Global and China Automated Parking and Autonomous Parking Industry Report, 2018-2019

Automated parking system (APS) or automated parking assistant (APA) can measure the distance and angle between vehicle body and surroundings, collect sensor data to work out operation flow whilst automatically tuning the steering wheel, brake and throttle to pull into the parking space. Automated parking system can be divided by technical grades into semi-automatic parking (automatic steering only), fully automated parking (inclusive of automatic steering and automatic forwarding & reversing), autonomous valet parking (AVP), among others.

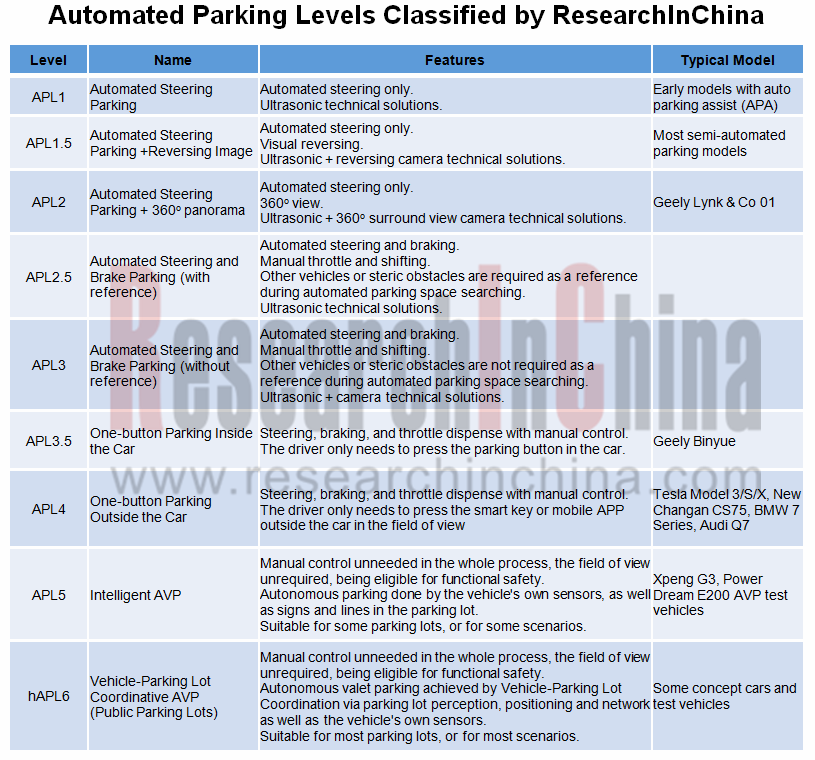

Automated parking system is generally composed of environment perception system, central control system (path planning system) and execution system (vehicle control system). Taking the diversity of automated parking systems into account, ResearchInChina recently rolled out the Global and China Automated Parking and Autonomous Parking Industry Report, 2018-2019 where all automated parking systems are classified into nine levels including APL1, APL1.5, APL2, APL2.5, APL3, APL3.5, APL4, APL5 and APL6. (See the table below)

According to ResearchInChina, the APS configuration rate of passenger vehicles in Chinese market was 5.3% in 2018, a not high figure due to technical immaturity shown as follows:

In the mass-produced vehicle models with APS, the automated parking system still desires to be improved in real experience and is faced with system recognition error and the occurrence of scratches.

Most APS renders ultrasonic sensors for monitoring parking spaces, but ultrasonic sensors are vulnerable to surface stains & defects, raindrops, ice, snow, etc., and thus fail to be brought into full play.

Recognition of parking space and the process of automated parking are subject to environmental factors. The currently mass-produced APS system, for example, usually cannot recognize well lids, pits or loose kerbs, tiny objects on the parking space, among others.

The current best-selling models with APS function are primarily from foreign automakers like Benz, Buick, Volkswagen, BMW and Land Rover as well as China-made premium brands LYNK&CO, Great Wall Motor’s WEY, etc.

As automotive intelligence technologies and sensor technologies in particular are developing apace, OEMs are beginning to apply more sensors in the automated parking system, facilitating maturity of the APS technologies. Automated parking has already been a highlight of new car sales.

Geely SUV Binyue is one of the five most successful new cars in Chinese market in 2018. It debuted on October 31, 2018, with the sales outnumbering ten thousand units and reaching 10,100 units in the first month of launch, 13,222 units in December 2018 and 14,627 units in January 2019. Binyue is provided with fully automated parking system that enables horizontal pull-in, vertical pull-in as well as horizontal pull-out by only a key-touch whilst the driver does not have any control on steering wheel, throttle and brake. Binyue has the automated parking level APL3.5.

CS75 (the hit model of Changan Automobile) has the APA4.0 parking system which enable a man standing outside the car to realize one-key parking. Only a touch on the automated parking button is needed, the car can search the tailgate automatically, and performs operations such as forwarding, reversing and wheel steering. The entire parking process needs no driver engagement. CS75 has an automated parking level at APL4.

BAIC plans to have the majority of its vehicle models be equipped with the automated parking technologies from July 2019.

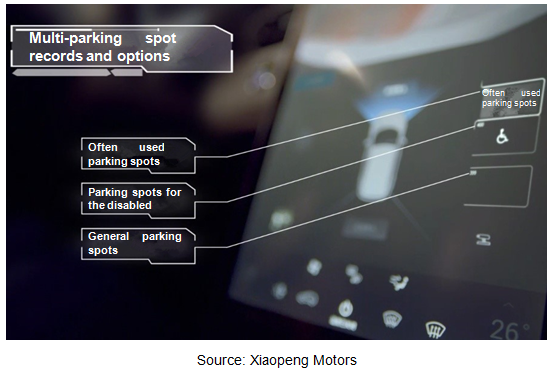

Among emerging car manufacturers, Xiaopeng Motors focuses on automatic parking. Xpeng G3 carries 20 environmental sensors including 12 ultrasonic sensors, 5 vision sensors and 3 radars. That XPENG uses numerous sensor systems to make parking spaces recognized more accurately and lift probability of success in parking is an effective solution to the problems of low parking space recognition and many unsuccessful parking cases, adding more automatic parking capabilities. Xiaopeng says that success rate of its car automatic parking system exceeds 70% compared with less than 5% in general automatic parking and Tesla’s 13%.

As automatic parking technology grows mature and OEMs invest more in APS, installation of such a system will soar from 2020 after years of slow increase, expectedly outstripping 20% in 2023.

Traditional automakers follow an upgrading automated parking technology roadmap in ToC market, while Tier1 suppliers, technology firms and start-ups also have made an attempt to deploy automated valet parking (AVP) pilot projects at one go in ToB market.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...