ADAS and Autonomous Driving Industry Chain Report 2018 (II)– Automotive Vision

ADAS and Autonomous Driving Industry Chain Report 2018 - Automotive Vision, about 240 pages, highlights the followings:

Overview of the automotive camera industry;

Overview of the automotive camera industry;

Lane detection function;

Lane detection function;

Autonomous Emergency Braking (AEB);

Autonomous Emergency Braking (AEB);

Night vision system and intelligent headlight;

Night vision system and intelligent headlight;

Driver monitoring system (DMS);

Driver monitoring system (DMS);

Study into foreign automotive vision companies;

Study into foreign automotive vision companies;

Study into Chinese automotive vision companies

Study into Chinese automotive vision companies

Automotive vision enterprises fall into two parts: car camera-related companies; the enterprises that are engaged in visual software development based on car camera to help achieve specific ADAS and autonomous driving functions.

Car camera is the one installed on the car to realize sundry image acquisition and video recording functions, mainly covering inner-view camera, rear-view camera, front-view camera, side-view camera, and surround-view camera. As a main sensor of ADAS autonomous driving era, the camera is widely used in lane detection, traffic sign recognition, obstacle monitoring, pedestrian recognition, fatigue driving monitoring, occupant monitoring, rear-view mirror replacement, reverse image, 360-degree panorama and so forth.

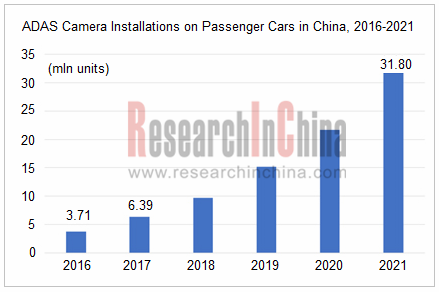

Camera installations amounted to 6.39 million units in the Chinese passenger car market in 2017, and the figure is expected to grow to 31.80 million units by 2021 with an AAGR of 49.3%, according to ResearchInChina.

The camera is mainly used for reverse image (rear view) and 360-degree panoramic view (surround view). And then forward- and inner-view cameras will become the main growth drivers. Major applications of the front-view camera are FCW, LDW and AEB, while the inner-view camera the driver monitoring system.

Being capable of capturing static images and videos, the camera, the most important imaging device, is primarily made up of lens, motor, filter, image sensor, and image signal processor (ISP).

Lens: Sunny Optical Technology, a leading automotive lens manufacturer in the world, shipped 18 million lenses in the first half of 2018. It has been a supplier of automotive lens for Magna, Continental, Delphi, Mobileye, Autoliv, Steel-mate, TTE, Panasonic and Fujitsu. The company also forays into the field of LiDAR optical parts.

Image sensor: ON Semiconductor and Sony are leaders, with the former sweeping a 44% share of the automotive image sensor market. Getting back into black ink by virtue of image sensor, Sony has continued to expand image sensor production capacity in recent years with heavy investment in automotive image sensor.

As an ADAS vendor, Mobileye stays far ahead of its global peers. The company has not only developed eyeQ series vision-based ADAS chips but made layout of REM map and RSS model, leaving its rivals far behind.

To keep its competitive edges in ADAS field, Mobileye also improves its layout in the autonomous driving field by integrating with Intel system. Mobileye’s ADAS solutions in 2018 feature 8 cameras and an improved redundancy design for perception link, leaving interfaces for LiDAR and MMW radar, and therefore realizing full perception for automated driving.

Mobileye Integration with Intel

The majority of Chinese vision ADAS vendors are the followers of Mobileye which has successfully turned to a provider of autonomous driving solutions from an ADAS supplier by way of being acquired by Intel. Having to seek for a transition, Chinese vision ADAS vendors can take the following three paths into account.

Firstly, the providers of partial ADAS function solutions grow to become providers of comprehensive autonomous driving and intelligent connected vehicle solutions (TIER 1) by means of mergers. Suzhou INVO Automotive Electronics, a leading player in vision ADAS, is hard to sustain growth and hit the ceiling if it develops on its own. TUS International (872.HK) with the background of Tsinghua University forays into intelligent and connected business through acquiring Suzhou INVO Automotive Electronics and taking over Telit’s in-vehicle communication business for USD105 million. TUS International is anticipated to become an important Tier1 vendor in the intelligent connected field in China if it continues to stage mergers and acquisitions in fields like sensor and chip, and to enrich its product portfolios.

Next, vision ADAS vendors may become providers of mobility service technology solutions like ZongMu Technology which starts from surround-view business to tap into automated parking and then foray into mobility services. The OEMs are successively transferring to be providers of mobility services, to which ZongMu Technology supplies mobility service technology solutions. ZongMu Technology attempts to break through the technical chains about autonomous driving mobility and service eco-system.

Last, products with core technologies are focused. For instance, Horizon Robotics prioritizes AI chip and Beijing SmarterEye has binocular stereo camera as its hit product. Most suppliers boasting core technologies will be ultimately either merged or acquired by the listed companies, while those that fail to forge core competitiveness will be knocked out.

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...

Automotive Intelligent Cockpit SoC Research Report, 2025

Cockpit SoC research: The localization rate exceeds 10%, and AI-oriented cockpit SoC will become the mainstream in the next 2-3 years

In the Chinese automotive intelligent cockpit SoC market, althoug...

Auto Shanghai 2025 Summary Report

The post-show summary report of 2025 Shanghai Auto Show, which mainly includes three parts: the exhibition introduction, OEM, and suppliers. Among them, OEM includes the introduction of models a...

Automotive Operating System and AIOS Integration Research Report, 2025

Research on automotive AI operating system (AIOS): from AI application and AI-driven to AI-native

Automotive Operating System and AIOS Integration Research Report, 2025, released by ResearchInChina, ...

Software-Defined Vehicles in 2025: OEM Software Development and Supply Chain Deployment Strategy Research Report

SDV Research: OEM software development and supply chain deployment strategies from 48 dimensions

The overall framework of software-defined vehicles: (1) Application software layer: cockpit software, ...

Research Report on Automotive Memory Chip Industry and Its Impact on Foundation Models, 2025

Research on automotive memory chips: driven by foundation models, performance requirements and costs of automotive memory chips are greatly improved.

From 2D+CNN small models to BEV+Transformer found...

48V Low-voltage Power Distribution Network (PDN) Architecture and Supply Chain Panorama Research Report, 2025

For a long time, the 48V low-voltage PDN architecture has been dominated by 48V mild hybrids. The electrical topology of 48V mild hybrids is relatively outdated, and Chinese OEMs have not given it suf...

Research Report on Overseas Cockpit Configuration and Supply Chain of Key Models, 2025

Overseas Cockpit Research: Tariffs stir up the global automotive market, and intelligent cockpits promote automobile exports

ResearchInChina has released the Research Report on Overseas Cockpit Co...

Automotive Display, Center Console and Cluster Industry Report, 2025

In addition to cockpit interaction, automotive display is another important carrier of the intelligent cockpit. In recent years, the intelligence level of cockpits has continued to improve, and automo...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2025

Functional safety research: under the "equal rights for intelligent driving", safety of the intended functionality (SOTIF) design is crucial

As Chinese new energy vehicle manufacturers propose "Equal...

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025

AI-Defined Vehicle Report: How AI Reshapes Vehicle Intelligence?

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025, released by ResearchInChina, studies, analyzes, and summarizes the c...

Automotive Digital Key (UWB, NearLink, and BLE 6.0) Industry Trend Report, 2025

Digital key research: which will dominate digital keys, growing UWB, emerging NearLink or promising Bluetooth 6.0?ResearchInChina has analyzed and predicted the digital key market, communication techn...