ADAS and Autonomous Driving Industry Chain Report 2018 (VII) - L4 Autonomous Driving Startups

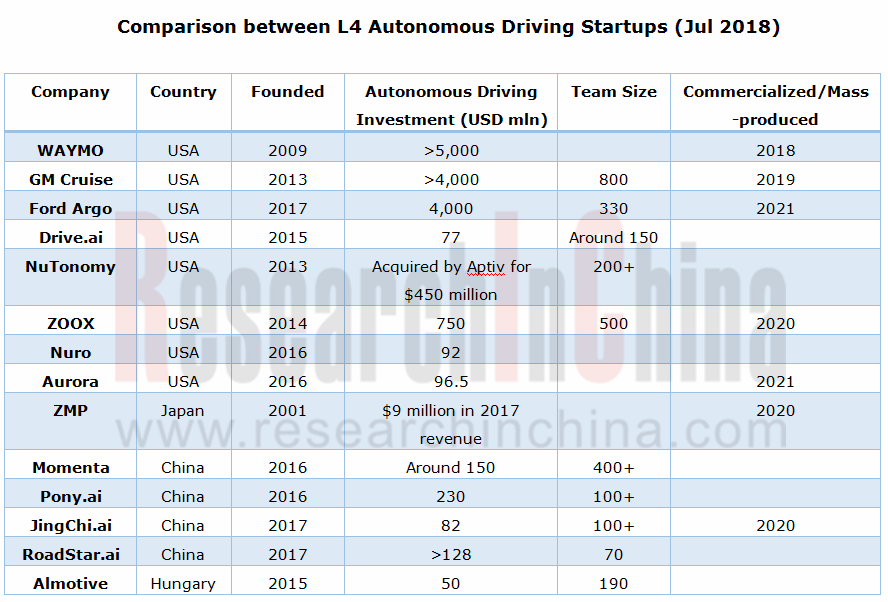

ADAS and Autonomous Driving Industry Chain Report 2018 (VII) - L4 Autonomous Driving Startups at 205 pages in length focuses on researching L4 autonomous driving startups as well as HD map and V2X for L4 autonomous driving.

Of the report series (seven reports), the previous five introduce commercialized ADAS, vision, automotive radar, computing platform, system integration, and low-speed autonomous driving which is to be commercially available soon. The last two reports highlight eventually to-be-commercialized commercial vehicle automated driving and L4 passenger car autonomous driving, respectively.

There have long been two camps in the implementation path of automated driving: Camp A mainly comprised of European and Asian OEMs advocates a progressive path evolving from L2 and L3 to L4 and L5 step by step; Camp B represented by Google stands for a radical path going straight to L4 and above.

In 2018, Camp A believes more firmly that L3 cannot be avoided and L2.5 and L2.75 should be derived from between L2 and L3, and L3.5 from between L3 and L4. To secure the reliability of human and computer driving together, it becomes an important subject to monitor human driver.

Camp B is more confident as well, as WAYMO sees its market capitalization climb to USD175 billion and tests tens of thousands of self-driving cars on roads.

The operational design domain (ODD) of WAYMO self-driving car is confined to just hundreds of square kilometers for the moment; L2-L3 self-driving cars at Camp A can travel on most roads. So the two camps will continue to live in peace with each other in the short run.

In July 2018, John Krafcik, WAYMO’s CEO, admitted that it would take a longer time than expected for the prevalence of autonomous vehicles.

There are at least four technical barriers needing to be surmounted in pushing ahead with L4 from designated scenarios to public roads: first, mass-production of powerful computing platforms; second, stronger sensing capabilities and lower cost of sensors; third, improvement of related technical standards; fourth, inadequate infrastructure. L4 automated driving start-ups will still depend on raised funds to survive in the next two to three years.

We have discussed computing platform and sensor in the previous reports. But L4 development will affect the existing landscape of sensor companies.

Considering too high sensor cost, WAYMO develops by itself all sensor systems it needs, including LiDAR. GM Crusie bought Strobe, a LiDAR company, and Ford Argo acquired Princeton Lightwave, a company engaged in LiDAR. WAYMO can cut 90% cost by developing LiDAR independently; GM Cruise indicates that it can use Strobe’s system to integrate all sensors into one chip, lowering LiDAR cost by 99%.

In addition to sensors, the automated driving leaders also design core computing chips themselves, for example, WAYMO, Tesla and Baidu are all developing their own AI-powered chips.

Singulato, an emerging Chinese automaker indicates that: conventional automotive design is a kind of separate design when it comes to intelligent driving capabilities, that is, separate data cannot be combined for multi-scenario application. In other words, a front ADAS company has a set of sensors of its own and another automated parking company also uses different sensors from others. They cannot share sensor data, which means the waste of resources. Singulato adopts integrated design at the beginning, using same sensors to implement more than a dozen of ADAS functions. And such design also makes subsequent OTA update easier.

Against the backdrop of growing integration, traditional ADAS and sensor companies need to rethink their market orientation in an era of L4.

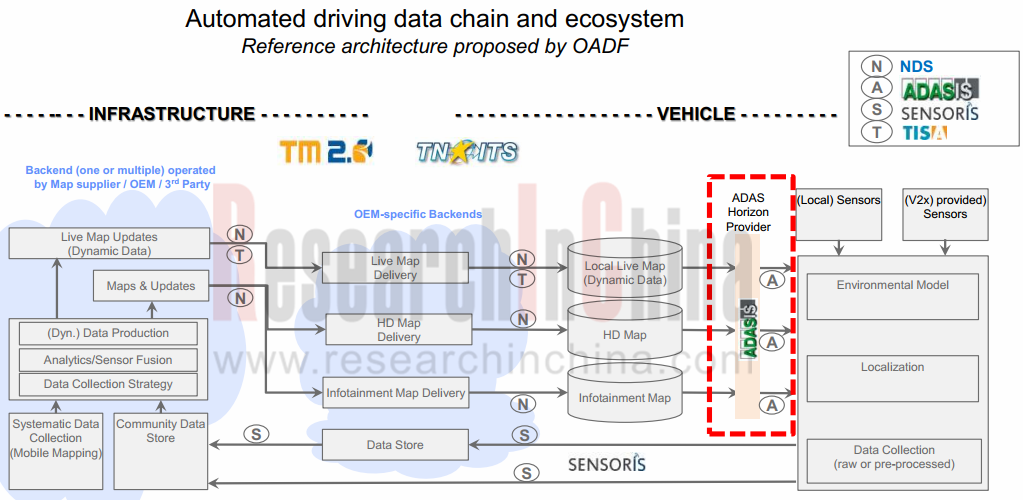

The number of sensors grows to a dozen and even dozens in the evolution from L2 to L4, generating a data traffic surge. Improvement in supporting facilities, mainly a better perception system, includes introduction of HD map and V2X, which also bring about massive data flow. Data confluence of various perception systems make acquisition, fusion and processing of autonomous driving data flow a focus in industrial competition and cooperation.

Absence of a universally accepted standard for acquisition and transmission of sensor (including HD map) data hinders the development of the industry. Hence, standards organizations like ADASIS, SENORIS, SIP-ADUS, CAICV HD MAP WG and ONEMAP have been initiated.

The year 2018 sees continued improvement in autonomous driving industry chain and influx of capital. As the market prospects of L4 become more visible, HD map and V2X, the auxiliaries of L4, are chased by enterprises and capital.

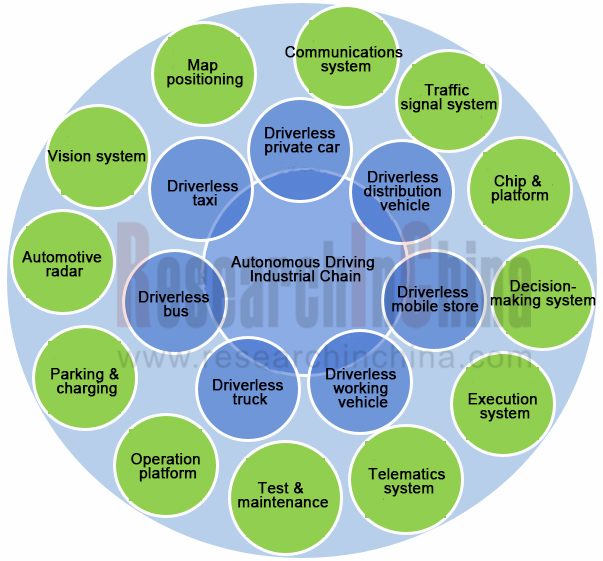

ResearchInChina tries to make an overall view of several hundreds of enterprises in autonomous driving industry and present a full picture of the industry via seven industrial-chain reports, 1,400 pages in total, whilst many problems are found, such as irrational layout, unclear orientation, disconnection from industrial chain, and lack of security policy.

As shown in the following diagram, the autonomous driving industry chain is so complicated that it’s a challenge for any enterprise to have a overall grasp of development trends.

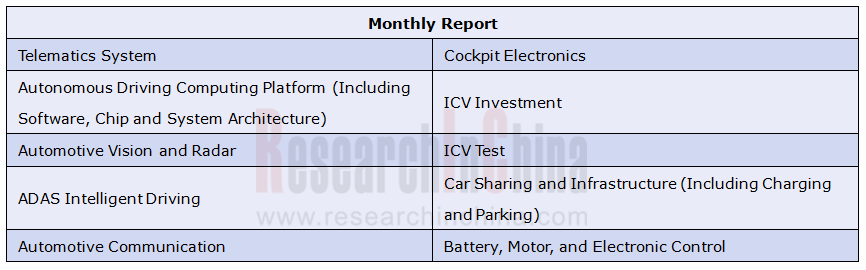

Dozens of times larger than the L2 market, the L4 market will take more than five years to grow mature in China. Tracking autonomous and ICV industry, ResearchInChina will release a weekly report every week and ten monthly reports every month, helping enterprises to see where the industry goes, take in competitive landscape, and seize opportunities in intelligent & connected and autonomous driving markets.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...