Global and China Automotive Wiring Harness, Connector and Cable Industry Report, 2019

-

Sep.2019

- Hard Copy

- USD

$3,400

-

- Pages:107

- Single User License

(PDF Unprintable)

- USD

$3,200

-

- Code:

ZYW241

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,800

-

- Hard Copy + Single User License

- USD

$3,600

-

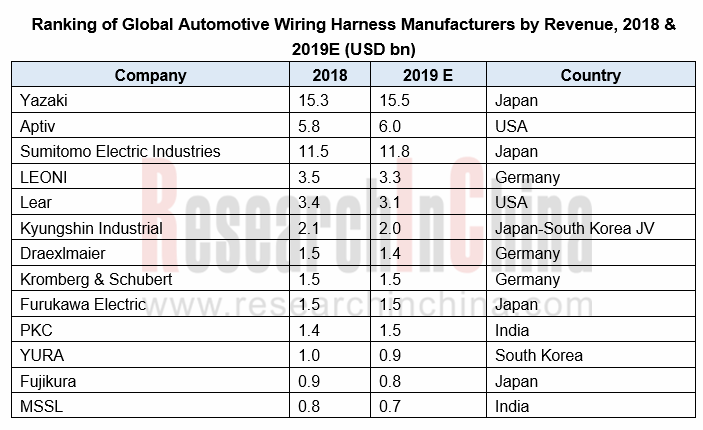

Automotive wiring harness companies worldwide can be divided into four echelons. The first-echelon players are just Yazaki and Sumitomo Electric Industries, each earning more than $10 billion a year, wherein Yazaki grows in an endogenous way and Sumitomo Electric Industries expands by collaborations and mergers and acquisitions.

MSSL, a joint venture of Sumitomo Wiring Systems (SWS), a subsidiary of Sumitomo Electric Industries, and India’s Samvardhana Motherson, has staged acquisitions in wiring harness field: in 2014, MSSL acquired the US-based Stoneridge for $67.5 million; in 2017, MSSL bought shares of PKC, a Finnish commercial vehicle wiring harness manufacturer for €570 million; MSSL means to acquire LEONI, a German company that is in a tight corner recently, and if the deal is done, Sumitomo Group will overtake Yazaki as the world’s biggest wiring harness producer in terms of revenue.

The second-echelon players are typically Aptiv, LEONI and Lear. Lear, a company that mainly operates automotive seating systems, a kind of business contributing over 75% revenue, will be likely to make its Electrical Division an independent business or sell it to others.

The third-echelon players include Kyyngshin Industrial, Draexlmaier, Kromberg & Schubert, Furukawa Electric, YURA and Fujikura. Kyyngshin Industrial is a joint venture of South Korea’s Kyungshin Co., Ltd. and Sumitomo Electric Industries. Players in the fourth echelon are a number of small wiring harness firms.

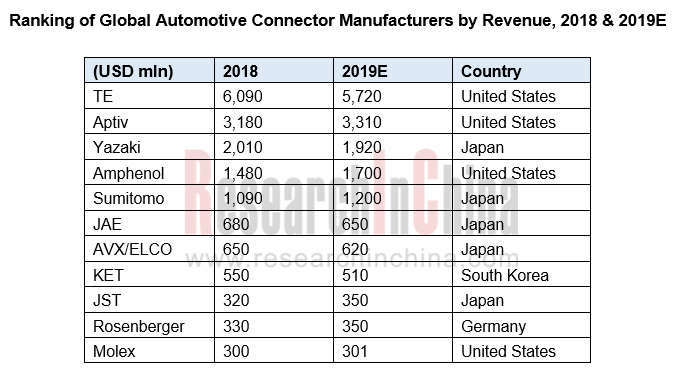

In 2018, global automotive connector market was worth roughly $17.8 billion (value per vehicle was around $193 on average, in comparison with an average of $169 in 2017). That was because large manufacturers raised their prices latter than cooper price rose in 2017 and new energy vehicle sales surged. Connector value per new energy vehicle averages at $500 to $800. In particular, considering safety much at an early stage of designing their new energy vehicles where they lack experience, OEMs often try to use many an expensive connector. The more experienced an OEM is, the less high voltage wiring harnesses and connectors it will use. What’s more, a vehicle tends to use more connectors, for adding a hardware capability needs almost several or even more than a dozen connectors. That’s the main stimulus to the expansion of the automotive connector market in future.

Yet OEMs are trying to reduce the use of connectors as well. In 2019, automotive connector market will expectedly increase by a tiny 0.6% over the previous year and reach $18.5 billion, as lower automobile sales led to a slump in revenue of the bellwether TE Connectivity. On one estimate, as a rise in global automobile sales comes with a swarm of new connector entrants in BEV market, automotive connector market may grow by 3.9% in 2020, predictably being valued at $23.6 billion in 2024.

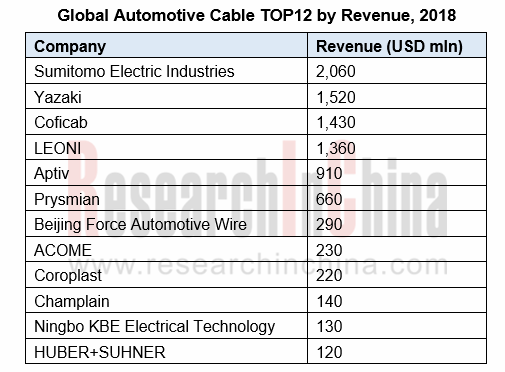

Big wiring harness vendors like Yazaki, Sumitomo, Fujikura, Furukawa, YURA, Aptiv and LEONI, are capable of making cables, especially Japanese companies all of which boast large capacities, state-of-the-art technologies and copper mines. Also, they can produce high voltage cables for new energy vehicles.

1 Automotive Wiring Harness & Connector Market

1.1 Global Automobile Market

1.2 Chinese Automobile Market

1.3 Global New Energy Vehicle Market

1.4 Chinese New Energy Vehicle Market

1.5 Chinese New Energy Passenger Car Market Pattern

1.6 Chinese New Energy Commercial Vehicle Market Pattern

1.7 Global Automotive Wiring Harness & Connector Market

1.8 Chinese Automotive Wiring Harness & Connector Market

1.9 Global New Energy Vehicle High Voltage Wiring Harness & Connector Market Segments

1.10 Chinese New Energy Vehicle High Voltage Wiring Harness & Connector Market Segments

2 Automotive Wiring Harness & Connector Industry Pattern

2.1 Ranking of Global Automotive Wiring Harness Manufacturers by Revenue, 2018 & 2019E

2.2 Global New Energy Vehicle High Voltage Wiring Harness Industry Pattern

2.3 Global New Energy Vehicle High Voltage Connector Industry Pattern

2.4 Chinese Automotive Wiring Harness Industry Pattern

2.5 Chinese New Energy Vehicle High Voltage Wiring Harness & Connector Market Pattern

2.6 Global Automotive Cable Industry Pattern

2.7 Relationships between New Energy Vehicle High Voltage Wiring Harness/Connector Suppliers and Automakers in China

3 Automotive Wiring Harness & Connector Technology

3.1 New Energy Vehicle Connector Standards

3.2 New Energy Vehicle High Voltage Connector Design

3.2.1 Heavy Current Contact Design

3.2.2 High Voltage Resistance Design

3.2.3 Overall Structure Design

3.3 Automotive Wiring Harness System Design

3.4 Overview of New Energy Vehicle High Voltage Wiring Harness

3.5 Overall Design of High Voltage Wiring Harness

3.5.1 Shielding Effectiveness Design

3.5.2 Mechanical Protection, Dustproof & Waterproof Design

3.5.3 Service Life Design

3.6 High Voltage Wiring Harness Requirements

3.7 Overview and Standards of High Voltage Cable

4 Automotive Wiring Harness & Connector Manufacturers

4.1 Aptiv

4.2 Sumitomo Electric Industries

4.3 BizLink

4.4 Lear

4.5 Shanghai Jinting Automobile Harness Limited (Jiangsu Etern Co., Ltd.)

4.6 Yazaki

4.7 Furukawa

4.8 Fujikura

4.9 LEONI

4.10 Draexlmaier

4.11 Kunshan Huguang Auto Electric Co., Ltd.

4.12 Kromberg & Schubert

4.13 Nexans

4.14 Shenzhen Deren Electronic Co., Ltd.

4.15 Yura

4.16 Kyyngshin Industrial

4.17 HaoDa Auto Parts (Zhejiang) Co., Ltd.

4.18 Tianhai Auto Electronics Group Co., Ltd.

4.19 Changchun Sanzhi Auto Parts Co., Ltd.

4.20 Auto-Kabel

4.21 Shenzhen Qiaoyun Technology Co., Ltd.

4.22 Tianjin Great Wall Jingyi Auto Parts Co., Ltd.

4.23 Samvardhana Motherson Group

4.24 MD Elektronik

4.25 Prettl

4.26 Forschner

5 Automotive Connector Manufacturers

5.1 Amphenol

5.2 Hu Lane Associate

5.3 Rosenberger

5.4 JAE

5.5 TE Connectivity

5.6 Nanjing Kangni Mechanical & Electrical Co., Ltd.

5.7 Sichuan Yonggui Technology Co., Ltd.

5.8 AVIC Jonhon Optronic Technology Co., Ltd.

5.9 Luxshare Precision Industry Co., Ltd.

5.10 JST

6 Automotive Cable Manufacturers

6.1 Ningbo KBE Electrical Technology Co., Ltd.

6.2 Beijing Force Automotive Wire Co., Ltd.

6.3 Jiangsu Hengtong New Energy Intelligent Control Technology Co., Ltd.

6.4 COFICAB

6.5 Coroplast

6.6 Draka (Prysmian)

6.7 HUBER+SUHNER

Global Automobile Sales, 2016-2022E

Global Light Vehicle Sales by Region, 2016-2019

Global Heavy Vehicle Sales by Region, 2016-2019

China’s Passenger Car Sales, 2011-2021E

Global New Energy Vehicle Sales, 2012-2021E

China’s New Energy Vehicle Sales and Growth Rate, 2015-2021E

China’s New Energy Vehicle Sales by Type, 2015-2021E

Chinese BEV Market Distribution by Size, 2019H1

Chinese PHEV Market Distribution by Size, 2019H1

Global Automotive Wiring Harness Market Size, 2017-2024E

Global Automotive Connector Market Size, 2017-2024E

Global High-voltage Wiring Harness Market Size and Growth Rate, 2017-2024E

Downstream Distribution of Global High-voltage Wiring Harness Market, 2017-2024E

Tesla’s High-voltage Connector Cost by Position

Market Share of Global Major Manufacturers of High-voltage Connectors for New Energy Vehicles, 2019

TOP 20 Automotive Wiring Harness Manufacturers in China by Revenue, 2018

TOP 12 Global Automotive Cable Manufacturers by Revenue, 2018

Automotive Wiring Harness Design Flow Chart

Typical Wiring Harness Module of ICE Vehicles

BEV High-voltage System Connection

Aptiv’s Quarterly Orders by Division, 2017Q1-2019Q2

Aptiv’s Customers, 2019

Aptiv’s Revenue, 2022E

Aptiv’s Revenue from Advanced Safety & User Experience by Region/Product, 2018

Aptiv’s Revenue from Signal & Power Solutions by Region/Product, 2018

Automotive Wiring Harness Revenue of Sumitomo Electric, 2014-2019

Automotive Wiring Harness Revenue of BizLink, 2014-2019

Lear’s Revenue, Net Profit Margin and Employees, 2014-2019

Lear’s Revenue by Business, 2014-2019

Lear’s Revenue and Operating Margin from Electrical System, 2014-2019

Lear’s Electrical System Revenue by Customer/Region/Product, 2018

Lear’s Electrical System by Product

Typical Applications of Lear’s Electrical System

Wiring Harness Revenue and Gross Margin of Shanghai Jinting Automobile Harness, 2016-2020E

Customers of Shanghai Jinting Automobile Harness, 2018

Main Products of Furukawa’s Automotive Business

Furukawa’s High-voltage Wiring Harness R&D

Fujikura’s Revenue and Operating Margin, 2009-2018

Fujikura’s Revenue by Region, 2018

Leoni’s Revenue by Region, 2017-2019

The Basic Principle of Leoni’s Y Connector

Leoni’s EMC Filter

Dr?xlmaier’s Revenue, 2014-2018 (EUR mln)

Customers of Kunshan Huguang Auto Electric, 2018

Nexans’ Revenue, 2010-2018

Nexans’ Employees, 2010-2018

DEREN’s Revenue by Business, 2017-2019

THB’s Organizational Structure

Amphenol’s Revenue and Operating Margin, 2014-2019

Amphenol’s Revenue by Application, 2018

Amphenol’s Revenue by Region, 2018

Amphenol’s Automobile Revenue Structure, 2015-2019

Organizational Structure of Hu Lane Associate

Revenue and Operating Margin of Hu Lane Associate, 2014-2019

Main Products of Hu Lane Associate

Revenue of Hu Lane Associate by Region, 2017-2019

Capacity of Hu Lane Associate

Product Development Strategy of Hu Lane Associate

Products of Hu Lane Associate

Customers of Hu Lane Associate, 2019

Rosenberger’s FARKA Connector

Rosenberger’s HSD Connector

JAE’s Revenue and Growth Rate, FY2014-FY2019

JAE’s Revenue and Operating Margin, FY2014-FY2019

JAE’s Revenue by Business, FY2015-FY2019

JAE’s Automotive Connectors

TE’s Revenue and Operating Margin, FY2014-FY2019

TE’s Business

TE’s Automotive Connector Revenue, FY2013-FY2019

TE’s Revenue from Transportation Division by Region

TE’s Quarterly Automotive Connector Revenue, 2017Q1-2019Q2

Target Electric Vehicle Fields of TE

TE’s Integrated Battery Solutions

Revenue and Net Income of Sichuan Yonggui, 2015-2019

Revenue of Sichuan Yonggui by Business, 2015-2019

Electric Vehicle Connector Revenue and Gross Margin of Sichuan Yonggui, 2015-2019

Main Products of Luxshare’s Automotive Division

Luxshare’s Revenue by Product, 2016-2021E

Luxshare’s Automotive Product Revenue, 2016-2021E

JST’s Revenue by Application, FY2019

JST’s Automotive Connectors

Revenue and Profit of Ningbo KBE, 2016-2020E

Revenue of Ningbo KBE by Business, 2016-2018

Customers of Ningbo KBE, 2018-2019

Ranking of Global New Energy Vehicles by Sales, 2018

Ranking of New Energy Buses by Sales, Jan-May 2019

Global New Energy High-voltage Connector Market Size, 2017-2024E

High-voltage Connector Cost by Position (excluding Tesla)

Ranking of Global Automotive Wiring Harness Manufacturers by Revenue, 2018-2019

Aptiv’s Financial Statement, 2014-2018

Revenue, Gross Margin, Output and Sales of Shanghai Jinting Automobile Harness, 2016-2019

Financial Data of Shanghai Jinting Automobile Harness, 2017-2018

Yazaki’s Revenue, FY2014-FY2019

Yazaki’s Revenue by Region, FY2016-FY2018

Furukawa’s Revenue and Operating Income, FY2014-FY2019

Leoni’s Revenue and EBIT, 2015-2019

Revenue and Net Income of Kunshan Huguang Auto Electric, 2015-2019

Revenue and Unit Price of Kunshan Huguang Auto Electric by Product, 2015-2018

Raw Materials Procurement of Kunshan Huguang Auto Electric, 2017-2018

Unit Price of Procured Raw Materials of Kunshan Huguang Auto Electric, 2015-2018

Procurement of Kunshan Huguang Auto Electric from Top Five Suppliers, 2016-2018

DEREN’s Revenue and Net Income, 2015-2019

DEREN’s Revenue and Gross Margin from Automotive Electrical System, 2017-2019

Yura’s Revenue and Operating Income, 2015-2019

THB’s Financial Data, 2013-2015

Revenue and Net Income of AVIC Jonhon Optronic Technology, 2014-2019

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...