ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Lidar

LiDAR Industry Report 2018-2019: Price Slump Conduces to Massive Shipment of LiDAR

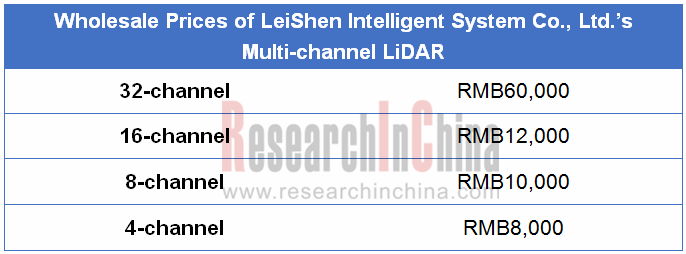

In the markets where Chinese companies master core technologies, price of products is bound to plummet. Take IPG for example, its 20W fiber lasers were priced at over RMB150,000 per unit in 2010, compared with current quote at RMB8,800 from the peer -- Shenzhen REEKO Information Technology Co., Ltd.. Maxphotonics Co., Ltd. and Shenzhen JPT Opto-electronics Co., Ltd. are another two rivals in the fiber laser price war.

The similar stories echo in the LiDAR market where price competition pricks up in 2019 as Hu Xiaobo, a founder of Maxphotonics Co., Ltd., ventures into the LiDAR field for a new undertaking.

Yet, front runners still have a big say in the automotive LiDAR market. Velodyne has shipped 30,000 LiDARs worth a whopping $500 million since production. The giant will continue to produce more LiDARs for autonomous driving and short-range ones used in ADAS for detecting road conditions, blind spots and obstacles.

Velodyne’s new factory in San Jose which already becomes operational, can produce as many as 1 million units a year. If acquiring orders for 100,000 units, Velodyne will cut down the price of its VLS 128-channel products to less than $1,000, and that of VLS 32 to roughly $650, let alone $500 for mass-produced 32-channel Velarry solid-state LiDAR and $150 for 8-channel ones.

It is clear that LiDAR price may be 10 times lower than what it is now, and the reduction hinges on how many are demanded.

Start-ups are rushing to deploy automotive LiDAR. Also, leading Tier-1 suppliers like Bosch, Continental, Aptiv, Valeo and Veoneer, are vying with each other in LiDAR research and development, and prepare to launch products in the next two years.

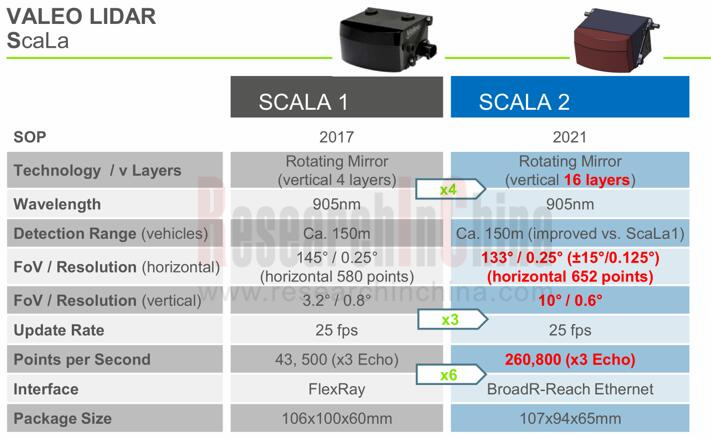

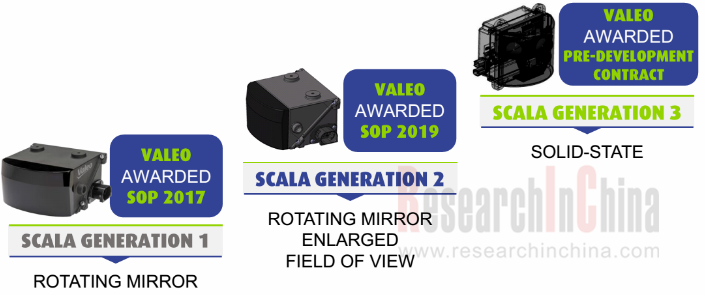

In Valeo’s case, as an early multi-channel LiDAR bulk supplier of OEMs, its product lines from the first generation to the second to the third, reflect the development trend of LiDAR.

Valeo plans to roll out its second-generation LiDAR in 2019, a product offering three times wider vertical field of view. Valeo’s upcoming SCALA Cocoon system combining five SCALA LiDARs, provides a 360-degree view of the vehicle’s surroundings. Its third-generation SCALA being developed is a MEMS-based solid-state LiDAR.

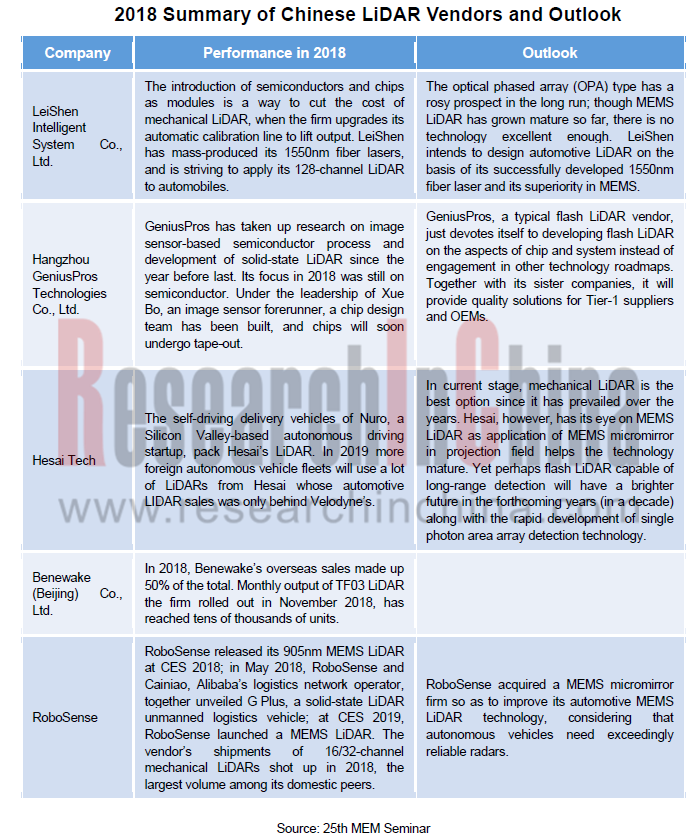

Comparing with the previous year, Chinese LiDAR vendors have come a long way in factory construction, mass production, shipment, financing and other aspects.

In 2018, Hesai Tech announced to close Series B funding rounds of RMB250 million, with its automotive LiDAR sales only second to Velodyne’s.

RoboSense raised RMB300 million from investors like Cainiao, SAIC and BAIC. Its shipments of 16/32-channel mechanical LiDARs boomed in 2018. The vendor also acquired a MEMS micromirror firm in the year.

Although the automotive market is “wintering”, the financing story in LiDAR industry still goes on.

In October 2018, Innovusion announced it raised about $30 million in Series A funding, led by NIO Capital and Eight Roads Ventures in China, and F-Prime Capital in the US.

In October 2018, Aeva announced a $45 million Series A funding round.

On October 29, 2018, Quanergy announced to close its Series C funding rounds of tens of millions of dollars.

In November 2018, AEye announced $40 million in Series B funding, led by Taiwania Capital with participation of Intel Capital, etc.

In early 2019, Benewake closed the Series B2 funding round, co-invested by Delta Capital, Keywise Capital and Cathay Capital. The firm also claimed shipments of hundreds of thousands of solid-state LiDARs.

In January 2019, Baraja announced to raise $32 million in a series A round of funding led by Sequoia China and Main Sequence Ventures’ CSIRO Innovation Fund, with participation of Blackbird Ventures.

In March 2019, Innoviz raised over $100 million.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...