Research on Automotive LiDAR Industry: How five technology roadmaps develop amid the upcoming mass production of high-channel LiDAR?

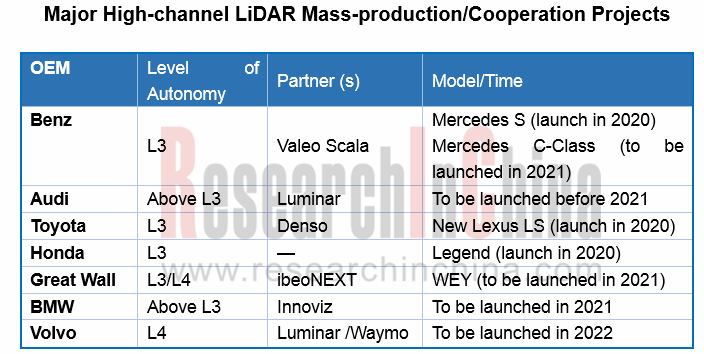

During 2020-2025, autonomous driving above L3 will be commercialized, for which LiDAR will become an important option. LiDAR vendors break through technical bottlenecks and work closely with OEMs to massively install high-channel LiDAR as soon as possible. Today, Audi has teamed up with Valeo/Luminar, BMW has cooperated with Innoviz, Volvo has collaborated with Luminar, Great Wall Motors has partnered with Ibeo, and Hyundai has joined forces with Velodyne. Even Mobileye, a proponent of visual ADAS, is developing its own LiDAR technology.

In early 2020, Bosch announced that it is making long-range LiDAR sensors production-ready-the first LiDAR (light detection and ranging) system that is suitable for automotive use. Continental delivers a 50-meter range 3D flash LiDAR sensor that's expected to find increasing application in commercial vehicles and off-highway machines in 2020. Valeo’s 16-channel SCALA 2, which can detect objects up to a distance of 150 meters, has won orders from some production vehicle models, and its SOP is expected in 2021. This shows that high-channel LiDAR is on the eve of mass production.

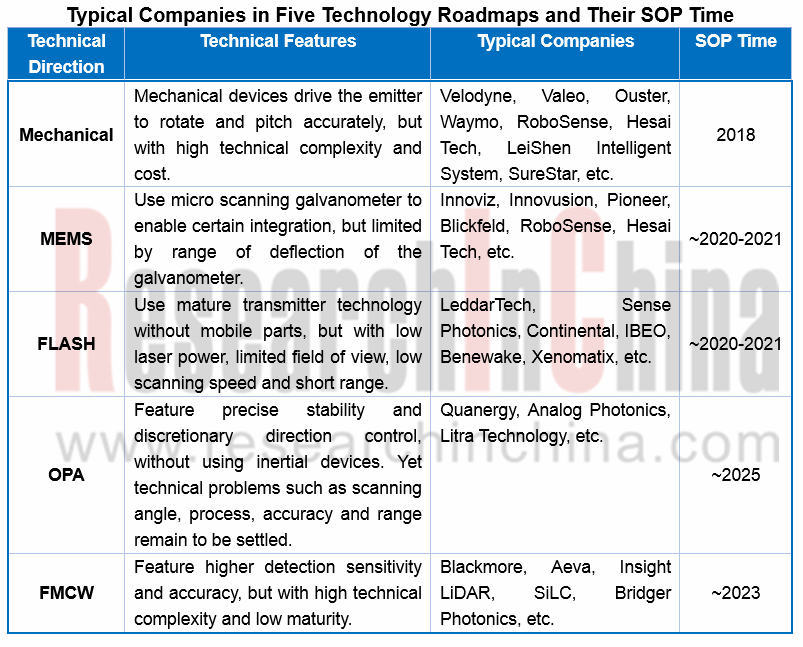

Still, the battle for technology roadmaps in the LiDAR field continues. There are now automotive LiDAR technology roadmaps encompassing mechanical, MEMS, FLASH, OPA and FMCW, among which FMCW is a coherent detection technology while the rest are pulsed ToF detection technologies.

Mechanical LiDAR

Mechanical LiDAR is the earliest developed and most mature product. Waymo's Honeycomb LiDAR is also based on mechanical technology. Although it has been criticized a lot, mechanical LiDAR is still the mainstream on the market. Representative companies of mechanical LiDAR include Velodyne, Valeo, Ouster, Waymo, RoboSense, Hesai Tech, SureStar, LeiShen Intelligent System, etc.

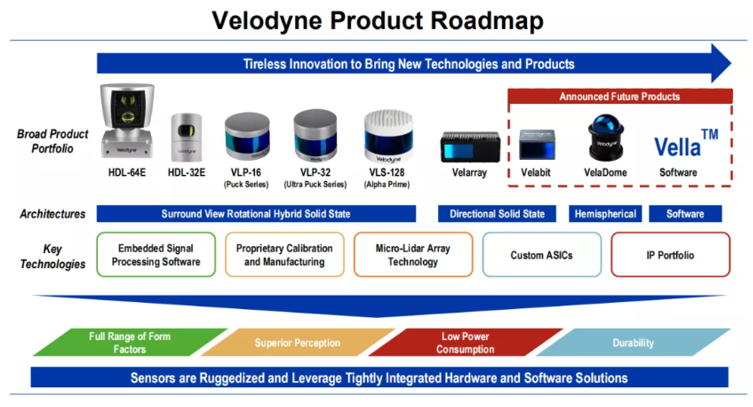

Most mechanical LiDAR vendors are pushing forward two strategies concurrently. On the one hand, they improve the mechanical LiDAR product line, try to reduce costs and enhance performance; on the other hand, they actively expand the solid-state LiDAR product portfolios (MEMS, FLASH, OPA, etc.).

For example, Velodyne has rolled out the all-solid-state Velarray LiDAR, and short-range VelaDome LiDAR perfect for automotive applications such as blind spot monitoring. Velodyne has acquired Mapper.ai, a HD map startup with a team of 25 talents, for quicker development of Vella software. In January 2020, Velodyne unveiled the cheap Velabit LiDAR priced only at $100.

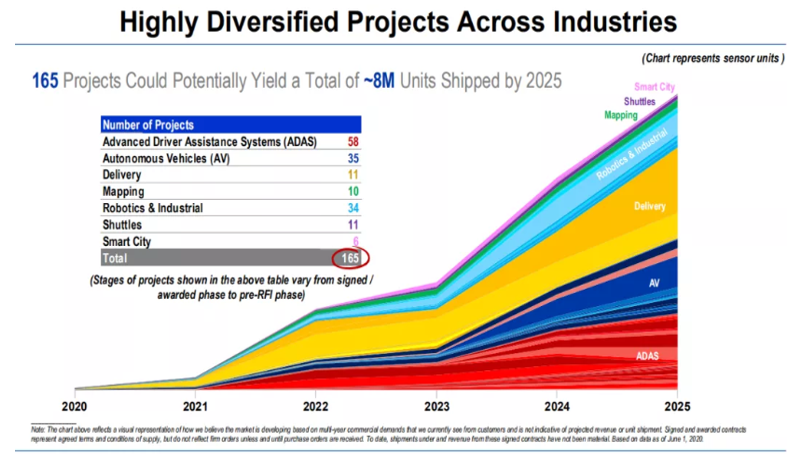

Velodyne branches out to ADAS and other fields aggressively. Nowadays, the autonomous driving business only contributes a quarter of Velodyne's revenue, whereas the remaining earnings come from ADAS, robotics, surveying and mapping, smart cities, shuttles, and unmanned distribution, among which unmanned delivery, Robotaxi and ADAS will become main revenue contributors for Velodyne in the next four years. It is estimated that Velodyne will ship 8 million units by 2025.

MEMS LiDAR

Typical suppliers of MEMS LiDAR include Innoviz, Innovusion, Pioneer, Blickfeld, RoboSense, Hesai Tech, etc.. Using micro galvanometers, MEMS LiDAR is limited in size, vibration reliability and operating temperature range.

As concerns MEMS mirrors, foreign companies are at the forefront, such as Innoluce acquired by Infineon based in Germany, Mirrorcle and MicroVision in the United States, Hamamatsu in Japan, and STMicroelectronics in Switzerland. Their Chinese counterparts include Xi'an ZhiSensor, Taiwan Opus, Silicon Vision Microsystem, among others. A few LiDAR companies supply MEMS mirrors through alliances or independent development. For instance, RoboSense has invested in Silicon Vision Microsystem to deploy MEMS LiDAR; Hesai Tech PandarGT 3.0 uses self-developed MEMS mirrors.

MEMS LiDAR will be spawned by most vendors as early as 2020-2021.

Innoviz, which adopts the MEMS technology roadmap as a typical provider, has received more than USD210 million in financing within only four years since its inception. Innoviz is to date competent for mass production and has fetched orders from OEMs. BMW has selected Innoviz for series production of its autonomous vehicles, starting in 2021. Besides, Innoviz has allied with Tier1 suppliers Harman, HiRain Technologies and Aptiv. The latest Innoviz One has a detection range of 0.1-250 meters and will be produced on a large scale in 2021.

Zvision, a Chinese MEMS LiDAR company, secured RMB70 million in Series A+ round of financing in April 2020.

Flash LiDAR

Typical Flash LiDAR vendors are LeddarTech, Sense Photonics, Continental, IBEO, Benewake, Xenomatix and Ouster.

Sense Photonics as the first one to overcome technical challenges has introduced Osprey, its first modular FLASH LiDAR which was sold on the market in January 2020 at a price of $3,200. Continental’s Flash LiDAR, HFL110 featuring 1,064nm laser and hybrid InGaas/CMOS focal plane array, is expected to be spawned in 2020. IBEO’s NEXT LiDAR is about to be mounted on Great Wall VV7 in 2021.

Another company LeddarTech stands out for building Leddar Ecosystem. In July 2020, LeddarTech acquired VayaVision, a sensor fusion and perception software company. Their cooperative solution enables the fusion of camera, radar, and LiDAR for faster time-to-market, and allows for fusion of up to 15 different sensors for Level 2 to Level 4 autonomous driving applications. Two well-known sensor vendors First Sensor and Sunny Optical Technology also join LeddarTech Leddar Ecosystem.

OPA LiDAR

For OPA LiDAR, Quanergy previously released S3 but has yet to commercialize it. Some players like Analog Photonics and Shenzhen Litra Technology are in the phase of development and exploration. It will expectedly take them over 5 years to launch the technology.

OPA LiDAR enables precise stability and discretionary direction control, without using inertial devices. Yet technical problems such as scanning angle, process, accuracy and range remain to be settled. Current integrated OPA technology fails to offer large aperture needed by mid- and long-range LiDAR, due to complexity, high power consumption or low optical efficiency. In August 2020, researchers at University of Colorado Boulder developed a serpentine optical phased array (SOPA) chip which can enlarge optical aperture for LiDAR.

FMCW LiDAR

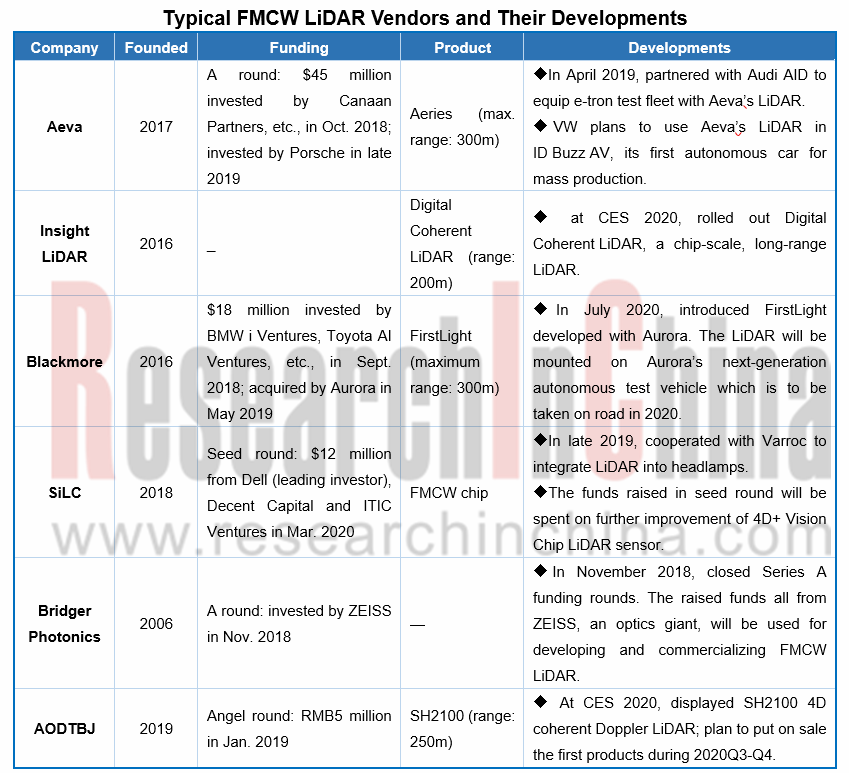

Coherent LiDAR is still in its infancy compared with pulsed ones. The leading technology for the LiDAR is frequency modulated continuous wave (FMCW), into which about 10 players worldwide get involved, including Aeva (invested by Porsche), Blackmore (acquired by Aurora in 2019), Strobe (acquired by Cruise in 2017), SiLC Technologies (invested by Dell), Bridger Photonics (invested by Carl Zeiss) and AODTBJ.

The reason why BMW, Toyota, Porsche, GM and Aurora select FMCW LiDAR lies in FMCW’s edges over pulsed ToF, on ability to directly detect speed (4D information) and high resolution range and permission to use cheap photoelectric detectors (e.g., PIN). The biggest challenge before FMCW technology is the need for being integrated with a plurality of optical components, e.g., laser, amplifier, phase and amplitude controlled low-noise photodiode, mode converter and optical waveguide, all of which should be further integrated into a commercial-scale compact FMCW LiDAR.

From the latest progress, it can be seen that Aeva’s Aeries FMCW system irons out the dependency between maximum detection range and point cloud density, and integrates multiple beams on a chip, achieving full range performance of over 300 meters for objects in addition to the ability to measure instant velocity for every point with a 120-degree field-of-view. The product is projected to be available for use in 2020, costing less than $500 once mass produced.

Furthermore, FirstLight, a LiDAR co-developed by Blackmore and Aurora, allows the Aurora Driver to see well beyond 300 meters even on targets that don't reflect much light, such as a pedestrian wearing dark clothing at night. Aurora has installed its Aurora Driver in six different vehicles, ranging from sedans and Chrysler Pacifica minivans to self-driving trucks. Aurora plans to use its FirstLight LiDAR in its fleet of self-driving development vehicles in 2020.

Actually, OEMs tend to choose more than one technologies. For example, Audi investing Blackmore, a typical FMCW firm, installed Valeo's 4-channel mechanical LiDAR into Audi A8 in 2018 and also has a plan to pack the to-be-produced cars in 2021 with Luminar’s solid state LiDAR.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...