V2X (Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2019-2020

5G+V2X CVIS will be a strong driver for highly automated driving.

The V2X industry is thriving with advances in automotive connectivity, to which great importance has been attached by car producing powers worldwide, and it is vigorously promoted and deployed about which the development plans, laws & regulations, technical criteria and pilot construction are in full swing in different countries.

Till 2025, the intelligent vehicles with conditional autonomy will be spawned in China, LTE-V2X and other networks will be regionally viable, 5G-V2X will be progressively available on expressways and in some cities, and the high-precision spatial-temporal datum service network will be fully covered, according to the Strategy for Innovative Development of Intelligent Vehicles circulated by National Development and Reform Commission (NDRC) in February 2020. An intelligent vehicle system with Chinese standards will be established between 2035 and 2050.

Two V2X technology roadmaps prevail worldwide, i.e., IEEE802.11p (DSRC) and C-V2X (Cellular-V2X). Application layer standards are drafted differently by countries.

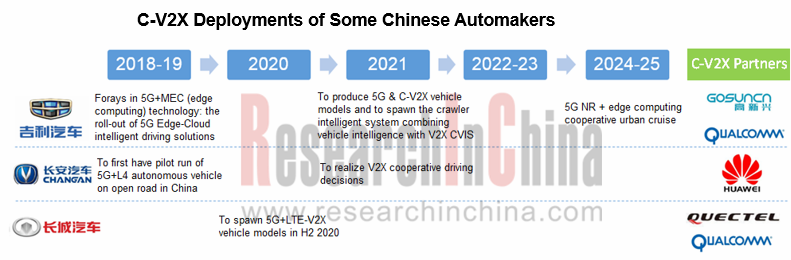

C-V2X springs up and wins the hearts of industry insiders since it is far superior to DSRC. C-V2X, encompassing LTE-V2X and 5G-V2X, gets energetically promoted in China.

In December 2019, Federal Communications Commission (FCC) passed a resolution with one accord that most spectrums of 5.9GHz band will be reallocated and they will be dedicated for the unlicensed spectrum technology and the C-V2X technology. Over the past two decades, 75MHz in the 5.9GHz band was used for DSRC, but FCC seeking to revise the rules pointed it out that DSRC is at a standstill for many years, particularly in April 2019 when Toyota stopped using DSRC V2X technology.

5G NR based V2X will boost the development of fully automated vehicles.

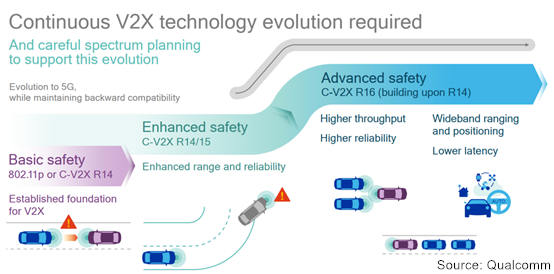

C-V2X (incl. LTE-V2X, 5G-V2X) is based on 3GPP specifications. LTE-V2X evolves towards 5G-V2X.

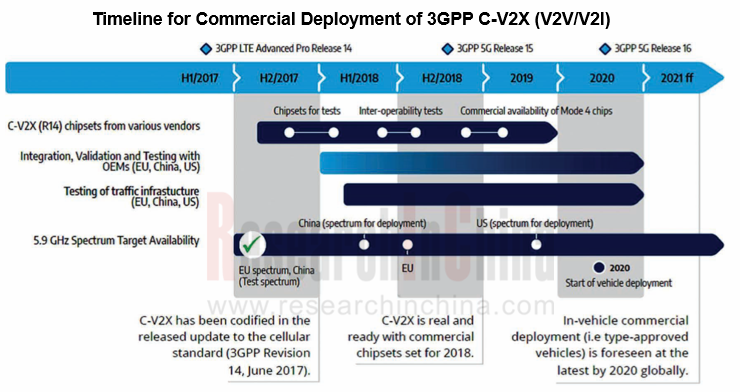

3GPP R14 standards supporting LTE-V2X was issued in 2017; 3GPP R15 standards that support LTE-V2X enhanced (LTE-eV2X) were formally completed in June 2018; 3GPP R16+ standards supportive for 5G-V2X started to be studied in June 2018.

LTE-V2X is designed mainly to enable driver assistance, improve road safety, efficiency and comfort. NR-V2X, a fusion of communication technologies, big data, artificial intelligence, among others, suffice autonomous driving and other new features better. 5G NR V2X standards are rapidly under way and physical layer specifications plan to be nailed down in March 2020.

Among the 25 projects about Rel-17 that were established at the 3GPP RAN Meeting held in Spain in December 2019, a standardization project -- 5G new radio sidelink enhancement -- will be a souped-up version of Rel-16 NR-V2X sidelink. Also, the technology roadmap of 3GPP 5G 3rd edition (Rel-17) was made explicitly during the Meeting. Noticeably, Chinese operators initiated and joined many projects of criteria constitution about 3GPP RAN R17.

Progress in C-V2X deployment

It is put forward in the Strategy for Innovative Development of Intelligent Vehicles to build a full-fledged intelligent vehicle infrastructure system, including (1) to build smart roads and next-generation national traffic control network, to expedite 5G construction and combination with telematics; (2) to study the licensing of special spectrums for automotive wireless communications, to hasten construction of wireless communication network for automotive use; (3) to accelerate construction of a unified national high-accuracy spatial temporal datum service capabilities by giving full play to the existing Beidou satellite positioning reference station network; (4) to develop the intelligent vehicle maps with unified standards, to build a perfect geographic information system containing road network information, to offer real-time kinematic (RTK) data services; (5) the existing facilities and data resources will be leveraged to build a national intelligent vehicle big data cloud-enabled platform.

5G+V2X, as a crucial infrastructure to autonomous driving, is booming with policy support. V2X started from 2019 to be piloted successively and will be more popular with 5G deployments in 2022. Meanwhile, 5G NR V2X is being tested and certified, setting the stage for large-scale application of intelligent vehicles with higher autonomy in 2025.

The traditional automotive terminals like T-Box are on the brink of a revolution. The automotive TCU (Telematics Control Unit) integrates 4G/5G module, C-V2X module, onboard navigation module and so forth, which means the opportunities and challenges to the providers of both cockpit electronics and conventional telematics.

Huawei Technologies rolled out the C-V2X T-Box compatible with both 4.5G and 5G; PATEO launched 4.5G C-V2X T-box; Neusoft released T-Box 3.0 combining C-V2X, 5G, Ethernet and other technologies; Samsung Harman announced the availability of TCU in-built with cellular NAD and Autotalks’ 2nd-Gen chipset, offering C-V2X capabilities.

Telematics evolves from initially TSP platform to intelligent connectivity platform and then to autonomous driving cloud-enabled platform (cooperative vehicle infrastructure system). 5G T-Box, a portal for big data of intelligent vehicles in future, will be the core product for smart hardware producers. Automakers also have collaborations with Tier 1 suppliers and plan to have the to-be-launched models configured with 5G+V2X successively.

Perfection of C-V2X industry chain in China

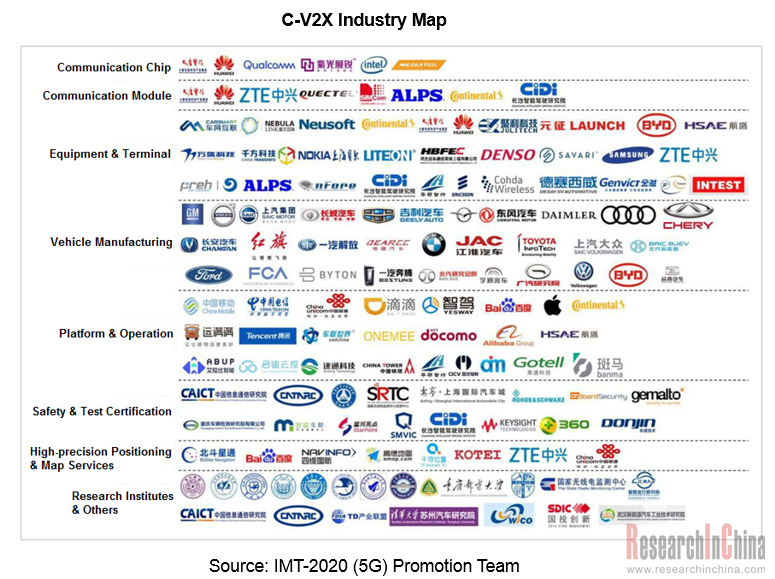

C-V2X industry chain involves communication chip, communication module, terminals & equipment, vehicle manufacturing, test & certification, operation services, etc., where there are many players such as chip vendors, equipment manufacturers, OEMs, solution providers and telecom carriers. In October 2019, C-V2X ‘Four Crosses’ (cross-chip module, cross-terminal, cross-vehicle, cross- safety platform) connectivity demonstrations were successfully held, a full interpretation of C-V2X complete chain technology competences and facilitating further C-V2X deployments at home.

Huawei make great strides in C-V2X and has unveiled C-V2X chip, gateway, T-Box, RSU (Road Side Unit) to end-to-end solutions. In 2019, Huawei launched 5G in-car module MH5000 which is highly integrated with 5G and C-V2X technologies and is packed with 5G baseband chip Balong 5000 with such features as one-core multi-mode, high rates, downlink-uplink decoupling, support of SA (5G standalone) and NSA (5G non-standalone) dual-mode network, support of C-V2X, to name a few.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...