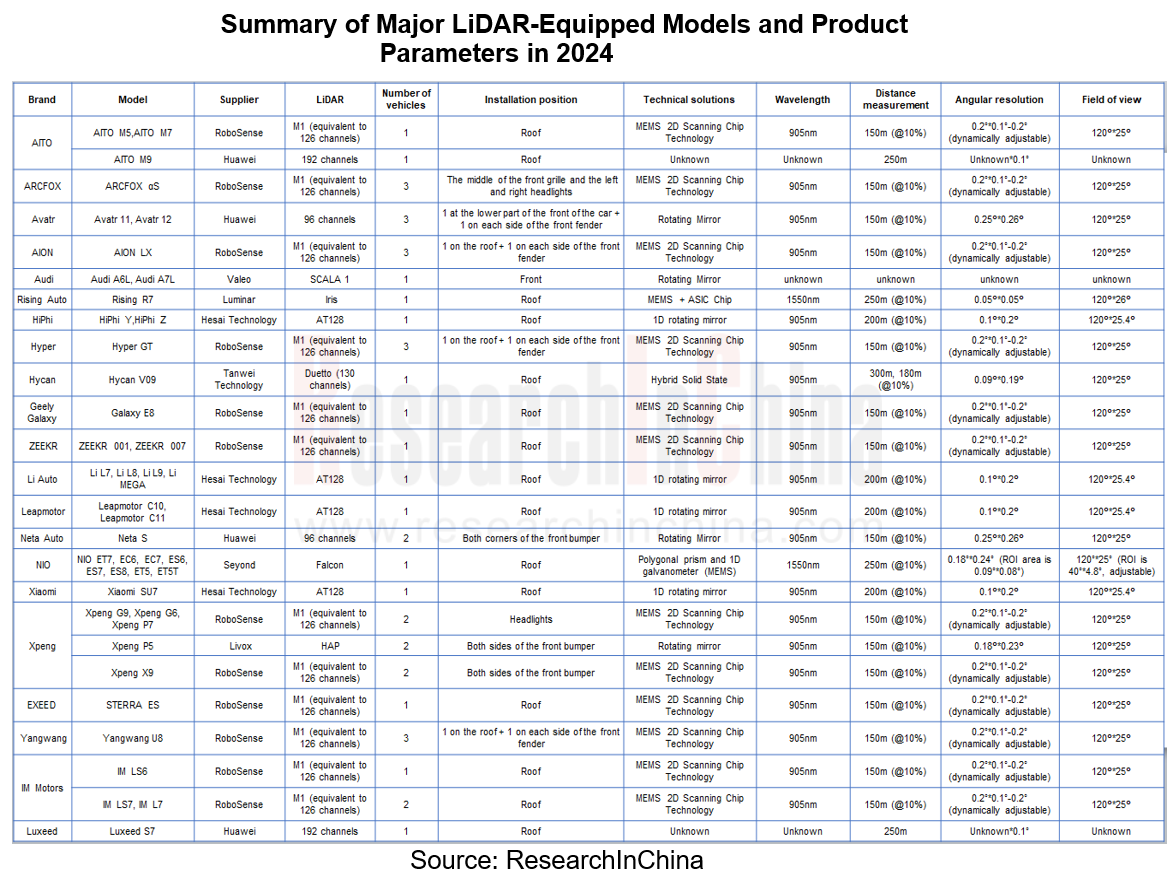

According to the statistics from ResearchInChina, LiDARs were installed in 173,000 passenger cars in China in Q1 2024, soaring by 144.2% from the prior-year period, with the installation rate increased from 1.7% to 3.6%, and most were applied by Chinese independent brands. In 2024, in addition to emerging brands like AITO, Xiaomi, and Leapmotor that have launched new cars equipped with LiDAR, Geely's new car Galaxy E8 carried LiDAR for the first time. Models to be launched with LiDAR include WEY Blue Mountain Intelligent Driving Edition (to be launched in June 2024, with 1 unit), 2nd-generation AION V (to be launched in July 2024, with 1 unit), Avatr 07 (to be launched in H2 2024, with 1 unit), Changan NEVO E07 (optional, to be launched in October 2024, with 2 units) and Yangwang U7 (to be launched in H2 2024, with 3 units).???

In Q1 2024, single-LiDAR solutions were installed 147,000 passenger cars, 142.7% more than in the same period last year, sweeping 85.2%, with the installation rate rising from 1.5% to 3.1%. They were largely mounted on AITO M7, Li L9 and NIO ES6 among others to support their use of advanced intelligent driving functions such as urban NOA. 3-LiDAR solutions were installed in 14,000 passenger cars compared with 4,000 cars in the same period of the previous year, with a year-on-year growth rate hitting 241.2%, higher than the 1-LiDAR and 2-LiDAR solutions, as a result of a low base last year and the higher sales of brands such as Avatr, Yangwang and ARCFOX.???

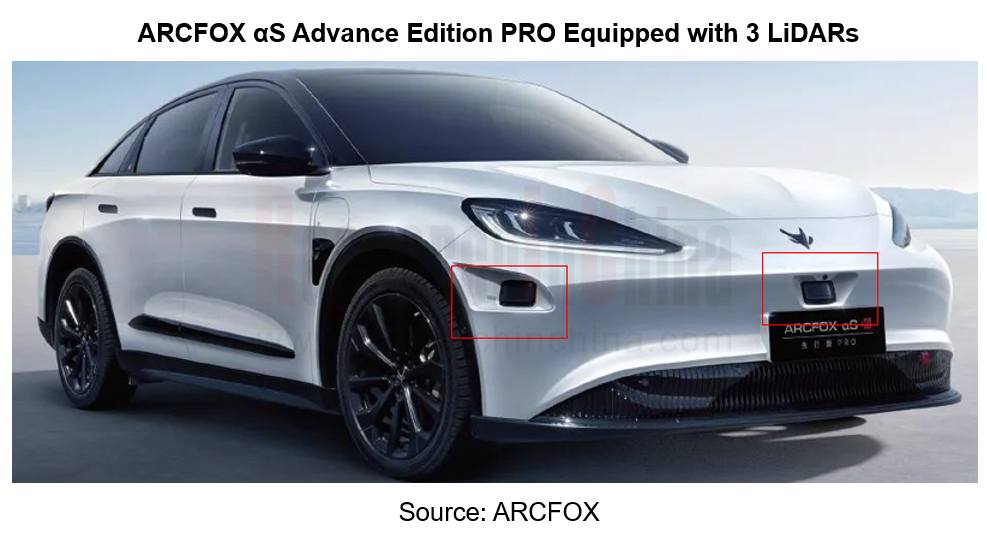

ARCFOX αS Advance Edition PRO, available on market in April 2024, is priced at RMB256,800. It comes standard with 3 Huawei LiDARs and HUAWEI ADS2.0 advanced intelligent driving solution, supporting such functions as CAS (Collision Avoidance System), smart parking, RPA (Remote Parking Assist), and AVP (Automated Valet Parking). This model has obtained a L3 autonomous driving public road test license in China.??

With integration into robotaxis and cockpits and headlights, LiDAR has a bright future.

According to Luminar, a listed US LiDAR company, Tesla accounted for more than 10% of the company's revenue for Q1 2024, that is, Tesla contributed more than USD2 million. It is supposed that these LiDARs will be used for testing robotaxis to support robotaxi products Tesla released in August 2024 and Musk's plan to launch robotaxis in China. Chinese robotaxi players such as Baidu Apollo, Pony.ai and WeRide also adopt the technology route of using LiDAR as the main sensor.??????

Not only Robotaxi, LiDAR can also be integrated into the cockpit and headlights. For example, DJI Automotive demonstrated its solution at the Beijing International Automotive Exhibition. This solution integrates four types of sensors: LiDAR + stereo sensor + mono sensor+ inertial navigation. Among them, stereo sensors provide dense point clouds, and LiDAR is mainly used to make up the ranging accuracy. Compared with the common LiDAR + front camera solution on the market, the LiDAR-vision solution can reduce the cost by 30% to 40%. This solution is scheduled to be mass-produced in late 2025 or early 2026.???

?

At the Beijing International Automotive Exhibition, Hesai Technology and Marelli together demonstrated the integration of Hesai’s ATX LiDAR into Marelli’s premium automotive lighting solution. This solution maintains the vehicle's sleek aesthetics and aerodynamic profile. It both protects the LiDAR and makes it easier to keep the LiDAR clean without an additional cleaning system.??

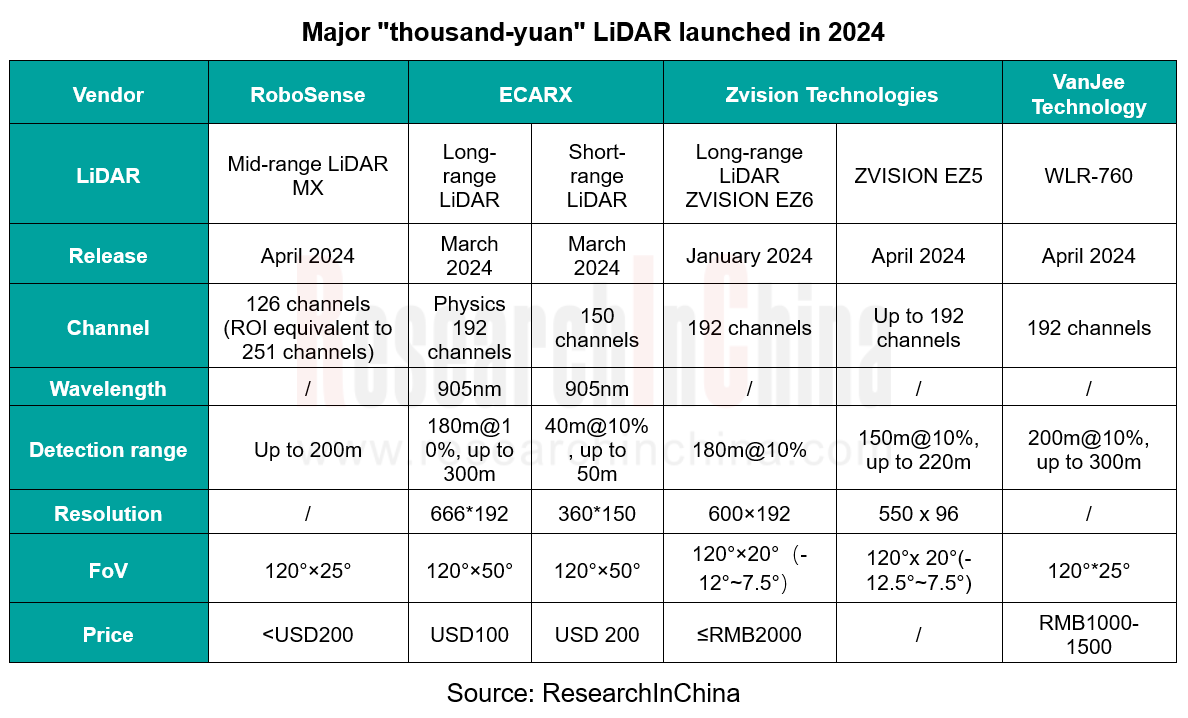

"Chip-based” helps reduce costs, and more “1,000 yuan” LiDARs are launched.

At the Beijing International Automotive Exhibition, multiple LiDAR products featuring "1,000 yuan" and "extreme cost performance" were unveiled.

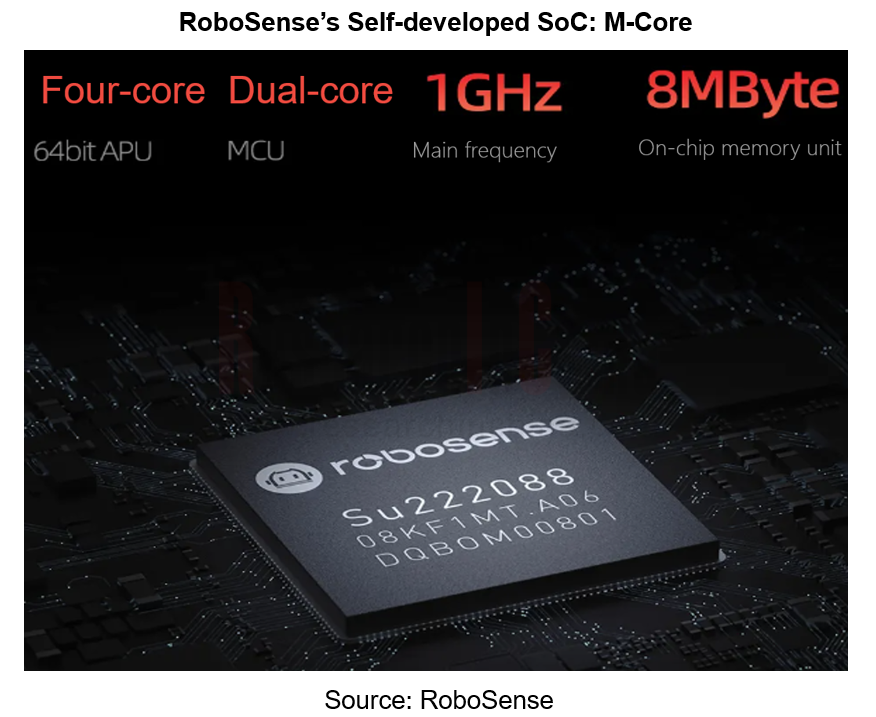

For example, RoboSense launched MX, a LiDAR based on full-stack chip implementation technology (which uses chip to implement the full-stack system with scanning, processing, and transceiver modules). Using the self-developed dedicated SoC M-Core to integrate the entire backend circuit into a single chip reduces MX's motherboard area by 50%, the power consumption by 40%, and the price to less than USD200. In Q1 2025, the first batch of MX products will be spawned and installed in cars.??????

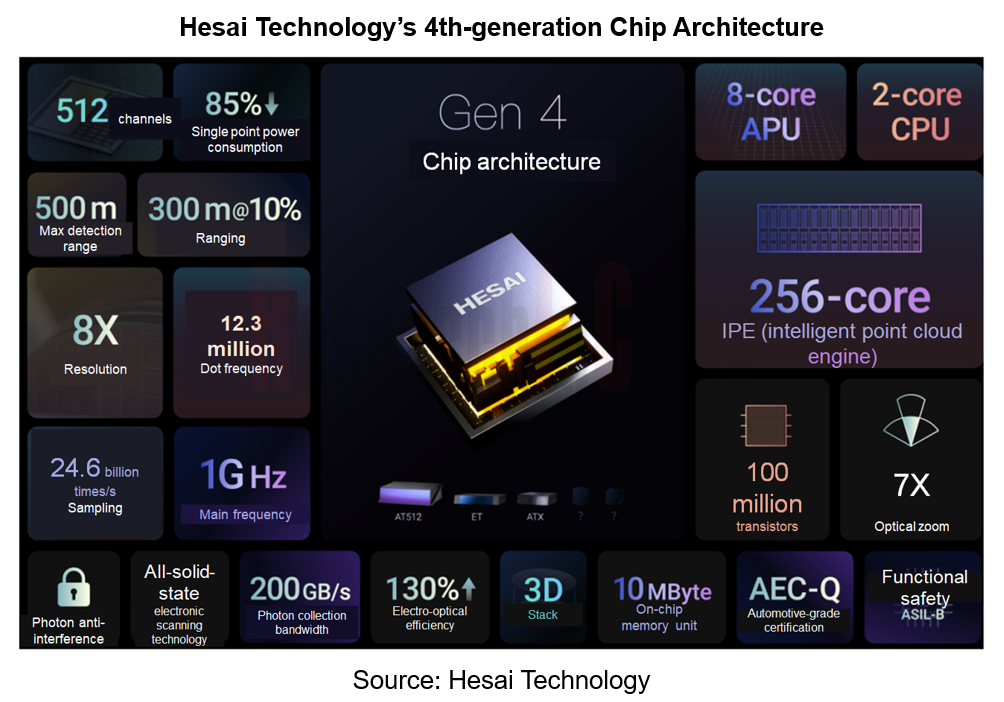

Hesai Technology's ATX ultra-wide FOV long-range LiDAR based on the fourth-generation chip architecture features cost performance. It still uses the mature architecture of “chip-based transceiver + 1D scanning” for Hesai AT Series. The higher integration of the transceiver module and the simplified core optical scanning structure enable 60% smaller size, 500g lighter weight, the minimum exposed window height of only 25mm, and only 8W power consumption.???

Zvision Technologies released ZVISION EZ5, an extremely cost-effective product which is designed on the highly integrated SPAD chip platform design. A single SPAD chip replaces most of the previous discrete components of optoelectronic front-end → amplification link → analog-to-digital conversion → digital signal processing, simplifying architecture and further reducing costs.

WLR-760 LiDAR launched by VanJee Technology adopts the VCSEL+SPAD route. Compared with conventional rotating mirror solutions, it reduces the material types by 60%. It reduces the total number of materials by 80% compared with the conventional semi-solid rotating mirror solution. Thanks to higher integration, the production processes are reduced by up to 30%. By VanJee’s estimate, when shipments reach more than 100,000 units, the cost can range at RMB1,000-1,500.?

Monthly Monitoring Report on China Automotive Sensor Technology and Data Trends? has 12 issues a year, and costs US$2,000 per issue, each with different topics.?

1 Topic Insight: Intelligent Driving and Sensor Trend Insights of 2024 Beijing International Automotive Exhibition

Overview of Beijing International Automotive Exhibition

1.1 OEMs

Trend 1: PHEV Models Continue to be Released, and the Proportion of HEVs Will Be on the Rise

Trend 2: Several OEMs Exhibit Hydrogen Fuel Cell Models

Trend 3: Traffic Is the Priority, and CEOs Become "Internet Celebrities" for Marketing

Trend 4: Joint Venture OEMs Accelerate the Pace of Local Suppliers to Make Their Car Models More Competitive

Trend 5: OEMs' Strategies Focus on New Energy and Going Overseas

Trend 6: More Models Are Equipped with 800V High-Voltage Fast-Charging Battery System

Trend 7: Independent OEMs Showcase SiC Power Modules

Trend 8: OEMs Enter Electro-Hybrid Technology to Eliminate Mileage Anxiety

Trend 9: More OEMs Join the Ranks of Mapless Intelligent Driving

Trend 10: Intelligent Driving Becomes Available All Over China

Trend 11: Multiple Models Carry Vision-only Solutions

Trend 12: FSD Is About to Enter China, Setting off a Wave of End-to-End Technologies

Trend 13

Trend 14

Trend 15

Trend 16

Trend 17

Trend 18

Trend 19

Trend 20

Trend 21

Trend 22

Trend 23

Trend 24

Trend 25

Trend 26

Trend 27

Trend 28

Trend 29

1.2 Industry Chain - Intelligent Driving and Sensors

Trend 1:Suppliers Launch More End-to-End Solutions

Trend 2:Cross-Domain Integration Solutions Are Released Tightly

Trend 3:Zonal Controllers are the Layout Focus

Trend 4:Cross-domain Integration Drives the Evolution of Vehicle Operating Systems

Trend 5:The Cost of Advanced Intelligent Driving Is Lowered in Favor of Its Use in Low-to-mid-end Models

Trend 6

Trend 7

Trend 8

Trend 9

Trend 10

Trend 11

Trend 12

Trend 13

Trend 14

Trend 15

Trend 16

Trend 17

Trend 18

Trend 19

Appendix:Beijing International Automotive Exhibition - Summary of Some Models

2 Data Monitoring

Data Indicators

Research Scope

2.1 Overall Installations of Camera and YoY

2.2 Front View Camera - Overall Installations and Installation Rate by OEM

2.3 Front View Camera - Installations and Installation Rate by Price

2.4 Front View Camera - Installations by Brand and Model

2.5 Side View Camera - Overall Installations and Installation Rate by OEM

2.6 Side View Camera - Installations and Installation Rate by Price

2.7 Side View Camera - Installations by Brand and Model

2.8 Surround View Camera - Overall Installations and Installation Rate by OEM

2.9 Surround View Camera - Installations and Installation Rate by Price

2.10 Surround View Camera - Installations by Brand and Model

2.11 Reversing Camera - Overall Installations and Installation Rate by OEM

2.12 Reversing Camera - Installations and Installation Rate by Price

2.13 Reversing Camera - Installations by Brand and Model

2.14 Cabin Camera (Including DMS & OMS) - Overall Installations and Installation Rate by OEM

2.15 Cabin Camera (Including DMS & OMS) - Installations and Installation Rate by Price

2.16 Cabin Camera (Including DMS & OMS) - Installations by Brand and Model

2.17 Driving Recorder Camera - Overall Installations and Installation Rate by OEM

2.18 Driving Recorder Camera - Installations and Installation Rate by Price

2.19 Driving Recorder Camera - Installations by Brand and Model

2.20 Radar - Overall Installations and Installation Rate by OEM

2.21 Radar - Installations and Installation Rate by Solution

2.22 Radar - Installations and Installation Rate by Price

2.23 Radar - Installations by Brand and Model

2.24 Ultrasonic Radar - Overall Installations and Installation Rate by OEM

2.25 Ultrasonic Radar - Installations and Installation Rate by Solution

2.26 Ultrasonic Radar - Installations and Installation Rate by Price

2.27 Ultrasonic Radar - Installations by Brand and Model

2.28 LiDAR - Overall Installations and Installation Rate by OEM

2.29 LiDAR - Installations and Installation Rate by Solution

2.30 LiDAR - Installations and Installation Rate by Price

2.31 LiDAR - Installations by Brand and Model

3 Industry Dynamics

3.3.1 Peterbilt Introduced Digital Vision System Rearview Mirror

3.3.2 PhiGent Robotics Introduced 7V Fisheye NOA Intelligent Driving Solution

3.3.3 Bosch Radar Head Li Mingkang Resigned and Joined a Silicon Valley 4D Radar Startup

3.3.4 Huawei Launched New Intelligent Vehicle Solution Brand "Qian Kun"

3.3.5 RoboSense Released RMB1000-level Mid-range LiDAR MX

3.3.6 RoboSense and Momenta Deepened Their Comprehensive Strategic Partnership

3.3.7 Hesai Technology Released Ultra-Wide FOV LiDAR ATX Based on the 4th Generation Chip Architecture

3.3.8 Hesai Technology and GAC Forged A Partnership

3.3.9 Hesai Technology Cooperated with Hongjing Drive on Multiple Fields from ADAS Technology to Intelligent Heavy Trucks

3.3.10 Hesai LiDAR-Marelli Headlamp Integrated Solution

3.3.11 Quanergy Introduced Next Generation 3D LiDAR Solution

3.3.12 LG Innotek Launched "High Performance LiDAR," Capable of Detecting Objects up to 250 Meters Away

3.3.13 RAYZ's Long-Range LiDAR Specification Upgraded Again

3.3.14 VanJee Technology Established A Korean Subsidiary to Expand Overseas Markets

3.3.15 LiangDao Intelligence and GoFurther.AI Formed A Strategic Partnership to Promote the Use of Lateral LiDAR in Production Autonomous Vehicles

3.3.16 STRADVISION’s New Generation SVNet Was Equipped with Horizon Journey? 3

3.3.17 Raytron’s Infrared Thermal Imaging ASIC-ISP Chip Passed AECQ Certification

3.3.18 SenardMicro’s Radar Chip Kestrel342 Came into Mass Production

3.3.19 Uhnder Launched 4D Digital Imaging Radar Chip S81, Supporting Up to 96 MIMO Channels

3.3.20 Raybow Successfully Passed IATF16949 Certification, Going All out to Entered the Automotive LiDAR Market

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...

Automotive Intelligent Cockpit SoC Research Report, 2025

Cockpit SoC research: The localization rate exceeds 10%, and AI-oriented cockpit SoC will become the mainstream in the next 2-3 years

In the Chinese automotive intelligent cockpit SoC market, althoug...

Auto Shanghai 2025 Summary Report

The post-show summary report of 2025 Shanghai Auto Show, which mainly includes three parts: the exhibition introduction, OEM, and suppliers. Among them, OEM includes the introduction of models a...

Automotive Operating System and AIOS Integration Research Report, 2025

Research on automotive AI operating system (AIOS): from AI application and AI-driven to AI-native

Automotive Operating System and AIOS Integration Research Report, 2025, released by ResearchInChina, ...

Software-Defined Vehicles in 2025: OEM Software Development and Supply Chain Deployment Strategy Research Report

SDV Research: OEM software development and supply chain deployment strategies from 48 dimensions

The overall framework of software-defined vehicles: (1) Application software layer: cockpit software, ...

Research Report on Automotive Memory Chip Industry and Its Impact on Foundation Models, 2025

Research on automotive memory chips: driven by foundation models, performance requirements and costs of automotive memory chips are greatly improved.

From 2D+CNN small models to BEV+Transformer found...

48V Low-voltage Power Distribution Network (PDN) Architecture and Supply Chain Panorama Research Report, 2025

For a long time, the 48V low-voltage PDN architecture has been dominated by 48V mild hybrids. The electrical topology of 48V mild hybrids is relatively outdated, and Chinese OEMs have not given it suf...

Research Report on Overseas Cockpit Configuration and Supply Chain of Key Models, 2025

Overseas Cockpit Research: Tariffs stir up the global automotive market, and intelligent cockpits promote automobile exports

ResearchInChina has released the Research Report on Overseas Cockpit Co...

Automotive Display, Center Console and Cluster Industry Report, 2025

In addition to cockpit interaction, automotive display is another important carrier of the intelligent cockpit. In recent years, the intelligence level of cockpits has continued to improve, and automo...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2025

Functional safety research: under the "equal rights for intelligent driving", safety of the intended functionality (SOTIF) design is crucial

As Chinese new energy vehicle manufacturers propose "Equal...

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025

AI-Defined Vehicle Report: How AI Reshapes Vehicle Intelligence?

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025, released by ResearchInChina, studies, analyzes, and summarizes the c...

Automotive Digital Key (UWB, NearLink, and BLE 6.0) Industry Trend Report, 2025

Digital key research: which will dominate digital keys, growing UWB, emerging NearLink or promising Bluetooth 6.0?ResearchInChina has analyzed and predicted the digital key market, communication techn...