Report on Emerging Automakers in China in 2018 (Corporate Reach & Connectivity Functions)

There have emerged more than a hundred new automakers in the wake of the rapidly expanding electric vehicle market in China over the past few years, among which fifty ones or so have gained popularity. Amid the depressed economy and the waning vehicle sales, the majority of these players will suffer a setback in attempts to expand, and capital and industrial resources will thus flow to a few big ones.

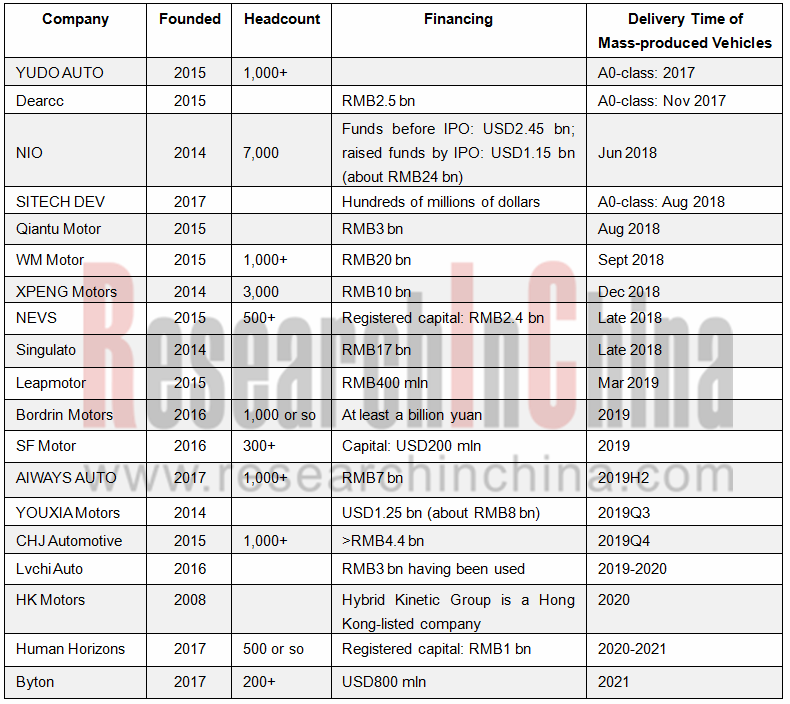

19 emerging automakers are analytically selected in the report focusing on their layout in production, research and development, manufacturing, marketing and mobility, as well as configurations of their typical connected vehicle models, technology roadmaps and development strategies.

Emerging automakers did not yet slow their pace of raising funds in the past two years. Bellwethers’ financing scale jumped from more than hundreds of millions of yuan to billions of yuan before hitting tens of billions of yuan in the near future.

Most of the 19 firms have launched cars on the market since 2018. The vehicles released by YUDO Auto and Dearcc in 2017 are A0-class models. In 2018 another 7 automakers have cars delivered or to be delivered; in 2019, 6 carmakers will have launches; between 2020 and 2021, four carmakers will do so.

Emerging automakers strive for a place in the huge Chinese automobile market where they compete in a differentiated way with the help of Tier1 suppliers. Thanks to more capital inflows, they can exert themselves to innovations in local Chinese market as automobile is going smart, connected, electrified and shared.

Most players use the cutting-edge automotive electrical/electronic architecture, coupling local featured services (e.g., allowing couriers to put a package directly into the receiver’s car trunk), to build intelligent connected cars. The report introduces 110 intelligent and connectivity capabilities as a points-based criterion system to evaluate how typical car models of the 19 firms are intelligent and connected.

Here is a briefing of connected car strategies and development directions of emerging automakers:

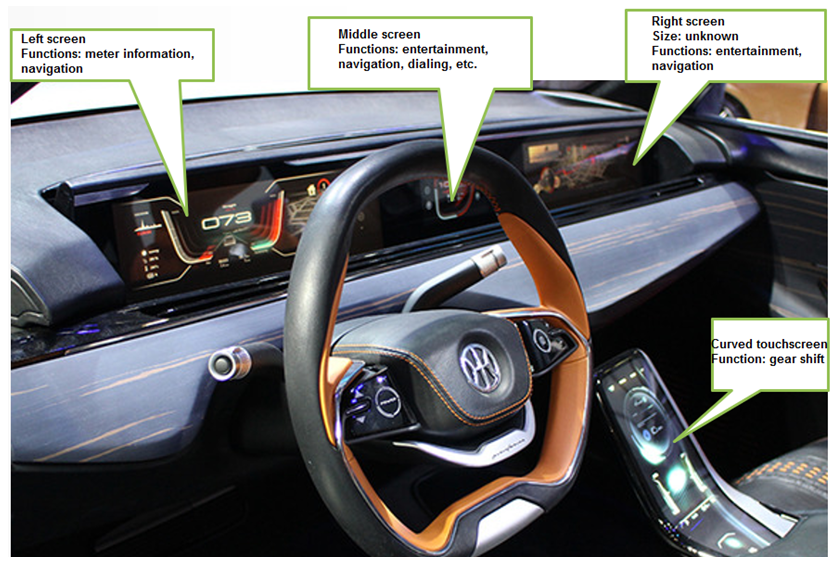

1. These firms prefer 4-to-6-inch LCD screens. Multi-screen is a highlight but also a challenge, because display and interaction of multiple screens cost a lot of computing resources, which undoubtedly leads to the rising costs of chip and software development.

2. More use of HUD, multiple interactive systems and biometric system provides front and rear seat occupants with independent space of entertainment and interaction.

3. More than 20 sensors are preset as hardware for upgrading ADAS and automated driving functions. Examples include NIO ES8 equipped with 21 sensors, Xpeng G3 with 25 and Singulato iS6 with 25. Some manufacturers even express that users can get an upgrade of hardware like sensors. OTA has been a standard configuration for software update.

4. For Chinese suppliers have no mature applicable automated driving solutions, the emerging automakers choose either Mobileye’s solutions or independent development and iterations, of which NIO, WM Motor and YOUXIA Motors partner with Mobileye. Those without cooperating with major suppliers are running out of time to develop telematics and automated driving systems by themselves (or teaming up with their partners), because their foreign counterparts like WAYMO and Tesla have left them far behind. Mobileye’s solutions, Banma Zhixing system and Baidu Apollo system are being utilized by more and more automakers.

5. These players set up special funds to back their own supply chain system. For example, NIO Capital, NIO’s fund management agency with fundraising target of RMB10 billion, has invested 15 companies in the areas of car sharing, autonomous driving and automotive new materials through its RMB funds; Dearcc’s automotive industry development funds managing more than RMB2.5 billion, will concentrate on investment in the industry chain of intelligent electric vehicle and integration of resources in new energy power technology, intelligent driving and shared services; Singulato and Suzhou Municipal Government have built a RMB10 billion joint investment fund for intelligent electric vehicle industry.

As a whole, the boom of emerging automakers lends vigor to innovation and transformation in China’s automobile industry. A great number of Chinese automakers offer opportunities for suppliers in the intelligent connected vehicle (ICV) industry chain covering sensors, software and algorithms, communication systems, controllers, chips, connectivity systems and system integration, mobility services, entertainment services, parking services and charging systems, making China the one boasting the most number of start-ups in the ICV field and innovating at the fastest speed.

Tesla achieved great success in the third quarter of 2018. It is believed that several out of dozens of Chinese emerging automakers will come to the fore.

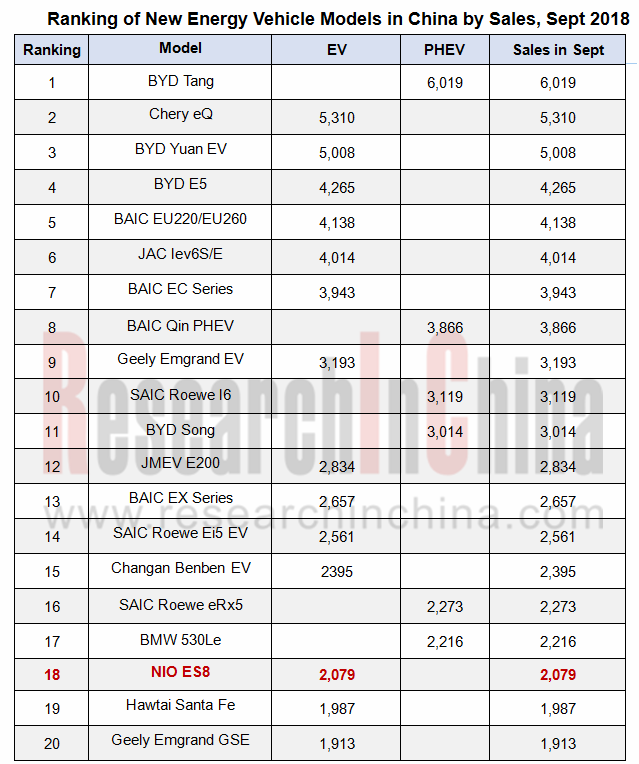

NIO ES8 has edged into the top20, according to the ranking list of new energy vehicle models in China by sales in September 2018. The emerging automakers will have more models on the list in the second half of 2019.

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...

Automotive Intelligent Cockpit SoC Research Report, 2025

Cockpit SoC research: The localization rate exceeds 10%, and AI-oriented cockpit SoC will become the mainstream in the next 2-3 years

In the Chinese automotive intelligent cockpit SoC market, althoug...

Auto Shanghai 2025 Summary Report

The post-show summary report of 2025 Shanghai Auto Show, which mainly includes three parts: the exhibition introduction, OEM, and suppliers. Among them, OEM includes the introduction of models a...

Automotive Operating System and AIOS Integration Research Report, 2025

Research on automotive AI operating system (AIOS): from AI application and AI-driven to AI-native

Automotive Operating System and AIOS Integration Research Report, 2025, released by ResearchInChina, ...

Software-Defined Vehicles in 2025: OEM Software Development and Supply Chain Deployment Strategy Research Report

SDV Research: OEM software development and supply chain deployment strategies from 48 dimensions

The overall framework of software-defined vehicles: (1) Application software layer: cockpit software, ...

Research Report on Automotive Memory Chip Industry and Its Impact on Foundation Models, 2025

Research on automotive memory chips: driven by foundation models, performance requirements and costs of automotive memory chips are greatly improved.

From 2D+CNN small models to BEV+Transformer found...

48V Low-voltage Power Distribution Network (PDN) Architecture and Supply Chain Panorama Research Report, 2025

For a long time, the 48V low-voltage PDN architecture has been dominated by 48V mild hybrids. The electrical topology of 48V mild hybrids is relatively outdated, and Chinese OEMs have not given it suf...

Research Report on Overseas Cockpit Configuration and Supply Chain of Key Models, 2025

Overseas Cockpit Research: Tariffs stir up the global automotive market, and intelligent cockpits promote automobile exports

ResearchInChina has released the Research Report on Overseas Cockpit Co...

Automotive Display, Center Console and Cluster Industry Report, 2025

In addition to cockpit interaction, automotive display is another important carrier of the intelligent cockpit. In recent years, the intelligence level of cockpits has continued to improve, and automo...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2025

Functional safety research: under the "equal rights for intelligent driving", safety of the intended functionality (SOTIF) design is crucial

As Chinese new energy vehicle manufacturers propose "Equal...

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025

AI-Defined Vehicle Report: How AI Reshapes Vehicle Intelligence?

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025, released by ResearchInChina, studies, analyzes, and summarizes the c...

Automotive Digital Key (UWB, NearLink, and BLE 6.0) Industry Trend Report, 2025

Digital key research: which will dominate digital keys, growing UWB, emerging NearLink or promising Bluetooth 6.0?ResearchInChina has analyzed and predicted the digital key market, communication techn...