Global and China Automotive Lens Industry Report, 2016-2020

-

Sep.2016

- Hard Copy

- USD

$2,200

-

- Pages:79

- Single User License

(PDF Unprintable)

- USD

$2,000

-

- Code:

ZLC036

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,100

-

- Hard Copy + Single User License

- USD

$2,400

-

With the high-speed growth of the global ADAS market, the demand for automotive cameras jumped radically with the market size growing at a compound annual rate of 31.3% during 2011-2015. Automotive lens meansoptical lens mounted on vehicles in order to implement various functions, consisting mainly of endoscope lens, rear view lens, front view lens, side view lens, surround view lens, etc.. The market of automotive lens which is a major part of automotive cameras is growing rapidly.

In 2015, the global shipments of OEM automotive lens approximated 48.5 million pieces, embracing 11.1 million pieces of front view automotive lens and 37.4 million pieces of rear view and surround view lens. In the next few years, the global shipment of OEM automotive lens will benefit from ADAS-related policies, maintain quick growth and reach 136.2 million pieces by 2020.

China's automotive lens OEM market size reached 10 million pieces in 2015, accounting for 20.6% of the global market. Wherein, there were 1.23 million pieces offront view automotive lens and 8.77 million pieces of rear view and surround view lens. "Made in China 2025", "Internet +" development strategy and other favorable policies proposed by China in 2015 will stimulate the demand for automotive lens. By 2020, China's automotive lens OEM market size will report 38.65 million pieces.

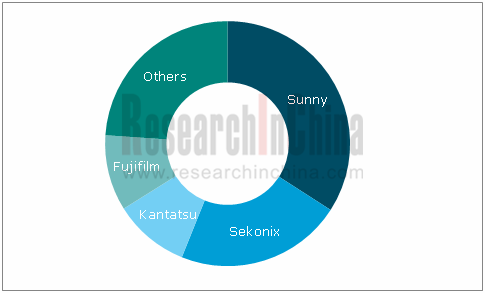

At present, the companies involved in the automotive lens industry are mostly traditional camera lens vendors, including Sekonix, Fujifilm, Sunny Optical, Largan Precision, GSEO, Union Optech, AbilityOpto-Electronics Technology and so on. Sunny Optical is the world's largest supplier of automotive lenses, serving Mobileye, Gentex, TRW, Valeo, Bosch, Continental, Delphi, Magna, among others. In 2015, Sunny Optical realized the shipment of 16.516 million pieces and enjoyed the market share of 34.1%.

Competitive Landscape of Global Automotive Lens Market (by Company), 2015

?

Source: ResearchInChina

In the next few years, the global and Chinese automotive camera market will continue to grow thanks to the followings:

1, Binocular Cameras Are Expected to be the Mainstream and Drive the Demand forAutomotive Lens

Compared with monocular cameras, binocular cameras are featured with high resolution, unlimited recognition rate, no need of sample database maintenance and so forth. Currently, binocular cameras have become the R & D focus of Japanese, German and other European and American vendors, and will replace monocular cameras to be the market mainstream in the future, which means that the demand for automotive lens will grow.

2, ADAS-related Policies Boost the Demand for Automotive Lens to Grow

In recent years, some countries and regions have issued a series of policies to prompt the popularity of ADAS. The United States requires all cars to install at least one rear view camera from 2018 onwards. The European New Car Assessment Program (NCAP) stipulates that only the AEB-installed cars whose active safety systems occupy 20% instead of 10% can be rated as 5 stars since 2014. Japan commands that all cars must install automatic emergency braking systems from 2016 onwards.

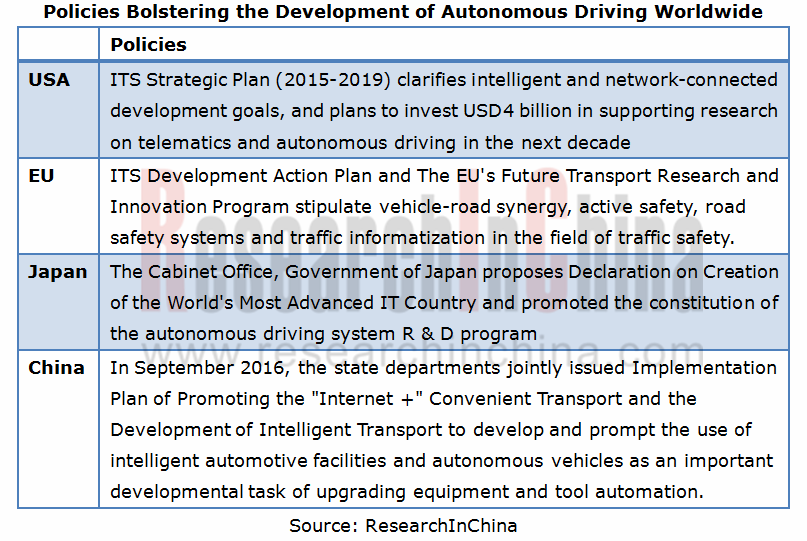

3, Favorable Autonomous Driving Policies Drive the Development of Automotive Lens

Currently, the US, EU, Japan, China and other countries and regions have enacted policies to promote the development of autonomous driving, which will benefit smart car-use cameras. Therefore, automotive lens will see rapid development as a key component of automotive cameras.

The report highlights the followings:

Size, segments, competitive pattern and development trend of global automotive lens OEM market;

Size, segments, competitive pattern and development trend of global automotive lens OEM market;

Size and segments of Chinese automotive lens OEM market;

Size and segments of Chinese automotive lens OEM market;

Analysis on automotive lens industry chain, including introduction to automotive camera??industry, ADAS market and impact of related sectors on automotive lens industry;

Analysis on automotive lens industry chain, including introduction to automotive camera??industry, ADAS market and impact of related sectors on automotive lens industry;

Operation, automotive lens business and the like of eight Chinese and five foreign automotive lens companies.

Operation, automotive lens business and the like of eight Chinese and five foreign automotive lens companies.

1 Introduction

1.1 Optical Lens

1.1.1 Definition

1.1.2 Main Parameters

1.1.3 Classification

1.1.4 Industry Chain

1.2 Automotive Lens

1.2.1 Application and Classification

1.2.2 Technical Features

2 Status Quo of Global Automotive Lens OEM Market

2.1 Market Size

2.2 Market Segments

2.2.1 Front View Automotive Lens

2.2.2 Rear View and Surround View Automotive Lens

2.3 Competitive Pattern

2.4 Development Trend

2.4.1 Binocular Camera Development Will Drive Growth in Demand for Automotive Lens

2.4.2 Favorable Autonomous Driving Policies Will Promote the Development of Automotive Lens

2.4.3 Considerable Demand of Automotive Lens in Aftermarket

2.4.4 HD Development of Automotive Lens

2.4.5 Surround View Cameras Replace Rear View Cameras

3 Chinese Automotive Lens OEM Market and Industry

3.1 Market Size

3.2 Market Segments

3.2.1 Front View Automotive Lens

3.2.2 Rear View and Surround View Automotive Lens

4 Automotive Lens Industry Chain

4.1 Automotive Camera

4.1.1 Industry Overview

4.1.2 Competitive Pattern

4.1.3 Relevant Laws and Regulations

4.2 ADAS Market

4.2.1 Introduction

4.2.2 Market Size

4.3 Impact of Related Industries on Automotive Lens Industry

4.3.1 The Policy-promoted ADAS Industry Is Conducive to Automotive Lens

4.3.2 Higher Penetration of ADAS System Promotes the Development of Automotive Lens

5 Main Chinese Companies

5.1 Sunny Optical Technology (Group) Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 R&D Costs

5.1.6 Main Automotive Lens Customers

5.1.7 Main Automotive Lens Products

5.1.8 Automotive Lens Shipment

5.1.9 Automotive Lens Sales

5.2 LarganPrecision Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Automotive Lens Business

5.3 Genius Electronic Optical (GSEO)

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Automotive Lens Business

5.4 Union Optech

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 R & D Costs

5.4.6 Production and Marketing

5.4.7 Main Customers

5.4.8 Automotive Lens Business

5.5 Ability Opto-Electronics Technology Co., Ltd.

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 R & D Costs

5.5.5 Automotive Lens Business

5.6 RICOM

5.6.1 Profile

5.6.2 Layout in Automotive Lens

5.7 Dongguan YuTong Optical Technology Co., Ltd. (YTOT)

5.7.1 Profile

5.7.2 Automotive Lens Business

5.8 Kinko Optical Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.8.3 Automotive Lens Business

6 Major Foreign Companies

6.1 SEKONIX

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Automotive Lens Business

6.1.5 WeihaiSEKONIX Electronics Co., Ltd.

6.2 FUJIFILM

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Automotive Lens Business

6.3 Sunex

6.3.1 Profile

6.3.2 Automotive Lens Business

6.3.3 SUNEX Optoelectronics Technology (Shanghai) Co., Ltd.

6.4 Universe Kogaku

6.5 KAVAS

Optical Lens Industry Chain

Application of Automotive Lens in Automobile

Classification of Automotive Lens

Global Automotive Lens OEM Shipment, 2014-2020E

Global Automotive Lens Market Structure (by Mounted Position), 2014-2020E

Comparison between Front Automotive Camera Solutions

Roadmap of Front ADAS Cameras

Global Shipment of OEM Front View Automotive Lenses, 2014-2020E

Mounted Position of Nissan’s Surround View Cameras

Mounted Position of Infiniti’s Surround View Cameras

Global Shipment of OEM Rear View and Surround View Automotive Lenses, 2014-2020E

Introduction to Global Main Automotive Lens Vendors

Revenue of Global Main Automotive Lens Vendors, 2013-2015

Competitive Landscape of Global Automotive Lens Market (by Company), 2015

Binocular Camera Development Direction

Global Autonomous Driving Promotion Policies by Region

Sales Volume of Driving Recorder-use Lens in China, 2013-2020E

China’s Automotive Lens OEM Market Size, 2015-2020E

China’s Automotive Lens Market Structure (by Mounted Position), 2015-2020E

China’s Front View Automotive Lens OEM Market Size, 2015-2020E

Market Penetration of Major ADAS Systems in China, Jan-Dec 2015

Market Penetration of Major ADAS Systems in China, Jan-Jul 2016

Preinstalled Amount of AEB Systems in China, Jan-Jul 2016

Market Penetration of Major ADAS Systems in China, Jan-Jul 2016 (by Price)

China’s Rear View and Surround View Automotive Lens OEM Market Size, 2015-2020E

Penetration Growth of ADAS Functions of Vehicle Models for Sale in China, Jul 2016

Preinstalled Amount of Passenger Car 360° Surround View Systems in China, Jan-Jul 2016

Automotive Camera Industry Chain

Structure Diagram of Main Components of Camera Modules

Market Share of Global Automotive Camera Module Suppliers, 2015

Laws and Regulations on Automotive Camera in the World, 2013-2020E

ADAS Application of Automotive Cameras

Main Functions of Automotive Cameras

Global ADAS Market Size, 2011-2020E

China’s ADAS Market Size, 2011-2020E

Global ADAS Promotion Policies by Region

Marketing Network of Sunny Optical

Net Assets of Sunny Optical, 2011-2015

Development Course of Sunny Optical

Operating Results of Sunny Optical, 2011-2015

Revenue Structure of Sunny Optical (by Product), 2011-2015

Revenue of Sunny Optical (by Region), 2014-2015

Revenue Structure of Sunny Optical (by Product), 2013-2016

Gross Margin of Sunny Optical, 2011-2015

R & D Costs of Sunny Optical, 2013-2015

Main Customers of Sunny Optical

Automotive Lens Revenue Structure of Sunny Optical (by Customer), 2015

Technical Specifications of Main Automotive Lenses of Sunny Optical

Automotive IR Night Vision Lens Technical Specifications of Sunny Optical

Automotive Lens Shipment of Sunny Optical, 2013-2016E

Automotive Lens Revenue of Sunny Optical, 2013-2016

Automotive Lens Unit Price of Sunny Optical, 2013-2016

Largan’s Revenue and Net Income, 2012-2015

Largan’s Revenue (by Region), 2014-2015

Technologies and Products Successfully Developed by Largan, by the end of 2015

Largan’s Automotive Optical Lens

Revenue and Net Income of Genius Electronic Optical, 2013-2015

Revenue of Genius Electronic Optical (by Product), 2013-2015

Revenue Structure of Genius Electronic Optical (by Product), 2013-2015

Parameters of Main Automotive Lenses of Genius Electronic Optical

Revenue and Net Income of Union Optech, 2013-2015

Revenue of Union Optech (by Type), 2013-2015

Revenue Structure of Union Optech (by Type), 2013-2015

Revenue of Union Optech (by Region), 2013-2015

Gross Margin of Union Optech, 2013-2015

Gross Margin of Union Optech (by Type), 2013-2015

R & D Costs of Union Optech, 2013-2015

Fundraising and Investment Projects of Union Optech

Production and Marketing of Union Optech, 2013-2015

Revenue of Union Optech's Top 5 Customers, 2013-2015

Automotive Lens-related Patents of Union Optech

Main Automotive Lens Parameters of Union Optech

Automotive Rear View Lens Parameters of Union Optech

Revenue and Net Income of Ability Opto-Electronics Technology, 2013-2016

Revenue of Ability Opto-Electronics Technology (by Product), 2013-2015

Revenue Structure of Ability Opto-Electronics Technology (by Product), 2013-2015

Revenue Structure of Ability Opto-Electronics Technology (by Customer), 2013-2015

Capacity and Output of Ability Opto-Electronics Technology (by Product), 2013-2015

R & D Costs of Ability Opto-Electronics Technology, 2013-2015

Main Automotive Lens Specifications of Ability Opto-Electronics Technology

Development Course of YuTong Optical

TY8052-HD Automotive HD Lens Specifications of YuTong Optical

YT8037-A Automotive HD Lens Specifications of YuTong Optical

Revenue and Net Income of Kinko Optical, 2012-2015

Main Automotive Lens Specifications of Kinko Optical

SEKONIX’s Operating Results, 2013-2015

SEKONIX’s Revenue (by Region), 2013-2015

SEKONIX’s Revenue Structure (by Region), 2013-2015

SEKONIX’s Layout in Automotive Lens

FUJIFILM’s Revenue and Net Income, FY2012-FY2016

FUJIFILM’s Revenue (by Division), FY2012-FY2016

FUJIFILM’s Revenue Structure (by Division), FY2012-FY2016

Key Applications of FUJIFILM’s Automotive Lens

Sunex’s Main Customers

Main Specifications of Sunex’s Automotive Lens

Main Information of SUNEX Optoelectronics Technology (Shanghai) Co., Ltd.

Product Mix of KAVAS

Main Customers of KAVAS

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...