ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Processor and Computing Chip

As automobiles are going smart, cockpit and intelligent driving require more efficient processors.

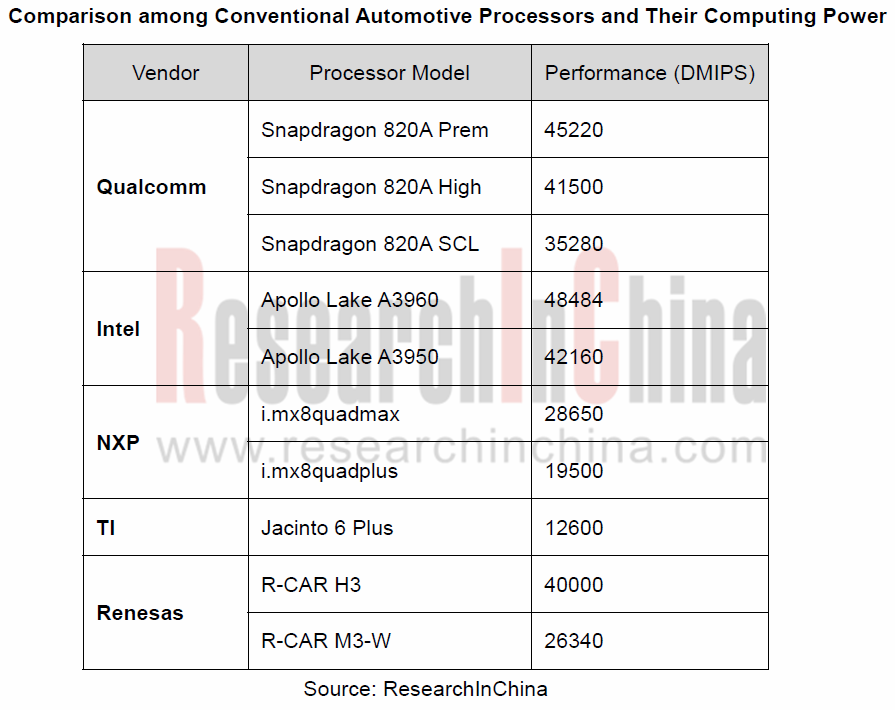

Full LCD instrument cluster with at least 3 or even 5 to 6 screens, will be an integral of a mainstream electronic cockpit solution which may be integrated with some local and cloud capabilities such as natural language processing (NLP), gesture control, fatigue detection, face recognition, AR HUD, HD map and V2X. So it can be said that cockpit has endless demand for computational resources, for instance, 50000DMIPS in 2020 and more after the year.

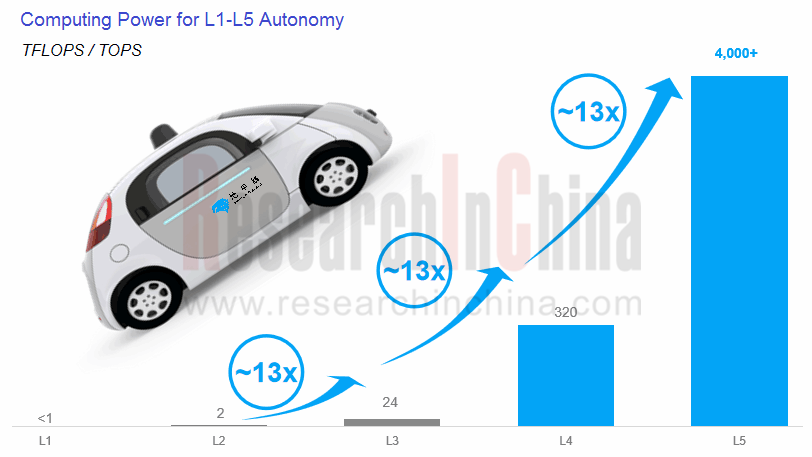

Autonomous driving needs processors that perform far better. According to Horizon Robotics’ summary of OEM demand, a higher level of automated driving means more orders of magnitude, namely, 2 TOPS for L2 autonomy, 24 TOPS for L3, 320 TOPS for L4 and 4,000+TOPS for L5.

Source: Horizon Robotics

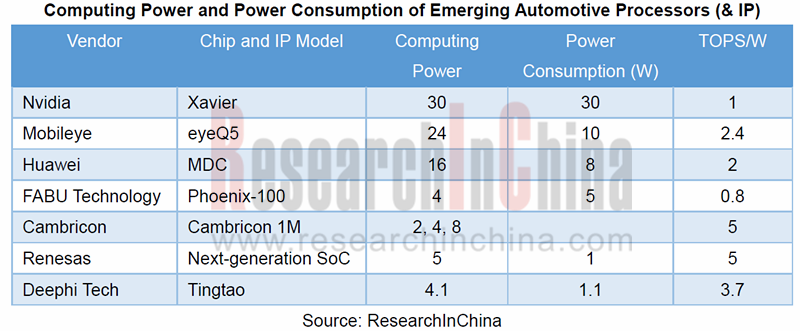

Only computing power is not enough. Complexity of automotive applications should be taken into account. That’s because an automotive processor also has to consider how much power is consumed, how much computing power is used or whether it is up to the automotive and safety standards or not.

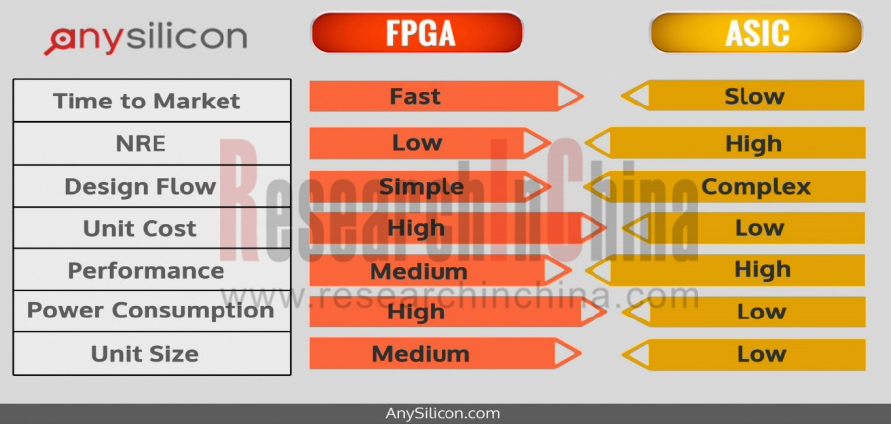

Automotive processor, also referred to as automotive computing chip, typically falls into three types: Application specific standard products (ASSP), like CPU and GPU; application specific integrated circuits (ASIC); field programmable gate arrays (FPGA). Conventional CPU and GPU have begun to find it hard to meet increasing new demand as AI computing is developing by leaps and bounds, and in terms of energy efficiency, underperform semi-custom FPGA and full-custom ASIC, both of which are booming.

By and large, FPGA and FPGA have their own merits and demerits, offering options for different areas

The huge demand from intelligent connected vehicle (ICV) for semiconductors (including processors) is an enticement for the inrush of consumer electronics processor vendors. Take example for Qualcomm, the fastest entrant whose 820E and 855E among other products have won great popularity in automotive sector. Of the top 25 OEMs worldwide, 18 have chosen the giant’s processors. Samsung, MediaTek, Huawei and even Apple follow suit to forge into the automotive semiconductor field.

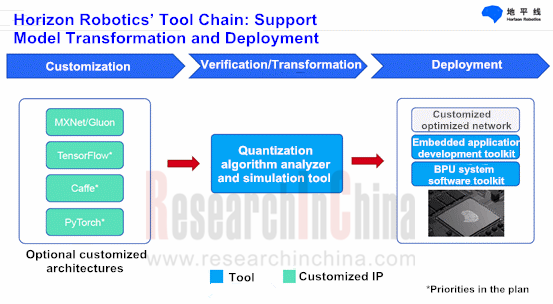

Processor vendors’ fight is more than in computing power area. Tool chain is also their battleground.

One competitive edge on processor lies in more tools for users’ easier and more efficient use of processors.

“No one will buy your GPU, if you don’t have software and applications”, said Greg Estes, the vice president of NVIDIA, at GTC CHINA 2018. With efforts, the inventor of the GPU has expanded its developer’s community with more than 1 million members and 600,000 GPU applications.

In 2017, NVIDIA unveiled new NVIDIA? TensorRT? 3 AI inference software that significantly boosts the performance and slashes the cost of inferencing from the cloud to edge devices, including self-driving cars and robots. With TensorRT, the user can get up to 40x faster inference performance comparing Tesla V100 to CPU. TensorRT inference with TensorFlow models running on a Volta GPU is up to 18x faster under a 7ms real-time latency requirement.

At CES 2019, NVIDIA didn’t release more efficient processors but enlarge its software tool kit. The company integrated its previous Drive Autopilot software, Drive AGX computing platform and DRIVE Works development tool into a platform, called Drive AP2X. DRIVE AutoPilot offers precise localization to the world’s HD maps for vehicle positioning on the road and creates a self-driving route. Drive Works provides developers with reference applications, tools and a complete module library.

Deephi Tech’s deep neural network development kit (DNNDK) is an equivalent of NVIDIA TensorRT. DNNDK offers a complete process from neural network inference to model compression, heterogeneous programming, compilation and operation deployment, which is a solution for deep learning algorithm engineers and software development engineers to accelerate AI computing load.

In July 2018, Xilinx acquired Deephi Tech in a USD300 million deal, helping the two-year-old firm promote FPGA.

Starting from EyeQ?5, Mobileye will support an automotive-grade standard operating system and provide a complete software development kit (SDK) to allow customers to differentiate their solutions by deploying their algorithms on EyeQ?5. The SDK may also be used for prototyping and deployment of Neural Networks, and for access to Mobileye pre-trained network layers.

In July 2018, Intel released OpenVINOTM Toolkit for accelerating development of high performance computer vision and deep learning vision application.

There are more than 70 AI start-ups globally, but few of them remain powerful enough to develop tool chain. And conforming to the active safety standards poses a bigger challenge to development of automotive computing chip tool chain.

In China, Horizon Robotics, an autonomous driving chip bellwether, provides full-stack perception software and full-stack tool chain. The way of coordinating algorithms, computing architecture and tool chain enables the firm’s BPU with a performance 30 times higher than GPU.

Automakers are deficient in deep learning capability of their processors as well, and they are going all out to improve weaknesses.

In early 2019, NXP joined forces with Kalray to co-develop an autonomous driving computing platform, with the aim of helping NXP gain muscle in deep learning. The partnership will combine NXP’s scalable portfolio of functional safety products for ADAS and Central Compute with Kalray’s high-performance intelligent MPPA (Massively Parallel Processor Array) processors. MPPA with an optimized tool and a library, enables the best performance of deep learning or vision algorithms.

Renesas plans to roll out next-generation R-CAR SoC for deep learning, which is expected to be mounted on L4 autonomous cars in 2020. The new SoC sample will be unveiled in 2019, and can compute 5 trillion times per second with power consumption of a mere 1W. Also, Renesas upgrades its processor tool chain and ecosystem via its Autonomy Platform.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...