Automotive Voice Market: Installation in New Passenger Cars in China Hit 28.7%

As software and hardware technologies advance, voice has been a key way for people to communicate with machines, particularly in automotive field where big auto brands are racing to launch the capability.

In 2019H1, 28.7% of new passenger cars on offer in China carried voice capability, with installation soaring by 57.8% from the same period of last year; brands that largely equipped their vehicles with the function included Geely, Nissan, Buick and Changan.

In 2018, China’s automotive voice market size ballooned by 73.5% year on year. Market competition is characterized by the following:

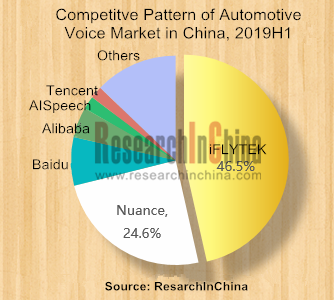

iFLYTEK as a bellwether in the market, swept 46.5% shares, and developed joint-venture brand customers beyond homegrown automakers.

Cerance (Nuance) is a voice provider for joint-venture brands, with a market share of 24.6% in the first half of 2019. Its voice convergence solutions have been an option for several companies.

Vehicle models packing voice technology of Baidu, Alibaba and Tencent (BAT), have begun to be spawned since 2018. Among BAT, Baidu is the most aggressive; Alibaba slows down in installation; Tencent will step forward by developing voice-enabled WeChat vehicle version and applets.

As the biggest speech provider in China, iFLYTEK has established a foothold in automotive field for 16 years, with rich experience in the area. By the end of 2018, iFLYTEK had forged close partnerships with a number of OEMs, with total installations of OEM automotive voice outnumbering 15 million.

iFLYTEK is working on IVI system by virtue of superiority in speech technologies. Its Feiyu IVI system has iterated to version 2.0 adding capabilities like voiceprint and face recognition beyond multi-dimensional voice interaction functions from integrated voice recognition, natural language understanding and speech synthesis to voice wake-up, voice enhancement, intelligent search and full duplex voice. Moreover, Feiyu 2.0 provides custom-made services, for example, IVI interface can display OEM’s unique label. The system has already been mounted on Changan CS95, Haval H7, Chery Arrizo GX/EX and Dongdeng Xiaokang 580.

Nuance as the world’s largest voice provider is about to complete spin-off of its automotive business in October 2019. The separate company named as Cerence, has 70 speech models (e.g., mandarin, Cantonese and Shanghainese), 1,250 patents, and a workforce of 1,300 including 240 staffs in China.

Cerence sees a rising share in the Chinese market as it broke the barriers on localization. ECARX GKUI 19 begins to use Cerence voice enhancement technology; Cerence local voice solution also becomes available to Banma Zhixing 3.0.

Tencent lags behind Baidu and Alibaba a bit in automotive voice. In August 2019, the launch of WeChat vehicle version invigorated new vitality into Tencent. WeChat vehicle version features voice-enabled message receiving and sending and a deep integration with navigation. The availability of smartphone Bluetooth perception allows automatic login when users get in car and automatic logout when they get off. Changan CS75 Plus is currently the first model carrying vehicular WeChat. For what to do next, Tencent Auto Intelligence will roll out an applet framework designed for voice and vehicle HMI, which enables voice wake-up driven by scenario engine, with lighter cloud load.

Global and China Automotive Voice Industry Report, 2019 highlights the following:

Intelligent speech industry and market (industry chain, application scenarios, development history, market size, competitive pattern, etc.);

Intelligent speech industry and market (industry chain, application scenarios, development history, market size, competitive pattern, etc.);

Global and China automotive voice markets (size, competitive pattern, development trends, major players’ layout, their development characteristics, etc.);

Global and China automotive voice markets (size, competitive pattern, development trends, major players’ layout, their development characteristics, etc.);

Chinese automotive voice suppliers (profile, operation, product system, R&D system, major clients, development plan, etc.).

Chinese automotive voice suppliers (profile, operation, product system, R&D system, major clients, development plan, etc.).

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...