Research on Roadside Perception: With Greater Policy Support, the RMB10 Billion Intelligent Roadside Perception Market Takes Off

In our Smart Road: Intelligent Roadside Perception Industry Report, 2020, we analyze policies, industry chain and technologies, market size, business model and suppliers in the intelligent roadside perception industry (including RSU, roadside sensor, MEC and cloud control platform).

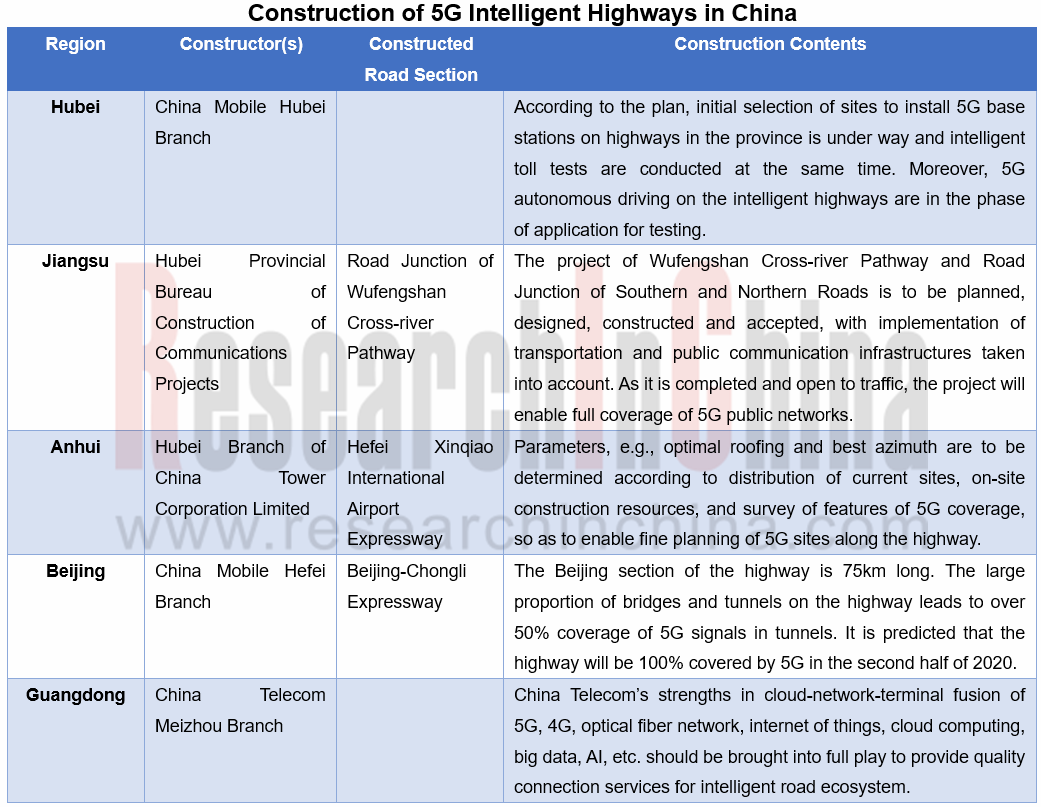

With the advancement of cooperative vehicle infrastructure system, China and the industry have come to know that the priority should be given to coordinated development between infrastructure and vehicle more than just vehicle. A plurality of policies was issued for intelligent road construction in China in 2020 alone. Wherein, the Guiding Opinions on Promoting the Construction of New Infrastructures for Transportation released in August 2020 makes it clear that ubiquitous perception facilities should be pervasive enough in the transportation industry; the Guide for Layout of Internet of Vehicles (IoV) Roadside Facilities, an association standard concerning roadside facilities published in August 2020, specifies layout of IoV roadside facilities in the C-V2X-based IoV traffic circumstance, and further promotion of roadside and cloud equipment to be unified.

With policy support, China’s intelligent roadside perception market (including radar, camera, etc.) is proliferating fast and is expected to be worth RMB40 billion by 2025. In the market, LiDAR costs the most in deployment, with a single set even priced up to tens of thousands of yuan. Yet LiDAR performs much better in roadside scenarios, notably complex intersections, for it could recognize target attributes precisely and offer far more accurate, reliable data combining with cameras. LiDAR is still at the start of application in roadside end and has yet to be used massively. If deployed on a large scale, the price of LiDAR will take a nosedive.

Intelligent roadside facilities: enormous social benefits fascinate government to invest

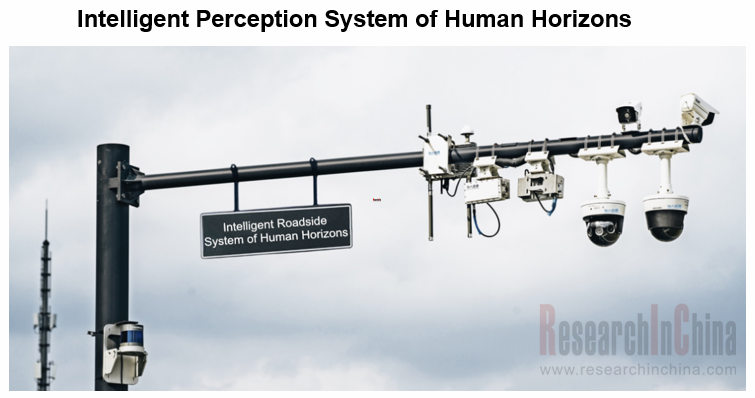

Core sensors of an autonomous vehicle that offer limited detection range, is far from meeting the needs for non-line-of-sight perception of surroundings, e.g., ultra long distance, intersections and blind spots. Intelligent roadside perception is thus needed to broaden the detection range around a vehicle and make autonomous driving safer and more reliable.

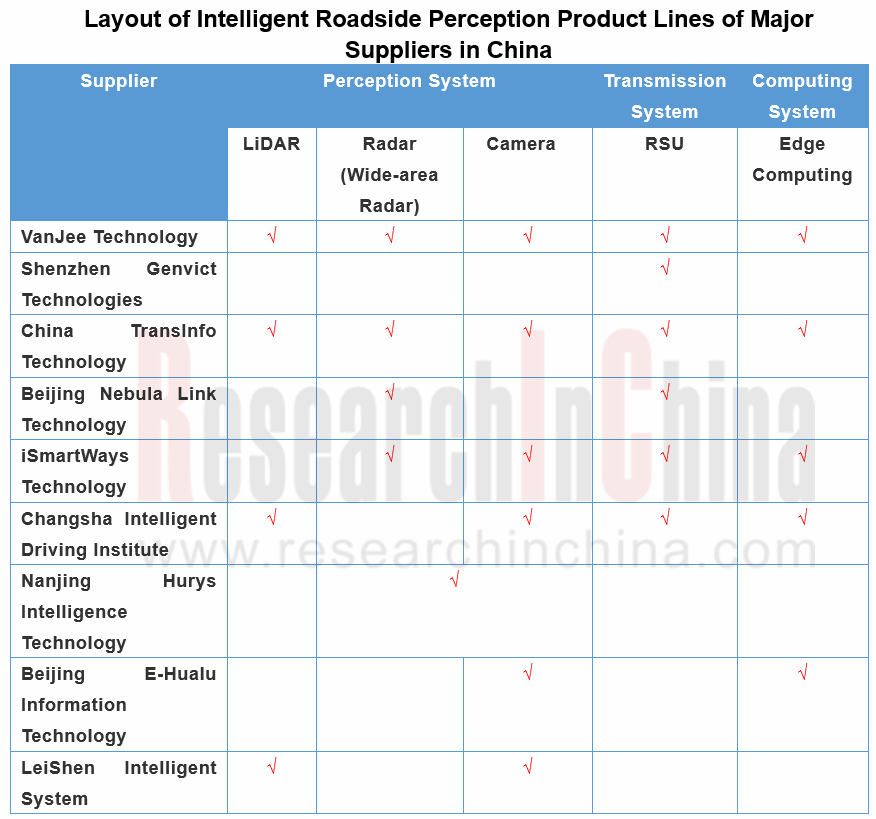

In current stage, roadside perception devices are led by camera, LiDAR and radar. Players like VanJee Technology Co., Ltd., China TransInfo Technology Co., Ltd. and Changsha Intelligent Driving Institute Ltd. have made sound deployments in roadside perception system, with product lines covering three systems (perception, transmission and computing). During the layout, roadside perception devices can be directly mounted on traffic light poles, intelligent poles and other facilities.

For single perception devices have some limitations, Chinese vendors are vigorously developing multi-sensor fusion solutions which perceive richer road environment information more accurately around the clock. Examples include VanJee Technology Co., Ltd. who already begins to work on data fusion between roadside 3D LiDARs and cameras to cover the drawbacks of LiDAR for greater ability to perceive.

Through the lens of commercial use, pilot roadside infrastructures constructed for demonstration nationwide have generated a mass of data, which is a solution to some technological problems. For example, the First Section (radars and cameras deployed every 250 meters) of Shanghai-Hangzhou-Ningbo Intelligent Expressway has made its pilot run for half a year, bringing about 8% faster average speed, a 20% increase in traffic capacity, a 10% reduction in congestion time, 90% accuracy in travel time forecast, a 10% fall in driving accidents, and a 10% cut in rescue time. It follows that intelligent roadside equipment could produce so obvious social benefits that government is more willing to construct for commercial use on large scale.

Business model: Application in specific scenarios will go first

After exploration, it is found that application in scenarios is an efficient model to develop intelligent roadside perception equipment. In the long-cycle market, pilot application first in specific commercial scenarios remains more efficient. Demonstration products such as intelligent perception and integrated smart traffic poles on intelligent highways and at city crossroads have been introduced successively.

In July 2020, Ezhou Airport Expressway, Hubei’s first intelligent highway invested and constructed by Hubei Provincial Communications Investment Group Co., Ltd., started construction, with a video detector installed every 150 meters on both sides of the road.

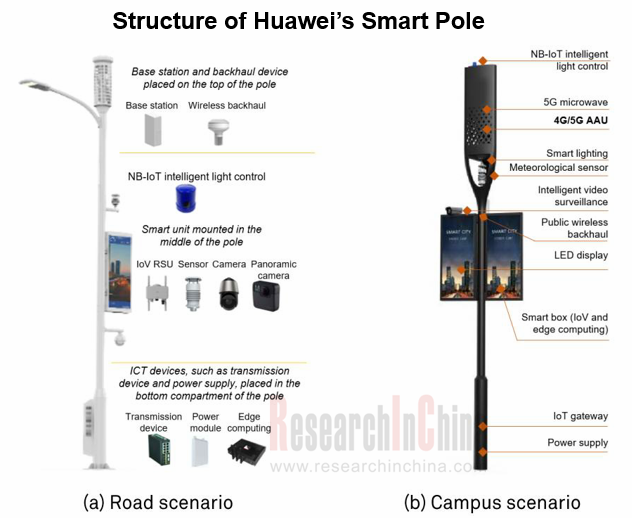

In July 2020, China’s first 5G multifunctional demonstration highway pole (Pole No.: K72+455) was installed on the Shenzhen Section of Guangshen Expressway. Every pole can carry such intelligent hardware as 5G base station, intelligent light, video surveillance system, emergency broadcaster and meteorological monitor.

IT giants race to enter

Evolvement of cooperative vehicle infrastructure system (CVIS) is decided by use of roadside equipment. Amid the rising penetration of intelligent roadside perception systems, the intelligent transportation network will be built up to further improve operational efficiency of cities and roads with technologies from edge computing to cloud control. Intelligent roadside perception system is a foundation for development of intelligent transportation.

Additionally, widespread layout of intelligent roadside equipment will drag down installation cost of vehicle V2X devices and push up their penetration. Only sound development of CVIS may make L4/L5 automated driving a reality.

IT tycoons like Huawei and BAT (Baidu, Alibaba and Tencent) who are bullish about the prospect of intelligent roadside equipment, scramble to march into the market.

Baidu focuses on research and development of roadside perception capabilities that meet needs of autonomous driving scenarios and fuse with V2X roadside perception information offered by the vehicle autonomous driving system. In the first half of 2020, Baidu has won the biddings for intelligent transportation projects in Nanjing, Hefei, Yangquan, Chongqing, to name a few.

Alibaba remains superior in infrastructure end, with Cainiao Alliance and ET City Brain. The giant will develop vehicle-infrastructure cooperation using technologies such as Alibaba Cloud Control Platform, AliOS and intelligent roadside facilities.

Tencent has a plan to expedite edge computing equipment installations and to build an open source platform for edge computing together with several partners.

Huawei makes concurrent efforts on vehicle and infrastructure ends, having rolled out products like roadside unit, EI-based Traffic Intelligent Twins, and OceanConnect intelligent transportation platform.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...