ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Low-speed Autonomous Vehicle

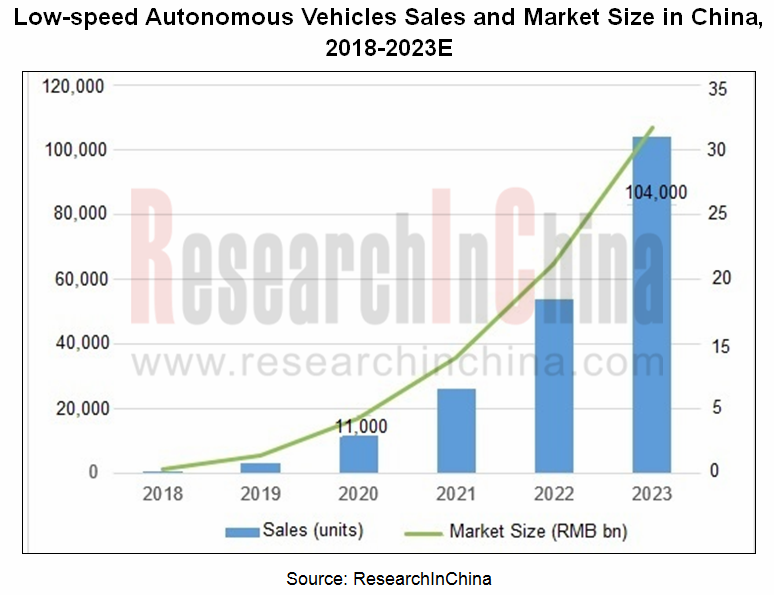

Low-speed Autonomous Driving Industry: Sales of Low-speed Autonomous Vehicles will Reach 11,000 Units in China in 2020

L4 and above autonomous driving suffers a setback but low-speed autonomous driving industry is advancing at a steady and fast pace.

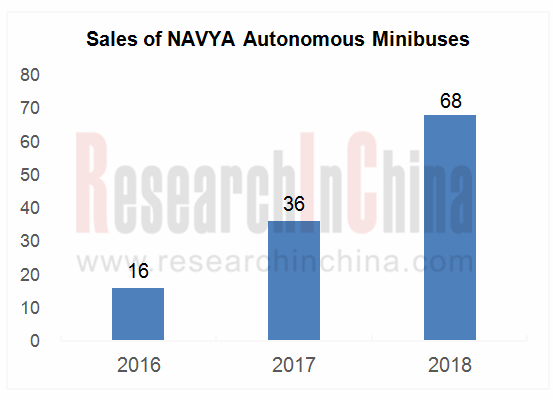

NAVYA, an autonomous minibus trailblazer, performed poorly in sales, far less than that of Baidu Apolong.

But there is no doubt that 2019 will see robust sales of low-speed autonomous vehicle. Nuro.ai which runs low-speed self-driving delivery pods, raised $940 million from SoftBank Vision Fund, with which it will strenuously scale up its AV fleets.

Baidu expects 10,000 Apollo-enabled L4 AVs in 2019, most of which will be low-speed ones. Idriveplus plans to produce 1,200 low-speed self-driving vehicles in 2019.

On our conservative estimate, 11,000 low-speed AVs including self-driving passenger cars, low-speed autonomous trucks and autonomous working vehicles, will be sold in China in 2020, and the sales figure will soar to 104,000 units in 2023.

Foreign low-speed autonomous vehicle firms are energetically dedicated to passenger cars while their Chinese peers focus on low-speed trucks.

In 2017, global food and parcel delivery market was valued at a staggering $400 billion, including roughly $80 billion of “last-mile” delivery market. Eighty percent of packages will be delivered by autonomous vehicles in the next decade, as is predicted by McKinsey.

Driverless delivery vehicle market will therefore be a tipping point of the low-speed autonomous driving market, where the key players include Nuro.ai, Starship, Auto X, Idriverplus, Neolix, Suning, Meituan, JD, Cainiao, Navibook, and Aisimba.

Yet, the promising driverless delivery vehicles are confronted with challenges as follows:

(a) High costs in early R&D and expensive maintenance cost. Due to technical and legal constraints, the self-driving vehicle without exception needs a safety officer, and even a security guard driving a car behind the driverless delivery vehicle.

(b) Public acceptance and policy barriers. Many Americans protest against small autonomous delivery vehicle, complaining about its infringement of people’s rights of way now that the sidewalks are regularly encroached. Consequently, the number of self-driving delivery vehicles running on road is to be limited in the United States. In China, the autonomous delivery vehicle has to be allowed with a license, and the policy is being discussed and waits to be drafted, and the issuance of permits s impossible for the moment. Related standards are anticipated to be set down within 2019.

(c) Still immature technologies and expensive products. A large number of autonomous vehicles fail to suit traffic environment on public roads and the real open road conditions are more complicated than those in communities and parks. Product stability desires to be tested.

(d) Vulnerability to damages. Like bike-sharing, the self-driving delivery vehicle will be readily destroyed by the immoralist and the deliveries will be possibly stolen if unattended.

Despite those aforementioned, the autonomous delivery vehicle is an irresistible trend, being expedited by the technical competence, channel distribution system and existing market resources of the key players.

The To B market is faced with not so many legal restrictions and damages as the To C market.

In October 2018, Cowarobot and Zoomlion co-founded a joint-stock subsidiary – Cowarobot Zoomlion Intelligence Technology Co., Ltd which is primarily focused on driverless sweepers, and they will lavish a total of at least RMB1 billion for mass-production of autonomous commercial vehicle, modification of production lines, operation of commercial fleets, among others.

The To B market features not so fierce competition. Beijing I-tage Technology Co., Ltd is engrossed in the driverless mining vehicle market; HiGo Automotive collaborated with UNIS to roll out indoor self-driving floor scrubber; Zoomlion partnered with Landing.AI (established by Andrew Ng) to develop autonomous agricultural machinery; UISEE launched autonomous luggage vehicle.

ADAS and Autonomous Driving Industry Chain Report, 2018-2019 of ResearchInChina covers following 17 reports:

1)Global Autonomous Driving Simulation and Virtual Test Industry Chain Report, 2018-2019

2)China Car Timeshare Rental and Autonomous Driving Report, 2018-2019

3)Report on Emerging Automakers in China, 2018-2019

4)Global and China HD Map Industry Report, 2018-2019

5)Global and China Automotive Domain Control Unit (DCU) Industry Report, 2018-2019

6)Global and China Automated Parking and Autonomous Parking Industry Report, 2018-2019

7)Cooperative Vehicle Infrastructure System (CVIS) and Vehicle to Everything (V2X) Industry Report, 2018-2019

8)Autonomous Driving High-precision Positioning Industry Report, 2018-2019

9)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Processor

10)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Lidar

11)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Radar

12)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Vision

13)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Passenger Car Makers

14)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– System Integrators

15)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Commercial Vehicle Automated Driving

16)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Low-speed Autonomous Vehicle

17)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– L4 Autonomous Driving

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...