Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2020 (I)

Leading Tier1 Suppliers’ Cockpit Business Research Report: Eight Development Trends of Intelligent Cockpit

Abstract: in the next two or three years, a range of new intelligent cockpit technologies will be in place and mounted on vehicles, according to the Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report.

High automation faces technical and regulation challenges and it takes a long period of time to build 5G network and roadside infrastructure. In this context, much enthusiasm for intelligent cockpit is being aroused before automated driving technology becomes mature enough. Intelligent cockpits featuring new design concept draw more attention from consumers than automated driving technology does.

Globally, OEMs and Tier1 suppliers are racing to explore how to launch new intelligent cockpit technologies. We expect that numerous intelligent cockpit products will be launched successively in the upcoming two years or three. Based on the picture at CES 2020, development trends for intelligent cockpit can be seen below:

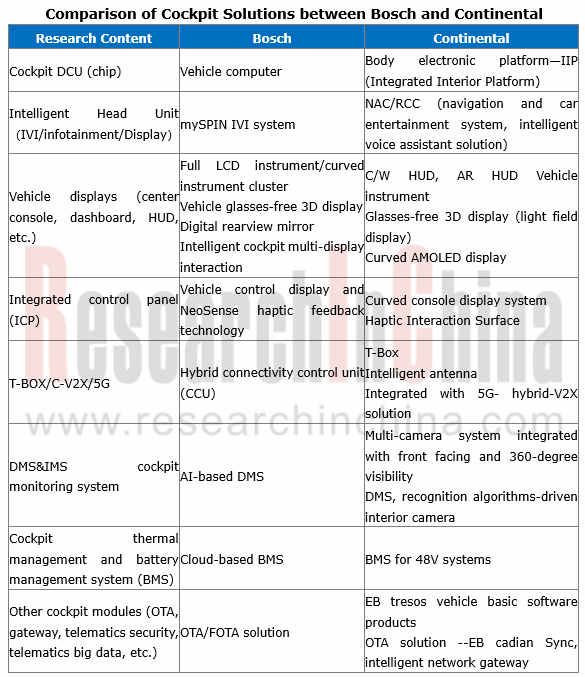

(1) Cockpit domain control unit (DCU): next-generation intelligent cockpit systems are DCU-centric and enable features of cockpit electronic systems through a unified software and hardware platform, which incorporate intelligent interaction, intelligent scenarios and personalized services and serve as the foundation for human-vehicle interaction and V2X connectivity.

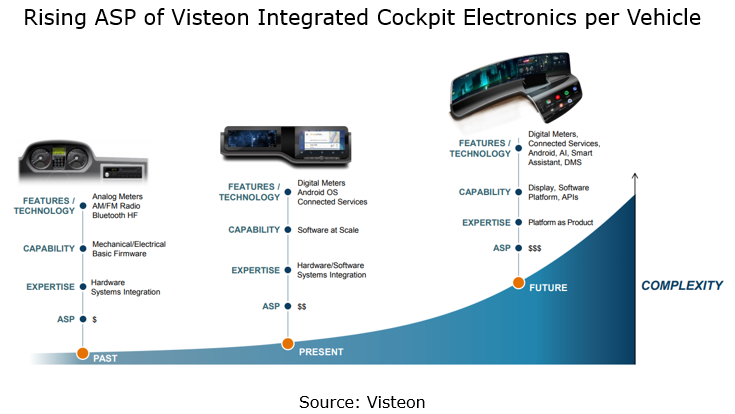

(2) Multi-display interaction: the cockpit design of dual-display interaction (center console, dashboard), four-display interaction (center console, dashboard, entertainment screen at the copilot’s seat, vehicle control display), or even five-display interaction (center console, dashboard, entertainment screen at the copilot’s seat, vehicle control display, rear seat entertainment display) is trending. Multi-display interaction needs complete cockpit domain architecture, and fusion of technologies, e.g., cockpit DCU, multi-chip (like TI automotive chips and Qualcomm entertainment chip), multiple operating systems (Linux, Android Automotive), Hypervisor virtualization technology, interaction logic, and HMI design. Tier1 suppliers are required to be more competent in product development and technology integration while seeking business growth amid the rising average selling price (ASP) of intelligent cockpit per vehicle.

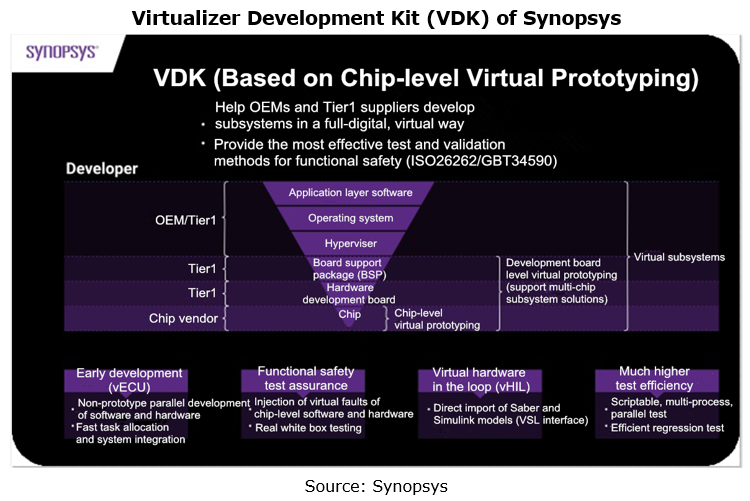

(3) Cockpit virtualization technology (separate development of software and hardware): virtual prototyping technology makes design, R&D and test of intelligent vehicles more efficient. Virtualizer Development Kit (VDK) based on virtual prototyping technology enables virtual simulation of electronic control units (ECU), e.g., chips, circuits and components. Automakers can commence development and test of software twelve months ahead of time before the availability of hardware, upgrading physical development to intelligent development in simulation environment. Also, ECUs for virtual simulation can accelerate and extend tests, and simulate various tests in extreme conditions, which is hard to achieve in real and physical circumstances and which secures faster roll-out of safer and more reliable products into market. The virtual prototyping technology is applicable to virtual development and test of all complex electronic systems such as intelligent cockpit and ADAS.

(4) Higher value of cockpit electronics software: the more complex vehicle system software means it makes up ever more of the total cost of a vehicle. OEMs and Tier1 suppliers are expanding software developers in R&D workforce. Examples include Desay SV, an intelligent cockpit bellwether in China, which boasted about 1,300 software engineers in 2019, a 70% share of its headcount; and Bosch in possession of 30,000 software talents, or 41% of the total staff in 2019 endeavoring to recruit more software developers. Between 2019 and 2020, Bosch set up Bosch China Innovation and Software R&D Center and Bosch Digital Cabin (Shanghai) R&D Center.

(5) Cockpit “terminal-cloud” integration, T-BOX and V2X as gateway of data from inside and outside vehicle, and cockpit big data as core competitive edge of products: intelligent cockpit will be a combination of terminals and cloud, in which all kinds of service contents, timely information sharing and complex computation will be offered and done over cloud, more than acts as a stand-alone terminal. In future cockpit big data will be the core competitive edge of products, making center console and dashboard, center information display (CID) navigation, T-BOX and air-conditioner controller, integrated.

(6) Evolution of vehicle display from flat rectangular screen to large curved screen: in January 2020, Corning’s high-performance Gorilla cold-rolled glass was first available to GAC Aion LX; in early 2020, Visteon and Corning joined hands to further develop ColdForm technology which will be spawned by Corning for automotive curved display systems; in July 2020, Rightware under Thundersoft, and LG Electronics partnered to develop the industry’s first curved OLED display for 2021 Cadillac Escalade.

(7) Glasses-free 3D display: 3D effect makes eyes capture information more quickly. Bosch, Continental and more all focus on mass production and installation of glasses-free 3D displays in the next two year or three. At CES 2020, Continental showcased its 3D Lightfield display technology which was co-developed with Leia Inc. and mass production is arranged in 2022.

(8) Driver monitoring system (DMS) or interior monitoring system (IMS): IMS based on camera and AI is the core product of Tier1 suppliers. DMS will play a crucial role in whether a new vehicle model can be rated five stars by Euro NCAP. For example, Continental plans to mass-produce DMS in 2021 and Bosch in 2022.

The Global and China Leading Tier1 Suppliers’ Cockpit Business Research Report studies in depth strategies, technologies and products of leading Tier1 suppliers of intelligent cockpit, and highlights the following: (1) strategic plan and business layout of intelligent cockpit; (2) layout of intelligent cockpit technology centers, R&D centers and production bases; (3) intelligent cockpit product line, products and technical solutions, typical customers and vehicle models, mass production schedule, etc.; (4) intelligent cockpit product roadmap and development plan; (5) suppliers of intelligent cockpit products, technology and modules.

The Global and China Leading Tier1 Suppliers’ Cockpit Business Research Report has two parts, of which:

Part 1 with 320 pages in total covers 6 Tier1 suppliers, i.e., Bosch, Continental, Denso, Valeo, Faurecia and Panasonic.

Part 2 with 350 pages in total covers 7 Tier1 suppliers, i.e., Aptiv, Visteon, LG Electronics, Hella, Samsung Harman, Desay SV and Joyson Electronics.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...