Global and China Automotive Infotainment Industry Report, 2016-2020

-

May 2017

- Hard Copy

- USD

$2,600

-

- Pages:110

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

ZYW234

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,800

-

Global and China Automotive Infotainment Industry Report, 2016-2021 covers the following:

1. Analysis and Forecast of Global and China automotive Infotainment market

2. Analysis and Forecast of Global and China automotive Infotainment industry

3. Status quo and trends of automotive Infotainment technologies

4. 23 key automotive Infotainment vendors

In 2016, the OEM Infotainment market size was estimated at USD24.2 billion, with shipments of about 32.1 million units and the average price of USD754. By 2020, the market size is expected to reach USD31 billion, the shipment about 38.3 million units, and the average price USD809. The main reason for the price increase lies in the adding of multiple features: ADAS (such as reversing video, 360 panorama) and enhanced communication functions (like Telematics system, especially 5G system); meanwhile, the increasingly complicated operating system of Infotainment causes higher and higher development costs, and beyond that, various HMI interfaces, capacitive touch screens, gesture, voice control and so on are developed.

Mobile phones have begun to compete with In-Vehicle Infotainment (IVI). With the popularity of the 4G network, the access speed of mobile phones to the network has been greatly accelerated. People have been accustomed to using mobile phones for the purpose of the Internet surfing, navigation and real-time traffic information, showing strong user stickiness. In this case, it is practical to follow the habits of consumers rather than educating them. The growth rate of IVI is to slow down beyond all doubt.

In 2016, Bosch and Aisin AW outperformed other companies. With a perfect layout in China, Bosch acts as a core supplier of SAIC GM, Shanghai Volkswagen and FAW-Volkswagen (except Audi) which are the top three carmakers in China; although the shipment growth rate was not high, the installation rate rose in 2016. Aisin AW further seized more market share in the supply chain of Audi and GM, grabbed the market share from Harman, Panasonic, Alpine and Pioneer, and attained the shipment of about 1.7 million units (an upsurge of 18%) in 2016. Harman averted its development focus from the medium and high-end market to the medium and low-end market, but the profit defied expectations despite the revenue swelled.

Chinese Infotainment industry can be divided into two camps: foreign and Chinese ones. The foreign camp mainly includes Bosch, Continental Automotive, Xugang Electronics, Harman and Japanese vendors. Bosch mainly serves FAW-Volkswagen, Shanghai Volkswagen and Shanghai GM. Continental targets FAW-Volkswagen and Shanghai Volkswagen. Xugang Electronics has Ford as its key customer. Japanese vendors serve BMW, Mercedes-Benz, Audi and Japanese carmakers, in which Aisin AW and Alpine are more powerful as the main suppliers of Audi. South Korean carmakers are all supported by Mobis. In the Chinese camp, the first-tier vendors embrace Desay SV Automotive, Shenzhen Hangsheng Electronics and Foryou. Desay SV Automotive primarily serves FAW-Volkswagen, FAW Mazda, Great Wall Motor and Chery, and its AM shipment is also high. Hangsheng Electronic cooperates with SAIC-GM-Wuling, Dongfeng Nissan, Dongfeng Venucia, Dongfeng Motor and Geely. Foryou’s main customers consist of Great Wall Motor, Geely, SAIC-GM-Wuling and Chery, but Foryou’s AM shipment plunges. Coagent Electronics S & T, Pateo, ChinaTSP, Inc. and Sound Technology rank among the second-tier vendors.

Squeezed by the first-tier vendors from Mainland China, Taiwanese vendors (such as Volkswagen’s supplier E-LEAD Electronic, Nissan’s supplier Join-link International Technogy, Dongfeng Peugeot’s supplier Jiangsu Shangyang Electronic Technology Co., Ltd.) lack cost competitiveness and see sharp fall in the revenue.

1. Global and China Automobile Market

1.1 Global Market

1.2 Chinese Market in 2016

1.3 Ranking of Chinese Automobile Market

2. Automotive Infotainment Industry and Market

2.1 Global Automotive Infotainment Market

2.2 China Automotive Infotainment Market

2.3 Infotainment Software and Hardware

2.4 Global Infotainment Industry Ranking

2.5 China Infotianment Industry

2.6 China Infotainment Supply Chain

2.7 Global Infotainment Supply Chain

3. Global Infotainment Companies

3.1 Harman

3.2 Continetal

3.3 Pioneer

3.4 Foryou Corporation

3.5 Alpine

3.6 Clarion

3.7 Delphi

3.8 Visteon

3.9 Hangsheng Electronic

3.10 Panasonic Automotive System (PAS)

3.11 Fujitsu Ten

3.12 Aisin AW

3.13 Denso

3.14 Coagent

3.15 Soling

3.16 JVC Kenwood

3.17 Bosch

3.18 Desay SV Automotive

3.19 E-LEAD

3.20 Anyo Pioneer

3.21 PATEO

3.22 Sound Technology

3.23 YF Tech

Global Light Vehicle Sales, 2010-2020E

Global Light Vehicle Sales by Region, 2014-2017

Automobile Sales in China, 2005-2017

Top 25 Companies in China by Automobile Sales, 2014-2016

Top 25 Brands in China by Automobile Sales, 2014-2016

Global Infotainment Market Size, 2015-2021E

Global Infotainment Shipment, 2014-2021E

OEM Automotive Infotainment Shipment in China, 2014-2021E

AM Automotive Infotainment Shipment in China, 2014-2021E

Infotainment OS Distribution in the World, 2016/2020

Infotainment OS Distribution in China, 2016/2020

Market Share of Major Global and Chinese Speech Recognition Vendors

Share of Global Infotainment Processor Market (Value), 2016

Market Share of Automotive Audio-Display Vendors Worldwide, 2016

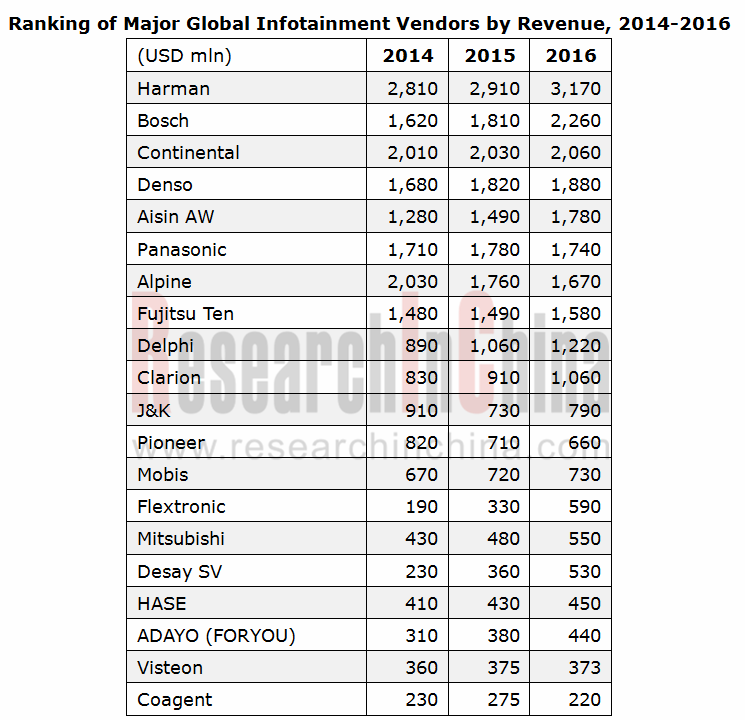

Ranking of Major Global Infotainment Vendors by Revenue, 2014-2016

Market Share of Infotainment Vendors in China (by Shipment), 2016

Market Share of Automotive Infotainment (incl. Navigation) Suppliers of FAW-Volkswagen (excluding Audi), 2016

Market Share of Shanghai Volkswagen’s Automotive Infotainment (incl. Navigation) Suppliers, 2016

Market Share of Shanghai GM’s Automotive Infotainment (incl. Navigation) Suppliers, 2016

Market Share of SAIC-GM-Wuling’s Automotive Infotainment (incl. Navigation) Suppliers, 2016

Market Share of Chang'an Automobile’s Automotive Infotainment (incl. Navigation) Suppliers, 2016

Market Share of Chang’an Ford’s Automotive Infotainment (incl. Navigation) Suppliers, 2016

Market Share of Dongfeng Nissan’s Automotive Infotainment (incl. Navigation) Suppliers, 2016

Market Share of Great Wall Motor’s Automotive Infotainment (incl. Navigation) Suppliers, 2016

China’s Automotive Infotainment (including Navigation) Supply Chain

Supply Ratio of Toyota’s Major Automotive Infotainment (incl. Navigation) Suppliers, 2016

Supply Ratio of Honda’s Major Automotive Infotainment (incl. Navigation) Suppliers, 2016

Supply Ratio of Nissan’s Major Automotive Infotainment (incl. Navigation) Suppliers, 2016

Supply Ratio of GM’s Major Automotive Infotainment (incl. Navigation) Suppliers, 2016

Supply Ratio of Ford’s Major Automotive Infotainment (incl. Navigation) Suppliers, 2016

Supply Ratio of Volkswagen’s Major Automotive Infotainment (incl. Navigation) Suppliers, 2016

Supply Ratio of BMW’s Major Automotive Infotainment (incl. Navigation) Suppliers, 2016

Supply Ratio of Mercedes Benz’s Major Automotive Infotainment (incl. Navigation) Suppliers, 2016

Supply Ratio of Hyundai’s Major Automotive Infotainment (incl. Navigation) Suppliers, 2016

Harman’s Revenue and Operating Margin, FY2004-FY2017

Harman's Sales by Segment, FY2010-FY2017

Harman’s Revenue by Region, FY2006-FY2016

Harman’s Quarterly Sales and EBITDA Margin, FY2013-FY2015

Harman’s Quarterly Sales by Segment, 2015-2016

Harman’s Quarterly Sales YoY Growth by Segment, 3Q2015-4Q2016

Harman’s Quarterly EBITDA Margin by Segment, 2015-2016

Harman’s Infotainment Milestones

Harman’s Car Audio Customers

Structure (%) of Harman’s Customers, FY2008-FY2016

Harman’s New Orders, 2016

Harman’s Manufacturing Bases Worldwide

Global Presence of Continental’s Automotive Interior

Continental’s Revenue and Operating Margin from Automotive Interior, 2007-2016

Revenue of Continental’s Automotive Interior by Region, 2009-2016

Continental’s Infotainment Milestones

Continental’s Main Infotainment Customers

Continental’s Position in Infotainment Market

Pioneer’s Shipment by Product, FY2010-FY2017

Pioneer’s Structure Map

Pioneer’s Revenue and Operating Margin, FY2006-FY2017

Pioneer’s Operation Income Structure, 3Q FY2016-3Q FY2017

Pioneer’s Revenue by Division, FY 2007-FY 2017

Pioneer’s Revenue and Operating Margin from Automotive Electronics Division, FY2007-FY2017

Pioneer’s Revenue by Region, FY2012- FY2015

Pioneer’s Forecasts in FY2017: Inventories, R&D Expenses, Capital Expenditures, Depreciation & Amortization

Close Cooperation between Pioneer and Here in Map Field

Pioneer’s Layout in Autonomous Driving

Pioneer’s Technical Roadmap

Balance Sheet of Foryou Corporation, 2012-2014

Revenue and Profits of Foryou Corporation, 2012-2014

Key Financial Indicators of Foryou Corporation, 2012-2014

Main Product Output of Foryou Corporation, 2012-2014

Revenue of Foryou Corporation by Business, 2012-2014

Customer Distribution of Foryou Corporation, 2013-2014

Alpine’s Revenue and Operating Margin, FY2006-FY2017

Alpine’s Revenue by Business, FY2012-FY2017

Revenue and Operating Margin of Alpine’s Car Audio Division, FY2006-FY2015

Revenue and Operating Margin of Alpine’s Infotainment, FY2005-FY2015

Alpine’s Revenue by Region, FY2005-FY2012

Alpine’s Revenue by Region, FY2014-FY2015

Alpine’s Sales by Region, FY2017

Alpine’s Revenue and Operating Margin for 23 Consecutive Quarters

Alpine’s Revenue by Segment for 23 Consecutive Quarters

Overview of Alpine’s Companies in China

Clarion’s Revenue and Operating Margin, FY2006-FY2017

Clarion’s Revenue by Region, FY2009-FY2017

Distribution of Clarion’s Production Bases

Clarion’s Organizational Structure in China

Delphi’s Recent Acquisitions and Platforms

Delphi’s Revenue and Operating Margin, 2007-2016

Delphi’s Operating Margin by Division, 2013-2016

Delphi’s Customer Distribution, 2010-2016

Delphi’s Revenue by Region, 2010-2015

Delphi’s Electronics & Safety Segment Revenue Mix by Product

Visteon’s Quarterly Revenue and Gross Margin for 12 Consecutive Quarters

Visteon’s Revenue by Product, 2015-2016

Visteon’s Revenue by Region, 2013-2016

Visteon’s Revenue by Customer, 2013-2016

Visteon’s Backlog by Region, by the end of 2016

Visteon’s Backlog by Product, by the end of 2016

Visteon’s Revenue in China, 2015-2016

Vehicle Infotainment Products of Hangsheng Electronics

Major Customers of PAS

Revenue of PAS by Region, FY2012

Panasonic’s Automotive Revenue by Product, FY2012

PASDL’s Organizational Structure

Fujitsu Ten’s Revenue and Operating Margin, FY2005-FY2017

Fujitsu Ten’s Revenue by Division, FY2005-FY2016

Aisin’s Customer Distribution, 2016-2017

Aisin AW’s Revenue and Operating Income, FY2007-FY2017

Aisin AW’s Navigator Output, FY2008-FY2017

Navigation Soft Production, FY2014-FY2017

Aisin AW’s Infotainment Customer Distribution, 2016

Denso’s Revenue and Operating Margin, FY2006-FY2017

Denso’s Customer Distribution, Q1-Q3 FY2017

Denso’s Product Distribution, Q1-Q3 FY2017

Denso’s Revenue and Operating Income by Region, Q1-Q3 FY2017

Denso’s ADAS

Revenue and Operating Income of Coagent Electronics S & T, 2013-2016

Revenue of Coagent Electronics S & T by Product, 2013-2015

Revenue of Coagent Electronics S & T by Business, 2013-2015

Organizational Structure of Coagent Electronics S & T

Revenue and Operating Income of Shenzhen Soling, 2011-2017

Output and Sales Volume of Shenzhen Soling, 2011-2014

Revenue of Shenzhen Soling by Channel, 2011-2016

Shenzhen Soling’s Financial Data, 2012-2014

Revenue and Operating Income of JVC Kenwood, FY2009-FY2017

J&K Sales of Japan Dealer-installed Navigation, FY2014-FY2019

J&K Sales of Japan Dealer-installed Dashcams, FY2017-FY2019

Financial Data of Desay SV Automotive, 2013-2015

Output of Desay SV Automotive by Product, 2013-2015

Revenue of Desay SV Automotive by Customer, 2013-2015

Revenue and Gross Margin of E-LEAD Electronic, 2009-2017

Monthly Revenue of E-LEAD Electronic, Feb 2015-Feb 2017

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...