Global and China Automotive Semiconductor Industry Report, 2016-2020

-

Feb.2017

- Hard Copy

- USD

$2,400

-

- Pages:154

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

ZJF058

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,600

-

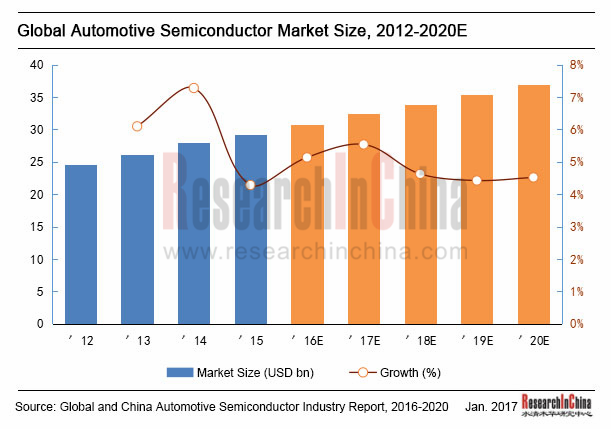

Automotive semiconductors were mostly used in niche markets like high-end luxury cars in the early days and have penetrated into the low-end markets at a faster pace in recent years. As high-end configurations become standard ones, such as reversing camera, automatic emergency call system, and ubiquitous driver assistance system, automotive semiconductor production has increased, with global automotive semiconductor market size reaching USD29.2 billion in 2015, up 4.3% from a year ago. Being more intelligent, the automobile has higher requirements on active safety, communication & navigation, vision technology, recognition technology, infotainment, comfort, and environmental friendliness, thus creating a huger demand for automotive semiconductors applied for safety control, on-board electronics and so forth. It is expected that the world’s automotive semiconductors will be worth USD 37 billion in 2020, a CAGR of 4.8% compared with 2015.

As the world’s largest automobile producer and consumer market, China has seen a ballooning automotive semiconductor market, thanks to booming semiconductor and automobile industries. Chinese automotive semiconductor market size was USD4.622 billion in 2015, sharing 15.8% of the global market, and is expected to hit USD8.011 billion in 2020, representing a CAGR of 11.6% during 2015-2020.

Automotive semiconductors can be divided into five categories: Power semiconductors, Sensors, Processors (Main for MCU), ASSP (mainly Connectivity and Amplifier), and Logic and others. In a conventional vehicle, semiconductors cost about USD320 with Power ones making up 26% and Sensors 16%; in a HEV, semiconductors cost USD690 or so with Power ones accounting for up to 75%; in an EV, semiconductors cost roughly USD700 with Power ones occupying 55%.

Globally, safety system, powertrain, automotive audio & video, chassis system, and body electronics are main application fields with a market size of USD4.9 billion, USD4.8 billion, USD5.2 billion, USD4.5 billion, and USD4.4 billion in 2015, respectively, seizing 16.8%, 16.4%, 17.8%, 15.4%, and 15.1% (81.5% in total) of automotive semiconductor market size.

Regarding competitive landscape, global automotive semiconductor industry is less concentrated with top5 automotive semiconductor companies (NXP, Infineon, Renesas, STMicroelectronics, and Texas Instruments) acquiring a combined 49.6% market share in 2015. NXP, with a 14.2% market share, finds a leading edge in automotive audio& video system and ADAS and some advantage in processor market after the acquisition of Freescale; Infineon, with an about 10.4% market share, is competitive in the fields of automotive sensor (#2), microcontroller (#3), and power semiconductor (#1); Renesas, with a 10.3% market share, enjoys a leadership in processor field; STMicroelectronics, with a 7.7% market share, is to some extent advantageous in segments like power semiconductor, short-range radar, and vision processing; Texas Instruments, with a 7.0% market share, focuses on industrial fields and doesn’t stand out in automotive field although with a more complete product line.

Global and China Automotive Semiconductor Industry Report, 2016-2020 highlights the following:

Global semiconductor industry (market size, competitive landscape, etc.);

Global semiconductor industry (market size, competitive landscape, etc.);

Global and China automobile industry (automobile production and sales, ownership, competitive landscape, etc.);

Global and China automobile industry (automobile production and sales, ownership, competitive landscape, etc.);

Global and China automotive semiconductor market size, competitive landscape, market segments, etc.);

Global and China automotive semiconductor market size, competitive landscape, market segments, etc.);

Global automotive semiconductor segments (sensor, processor, and power semiconductor (application, market size, competitive landscape, etc.));

Global automotive semiconductor segments (sensor, processor, and power semiconductor (application, market size, competitive landscape, etc.));

13 automotive semiconductor companies (Infineon, NXP, Texas Instruments, ON Semiconductor, ROHM Semiconductor, Renesas, STMicroelectronics, Bosch Semiconductors & Sensors, Melexis, Sensata, Fuji Electric, Murata, and TDK) (profile, financial position, production & sales, major customers, main products, R&D, production bases, technological features, etc.)

13 automotive semiconductor companies (Infineon, NXP, Texas Instruments, ON Semiconductor, ROHM Semiconductor, Renesas, STMicroelectronics, Bosch Semiconductors & Sensors, Melexis, Sensata, Fuji Electric, Murata, and TDK) (profile, financial position, production & sales, major customers, main products, R&D, production bases, technological features, etc.)

1 Global Semiconductor Industry

1.1 Overview of Semiconductor Market

1.2 Supply Chain of Semiconductor Industry

1.3 Overview of Semiconductor Industry

2 Global and Chinese Automobile Market

2.1 Global Automobile Production

2.1.1 Total Production

2.1.2 Regional Markets

2.1.3 Competitive Landscape

2.2 Chinese Automobile Market

2.2.1 Production

2.2.2 Automobile Ownership

2.2.3 Market Pattern

2.3 Recent Developments of the Chinese Automobile Market in 2016

3 Automotive Semiconductor Industry

3.1 Global Automotive Semiconductor Market Size

3.2 Competitive Landscape

3.3 Chinese Automotive Semiconductor Market

4 Major Automotive Semiconductor Segments

4.1 Automotive Sensor

4.1.1 Application of Sensor in Automobile

4.1.2 Market Size

4.1.3 Competitive Landscape

4.1.4 Automotive CMOS Image Sensor

4.2 Automotive Processor

4.2.1 Market Size

4.2.2 Competitive Landscape

4.3 Power Semiconductor

4.3.1 Introduction

4.3.2 HEV/EV Power Semiconductor

4.3.3 Competitive Landscape

5 Automotive Semiconductor Companies

5.1 Infineon

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Automotive Semiconductor Business

5.1.5 Key Customers

5.1.6 Acquisition of Wolfspeed

5.1.7 Business in China

5.2 Bosch Semiconductors & Sensors

5.2.1 Profile

5.2.2 Automotive Semiconductor Business

5.3 ROHM Semiconductor

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Automotive Semiconductor Business

5.3.5 Automotive Semiconductor Revenue

5.4 ON Semiconductor

5.4.1 Profile

5.4.2 Revenue

5.4.3 Revenue Structure

5.4.4 Acquisition of Fairchild

5.5 TI

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 R&D Investment

5.5.5 Automotive Semiconductor Business

5.5.6 Business in China

5.6 STMicroelectronics

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Automotive Semiconductor Business

5.7 Renesas

5.7.1 Profile

5.7.2 Operation

5.7.3 Automotive Semiconductor Business

5.7.4 Main Automotive Semiconductor Products and Solutions

5.7.5 Corporate Strategy

5.7.6 Strategy for China

5.8 NXP Semiconductors

5.8.1 Profile

5.8.2 Operation

5.8.3 Revenue Structure

5.8.4 Automotive Semiconductor Business

5.8.5 Business in China

5.9 Melexis

5.9.1 Profile

5.9.2 Revenue Structure

5.9.3 Automotive Semiconductor Business

5.10 Sensata

5.10.1 Profile

5.10.2 Operation

5.10.3 Revenue Structure

5.11 Fuji Electric

5.11.1 Profile

5.11.2 Operation

5.11.3 Revenue Structure

5.11.4 Semiconductor Business

5.12 TDK

5.12.1 Profile

5.12.2 Operation

5.12.3 Primary Business

5.12.4 Product

5.12.5 R&D

5.12.6 Latest Developments

5.12.7 TDK Xiamen Co., Ltd.

5.13 Murata

5.13.1 Profile

5.13.2 Operation

5.13.3 Primary Business

5.13.4 Orders and Stock

5.13.5 Main Products

5.13.6 Wuxi Murata Electronics Co., Ltd.

5.13.7 Beijing Murata Electronics Co., Ltd.

5.13.8 Capacity Expansion Plans

5.13.9 Latest Developments

Global Semiconductor Market Size, 2013-2020E

Global Semiconductor Market Distribution by Product, 2013-2016

Growth Rate of Global Semiconductor Products, 2013-2016

Semiconductor Outsourced Supply Chain

Semiconductor Company Systems

Semiconductor Outsourced Supply Chain Example

Food Chain IC CAD Design Industry

Geographical Distribution of Semiconductor Sales Worldwide, 2015

Global Top20 Vendors by Semiconductor Sales, 2015-2016

Global Automobile Production, 2011-2020E

Automobile Production in Major Countries by Model, 2015

Automobile Production in Major Countries by Model, 2016H1

Market Share of Major Carmakers, 2015

China’s Automobile Production, 2010-2020E

China’s Automobile Ownership, 2007-2020E

Top10 Carmakers in China, Jan-Oct 2016

Top10 Passenger Car Brands in China by Production, Jan-Oct 2016

Top10 Commercial Vehicle Manufacturers in China by Production, Jan-Oct 2016

Automobile Production and Sales in China, Oct 2016

Proportion of Automobile Production in China by Type, Jan-Oct 2016

Proportion of Automobile Sales in China by Type, Jan-Oct 2016

Passenger Car Production and Sales in China, Jan-Oct 2016

Sedan Production and Sales in China, Jan-Oct 2016

MPV Production and Sales in China, Jan-Oct 2016

Cross Passenger Car Production and Sales in China, Jan-Oct 2016

SUV Production and Sales in China, Jan-Oct 2016

Commercial Vehicle Production and Sales in China, Jan-Oct 2016

Truck Production and Sales in China, Jan-Oct 2016

Bus Production and Sales in China, Jan-Oct 2016

Global Automotive Semiconductor Market Size, 2012-2020E

Global Automotive Semiconductor Market Distribution by Product, 2016

Global Automotive Semiconductor Market Distribution by Application, 2012-2020E

Market Share of Global Top5 Automotive Semiconductor Vendors, 2014-2015

Chinese Automotive Semiconductor Market Size, 2012-2020E

Applications of Automotive Sensor

Application of Sensor in Power System

Application of Sensor in Safety System

Application of Automotive CMOS Image Sensor in KIA

Global Automotive Sensor Market Size, 2012-2020E

Ranking of Global Automotive Sensor Companies by Revenue, 2014-2016

Applications of Automotive CMOS Image Sensor

Automotive CMOS Image Sensor Shipments, 2009-2020E

Market Share of Major Automotive CMOS Image Sensor Vendors, 2015

Automotive Processor Market Size, 2014&2019E

Number of Automotive Processors Per Vehicle, 2007 vs. 2012 vs.2020E

Market Share of Major Automotive MCU Vendors, 2016

Application Range of Automotive Power Semiconductors

Application of MOSFET in Motor Control

EV Vehicles Current Block Diagram

Power Semiconductor Devices in Toyota Prius

Power Semiconductor Devices in Toyota Lexus Ls600H

Main Power Semiconductors and Applications

Market Share of Major Automotive Power Semiconductor Vendors, 2016

Market Share of Top5 Power Semiconductor Vendors, 2015

Geographical Distribution of Infineon’s Employees, FY2016

Revenue and Gross Margin of Infineon, FY2010-FY2016

Revenue of Infineon by Division, FY2015-FY2016

Revenue of Infineon by Region, FY2015-FY2016

Operating Income of Infineon by Division, FY2015-FY2016

Applications of Infineon’s Automotive Semiconductors

Infineon Radar Solutions

Infineon Camera Technology Solutions

Infineon Clutch System

Infineon Entered Lidar Field via Acquisition of Innoluce

Infineon ADAS Solutions

ADAS Battery System Solutions

Market Share of Infineon’s Automotive Semiconductor Business, 2015

Major Customers for Infineon’s Automotive Semiconductors

Assembly of Infineon’s Powertrain in Global Top10 Carmakers

Infineon’s Revenue and Growth Rate in China, FY2010-FY2016

Infineon’s Production Bases Worldwide

Automotive Semiconductor Business of Bosch

Profile of ROHM Semiconductor

Revenue and Operating Margin of ROHM Semiconductor, FY2011-FY2017E

Revenue of ROHM Semiconductor by Division, FY2011-FY2017E

Revenue of ROHM Semiconductor by Application, FY2004-FY2017

Development Focus of Automotive Semiconductor Business of ROHM Semiconductor

ROHM On-board Audio & Video Semiconductor

ROHM Body Control Semiconductor

ROHM Powertrain Semiconductor

ROHM Safety System Semiconductor

Trend of ROHM’s Revenue from Automotive Semiconductor by Application, FY2016-FY2020

Main Businesses of ON Semiconductor

Main Products of ON Semiconductor

Main Terminal Markets of ON Semiconductor

Key Customers of ON Semiconductor

Revenue and Net Income of ON Semiconductor, 2011-2016

Revenue of ON Semiconductor by Business Unit, 2012-2016

Revenue of ON Semiconductor by Region, 2012-2015

Revenue of ON Semiconductor by Application, 2012-2016

ON Semiconductor’s Revenue from Automotive Business, 2012-2014

Application Structure of ON Semiconductor’s SPG Business Unit, 2014

On Semi Position

Application Structure of ON Semiconductor’s SSG Business Unit, 2014

Development History of ON Semiconductor’s ISG Business Unit

Automotive Revenue of ON Semiconductor’s APG Business Unit, 2012-2014

Basic Information of ON Semiconductor after Acquisition of Fairchild

Product Line Expansion of ON Semiconductor after Acquisition of Fairchild

Market Status of ON Semiconductor after Acquisition of Fairchild

Revenue of ON Semiconductor by End Market after Acquisition of Fairchild

Distribution of TI’s Employees Worldwide

Main Businesses of TI

Revenue and Net Income of TI, 2010-2016

Revenue of TI by Division, 2010-2016

Operating Income of TI by Division, 2010-2016

Revenue of TI by Region, 2013-2015

R&D Investment of TI in Main Businesses, 2013-2015

TI’s ADAS Solutions

TI’s Automotive Safety System Solutions

TI Automotive Infotainment Diagram

TI Car Charging Spots

Revenue of TI by Application, 2013-2016

TI’s Revenue in China, 2013-2015

Main Businesses of STMicroelectronics

Revenue and Gross Margin of STMicroelectronics, 2010-2016

Revenue Structure of STMicroelectronics by Product, 2013-2016

Revenue Structure of STMicroelectronics by Region, 2013-2016

Main Automotive Semiconductors of STMicroelectronics

Powertrain and Intelligent Safety Solutions of STMicroelectronics

Market Position of STMicroelectronics in ADAS

ST Body Electronics Solutions

ST On-board Audio & Video Solutions

Major Customers for STMicroelectronics’s Automotive Semiconductors

Market Position of STMicroelectronics in Automotive Semiconductor Field

Main Businesses of Renesas

Revenue and Net Income of Renesas, FY2011-FY2016

Quarterly Gross Margin of Renesas, FY2013-FY2016

Quarterly Operating Margin of Renesas, FY2014-FY2016

Quarterly Automotive Revenue of Renesas, FY2015-FY2016

Quarterly General-purpose Revenue of Renesas, FY2015-FY2016

Renesas Automotive Focus

Renesas HEV/EV Automotive Focus

Renesas HEV/EV Automotive MCU Roadmap

Renesas Powertrain MCU Roadmap

Renesas Chassis MCU Roadmap

Renesas Airbag MCU Roadmap

Renesas ADAS MCU Roadmap

Renesas Instrument Cluster MCU Roadmap

Renesas Car Audio MCU Roadmap

Mid-term Strategic Goals of Renesas

Paths for Realization of Renesas’ Mid-term Strategy

Key Investment Businesses of Renesas in Mid-term Strategy

Renesas’ Strategy for Autonomous Driving Business

Renesas’ Strategy for the Chinese Market

Business Line, Market Positions & Key Customers of NXP

Revenue and Net Income of NXP, 2010-2016

Revenue of NXP by Product, 2014-2016

Proportion of NXP’s Revenue from Main Application Markets and Market Position, 2015

Synergy of NXP’s Acquisition of Freescale

NXP’s Leader Strategy for Automotive Audio & Video Semiconductor Market, 2016-2019E

Position of NXP in Intelligent Car Key Market

NXP’s Focus in ADAS Market

NXP’s Main Solutions for Automotive Radar

NXP’s Leader Strategy for Automotive Radar Market, 2016-2019E

Synergy Gained from NXP’s Merger with Freescale in ADAS Field

Main Niches for Development of NXP Secure V2X

Comparison of Growth (%) in NXP’s Automotive Semiconductor Business and the Whole Industry

Organizational Structure of Melexis

Revenue and Net Income of Melexis, FY2010-FY2016

Revenue of Melexis by Region, 2013-2015

Main Businesses of Sensata

Revenue and Net Income of Sensata, 2010-2016

Revenue of Sensata by Division, 2013-2015

Revenue of Sensata by Region, 2012-2015

Fuji Electric’s Electronic Equipment

Operating Revenue and Net Income of Fuji Electric, FY2012-FY2017

Revenue of Fuji Electric by Product, FY2015-FY2017

Revenue of Fuji Electric by Region, FY2012-FY2016

Main Products of Fuji Electric

New Products of Fuji Electric’s Electronic Devices Segment

Profile of TDK

Five Core Technologies and Fifteen Key Businesses of TDK

Operating Revenue and Net Income of TDK, FY2010-FY2017 (JPY mln)

Revenue of TDK by Product, FY2013-FY2017 (JPY bn)

Revenue of TDK by Region, FY2011-FY2017 (JPY mln)

Main Passive Components Product of TDK

R&D Expenses to Net Sales Ratio of TDK, FY2007-2016

Main Technical Indicators of TDK’s CGA6 and CGA9

Main Technical Indicators of TDK’s Resin Electrodes

Profile of Xiamen TDK

Main MLCC Products of Xiamen TDK

Profile of Murata

Operating Revenue and Net Income of Murata, FY2012-FY2017

Revenue of Murata by Product, FY2015-FY2017

Revenue of Murata by Region, FY2014-FY2016

Revenue of Murata by Application, FY2004-FY2016

Orders for Main Products of Murata, FY2016

Stocks of Main Products of Murata, FY2016

Murata Automotive ECU

Murata Automotive AT Semiconductor

Murata Automotive Stand-by Motor

Murata Automotive TPMS

Murata Automotive ABS/ESC

Profile of Wuxi Murata Electronics

Profile of Beijing Murata Electronics

Fukui Murata’s Plans for Construction of New Plants

Electrical Properties of Automotive AEC-Q200

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...