Automotive OTA Research: 3.838 Million Passenger Cars Packed OTA Capability in China in 2019, Soaring by 60.6% Year on Year

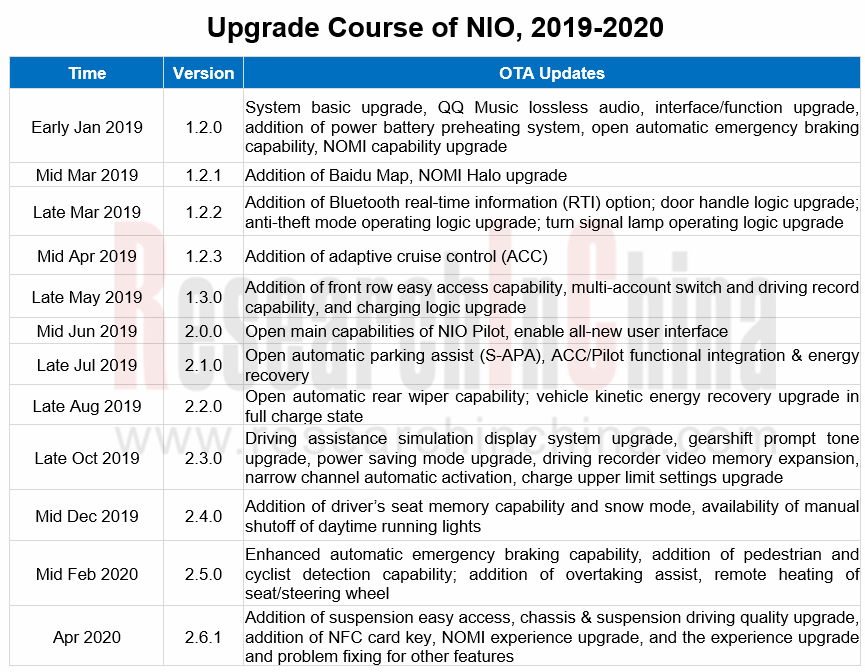

Against all odds, controversial Tesla and NIO were eventually out of the woods. What they live on is FOTA (Firmware-over-the-air). Upgrading software and hardware provides new experience for car owners, making them more satisfied and very loyal.

Even nowadays, few vehicle models enable FOTA, really a hard nut to crack.

Considering safety and FOTA challenges, traditional automakers mostly choose to tap into vehicle system SOTA (Software-over-the-air) and act prudently in FOTA promotion. Through the lens of a typical FOTA flow, realizing FOTA needs E/E architecture disruption, and the support of new technologies like automotive Ethernet, cyber security, intelligent gateway, great computing power, and large memory.

Conventional OEMs have made slow progress in FOTA development over the past several years. Yet they took a big step forward in 2019. It can be seen from the table below that there is a gap between main OEMs and Tesla. Success of Tesla Model 3 weighs so heavily on traditional automakers that they are highly endangered except sweating for rapid transformation.

VW is the most aggressive among OEMs, while its counterparts are also working hard. The race to roll out intelligent gateway chip in early 2020 is a reflection of OEM’s eager hoping to enable FOTA as early as possible just as Tesla has done.

Installation of SOTA easier to realize is soaring in both volume and rate. In 2019, 3.838 million passenger cars, or 19% of the total, were provided with SOTA, jumping by 60.6% compared with 2.39 million units, or 11.8% of the total in 2018, according to ResearchInChina.

Among typical OEMs, GM leads in OTA capability. Its new-generation electronic architecture enables FOTA updates on its ICE models, which means OTA is available to recalibrate or upgrade engine and transmission control modules, vehicle communication system, entertainment system, driving control and body control ECU at a later stage.

In 2020, Buick’s latest interconnection system, eConnect3.0 enables OTA updates of 9 major models such as OnStar module, IVI system, intelligent driving control module, body control module, and iBooster brake booster.

In 2020, the latest Cadillac CT5 model will pack GM’s new electronic architecture. CT5 allows OTA updates of more than 30 vehicle control modules including software modules (e.g., IVI and smart connectivity) and firmware electronic modules (e.g., powertrain, chassis and electrical control).

GM plans to apply its next-generation E/E architecture to most of its car lineups before 2023.

Chinese companies that excel in application layer innovation already make plenty of OTA micro-innovations. Examples include SAIC providing personalized OTA -- DOTA, and BYD and XPENG Motors both offering high temperature disinfection capability enabled by OTA updates.

In April 2020, BYD announced its new models like Tang added with “high temperature disinfection capability” enabled by OTA updates. This capability is not simple upgrade and introduction but involves a complete set of OTA-based working logic of multiple ECUs (e.g., multimedia, air-conditioner controller and PTC heater) in a safe way.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...